🎯 What Makes This Strategy Special?

You know what? This strategy is like installing a “super radar” for the market! Instead of simply looking at one or two indicators, it combines 9 different technical indicators like a band, where each indicator is an “instrument.” The strategy only generates trading signals when they play harmonious “notes” together. Imagine having 9 experts whispering advice in your ear simultaneously, and you only act when most of them agree!

📊 Core Mechanism Revealed

Here’s the key point! The essence of this strategy lies in the “parametric multiplier” concept. It first normalizes indicators like RSI, ADX, momentum, ROC, ATR, volume, acceleration, and slope to the same scale, then multiplies them together to get a “comprehensive strength value.” It’s like cooking - every seasoning has its optimal proportion, and this strategy helps you find the perfect recipe for various market “seasonings”! When the comprehensive strength value crosses its moving average, that’s the optimal entry timing.

🔧 Customizable Trading Weapon

What’s the coolest feature of this strategy? You can combine components like building blocks! Don’t want to use a certain indicator? Just turn it off. Want to adjust period parameters? It’s up to you. There’s even an SMA trend filter to help you avoid the pitfall of counter-trend trading. This is like a “trading strategy DIY toolkit” that lets you adjust configurations based on different market environments.

⚡ Practical Application Guide

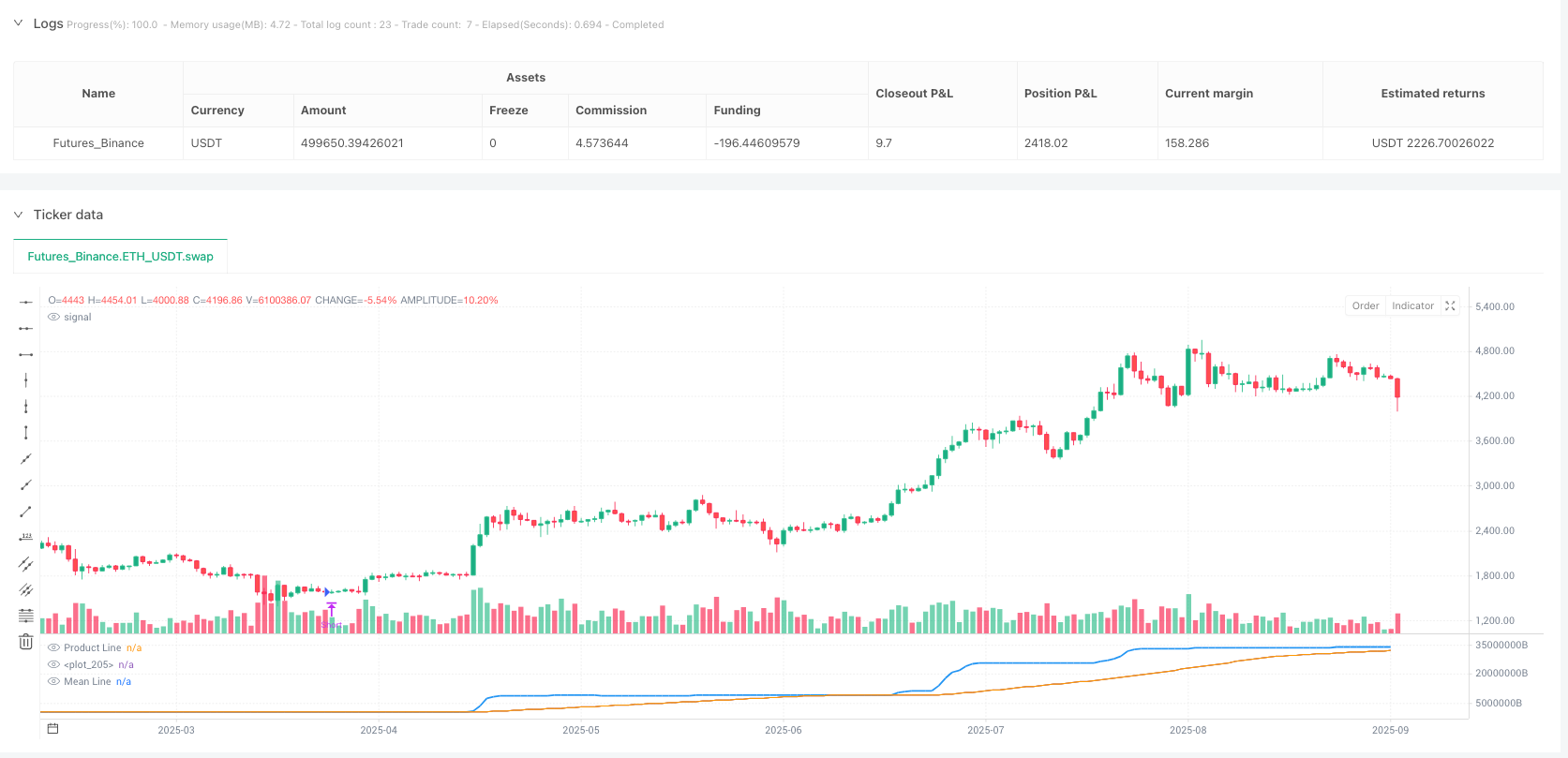

Here’s your pitfall avoidance guide! This strategy is particularly suitable for mixed oscillating and trending market environments. Go long when the blue product line crosses above the orange mean line, and go short when it crosses below. The strategy thoughtfully includes automatic position closing mechanisms to prevent you from stubbornly holding positions when reverse signals appear. Remember, enabling the trend filter helps you navigate major trends with ease, while disabling it captures more short-term opportunities!

//@version=5

strategy("Parametric Multiplier Backtester", shorttitle="PMB", overlay=false)

// Author: Script_Algo

// License: MIT

// Permission is hereby granted, free of charge, to any person obtaining a copy

// of this software and associated documentation files (the "Software"), to deal

// in the Software without restriction, including without limitation the rights

// to use, copy, modify, merge, publish, distribute, sublicense, and/or sell

// copies of the Software, subject to the following conditions:

// The above copyright notice and this permission notice shall be included in

// all copies or substantial portions of the Software.

// === Input Parameters ===

// Price

useClose = input.bool(true, "▪ Use Price", group="Parameter Settings")

priceSource = input.source(close, "Price Source", group="Parameter Settings")

// RSI

useRSI = input.bool(true, "▪ Use RSI", group="Parameter Settings")

rsiLength = input.int(8, "RSI Period", minval=1, group="Parameter Settings")

rsiSource = input.source(close, "RSI Source", group="Parameter Settings")

// ADX

useADX = input.bool(true, "▪ Use ADX", group="Parameter Settings")

adxLength = input.int(11, "ADX Period", minval=1, group="Parameter Settings")

// Momentum

useMomentum = input.bool(true, "▪ Use Momentum", group="Parameter Settings")

momLength = input.int(8, "Momentum Period", minval=1, group="Parameter Settings")

momSource = input.source(close, "Momentum Source", group="Parameter Settings")

// ROC

useROC = input.bool(true, "▪ Use ROC", group="Parameter Settings")

rocLength = input.int(3, "ROC Period", minval=1, group="Parameter Settings")

rocSource = input.source(close, "ROC Source", group="Parameter Settings")

// ATR

useATR = input.bool(true, "▪ Use ATR", group="Parameter Settings")

atrLength = input.int(40, "ATR Period", minval=1, group="Parameter Settings")

// Volume

useVolume = input.bool(true, "▪ Use Volume", group="Parameter Settings")

volumeSmoothing = input.int(200, "Volume Smoothing", minval=1, group="Parameter Settings")

// Acceleration

useAcceleration = input.bool(true, "▪ Use Acceleration", group="Parameter Settings")

accLength = input.int(500, "Acceleration Period", minval=1, group="Parameter Settings")

accSource = input.source(close, "Acceleration Source", group="Parameter Settings")

// Slope

useSlope = input.bool(true, "▪ Use Slope", group="Parameter Settings")

slopeLength = input.int(6, "Slope Period", minval=2, group="Parameter Settings")

slopeSource = input.source(close, "Slope Source", group="Parameter Settings")

// Normalization

normalizeValues = input.bool(true, "Normalize Values", group="General Settings")

lookbackPeriod = input.int(20, "Normalization Period", minval=10, group="General Settings")

// Product line smoothing

smoothProduct = input.bool(true, "Smooth Product Line", group="General Settings")

smoothingLength = input.int(200, "Smoothing Period", minval=1, group="General Settings")

// === SMA Trend Filter ===

trendFilter = input.bool(false, "Use SMA Trend Filter", group="Trend Filter")

smaPeriod = input.int(200, "SMA Period for Filter", minval=1, group="Trend Filter")

// === Indicator Calculations ===

// RSI

rsiValue = ta.rsi(rsiSource, rsiLength)

// ADX (correct calculation)

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = ta.tr

plus = fixnan(100 * ta.rma(plusDM, len) / ta.rma(truerange, len))

minus = fixnan(100 * ta.rma(minusDM, len) / ta.rma(truerange, len))

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), len)

[adx, plus, minus]

[adxValue, diPlus, diMinus] = dirmov(adxLength)

// Momentum

momValue = (momSource / momSource[momLength]) * 100

// ROC

rocValue = ((rocSource - rocSource[rocLength]) / rocSource[rocLength]) * 100

// ATR

atrValue = ta.atr(atrLength)

// Volume

smaVolume = ta.sma(volume, volumeSmoothing)

// Acceleration (расчет ускорения цены)

accValue = (accSource / accSource[accLength] - 1) * 100

// Slope (расчет наклона линейной регрессии)

slopeValue = ta.linreg(slopeSource, slopeLength, 0) - ta.linreg(slopeSource, slopeLength, slopeLength)

// Price

priceValue = priceSource

// === Value Normalization ===

normalize_func(_value, _use, _length) =>

if not _use

1

else

if normalizeValues

minVal = ta.lowest(_value, _length)

maxVal = ta.highest(_value, _length)

valueRange = maxVal - minVal

valueRange > 0 ? (_value - minVal) / valueRange * 100 + 1 : 1

else

_value

// Normalized values

normPrice = normalize_func(priceValue, useClose, lookbackPeriod)

normRSI = normalize_func(rsiValue, useRSI, lookbackPeriod)

normADX = normalize_func(adxValue, useADX, lookbackPeriod)

normMomentum = normalize_func(momValue, useMomentum, lookbackPeriod)

normROC = normalize_func(rocValue, useROC, lookbackPeriod)

normATR = normalize_func(atrValue, useATR, lookbackPeriod)

normVolume = normalize_func(smaVolume, useVolume, lookbackPeriod)

normAcceleration = normalize_func(accValue, useAcceleration, lookbackPeriod)

normSlope = normalize_func(slopeValue, useSlope, lookbackPeriod)

// === Product Calculation ===

productValue = 1.0

// Multiply only if parameter is enabled

if useClose

productValue *= normPrice

if useRSI

productValue *= normRSI

if useADX

productValue *= normADX

if useMomentum

productValue *= normMomentum

if useROC

productValue *= normROC

if useATR

productValue *= normATR

if useVolume

productValue *= normVolume

if useAcceleration

productValue *= normAcceleration

if useSlope

productValue *= normSlope

// Product line smoothing

smoothedProduct = smoothProduct ? ta.sma(productValue, smoothingLength) : productValue

// Mean line

meanLine = ta.sma(smoothedProduct, 50)

// SMA trend filter

smaFilter = ta.sma(close, smaPeriod)

// === Trading Conditions ===

// Bullish crossover (product line crosses mean line from below)

bullishCross = ta.crossover(smoothedProduct, meanLine)

// Bearish crossover (product line crosses mean line from above)

bearishCross = ta.crossunder(smoothedProduct, meanLine)

// Entry conditions with trend filter

longCondition = bullishCross and (not trendFilter or close > smaFilter)

shortCondition = bearishCross and (not trendFilter or close < smaFilter)

// === Strategy Execution ===

// Close opposite positions before opening new ones

if (longCondition)

strategy.close("Short", comment="Close Short Entry Long")

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.close("Long", comment="Close Long Entry Short")

strategy.entry("Short", strategy.short)

// Additional exit conditions for more precise control

if (bearishCross and strategy.position_size > 0)

strategy.close("Long", comment="Exit Long")

if (bullishCross and strategy.position_size < 0)

strategy.close("Short", comment="Exit Short")

// === Visualization (as oscillator below chart) ===

// Plot product line and mean line in separate pane

plot(smoothedProduct, color=color.blue, linewidth=2, title="Product Line")

plot(meanLine, color=color.orange, linewidth=1, title="Mean Line")

// Fill area between lines

fill(plot(smoothedProduct), plot(meanLine), color=smoothedProduct > meanLine ? color.new(color.green, 90) : color.new(color.red, 90))

// Information table

var table infoTable = table.new(position.top_right, 1, 1, bgcolor=color.white, border_width=1)

if barstate.islast

table.cell(infoTable, 0, 0, "Current Value: " + str.tostring(smoothedProduct, "#.##"), text_color=color.black)