Protocolo de motor de ondas

ATR volatility ACCUMULATION DCA

No es un DCA normal, es un motor de oscilación con cerebro.

Los datos de retrospectiva se enfrentan directamente a las inversiones tradicionales: una caída del 5% provocó la compra, y un aumento del 3.9% provocó la venta, pero la clave está en que las inversiones de los inversores no se han visto afectadas por la caída de los precios.El motor de fluctuación se ajusta al ATR para comprar valores bajados│ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │ │

El problema con las estrategias tradicionales de DCA es la compra sin cerebro, y la lógica central de este protocolo es que el DCA no es una estrategia de compra sin cerebro.Sólo disparar en la ventana de la oportunidad realPor ejemplo, comprar con una caída normal del 5%, pero si la fluctuación actual alcanza el 20%, la depreciación de la compra real se elevará al 6%.

8 configuraciones predeterminadas, cada una con una expectativa de ganancias clara

Modelo de acumulación de BTC por ciclo: compra con 5% de caída, 6% de posición, monto fijo de \(500, adecuado para los titulares a largo plazo. El método de arbitraje a corto plazo de BTC: compra con una caída del 3.1% y venta del 10% de las posiciones, un monto fijo de \)6,000 y un umbral de ganancias del 75%. ETH fluctuación de la cosecha: 4.5% de caída en la compra, 15% de posición, que permite la compra por debajo de la línea de costo, 30% de umbral de ganancias.

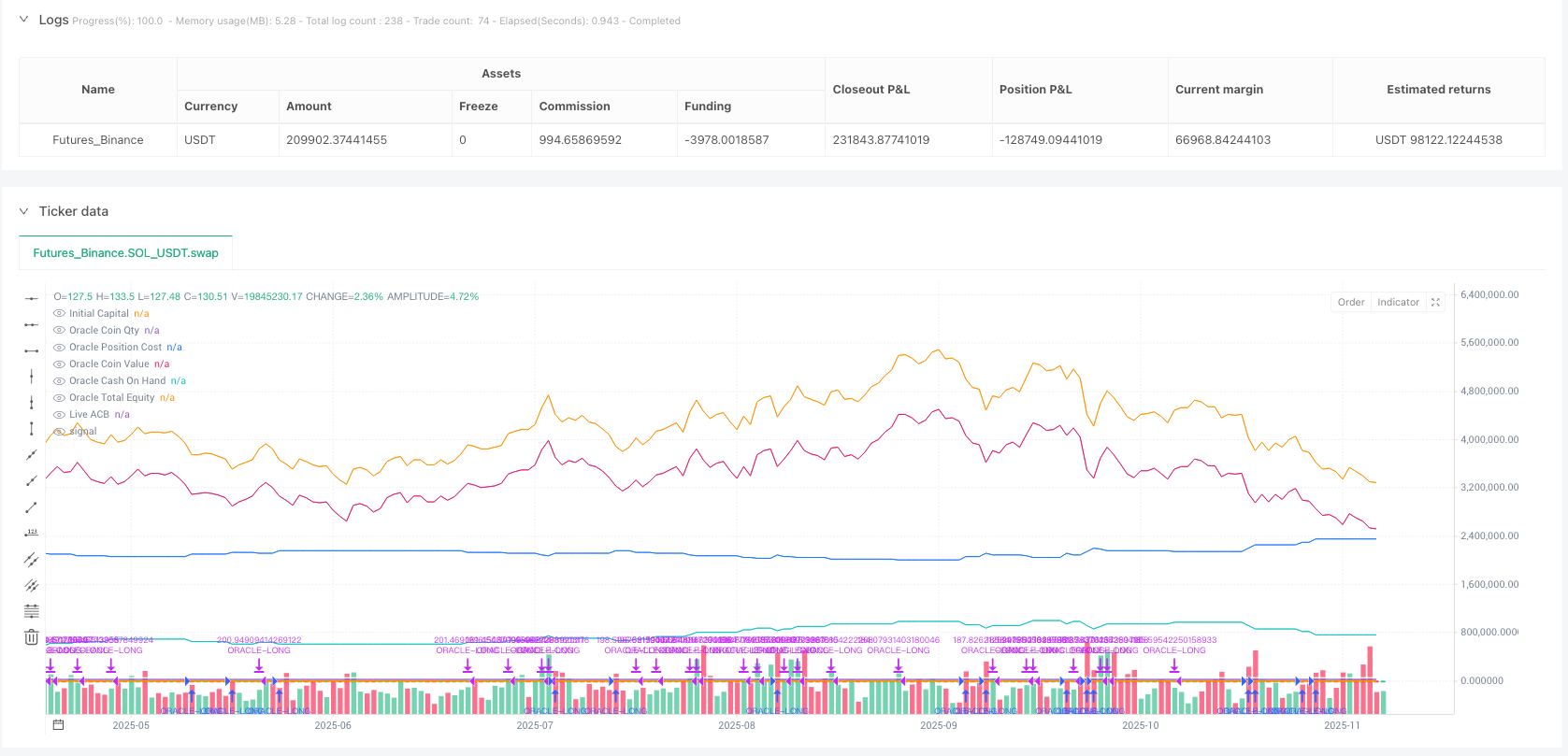

Cada configuración ha sido verificada por retroalimentación y no por una decisión de cabeza.Las diferencias en el margen de ganancias de SOL y XRP reflejan las características de volatilidad y la diferencia de liquidez de los diferentes activos.

El bloqueo colectivo: el mayor problema de la estrategia DCA

El mayor problema de los DCA tradicionales es no saber cuándo dejar de comprar. Este protocolo lo resuelve con el “sello de grupo”: o el precio aumenta un 3.9% sobre el costo promedio, o se sella el grupo acumulado actual sin oportunidades de compra calificadas en 10 ciclos consecutivos.

La línea de costo promedio después del sellado se convierte en la referencia de venta❚ Sólo el precio que rompa la línea de costos de cierre + el umbral de ganancias (entre el 30% y el 75%) puede desencadenar una venta. Esto evita la compra interminable y la obtención de ganancias prematuras.

El mecanismo de la columna de calma es aún más sorprendente: si no hay 10 ciclos consecutivos que activen las condiciones de compra, el mercado se ha estabilizado y hay que prepararse para la cosecha en lugar de seguir acumulando.

El efecto volante: los beneficios compran servicios para la próxima vez

Una vez activado el modo volante, los beneficios de cada venta se vuelven a invertir en el fondo de efectivo, aumentando la cantidad de municiones que se comprarán la próxima vez.Las estrategias para ganar fuerza en el mercado de toros。

Por ejemplo: \(100,000 inicial, 20% de ganancias acumuladas en la primera ronda, y un fondo de efectivo de \)120,000 después de la venta. La siguiente vez que se compra, la posición del 6% es de \(7,200 en lugar de \)6,000.

Sin embargo, los volantes también tienen un costo: en las últimas semanas de la Bolsa de Bolsa se compran en exceso debido a la gran cantidad de efectivo disponible, lo que requiere un control estricto del límite de compra de una sola vez.

Control de riesgos: el triple seguro

Primero: Control de compra por encima de la línea de costo. Se puede configurar solo para comprar por debajo del costo promedio, para evitar el aumento. Segundo: Limitación de la cantidad mínima. Se requiere una cantidad mínima de dólares en cada compra/venta para evitar transacciones pequeñas y sin sentido. Tercero: ajuste del motor de oscilación. Aumenta automáticamente el umbral de compra durante la alta oscilación y reduce el umbral durante la baja oscilación.

Pero esta estrategia funciona en mercados convulsionados.Si el mercado se mantiene horizontal durante un largo período de tiempo, los fondos se bloquean a largo plazo si no se puede provocar una fuerte caída de las compras y no se puede alcanzar el umbral de ganancias.

Consejos para la batalla: La clave está en la elección del mercado

Este tipo de acuerdos son más adecuados para mercados con tendencias claras, especialmente en el caso de las criptomonedas. La acumulación comienza a finales de los mercados bajistas y la cosecha comienza a mediados de los mercados alcistas, lo que es más efectivo.

No lo use en las siguientes situaciones: 1) mercado de acciones con alta frecuencia de oscilaciones 2) mercado de divisas sin una tendencia clara 3) monedas pequeñas con muy poca liquidez.

La retrospectiva histórica muestra que las ganancias ajustadas al riesgo son superiores a la inversión simple, pero esto no significa que las ganancias futuras sean inevitablesCualquier estrategia cuantitativa tiene un riesgo de fracaso y requiere un monitoreo y un ajuste continuos.

//@version=6

// ============================================================================

// ORACLE PROTOCOL — ARCH PUBLIC clone (Standalone) — CLEAN-PUB STYLE (derived)

// Variant: v1.9v-standalone (publish-ready) 25/11/2025

// Notes:

// - Keeps your v1.9v canonical script intact (this is a separate modified copy).

// - Single exit mode: ProfitGate + Candle (per-candle) — no selector.

// - Live ACB plot toggle only (sealed ACB still operates internally but is not shown).

// - No freeze-point markers plotted.

// - Sizing: flywheel dynamic sizing remains the primary source but fixed-dollar entry

// and min-$ overrides remain available (as in Arch public PDFs/screenshots).

// - Volatility Engine (VE) applies ONLY to entries; exit-side VE removed.

// - Manual equity top-up removed (flywheel auto-updates cash).

// - VE ATR length and max-vol fields are fixed (not exposed in UI).

// ============================================================================

strategy("Oracle Protocol — Arch Public (Clone) • v1.9v-standalone (publish)",

overlay=true,

initial_capital=100000,

commission_type=strategy.commission.percent,

commission_value=0.1,

pyramiding=9999,

calc_on_every_tick=true,

process_orders_on_close=true)

// ============================================================================

// 1) PRESETS (Arch PDFs)

// ============================================================================

grp_oracle = "Oracle — Core"

oraclePreset = input.string(

"BTC • Cycle Accumulation",

"Recipe Preset",

options = [

"BTC • Cycle Accumulation",

"BTC • Cycle Swing Arbitrage",

"BTC • Short Target Accumulation",

"BTC • Short Target Arbitrage",

"ETH • Volatility Harvesting",

"SOL • Volatility Harvesting",

"XRP • Volatility Harvesting",

"SUI • Volatility Harvesting"

],

group = grp_oracle)

var float longThreshPct = 0.0

var float exitThreshPct = 0.0

var bool onlySellAboveCost = true

var bool recipe_buyBelowACB = false

var float sellProfitGatePct = 0.0

var float entryPct = 0.0

var float exitPct = 0.0

var float fixedEntryUsd = 0.0

var float fixedExitUsd = 0.0

if oraclePreset == "BTC • Cycle Accumulation"

longThreshPct := 5.0

exitThreshPct := 3.9

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 50.0

entryPct := 6.0

exitPct := 1.0

fixedEntryUsd := 500

fixedExitUsd := 500

else if oraclePreset == "BTC • Cycle Swing Arbitrage"

longThreshPct := 5.9

exitThreshPct := 3.5

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 49.0

entryPct := 10.0

exitPct := 50.0

fixedEntryUsd := 10000

fixedExitUsd := 15000

else if oraclePreset == "BTC • Short Target Accumulation"

longThreshPct := 3.1

exitThreshPct := 2.5

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 30.0

entryPct := 10.0

exitPct := 10.0

fixedEntryUsd := 6000

fixedExitUsd := 5000

else if oraclePreset == "BTC • Short Target Arbitrage"

longThreshPct := 3.1

exitThreshPct := 2.5

onlySellAboveCost := true

recipe_buyBelowACB := true

sellProfitGatePct := 75.0

entryPct := 10.0

exitPct := 100.0

fixedEntryUsd := 10000

fixedExitUsd := 5000

else if oraclePreset == "ETH • Volatility Harvesting"

longThreshPct := 4.5

exitThreshPct := 5.0

onlySellAboveCost := true

recipe_buyBelowACB := true

sellProfitGatePct := 30.0

entryPct := 15.0

exitPct := 40.0

fixedEntryUsd := 6000

fixedExitUsd := 20000

else if oraclePreset == "SOL • Volatility Harvesting"

longThreshPct := 5.0

exitThreshPct := 5.0

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 35.0

entryPct := 7.0

exitPct := 5.0

fixedEntryUsd := 5000

fixedExitUsd := 5000

else if oraclePreset == "XRP • Volatility Harvesting"

longThreshPct := 4.5

exitThreshPct := 10.0

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 10.0

entryPct := 17.0

exitPct := 50.0

fixedEntryUsd := 8000

fixedExitUsd := 5000

else if oraclePreset == "SUI • Volatility Harvesting"

longThreshPct := 5.0

exitThreshPct := 5.0

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 10.0

entryPct := 5.0

exitPct := 10.0

fixedEntryUsd := 5000

fixedExitUsd := 15000

// ============================================================================

// 2) EXTRAS & VOLATILITY SPLITS (CLEAN PUBLIC VARIANTS)

// - Volatility engine inputs are fixed and not exposed in the UI

// ============================================================================

// UI group for extras (keeps flywheel toggle visible)

grp_extras = "Oracle — Extras"

useFlywheel = input.bool(true, "Reinvest Realized Profits (Flywheel)", group = grp_extras)

// Volatility engine: ENTRY only (VE params fixed, not shown)

useVolEngineEntry = input.bool(true, "Enable Volatility Engine (Entries only)", group = grp_extras)

// Fixed/hidden VE parameters (not exposed in UI per your request)

atrLen_fixed = 14

maxVolAdjPct_fixed = 40.0

// NOTE: manual_equity_topup removed for publish variant — flywheel handles auto top-up

buyBelowMode = input.string(

"Use Recipe Setting",

"Buy Below ACB Mode",

options = ["Use Recipe Setting", "Force Buy Below ACB", "Allow Buys Above ACB"],

group = grp_extras)

// ============================================================================

// 3) QUIET BARS (cluster seal) — unchanged behavior, UI visible

// ============================================================================

grp_qb = "Oracle — Quiet Bars (Cluster Seal)"

useQuietBars = input.bool(true, "Enable Quiet-Bars Seal", group=grp_qb)

quietBars = input.int(10, "Quiet Bars (no eligible buys)", minval=1, group=grp_qb)

// ============================================================================

// 4) SELL MODE — SINGLE ARCH EXIT (ProfitGate + Candle) ONLY

// (no selector; fixed behavior to match Arch public)

// ============================================================================

grp_sell = "Oracle — Sell Behaviour"

// no sellMode selector in this publish variant — fixed logic below

// ============================================================================

// 5) DISPLAY & PLOTS (simplified)

// - only Live ACB toggle remains visible.

// - sealed ACB and freeze points are intentionally not plotted.

// ============================================================================

grp_display = "Oracle — Display"

showLiveACB = input.bool(true, "Show Live ACB", group = grp_display)

acbColor = input.color(color.new(color.yellow, 0), "ACB Line Color", group = grp_display)

showExitGuides = input.bool(false, "Show Exit Guide Lines", group = grp_display)

// ============================================================================

// 6) 3C SIZING & MINIMUMS / OVERRIDES

// - primary sizing source is flywheel (cash ledger).

// - but fixed-entry USD and min-$ overrides remain (per Arch public).

// ============================================================================

grp_3c_sz = "Oracle — Sizing"

use3C = input.bool(true, "Enable 3Commas JSON Alerts", group = grp_3c_sz)

botTag = input.string("ORACLE", "Bot Tag / Pair Hint", group = grp_3c_sz)

// Keep min$/fixed entry & exit overrides visible (Arch style)

useMinEntry = input.bool(true, "Use Min $ on Entry", group = grp_oracle)

useMinExit = input.bool(true, "Use Min $ on Exit", group = grp_oracle)

manualMinEntry = input.float(0.0, "Manual Min $ Entry (0 = use recipe)", group = grp_oracle, step = 10)

manualMinExit = input.float(0.0, "Manual Min $ Exit (0 = use recipe)", group = grp_oracle, step = 10)

grp_override = "Oracle — Amount Override"

entryUsd_override = input.float(0.0, "Entry USD Override (0 = none)", group = grp_override, step = 10)

exitUsd_override = input.float(0.0, "Exit USD Override (0 = none)", group = grp_override, step = 10)

// ============================================================================

// 7) VOLATILITY ENGINE VALUES (ENTRY only)

// - VE uses fixed internal params (atrLen_fixed, maxVolAdjPct_fixed).

// - VE not applied to exits in this publish variant.

// ============================================================================

atrVal = ta.atr(atrLen_fixed)

volPct = atrVal / close * 100.0

volAdj = math.min(volPct, maxVolAdjPct_fixed)

longThreshEff = longThreshPct * (useVolEngineEntry ? (1 + volAdj/100.0) : 1)

// exit threshold is NOT adjusted by VE in this variant:

exitThreshEff = exitThreshPct

// ============================================================================

// 8) POSITION STATE & HELPERS

// ============================================================================

var float q = 0.0 // live coin quantity

var float cost = 0.0 // live position cost ($)

var float live_acb = 0.0 // live average cost (cost / q)

var float realized = 0.0

// Flywheel cash ledger (realised cash available for reinvest) — auto only

var float cash = na

if na(cash)

cash := strategy.initial_capital

// Cluster / gating state (sealed base) — sealed_acb still used internally but not shown

var bool clusterOpen = false

var float sealed_acb = na // frozen when a cluster seals (sealed accumulation base)

var int lastEntryBar = na

var int lastEligibleBuyBar = na // for quiet-bars seal

var int sell_steps_done = 0 // number of incremental exits already taken since gate armed

var float last_sell_ref = na // last sell price used for pullback re-arm (not used here)

var bool mode_single_sold = false // lock for Single per Rally (internal use)

// Helpers (array returns)

f_add_fill(_qty, _px, _q, _cost) =>

// returns newQty, newCost, newACB

_newCost = _cost + _qty * _px

_newQty = _q + _qty

_newACB = _newQty > 0 ? _newCost / _newQty : 0.0

array.from(_newQty, _newCost, _newACB)

f_reduce_fill(_qty, _px, _q, _cost) =>

// returns newQty, newCost, newACB, sellVal, costReduced, proportion

_sellVal = _qty * _px

_prop = _q > 0 ? _qty / _q : 0.0

_costReduced = _cost * _prop

_newCost = _cost - _costReduced

_newQty = _q - _qty

_newACB = _newQty > 0 ? _newCost / _newQty : 0.0

array.from(_newQty, _newCost, _newACB, _sellVal, _costReduced, _prop)

// ============================================================================

// 9) BUY SIGNALS & BUY-BELOW MODE

// ============================================================================

dropFromPrev = close[1] != 0 ? (close - close[1]) / close[1] * 100.0 : 0.0

wantBuy = dropFromPrev <= -longThreshEff

needBuyBelow = recipe_buyBelowACB

if buyBelowMode == "Force Buy Below ACB"

needBuyBelow := true

else if buyBelowMode == "Allow Buys Above ACB"

needBuyBelow := false

canBuyBelow = not needBuyBelow or (needBuyBelow and (live_acb == 0 or close < live_acb))

// Track “eligible” buys (quiet-bars gate references opportunity, not just fills)

if wantBuy and canBuyBelow

lastEligibleBuyBar := bar_index

// ============================================================================

// 10) SIZING (flywheel-driven; keep fixed/min-dollar options for entry & exit)

// ============================================================================

baseAcct = cash // flywheel only in this variant

// entry as percentage of baseAcct (dynamic) with fixed/min-dollar fallback (Arch-style)

entryUsd = baseAcct * (entryPct / 100.0)

// Entry min floor (keep manual/fixed options per Arch)

if useMinEntry

entryFloor = manualMinEntry > 0 ? manualMinEntry : fixedEntryUsd

entryUsd := math.max(entryUsd, entryFloor)

// override priority

entryUsd := entryUsd_override > 0 ? entryUsd_override : entryUsd

// entry qty

eQty = close > 0 ? entryUsd / close : 0.0

// Exit sizing: percentage of HOLDINGS (Arch) with min-$ fallback (unchanged)

exitQty_pct = q * (exitPct / 100.0)

exitFloorQty = close > 0 ? ( (manualMinExit > 0 ? manualMinExit : fixedExitUsd) / close ) : 0.0

xQty_base = math.max(exitQty_pct, exitFloorQty)

xQty = math.min(xQty_base, q)

xQty := exitUsd_override > 0 and close > 0 ? math.min(exitUsd_override / close, q) : xQty

// ============================================================================

// 11) ENTRY — opens/extends accumulation cluster; resets SELL steps

// Cash gate: only execute buy if cash >= entryUsd and on confirmed bar close

// ============================================================================

newEntry = false

entryCost = eQty * close

hasCash = entryCost > 0 and cash >= entryCost

if barstate.isconfirmed and wantBuy and canBuyBelow and eQty > 0 and hasCash

strategy.entry("ORACLE-LONG", strategy.long, qty=eQty, comment="ORACLE-BUY")

_fill = f_add_fill(eQty, close, q, cost)

q := array.get(_fill, 0)

cost := array.get(_fill, 1)

live_acb := array.get(_fill, 2)

cash -= entryCost

lastEntryBar := bar_index

lastEligibleBuyBar := bar_index

if not clusterOpen

clusterOpen := true

sealed_acb := na

sell_steps_done := 0

mode_single_sold := false

last_sell_ref := na

// set sealed_acb initial for cluster if na

if na(sealed_acb)

sealed_acb := live_acb

newEntry := true

// ============================================================================

// 12) CLUSTER SEAL — Exit-Threshold OR Quiet-Bars

// - On sealing, we freeze sealed_acb internally (not plotted).

// ============================================================================

riseFromLiveACB = live_acb > 0 ? (close - live_acb ) / live_acb * 100.0 : 0.0

sealByThresh = riseFromLiveACB >= exitThreshEff

barsSinceElig = na(lastEligibleBuyBar) ? 10000 : (bar_index - lastEligibleBuyBar)

sealByQuiet = useQuietBars and (barsSinceElig >= quietBars)

sealed_changed = false

if clusterOpen and (sealByThresh or sealByQuiet)

clusterOpen := false

// freeze sealed base as the last live_acb at seal time (preserve cycle anchor)

sealed_acb := live_acb

sell_steps_done := 0

mode_single_sold := false

last_sell_ref := na

sealed_changed := true

// ============================================================================

// 13) SELL LOGIC — SINGLE ARCH EXIT: ProfitGate + Candle (Per-Candle)

// - Profit gate base: use sealed refBase if present, otherwise live_acb (no toggle).

// - VE not applied to exits in this variant.

// ============================================================================

refBase = na(sealed_acb) ? live_acb : sealed_acb

riseFromRef = refBase > 0 ? (close - refBase) / refBase * 100.0 : 0.0

sellAboveOK = not onlySellAboveCost or close > live_acb

profitRefBase = refBase // sealed if available, else live_acb (no UI toggle in this variant)

// Basic profit gate price/boolean (uses profitRefBase)

profitGateLevelPrice = profitRefBase * (1 + sellProfitGatePct / 100.0)

profitGateCrossed = profitRefBase > 0 ? (close >= profitGateLevelPrice) : false

// Candle-based rise (percent move relative to previous close)

riseFromPrev = close[1] != 0 ? (close - close[1]) / close[1] * 100.0 : 0.0

candleRiseOK = riseFromPrev >= exitThreshEff

// Final allow-sell boolean for this publish variant (ProfitGate + Candle)

var bool allowSellThisBar = false

allowSellThisBar := false

allowSellThisBar := profitGateCrossed and candleRiseOK and xQty > 0 and q > 0 and sellAboveOK and barstate.isconfirmed

// Perform sell if allowed

actualExitQty = 0.0

if allowSellThisBar

actualExitQty := xQty

if actualExitQty > 0

strategy.close("ORACLE-LONG", qty = actualExitQty, comment = "ORACLE-SELL")

_r = f_reduce_fill(actualExitQty, close, q, cost)

q := array.get(_r, 0)

cost := array.get(_r, 1)

live_acb := array.get(_r, 2)

sellVal = array.get(_r, 3)

cRed = array.get(_r, 4)

tradePnL = sellVal - cRed

realized += tradePnL

cash += sellVal

sell_steps_done += 1

last_sell_ref := close

mode_single_sold := true

if q <= 0

// fully sold - reset sealed base and steps (internal)

sealed_acb := na

sell_steps_done := 0

mode_single_sold := false

last_sell_ref := na

// Re-arm logic (simplified): allow new sells only after retrace below refBase by exitThreshEff or if fully sold

if barstate.isconfirmed

if mode_single_sold

retrace_condition = not na(refBase) ? (close < refBase * (1 - exitThreshEff/100.0)) : false

if retrace_condition or q == 0

mode_single_sold := false

sell_steps_done := 0

last_sell_ref := na

// ============================================================================

// 14) BALANCES & 3C JSON (flywheel-based sizing)

// ============================================================================

cash_on_hand = math.max(cash, 0)

coin_value = q * close

total_equity = cash_on_hand + coin_value

base_for_3c = cash_on_hand // flywheel only in this publish variant

entryUsd_3c = base_for_3c * (entryPct / 100.0)

if useMinEntry

entryUsd_3c := math.max(entryUsd_3c, (manualMinEntry > 0 ? manualMinEntry : fixedEntryUsd))

entryUsd_3c := entryUsd_override > 0 ? entryUsd_override : entryUsd_3c

// ============================================================================

// 15) PLOTS (Data Window + Live ACB only + optional guides)

// - Sealed ACB and freeze markers intentionally NOT plotted in this variant.

// ============================================================================

plot(strategy.initial_capital, title="Initial Capital", color=color.white)

plot(q, title="Oracle Coin Qty", precision = 6)

plot(cost, title="Oracle Position Cost")

plot(coin_value, title="Oracle Coin Value")

plot(cash_on_hand, title="Oracle Cash On Hand")

plot(total_equity, title="Oracle Total Equity")

plot(live_acb > 0 and showLiveACB ? live_acb : na, title="Live ACB", color=color.new(color.orange,0), linewidth=2, style=plot.style_line)

// Exit guide lines reference refBase but are optional (kept for debugging/visual confirmation)

guide_exit_line = showExitGuides and not na(refBase) ? refBase * (1 + exitThreshEff/100.0) : na

guide_gate_line = showExitGuides and not na(refBase) ? refBase * (1 + sellProfitGatePct/100.0) : na

plot(guide_exit_line, title="Exit Threshold Line", display=showExitGuides ? display.all : display.none, linewidth=1, style=plot.style_linebr)

plot(guide_gate_line, title="Profit Gate Line (ref base)", display=showExitGuides ? display.all : display.none, linewidth=1, style=plot.style_linebr)

// Also plot the profit gate price computed from profitRefBase (if guides enabled)

plot(not na(profitRefBase) and showExitGuides ? profitRefBase * (1 + sellProfitGatePct/100.0) : na, title="Profit Gate (ref base)", display=showExitGuides ? display.all : display.none, linewidth=1, style=plot.style_line)