Aperçu

Cette stratégie est un système de trading basé sur la moyenne mobile exponentielle (EMA) qui utilise principalement le croisement de l’EMA20 et de l’EMA50 pour identifier les changements dans les tendances du marché. La stratégie conçoit des points de profit dynamiques à plusieurs niveaux et combine des mécanismes de stop-loss pour contrôler les risques. Le système affiche visuellement la direction des tendances du marché grâce à des changements de couleur d’arrière-plan, aidant les traders à mieux comprendre les tendances du marché.

Principe de stratégie

La logique fondamentale de la stratégie repose sur les aspects suivants :

- Utilisez le croisement de l’EMA20 et de l’EMA50 pour déterminer la direction de la tendance : un signal d’achat est généré lorsque l’EMA20 passe au-dessus de l’EMA50, et un signal de vente est généré lorsqu’il passe en dessous

- Définissez dynamiquement quatre objectifs de profit en fonction de la plage de fluctuation du chandelier précédent :

- TP1 est réglé sur 0,5 fois la plage de fluctuation

- TP2 est réglé sur 1,0 fois la plage de fluctuation

- TP3 est réglé sur 1,5 fois la plage de fluctuation

- TP4 est réglé sur 2,0 fois la plage de fluctuation

- Fixez un stop loss de 3 % pour contrôler le risque

- La direction de la tendance est affichée en changeant la couleur d’arrière-plan de la ligne K : la tendance à la hausse est affichée en vert et la tendance à la baisse est affichée en rouge

Avantages stratégiques

- Définition dynamique des points de profit : ajustez automatiquement les objectifs de profit en fonction de la volatilité du marché en temps réel, hautement adaptable

- Mécanisme de profit à plusieurs niveaux : en définissant plusieurs points de profit, il garantit non seulement le blocage des bénéfices, mais donne également de l’espace pour que la tendance se développe pleinement

- Effet de visualisation exceptionnel : la direction de la tendance est affichée intuitivement grâce à la couleur d’arrière-plan, ce qui est pratique pour une évaluation rapide de l’état du marché

- Contrôle parfait des risques : définissez un point de stop loss fixe pour contrôler efficacement la perte maximale de chaque transaction

- Paramètres flexibles et ajustables : les traders peuvent ajuster le multiplicateur de points de profit et le pourcentage de stop loss en fonction des différentes conditions du marché

Risque stratégique

- Hystérésis de la moyenne mobile : l’EMA elle-même présente une hystérésis, ce qui peut entraîner une génération ultérieure du signal

- Risque de marché volatil : de fréquents faux signaux peuvent survenir dans un marché latéral et volatil

- Paramètres de stop loss fixe : le stop loss à pourcentage fixe peut ne pas convenir à toutes les conditions de marché

- Espacement des points de profit : dans un marché volatil, l’espacement entre les points de profit peut être trop grand ou trop petit

Orientation de l’optimisation de la stratégie

- Introduire des indicateurs auxiliaires : des indicateurs tels que RSI ou MACD peuvent être ajoutés pour confirmer les signaux de croisement

- Optimisez le mécanisme de stop loss : envisagez d’utiliser l’ATR pour définir dynamiquement la distance du stop loss

- Ajouter un filtre temporel : ajouter une fenêtre de temps de trading pour éviter les périodes de forte volatilité

- Améliorer la gestion des positions : ajuster dynamiquement la taille des positions en fonction de la volatilité du marché

- Optimiser la confirmation du signal : vous pouvez ajouter des indicateurs tels que le volume des transactions comme conditions de confirmation auxiliaires

Résumer

Il s’agit d’une stratégie de suivi de tendance avec une structure complète et une logique claire. Capturez les tendances grâce au croisement des moyennes mobiles, gérez les rendements à l’aide de points de profit dynamiques et contrôlez les risques avec le stop-loss. La conception visuelle de la stratégie est intuitive et efficace, et les paramètres sont flexibles et réglables. Bien qu’il existe un problème de décalage inhérent à la moyenne mobile, la stabilité et la rentabilité de la stratégie peuvent être encore améliorées grâce à l’optimisation et à l’amélioration.

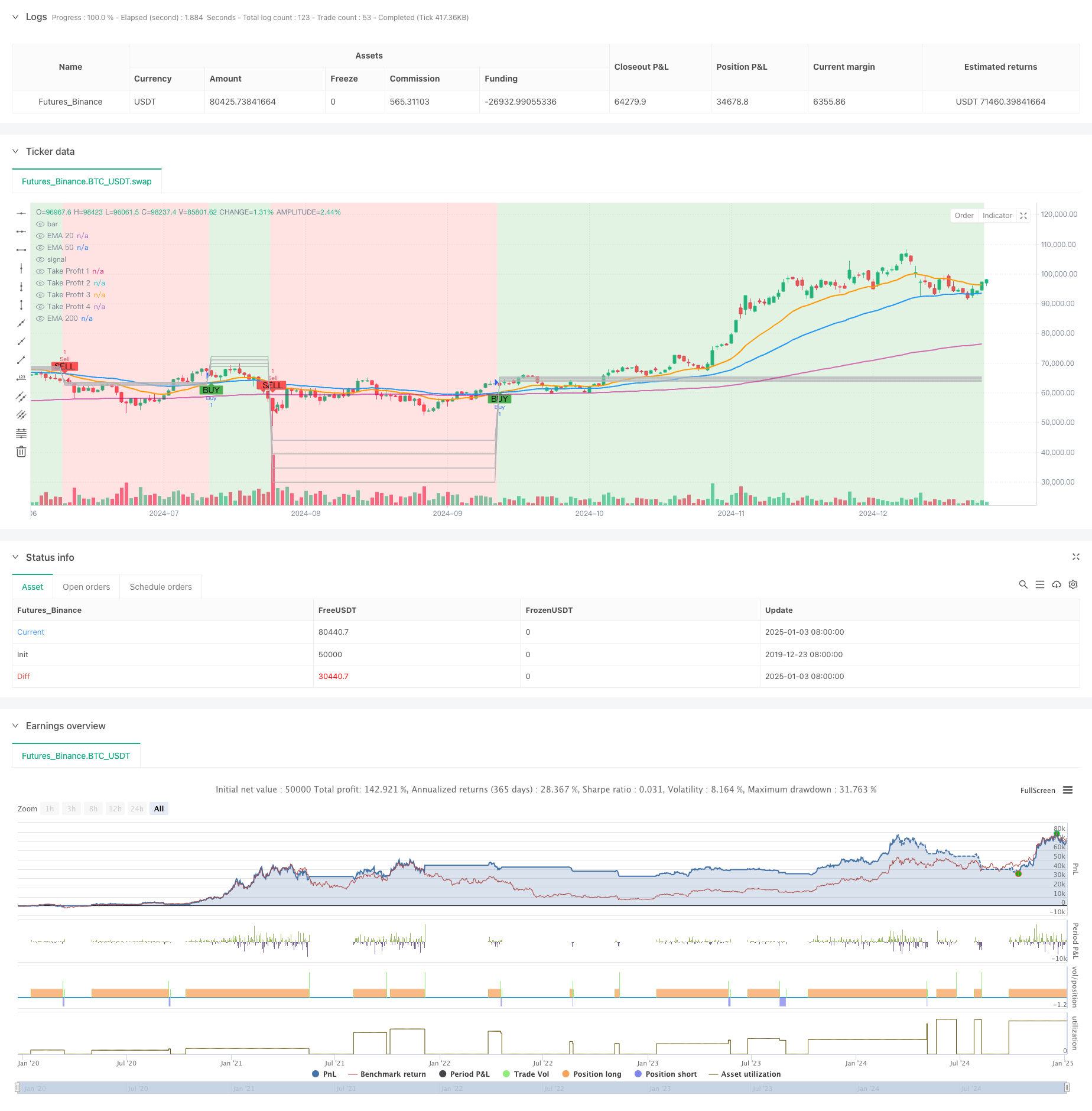

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Crossover Strategy with Take Profit and Candle Highlighting", overlay=true)

// Define the EMAs

ema200 = ta.ema(close, 200)

ema50 = ta.ema(close, 50)

ema20 = ta.ema(close, 20)

// Plot the EMAs

plot(ema200, color=#c204898e, title="EMA 200", linewidth=2)

plot(ema50, color=color.blue, title="EMA 50", linewidth=2)

plot(ema20, color=color.orange, title="EMA 20", linewidth=2)

// Define Buy and Sell conditions based on EMA crossover

buySignal = ta.crossover(ema20, ema50) // EMA 20 crosses above EMA 50 (Bullish)

sellSignal = ta.crossunder(ema20, ema50) // EMA 20 crosses below EMA 50 (Bearish)

// Define input values for Take Profit multipliers

tp1_multiplier = input.float(0.5, title="TP1 Multiplier", minval=0.1, maxval=5.0, step=0.1)

tp2_multiplier = input.float(1.0, title="TP2 Multiplier", minval=0.1, maxval=5.0, step=0.1)

tp3_multiplier = input.float(1.5, title="TP3 Multiplier", minval=0.1, maxval=5.0, step=0.1)

tp4_multiplier = input.float(2.0, title="TP4 Multiplier", minval=0.1, maxval=5.0, step=0.1)

// Define Take Profit Levels as float variables initialized with na

var float takeProfit1 = na

var float takeProfit2 = na

var float takeProfit3 = na

var float takeProfit4 = na

// Calculate take profit levels based on the multipliers

if buySignal

takeProfit1 := high + (high - low) * tp1_multiplier // TP1: Set TP at multiplier of previous range above the high

takeProfit2 := high + (high - low) * tp2_multiplier // TP2: Set TP at multiplier of previous range above the high

takeProfit3 := high + (high - low) * tp3_multiplier // TP3: Set TP at multiplier of previous range above the high

takeProfit4 := high + (high - low) * tp4_multiplier // TP4: Set TP at multiplier of previous range above the high

if sellSignal

takeProfit1 := low - (high - low) * tp1_multiplier // TP1: Set TP at multiplier of previous range below the low

takeProfit2 := low - (high - low) * tp2_multiplier // TP2: Set TP at multiplier of previous range below the low

takeProfit3 := low - (high - low) * tp3_multiplier // TP3: Set TP at multiplier of previous range below the low

takeProfit4 := low - (high - low) * tp4_multiplier // TP4: Set TP at multiplier of previous range below the low

// Plot Take Profit Levels on the chart

plot(takeProfit1, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 1")

plot(takeProfit2, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 2")

plot(takeProfit3, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 3")

plot(takeProfit4, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 4")

// Create buy and sell signals on the chart

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")

// Highlight the candles based on trend direction

uptrend = ta.crossover(ema20, ema50) // EMA 20 crosses above EMA 50 (Bullish)

downtrend = ta.crossunder(ema20, ema50) // EMA 20 crosses below EMA 50 (Bearish)

// Highlighting candles based on trend

bgcolor(color = ema20 > ema50 ? color.new(color.green, 80) : ema20 < ema50 ? color.new(color.red, 80) : na)

// Execute buy and sell orders on the chart

strategy.entry("Buy", strategy.long, when=buySignal)

strategy.entry("Sell", strategy.short, when=sellSignal)

// Exit conditions based on Take Profit levels

strategy.exit("Take Profit 1", "Buy", limit=takeProfit1)

strategy.exit("Take Profit 2", "Buy", limit=takeProfit2)

strategy.exit("Take Profit 3", "Buy", limit=takeProfit3)

strategy.exit("Take Profit 4", "Buy", limit=takeProfit4)

strategy.exit("Take Profit 1", "Sell", limit=takeProfit1)

strategy.exit("Take Profit 2", "Sell", limit=takeProfit2)

strategy.exit("Take Profit 3", "Sell", limit=takeProfit3)

strategy.exit("Take Profit 4", "Sell", limit=takeProfit4)

// Optionally, add a stop loss

stopLoss = 0.03 // Example: 3% stop loss

strategy.exit("Stop Loss", "Buy", stop=close * (1 - stopLoss))

strategy.exit("Stop Loss", "Sell", stop=close * (1 + stopLoss))