C’est quoi cette tactique des dieux saints ?

Cette stratégie est comme un “super radar” pour le marché: au lieu de simplement regarder un ou deux indicateurs, elle regroupe neuf indicateurs techniques différents comme un orchestre, chacun étant un “instrument”, et la stratégie n’émet un signal de transaction que lorsqu’ils jouent une “note” harmonieuse.

La révélation des principes fondamentaux du yoga

L’essence de cette stratégie réside dans la notion de “paramètres multipliés”. Elle standardise les indicateurs tels que le RSI, l’ADX, la dynamique, le taux de variation, l’ATR, le trafic, l’accélération et l’inclinaison sur la même échelle, puis les multiplie pour obtenir une “valeur de force globale”.

Les instruments de négociation personnalisables

Qu’est-ce qui est le plus cool dans cette stratégie? Vous pouvez la combiner librement comme si vous construisiez des blocs! Vous ne voulez pas utiliser un indicateur?

Guide de l’utilisation de l’acier au combat

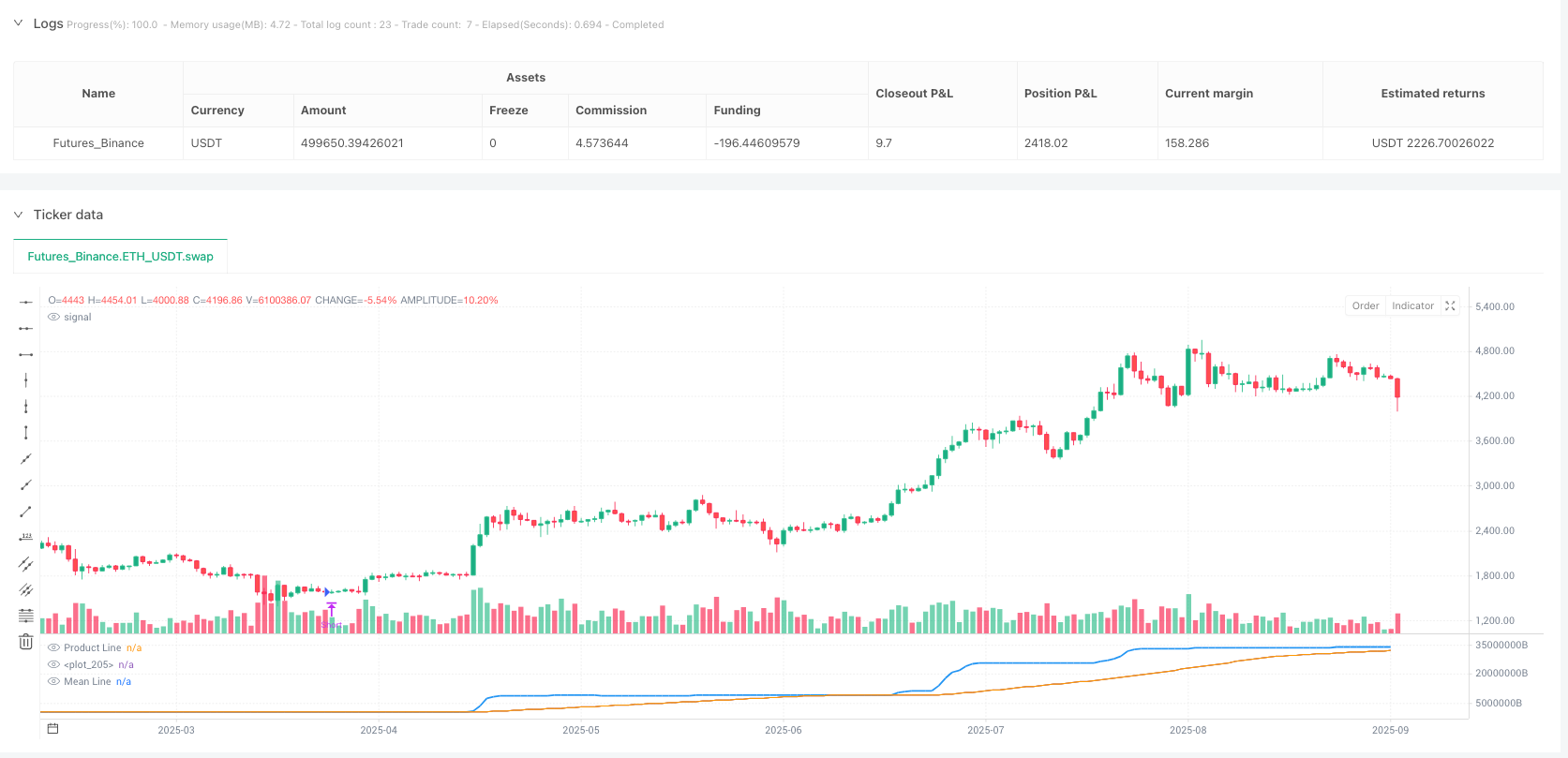

La stratégie est particulièrement adaptée aux conditions de marché où les chocs et les tendances sont mélangés. Faites plus lorsque la ligne bleue traverse la ligne orange à la hausse, et videz-la lorsque vous la traversez à la baisse. La stratégie est également soigneusement configurée pour un mécanisme de placement automatique qui vous évite de maintenir une position lorsque des signaux de revers apparaissent.

//@version=5

strategy("Parametric Multiplier Backtester", shorttitle="PMB", overlay=false)

// Author: Script_Algo

// License: MIT

// Permission is hereby granted, free of charge, to any person obtaining a copy

// of this software and associated documentation files (the "Software"), to deal

// in the Software without restriction, including without limitation the rights

// to use, copy, modify, merge, publish, distribute, sublicense, and/or sell

// copies of the Software, subject to the following conditions:

// The above copyright notice and this permission notice shall be included in

// all copies or substantial portions of the Software.

// === Input Parameters ===

// Price

useClose = input.bool(true, "▪ Use Price", group="Parameter Settings")

priceSource = input.source(close, "Price Source", group="Parameter Settings")

// RSI

useRSI = input.bool(true, "▪ Use RSI", group="Parameter Settings")

rsiLength = input.int(8, "RSI Period", minval=1, group="Parameter Settings")

rsiSource = input.source(close, "RSI Source", group="Parameter Settings")

// ADX

useADX = input.bool(true, "▪ Use ADX", group="Parameter Settings")

adxLength = input.int(11, "ADX Period", minval=1, group="Parameter Settings")

// Momentum

useMomentum = input.bool(true, "▪ Use Momentum", group="Parameter Settings")

momLength = input.int(8, "Momentum Period", minval=1, group="Parameter Settings")

momSource = input.source(close, "Momentum Source", group="Parameter Settings")

// ROC

useROC = input.bool(true, "▪ Use ROC", group="Parameter Settings")

rocLength = input.int(3, "ROC Period", minval=1, group="Parameter Settings")

rocSource = input.source(close, "ROC Source", group="Parameter Settings")

// ATR

useATR = input.bool(true, "▪ Use ATR", group="Parameter Settings")

atrLength = input.int(40, "ATR Period", minval=1, group="Parameter Settings")

// Volume

useVolume = input.bool(true, "▪ Use Volume", group="Parameter Settings")

volumeSmoothing = input.int(200, "Volume Smoothing", minval=1, group="Parameter Settings")

// Acceleration

useAcceleration = input.bool(true, "▪ Use Acceleration", group="Parameter Settings")

accLength = input.int(500, "Acceleration Period", minval=1, group="Parameter Settings")

accSource = input.source(close, "Acceleration Source", group="Parameter Settings")

// Slope

useSlope = input.bool(true, "▪ Use Slope", group="Parameter Settings")

slopeLength = input.int(6, "Slope Period", minval=2, group="Parameter Settings")

slopeSource = input.source(close, "Slope Source", group="Parameter Settings")

// Normalization

normalizeValues = input.bool(true, "Normalize Values", group="General Settings")

lookbackPeriod = input.int(20, "Normalization Period", minval=10, group="General Settings")

// Product line smoothing

smoothProduct = input.bool(true, "Smooth Product Line", group="General Settings")

smoothingLength = input.int(200, "Smoothing Period", minval=1, group="General Settings")

// === SMA Trend Filter ===

trendFilter = input.bool(false, "Use SMA Trend Filter", group="Trend Filter")

smaPeriod = input.int(200, "SMA Period for Filter", minval=1, group="Trend Filter")

// === Indicator Calculations ===

// RSI

rsiValue = ta.rsi(rsiSource, rsiLength)

// ADX (correct calculation)

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = ta.tr

plus = fixnan(100 * ta.rma(plusDM, len) / ta.rma(truerange, len))

minus = fixnan(100 * ta.rma(minusDM, len) / ta.rma(truerange, len))

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), len)

[adx, plus, minus]

[adxValue, diPlus, diMinus] = dirmov(adxLength)

// Momentum

momValue = (momSource / momSource[momLength]) * 100

// ROC

rocValue = ((rocSource - rocSource[rocLength]) / rocSource[rocLength]) * 100

// ATR

atrValue = ta.atr(atrLength)

// Volume

smaVolume = ta.sma(volume, volumeSmoothing)

// Acceleration (расчет ускорения цены)

accValue = (accSource / accSource[accLength] - 1) * 100

// Slope (расчет наклона линейной регрессии)

slopeValue = ta.linreg(slopeSource, slopeLength, 0) - ta.linreg(slopeSource, slopeLength, slopeLength)

// Price

priceValue = priceSource

// === Value Normalization ===

normalize_func(_value, _use, _length) =>

if not _use

1

else

if normalizeValues

minVal = ta.lowest(_value, _length)

maxVal = ta.highest(_value, _length)

valueRange = maxVal - minVal

valueRange > 0 ? (_value - minVal) / valueRange * 100 + 1 : 1

else

_value

// Normalized values

normPrice = normalize_func(priceValue, useClose, lookbackPeriod)

normRSI = normalize_func(rsiValue, useRSI, lookbackPeriod)

normADX = normalize_func(adxValue, useADX, lookbackPeriod)

normMomentum = normalize_func(momValue, useMomentum, lookbackPeriod)

normROC = normalize_func(rocValue, useROC, lookbackPeriod)

normATR = normalize_func(atrValue, useATR, lookbackPeriod)

normVolume = normalize_func(smaVolume, useVolume, lookbackPeriod)

normAcceleration = normalize_func(accValue, useAcceleration, lookbackPeriod)

normSlope = normalize_func(slopeValue, useSlope, lookbackPeriod)

// === Product Calculation ===

productValue = 1.0

// Multiply only if parameter is enabled

if useClose

productValue *= normPrice

if useRSI

productValue *= normRSI

if useADX

productValue *= normADX

if useMomentum

productValue *= normMomentum

if useROC

productValue *= normROC

if useATR

productValue *= normATR

if useVolume

productValue *= normVolume

if useAcceleration

productValue *= normAcceleration

if useSlope

productValue *= normSlope

// Product line smoothing

smoothedProduct = smoothProduct ? ta.sma(productValue, smoothingLength) : productValue

// Mean line

meanLine = ta.sma(smoothedProduct, 50)

// SMA trend filter

smaFilter = ta.sma(close, smaPeriod)

// === Trading Conditions ===

// Bullish crossover (product line crosses mean line from below)

bullishCross = ta.crossover(smoothedProduct, meanLine)

// Bearish crossover (product line crosses mean line from above)

bearishCross = ta.crossunder(smoothedProduct, meanLine)

// Entry conditions with trend filter

longCondition = bullishCross and (not trendFilter or close > smaFilter)

shortCondition = bearishCross and (not trendFilter or close < smaFilter)

// === Strategy Execution ===

// Close opposite positions before opening new ones

if (longCondition)

strategy.close("Short", comment="Close Short Entry Long")

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.close("Long", comment="Close Long Entry Short")

strategy.entry("Short", strategy.short)

// Additional exit conditions for more precise control

if (bearishCross and strategy.position_size > 0)

strategy.close("Long", comment="Exit Long")

if (bullishCross and strategy.position_size < 0)

strategy.close("Short", comment="Exit Short")

// === Visualization (as oscillator below chart) ===

// Plot product line and mean line in separate pane

plot(smoothedProduct, color=color.blue, linewidth=2, title="Product Line")

plot(meanLine, color=color.orange, linewidth=1, title="Mean Line")

// Fill area between lines

fill(plot(smoothedProduct), plot(meanLine), color=smoothedProduct > meanLine ? color.new(color.green, 90) : color.new(color.red, 90))

// Information table

var table infoTable = table.new(position.top_right, 1, 1, bgcolor=color.white, border_width=1)

if barstate.islast

table.cell(infoTable, 0, 0, "Current Value: " + str.tostring(smoothedProduct, "#.##"), text_color=color.black)