🎯 这是什么神仙策略?

你知道吗?这个策略就像是给市场装了一个”超级雷达”!它不是简单地看一两个指标,而是把9个不同的技术指标像乐队一样组合在一起,每个指标都是一个”乐器”,只有当它们奏出和谐的”音符”时,策略才会发出交易信号。想象一下,这就像是有9个专家同时在你耳边给建议,只有当大部分人都同意时,你才行动!

📊 核心原理大揭秘

划重点!这个策略的精髓在于”参数乘数”概念。它把RSI、ADX、动量、变化率、ATR、成交量、加速度和斜率等指标先标准化到同一个尺度,然后把它们相乘得到一个”综合力量值”。就像做菜一样,每种调料都有最佳比例,这个策略帮你找到市场各种”调料”的完美配比!当综合力量值穿越其均线时,就是入场的最佳时机。

🔧 可定制化的交易利器

这个策略最酷的地方是什么?你可以像搭积木一样自由组合!不想用某个指标?直接关掉就行。想调整周期参数?随你喜欢。甚至还有SMA趋势过滤器,帮你避开逆势交易的大坑。这就像是一个”交易策略DIY工具包”,让你根据不同市场环境调整配置。

⚡ 实战应用指南

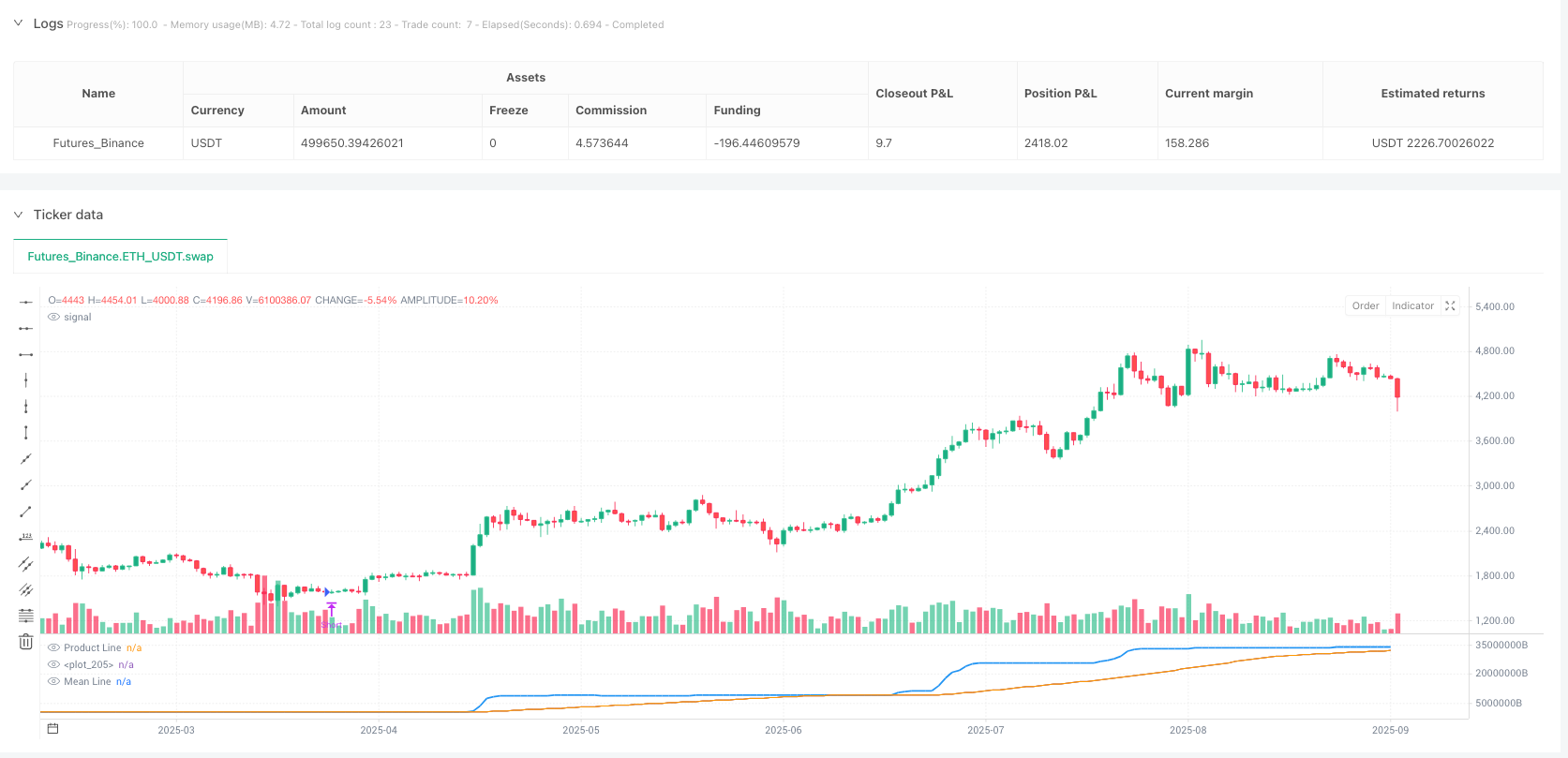

避坑指南来了!这个策略特别适合震荡和趋势混合的市场环境。当蓝色的产品线向上穿越橙色的均线时做多,向下穿越时做空。策略还贴心地设置了自动平仓机制,避免你在反向信号出现时还傻傻持仓。记住,开启趋势过滤器能让你在大趋势中游刃有余,关闭它则能捕捉更多短期机会!

策略源码

//@version=5

strategy("Parametric Multiplier Backtester", shorttitle="PMB", overlay=false)

// Author: Script_Algo

// License: MIT

// Permission is hereby granted, free of charge, to any person obtaining a copy

// of this software and associated documentation files (the "Software"), to deal

// in the Software without restriction, including without limitation the rights

// to use, copy, modify, merge, publish, distribute, sublicense, and/or sell

// copies of the Software, subject to the following conditions:

// The above copyright notice and this permission notice shall be included in

// all copies or substantial portions of the Software.

// === Input Parameters ===

// Price

useClose = input.bool(true, "▪ Use Price", group="Parameter Settings")

priceSource = input.source(close, "Price Source", group="Parameter Settings")

// RSI

useRSI = input.bool(true, "▪ Use RSI", group="Parameter Settings")

rsiLength = input.int(8, "RSI Period", minval=1, group="Parameter Settings")

rsiSource = input.source(close, "RSI Source", group="Parameter Settings")

// ADX

useADX = input.bool(true, "▪ Use ADX", group="Parameter Settings")

adxLength = input.int(11, "ADX Period", minval=1, group="Parameter Settings")

// Momentum

useMomentum = input.bool(true, "▪ Use Momentum", group="Parameter Settings")

momLength = input.int(8, "Momentum Period", minval=1, group="Parameter Settings")

momSource = input.source(close, "Momentum Source", group="Parameter Settings")

// ROC

useROC = input.bool(true, "▪ Use ROC", group="Parameter Settings")

rocLength = input.int(3, "ROC Period", minval=1, group="Parameter Settings")

rocSource = input.source(close, "ROC Source", group="Parameter Settings")

// ATR

useATR = input.bool(true, "▪ Use ATR", group="Parameter Settings")

atrLength = input.int(40, "ATR Period", minval=1, group="Parameter Settings")

// Volume

useVolume = input.bool(true, "▪ Use Volume", group="Parameter Settings")

volumeSmoothing = input.int(200, "Volume Smoothing", minval=1, group="Parameter Settings")

// Acceleration

useAcceleration = input.bool(true, "▪ Use Acceleration", group="Parameter Settings")

accLength = input.int(500, "Acceleration Period", minval=1, group="Parameter Settings")

accSource = input.source(close, "Acceleration Source", group="Parameter Settings")

// Slope

useSlope = input.bool(true, "▪ Use Slope", group="Parameter Settings")

slopeLength = input.int(6, "Slope Period", minval=2, group="Parameter Settings")

slopeSource = input.source(close, "Slope Source", group="Parameter Settings")

// Normalization

normalizeValues = input.bool(true, "Normalize Values", group="General Settings")

lookbackPeriod = input.int(20, "Normalization Period", minval=10, group="General Settings")

// Product line smoothing

smoothProduct = input.bool(true, "Smooth Product Line", group="General Settings")

smoothingLength = input.int(200, "Smoothing Period", minval=1, group="General Settings")

// === SMA Trend Filter ===

trendFilter = input.bool(false, "Use SMA Trend Filter", group="Trend Filter")

smaPeriod = input.int(200, "SMA Period for Filter", minval=1, group="Trend Filter")

// === Indicator Calculations ===

// RSI

rsiValue = ta.rsi(rsiSource, rsiLength)

// ADX (correct calculation)

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = ta.tr

plus = fixnan(100 * ta.rma(plusDM, len) / ta.rma(truerange, len))

minus = fixnan(100 * ta.rma(minusDM, len) / ta.rma(truerange, len))

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), len)

[adx, plus, minus]

[adxValue, diPlus, diMinus] = dirmov(adxLength)

// Momentum

momValue = (momSource / momSource[momLength]) * 100

// ROC

rocValue = ((rocSource - rocSource[rocLength]) / rocSource[rocLength]) * 100

// ATR

atrValue = ta.atr(atrLength)

// Volume

smaVolume = ta.sma(volume, volumeSmoothing)

// Acceleration (расчет ускорения цены)

accValue = (accSource / accSource[accLength] - 1) * 100

// Slope (расчет наклона линейной регрессии)

slopeValue = ta.linreg(slopeSource, slopeLength, 0) - ta.linreg(slopeSource, slopeLength, slopeLength)

// Price

priceValue = priceSource

// === Value Normalization ===

normalize_func(_value, _use, _length) =>

if not _use

1

else

if normalizeValues

minVal = ta.lowest(_value, _length)

maxVal = ta.highest(_value, _length)

valueRange = maxVal - minVal

valueRange > 0 ? (_value - minVal) / valueRange * 100 + 1 : 1

else

_value

// Normalized values

normPrice = normalize_func(priceValue, useClose, lookbackPeriod)

normRSI = normalize_func(rsiValue, useRSI, lookbackPeriod)

normADX = normalize_func(adxValue, useADX, lookbackPeriod)

normMomentum = normalize_func(momValue, useMomentum, lookbackPeriod)

normROC = normalize_func(rocValue, useROC, lookbackPeriod)

normATR = normalize_func(atrValue, useATR, lookbackPeriod)

normVolume = normalize_func(smaVolume, useVolume, lookbackPeriod)

normAcceleration = normalize_func(accValue, useAcceleration, lookbackPeriod)

normSlope = normalize_func(slopeValue, useSlope, lookbackPeriod)

// === Product Calculation ===

productValue = 1.0

// Multiply only if parameter is enabled

if useClose

productValue *= normPrice

if useRSI

productValue *= normRSI

if useADX

productValue *= normADX

if useMomentum

productValue *= normMomentum

if useROC

productValue *= normROC

if useATR

productValue *= normATR

if useVolume

productValue *= normVolume

if useAcceleration

productValue *= normAcceleration

if useSlope

productValue *= normSlope

// Product line smoothing

smoothedProduct = smoothProduct ? ta.sma(productValue, smoothingLength) : productValue

// Mean line

meanLine = ta.sma(smoothedProduct, 50)

// SMA trend filter

smaFilter = ta.sma(close, smaPeriod)

// === Trading Conditions ===

// Bullish crossover (product line crosses mean line from below)

bullishCross = ta.crossover(smoothedProduct, meanLine)

// Bearish crossover (product line crosses mean line from above)

bearishCross = ta.crossunder(smoothedProduct, meanLine)

// Entry conditions with trend filter

longCondition = bullishCross and (not trendFilter or close > smaFilter)

shortCondition = bearishCross and (not trendFilter or close < smaFilter)

// === Strategy Execution ===

// Close opposite positions before opening new ones

if (longCondition)

strategy.close("Short", comment="Close Short Entry Long")

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.close("Long", comment="Close Long Entry Short")

strategy.entry("Short", strategy.short)

// Additional exit conditions for more precise control

if (bearishCross and strategy.position_size > 0)

strategy.close("Long", comment="Exit Long")

if (bullishCross and strategy.position_size < 0)

strategy.close("Short", comment="Exit Short")

// === Visualization (as oscillator below chart) ===

// Plot product line and mean line in separate pane

plot(smoothedProduct, color=color.blue, linewidth=2, title="Product Line")

plot(meanLine, color=color.orange, linewidth=1, title="Mean Line")

// Fill area between lines

fill(plot(smoothedProduct), plot(meanLine), color=smoothedProduct > meanLine ? color.new(color.green, 90) : color.new(color.red, 90))

// Information table

var table infoTable = table.new(position.top_right, 1, 1, bgcolor=color.white, border_width=1)

if barstate.islast

table.cell(infoTable, 0, 0, "Current Value: " + str.tostring(smoothedProduct, "#.##"), text_color=color.black)

相关推荐