🎯 策略核心亮点:不只是看价格的EMA策略

你知道吗?大部分人用EMA只会看价格,但这个策略厉害在哪?它能从6种不同数据源计算EMA!就像做菜不只用盐调味,还能用糖、醋、酱油一样,给你更丰富的交易信号。

划重点!这6种数据源包括:普通价格、成交量、变化率、平均K线价格、平均K线成交量、平均K线变化率。每种都有不同的市场洞察力!

📊 三重过滤系统:让信号更精准

这个策略不是随便给信号的!它有三道”安检”:

第一道:EMA趋势判断 📈 就像看天气预报,先确定大方向是晴是雨

第二道:ADX强度过滤 💪

ADX就像测量风力的仪器,只有趋势够强(默认25以上),才发出信号。避免在震荡市中被来回打脸!

第三道:成交量确认 🔊 成交量突增就像股票在”大声说话”,证明这个信号是认真的,不是开玩笑

🎮 三种退出模式:适应不同交易风格

最贴心的是,这个策略给了3种退出方式,就像游戏有简单、普通、困难三个难度:

模式1:反向信号退出 🔄 最简单粗暴,多头信号来了就平空开多,空头信号来了就平多开空

模式2:ATR动态止盈止损 📏 根据市场波动性自动调整,波动大的时候止损放宽点,波动小的时候收紧点

模式3:固定百分比止盈止损 📊 最好理解,赚2%就跑,亏1.5%就认输(可自定义)

🚀 实战应用建议

适用周期:中短期交易,特别适合有一定波动性的市场 避坑指南:震荡市要小心,建议开启ADX过滤 进阶玩法:可以尝试不同数据源,成交量源在放量突破时特别有效!

这个策略最大的优势就是灵活性强,你可以根据不同市场环境选择最合适的数据源和退出模式。记住,没有完美的策略,只有最适合当前市场的策略!

策略源码

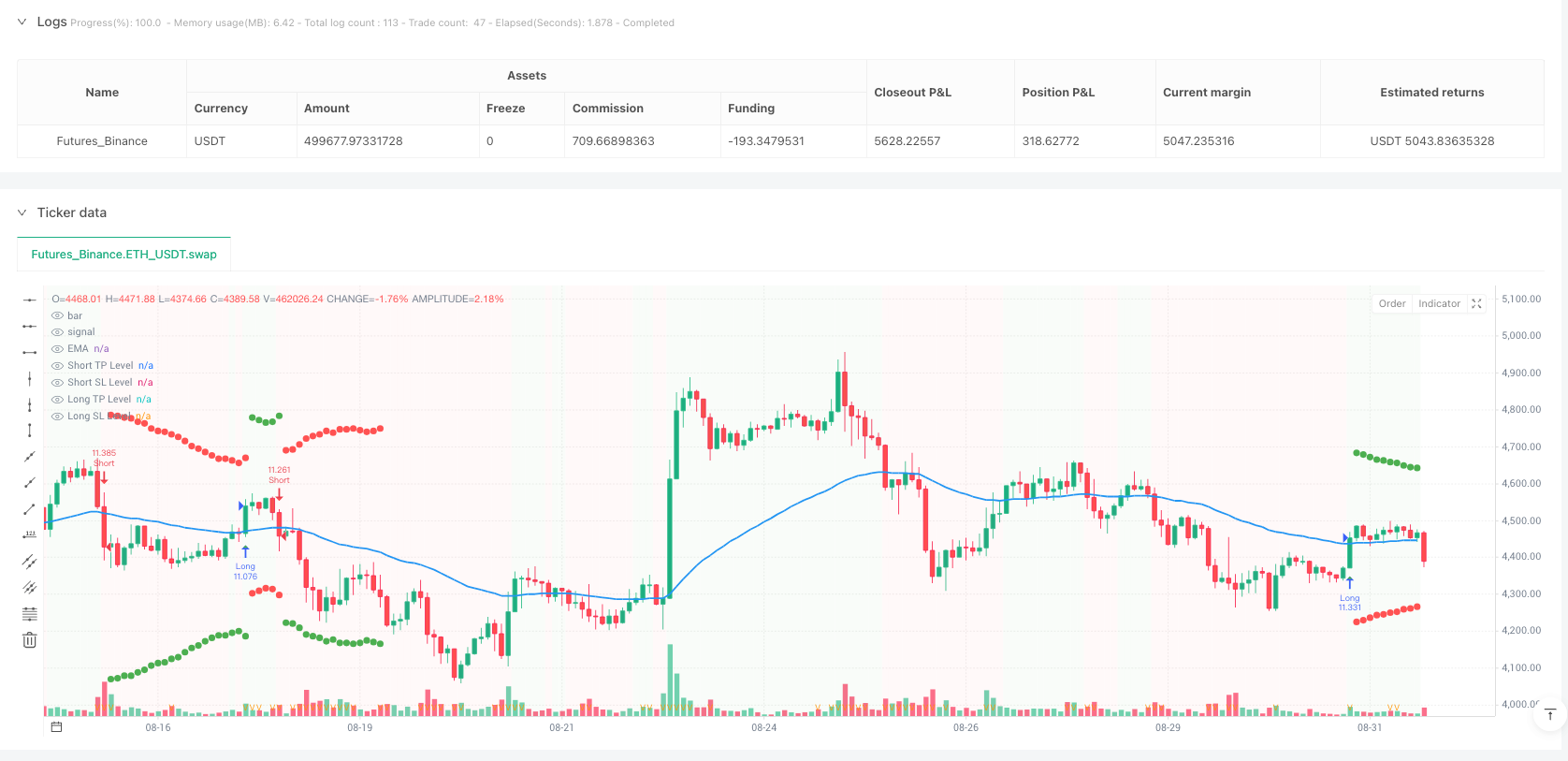

/*backtest

start: 2025-01-01 00:00:00

end: 2025-09-01 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=5

//@fenyesk

strategy("EMA inFusion Pro - Source Selection", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// =============================================

// === INPUT PARAMETERS =======================

// =============================================

// Moving Average Source Selection

maSourceSelection = input.string("Price", "Moving Average Source",

options=["Price", "Volume", "Rate of Change", "Heikin Ashi Price", "Heikin Ashi Volume", "Heikin Ashi Rate of Change"],

tooltip="Select data source for EMA calculation")

// EMA Settings

emaLength = input.int(50, title="EMA Length", minval=1, maxval=200)

rocLength = input.int(1, title="Rate of Change Length", minval=1, maxval=50, tooltip="Length for ROC calculation")

// ADX Filter Settings

useAdxFilter = input.bool(true, title="Use ADX Filter", group="ADX Settings")

adxLength = input.int(14, title="ADX Length", minval=1, maxval=50, group="ADX Settings")

adxThreshold = input.float(25, title="ADX Threshold", minval=10, maxval=50, step=0.5, group="ADX Settings")

// Volume Spike Settings

useVolumeFilter = input.bool(true, title="Use Volume Spike Filter", group="Volume Settings")

volumeMultiplier = input.float(1.0, title="Volume Spike Multiplier", minval=1.0, maxval=5.0, step=0.1, group="Volume Settings")

volumeSmaLength = input.int(20, title="Volume SMA Length", minval=5, maxval=100, group="Volume Settings")

// Trading Exit Mode Selector

tradingMode = input.int(2, title="Trading Exit Mode", minval=1, maxval=3,

tooltip="1: Exit on reverse signal\n2: ATR based TP/SL\n3: Percent based TP/SL",

group="Exit Strategy")

// Mode 3: Percent-Based Settings

takeProfitPercent = input.float(2.0, title="Take Profit %", minval=0.1, maxval=10.0, step=0.1, group="Percent Exit")

stopLossPercent = input.float(1.5, title="Stop Loss %", minval=0.1, maxval=10.0, step=0.1, group="Percent Exit")

// Mode 2: ATR-Based Settings

atrLength = input.int(14, title="ATR Length", minval=1, maxval=50, group="ATR Exit")

atrMultiplierTp = input.float(4.0, title="ATR Take Profit Multiplier", minval=0.1, maxval=10.0, step=0.1, group="ATR Exit")

atrMultiplierSl = input.float(4.0, title="ATR Stop Loss Multiplier", minval=0.1, maxval=10.0, step=0.1, group="ATR Exit")

// =============================================

// === SOURCE CALCULATIONS ====================

// =============================================

// Rate of Change calculation

roc(src, length) =>

change = src - src[length]

src[length] != 0 ? (change / src[length] * 100) : 0

// Standard Rate of Change

rocPrice = roc(close, rocLength)

rocVolume = roc(volume, rocLength)

// Heikin Ashi calculations

haClose = (open + high + low + close) / 4

var float haOpen = na

haOpen := na(haOpen[1]) ? (open + close) / 2 : (haOpen[1] + haClose[1]) / 2

haHigh = math.max(high, math.max(haOpen, haClose))

haLow = math.min(low, math.min(haOpen, haClose))

// Heikin Ashi Rate of Change

haRocPrice = roc(haClose, rocLength)

haRocVolume = roc(volume, rocLength) // Volume remains same for HA

// Define EMA source based on selection

emaSource = switch maSourceSelection

"Price" => close

"Volume" => volume

"Rate of Change" => rocPrice

"Heikin Ashi Price" => haClose

"Heikin Ashi Volume" => volume // Volume doesn't change in HA

"Heikin Ashi Rate of Change" => haRocPrice

=> close // Default fallback

// =============================================

// === INDICATOR CALCULATIONS =================

// =============================================

// Core Indicators

emaValue = ta.ema(emaSource, emaLength)

[diPlus, diMinus, adx] = ta.dmi(adxLength, adxLength)

volumeSma = ta.sma(volume, volumeSmaLength)

volumeSpike = volume > (volumeSma * volumeMultiplier)

atrValue = ta.atr(atrLength)

// Trend Conditions (adjusted for different source types)

bullishTrend = switch maSourceSelection

"Price" => close > emaValue

"Heikin Ashi Price" => haClose > emaValue

"Volume" => volume > emaValue

"Heikin Ashi Volume" => volume > emaValue

"Rate of Change" => rocPrice > emaValue

"Heikin Ashi Rate of Change" => haRocPrice > emaValue

=> close > emaValue

bearishTrend = not bullishTrend

// Cross conditions (adjusted for source type)

emaCrossUp = switch maSourceSelection

"Price" => ta.crossover(close, emaValue)

"Heikin Ashi Price" => ta.crossover(haClose, emaValue)

"Volume" => ta.crossover(volume, emaValue)

"Heikin Ashi Volume" => ta.crossover(volume, emaValue)

"Rate of Change" => ta.crossover(rocPrice, emaValue)

"Heikin Ashi Rate of Change" => ta.crossover(haRocPrice, emaValue)

=> ta.crossover(close, emaValue)

emaCrossDown = switch maSourceSelection

"Price" => ta.crossunder(close, emaValue)

"Heikin Ashi Price" => ta.crossunder(haClose, emaValue)

"Volume" => ta.crossunder(volume, emaValue)

"Heikin Ashi Volume" => ta.crossunder(volume, emaValue)

"Rate of Change" => ta.crossunder(rocPrice, emaValue)

"Heikin Ashi Rate of Change" => ta.crossunder(haRocPrice, emaValue)

=> ta.crossunder(close, emaValue)

// Filters

strongTrend = useAdxFilter ? adx >= adxThreshold : true

volumeConfirm = useVolumeFilter ? volumeSpike : true

// Entry Signals

longCondition = emaCrossUp and strongTrend and volumeConfirm

shortCondition = emaCrossDown and strongTrend and volumeConfirm

// =============================================

// === STRATEGY EXECUTION WITH EXIT MODES =====

// =============================================

// MODE 1: EXIT ON REVERSE SIGNAL

if (tradingMode == 1)

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.close("Short")

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.close("Long")

// MODE 2: ATR-BASED TAKE PROFIT & STOP LOSS

else if (tradingMode == 2)

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Long TP/SL", "Long",

profit=atrMultiplierTp * atrValue / syminfo.mintick,

loss=atrMultiplierSl * atrValue / syminfo.mintick)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Short TP/SL", "Short",

profit=atrMultiplierTp * atrValue / syminfo.mintick,

loss=atrMultiplierSl * atrValue / syminfo.mintick)

// MODE 3: PERCENT-BASED TAKE PROFIT & STOP LOSS

else if (tradingMode == 3)

if (longCondition)

longTpPrice = close * (1 + takeProfitPercent / 100)

longSlPrice = close * (1 - stopLossPercent / 100)

strategy.entry("Long", strategy.long)

strategy.exit("Long TP/SL", "Long", limit=longTpPrice, stop=longSlPrice)

if (shortCondition)

shortTpPrice = close * (1 - takeProfitPercent / 100)

shortSlPrice = close * (1 + stopLossPercent / 100)

strategy.entry("Short", strategy.short)

strategy.exit("Short TP/SL", "Short", limit=shortTpPrice, stop=shortSlPrice)

// =============================================

// === VISUALIZATIONS =========================

// =============================================

// Plot EMA with dynamic color based on source type

emaColor = switch maSourceSelection

"Price" => color.blue

"Volume" => color.orange

"Rate of Change" => color.purple

"Heikin Ashi Price" => color.green

"Heikin Ashi Volume" => color.red

"Heikin Ashi Rate of Change" => color.maroon

=> color.blue

plot(emaValue, title="EMA", color=emaColor, linewidth=2)

// Plot source data for reference (in separate pane when not price-based)

sourceColor = maSourceSelection == "Price" or maSourceSelection == "Heikin Ashi Price" ? na : color.gray

plot(str.contains(maSourceSelection, "Price") ? na : emaSource, title="Source Data", color=sourceColor)

// Background color based on trend

bgcolor(bullishTrend ? color.new(color.green, 95) : color.new(color.red, 95), title="Trend Background")

// Entry signals

plotshape(longCondition, title="Long Signal", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(shortCondition, title="Short Signal", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// Volume spikes

plotchar(useVolumeFilter and volumeSpike, title="Volume Spike", char="V", location=location.bottom, color=color.orange, size=size.tiny)

// ATR-based levels for Mode 2

plot(tradingMode == 2 and strategy.position_size > 0 ? strategy.position_avg_price + (atrMultiplierTp * atrValue) : na,

title="Long TP Level", color=color.green, style=plot.style_circles, linewidth=1)

plot(tradingMode == 2 and strategy.position_size > 0 ? strategy.position_avg_price - (atrMultiplierSl * atrValue) : na,

title="Long SL Level", color=color.red, style=plot.style_circles, linewidth=1)

plot(tradingMode == 2 and strategy.position_size < 0 ? strategy.position_avg_price - (atrMultiplierTp * atrValue) : na,

title="Short TP Level", color=color.green, style=plot.style_circles, linewidth=1)

plot(tradingMode == 2 and strategy.position_size < 0 ? strategy.position_avg_price + (atrMultiplierSl * atrValue) : na,

title="Short SL Level", color=color.red, style=plot.style_circles, linewidth=1)

// Alert conditions

alertcondition(longCondition, title="Long Entry", message="EMA Fusion Pro: Long entry signal")

alertcondition(shortCondition, title="Short Entry", message="EMA Fusion Pro: Short entry signal")

相关推荐