概述

该策略是一个基于多重技术指标的趋势跟踪和动量交易系统。它主要结合了平均趋向指标(ADX)、相对强弱指标(RSI)和真实波幅(ATR)来识别潜在的做多机会,并利用ATR来设定动态的获利和止损价位。该策略特别适用于1分钟时间周期的期权交易,通过严格的入场条件和风险管理来提高交易的成功率。

策略原理

策略的核心逻辑包含以下几个关键组成部分: 1. 趋势确认: 使用ADX>18且+DI大于-DI来确认市场处于上升趋势。 2. 动量验证: 要求RSI突破60且位于其20周期移动平均线之上,验证价格动量。 3. 入场时机: 当趋势和动量条件同时满足时,系统在当前收盘价位建立多头仓位。 4. 目标管理: 基于入场时的ATR值设定动态的获利目标(2.5倍ATR)和止损位(1.5倍ATR)。

策略优势

- 多维度确认: 通过结合趋势和动量指标,提供更可靠的交易信号。

- 动态风险管理: 使用ATR动态调整止盈止损位置,适应市场波动性变化。

- 清晰的交易规则: 入场和出场条件明确,降低主观判断带来的干扰。

- 适应性强: 策略参数可根据不同市场环境和交易品种进行优化调整。

策略风险

- 假突破风险: RSI突破60可能出现假信号,需要结合其他指标验证。

- 滑点影响: 在1分钟周期的快速市场中,可能面临较大的滑点风险。

- 市场环境依赖: 策略在趋势明显的市场表现较好,震荡市可能频繁触发止损。

- 参数敏感性: 多个指标参数的设置需要平衡,不当的参数组合可能影响策略表现。

策略优化方向

- 入场优化: 可增加成交量确认机制,提高信号可靠性。

- 仓位管理: 引入动态仓位管理系统,根据市场波动性调整持仓规模。

- 出场机制: 可考虑添加追踪止损功能,更好地保护盈利。

- 时间过滤: 增加交易时间窗口过滤,避开波动性过大或流动性不足的时段。

总结

该策略通过综合运用多个技术指标,构建了一个完整的交易系统。其优势在于结合了趋势和动量分析,并采用动态的风险管理方法。虽然存在一定的风险,但通过合理的参数优化和风险控制措施,能够在实际交易中取得稳定的表现。建议交易者在实盘使用前,对策略进行充分的回测和参数优化,并根据具体交易品种的特点进行适当调整。

策略源码

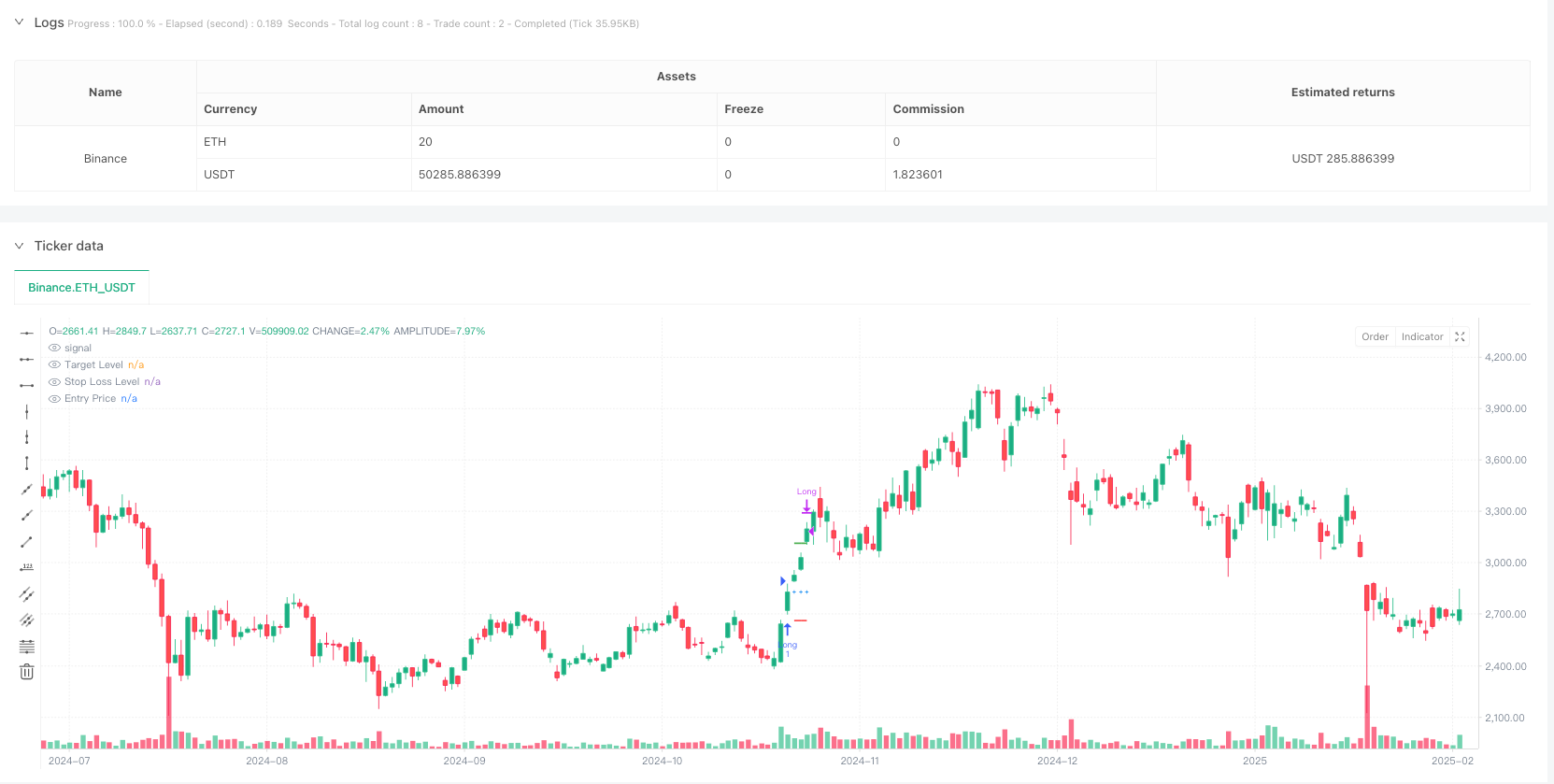

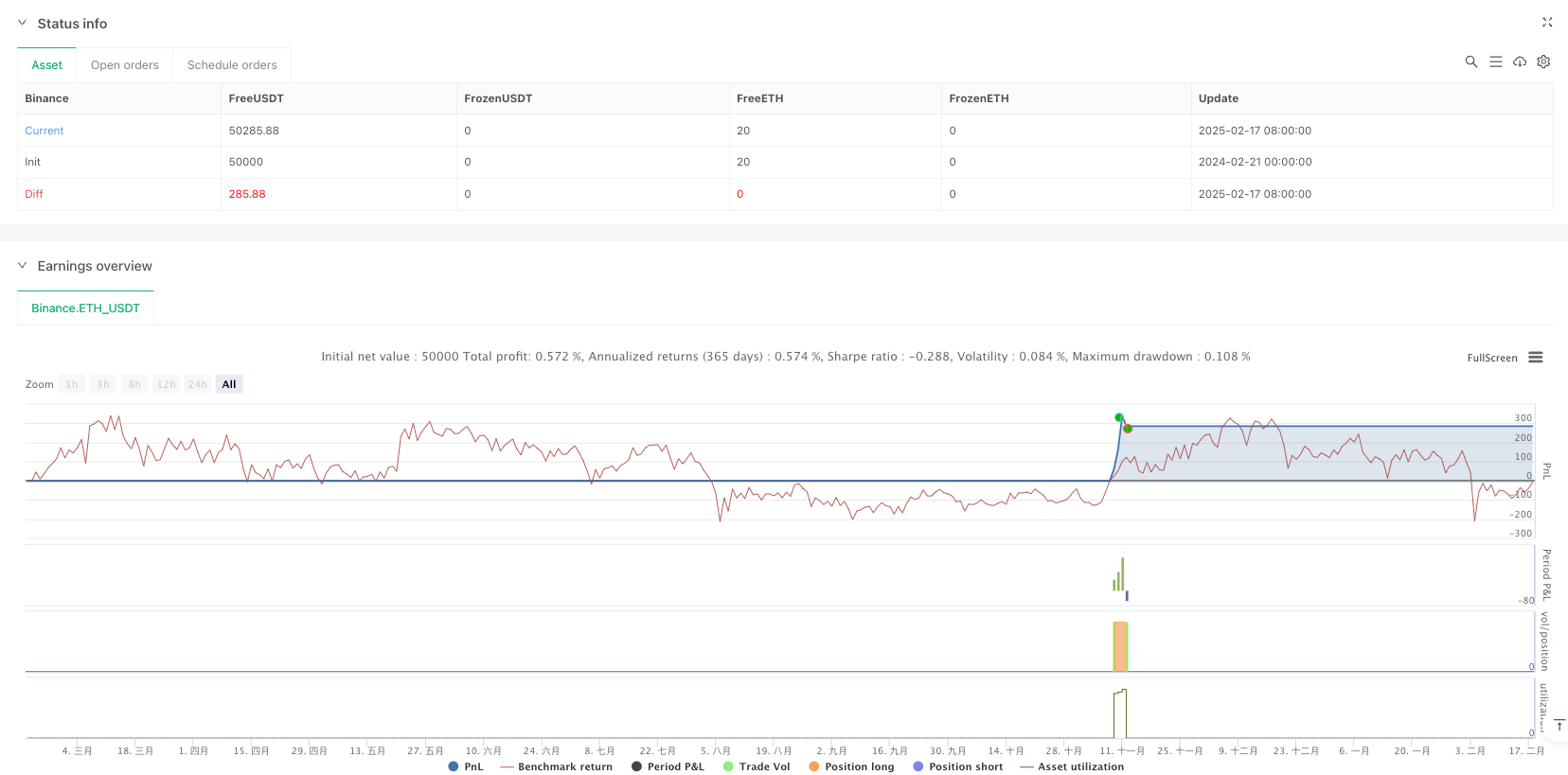

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SPcuttack

//@version=6

strategy("ADX & RSI Strategy with ATR Targets", overlay=true)

// Input parameters

adxLength = input.int(14, title="ADX Length")

adxSmoothing = input.int(14, title="ADX Smoothing")

rsiLength = input.int(14, title="RSI Length")

rsiSmaLength = input.int(20, title="RSI SMA Length")

atrLength = input.int(14, title="ATR Length")

atrMultiplierTarget = input.float(2.5, title="ATR Multiplier for Target")

atrMultiplierStop = input.float(1.5, title="ATR Multiplier for Stop Loss")

// ADX and DMI calculations

[adx, plusDI, minusDI] = ta.dmi(adxLength, adxSmoothing)

// RSI calculations

rsi = ta.rsi(close, rsiLength)

rsiSma = ta.sma(rsi, rsiSmaLength)

// ATR calculation

atr = ta.atr(atrLength)

// Slope calculations (difference from the previous value)

adxSlope = adx - adx[1]

rsiSlope = rsi - rsi[1]

// Entry conditions

adxCondition = adx > 18 and plusDI > minusDI and adxSlope > 0

rsiCondition = rsi > rsiSma and rsiSlope > 0

rsiCross60 = ta.crossover(rsi, 60)

// Global variable for long entry

var bool longEntry = false

if (adxCondition and rsiCondition and rsiCross60)

longEntry := true

else

longEntry := false

// Variables for target and stop loss levels

var float entryPrice = na

var float targetLevel = na

var float stopLossLevel = na

// Strategy actions

if (longEntry)

entryPrice := close

targetLevel := entryPrice + atr * atrMultiplierTarget

stopLossLevel := entryPrice - atr * atrMultiplierStop

strategy.entry("Long", strategy.long)

if (strategy.position_size > 0)

if (close >= targetLevel)

strategy.close("Long", comment="Tgt Hit")

if (close <= stopLossLevel)

strategy.close("Long", comment="SL Hit")

// Ensure lines plot on the chart body

targetLine = strategy.position_size > 0 ? targetLevel : na

stopLossLine = strategy.position_size > 0 ? stopLossLevel : na

plot(targetLine, title="Target Level", color=color.green, linewidth=2, offset=0)

plot(stopLossLine, title="Stop Loss Level", color=color.red, linewidth=2, offset=0)

// Add entry price for reference

plot(strategy.position_size > 0 ? entryPrice : na, title="Entry Price", color=color.blue, linewidth=1, style=plot.style_cross, offset=0)

相关推荐