概述

该策略是一个综合性的趋势跟踪交易系统,结合了多个技术指标来确定市场趋势和交易时机。策略核心基于快速与慢速简单移动平均线(SMA)的交叉信号,并通过相对强弱指标(RSI)和平均趋向指数(ADX)进行趋势确认,同时利用真实波幅(ATR)进行风险管理。策略采用资金管理原则,限制单笔交易风险不超过账户资金的2%。

策略原理

策略运行机制主要包含以下几个关键部分: 1. 趋势识别:使用SMA10和SMA200的交叉来捕捉趋势变化,快线突破慢线上方视为做多信号,反之为做空信号。 2. 趋势确认:通过RSI和ADX双重确认,RSI需要突破50水平,ADX需要大于20以确认趋势强度。 3. 风险控制:基于ATR进行动态止损设置,并采用资金管理限制单笔交易风险。 4. 持仓管理:实现trailing stop机制,动态调整止损位置以锁定利润。

策略优势

- 多重指标交叉验证,提高信号可靠性

- 结合趋势强度和动量指标,降低假突破风险

- 完善的风险管理体系,包括仓位控制和动态止损

- 适用于多个时间周期(M5-MN),具有较强的适应性

- 支持对冲交易,增加策略应用场景

策略风险

- 震荡市场可能产生频繁假信号

- 长周期均线滞后性较强,可能错过趋势初期机会

- 多重指标过滤可能导致错过部分有效信号

- 固定的指标参数可能不适应所有市场环境

- 交易成本可能影响小周期交易盈利能力

策略优化方向

- 引入自适应指标参数,根据市场波动性动态调整

- 增加市场环境识别机制,在不同市场条件下采用不同策略参数

- 优化止损方案,考虑结合支撑阻力位设置止损位置

- 加入交易量指标,提高信号可靠性

- 开发市场切换机制,在不适合的市场环境自动停止交易

总结

该策略通过多重技术指标的组合应用,建立了一个相对完整的趋势跟踪交易系统。策略在设计上注重信号可靠性和风险管理,具有较好的实用性。通过优化建议的实施,策略有望进一步提升性能表现。建议在实盘应用前进行充分的回测验证,并根据具体交易品种特点进行参数优化。

策略源码

/*backtest

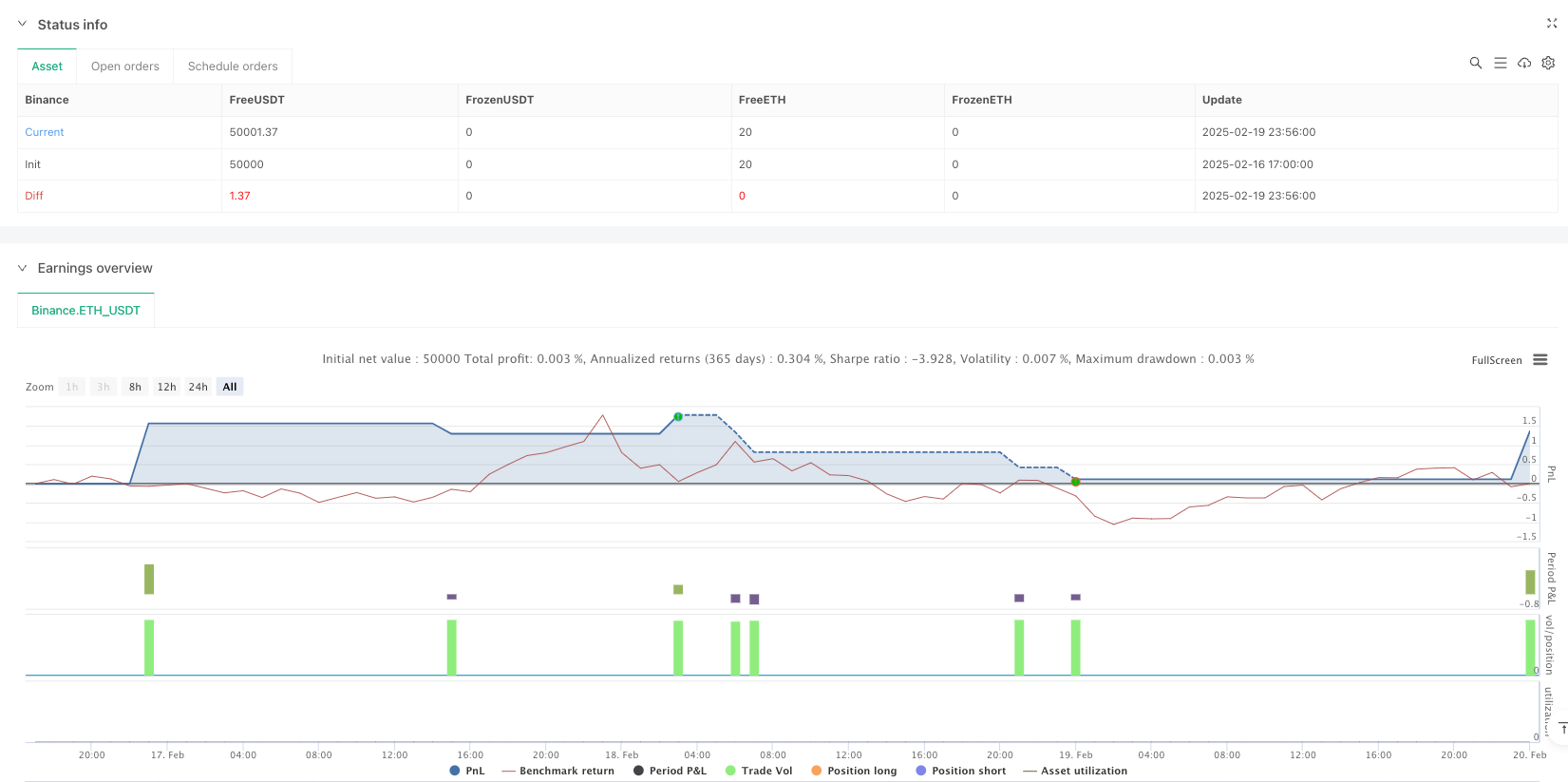

start: 2025-02-16 17:00:00

end: 2025-02-20 00:00:00

period: 4m

basePeriod: 4m

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("SMA + RSI + ADX + ATR Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=2)

// === Input Parameters ===

sma_fast_length = input(10, title="SMA Fast Period")

sma_slow_length = input(200, title="SMA Slow Period")

rsi_length = input(14, title="RSI Period")

adx_length = input(14, title="ADX Period")

adx_smoothing = input(14, title="ADX Smoothing Period") // <-- New parameter!

atr_length = input(14, title="ATR Period")

// === Filtering Levels for RSI and ADX ===

rsi_buy_level = input(50, title="RSI Buy Level")

rsi_sell_level = input(50, title="RSI Sell Level")

adx_min_trend = input(20, title="ADX Minimum Trend Strength")

// === Trailing Stop ===

use_trailing_stop = input(true, title="Enable Trailing Stop")

trailing_stop_pips = input(30, title="Trailing Stop (Pips)")

trailing_step_pips = input(5, title="Trailing Step (Pips)")

// === Indicators ===

sma_fast = ta.sma(close, sma_fast_length)

sma_slow = ta.sma(close, sma_slow_length)

rsi_value = ta.rsi(close, rsi_length)

[diPlus, diMinus, adx_value] = ta.dmi(adx_length, adx_smoothing) // <-- Corrected: added `adx_smoothing`

atr_value = ta.atr(atr_length)

// === Entry Logic ===

longCondition = ta.crossover(sma_fast, sma_slow) and rsi_value > rsi_buy_level and adx_value > adx_min_trend

shortCondition = ta.crossunder(sma_fast, sma_slow) and rsi_value < rsi_sell_level and adx_value > adx_min_trend

// === Open Positions ===

if longCondition

strategy.entry("BUY", strategy.long)

if shortCondition

strategy.entry("SELL", strategy.short)

// === Trailing Stop ===

if use_trailing_stop

strategy.exit("Exit Long", from_entry="BUY", trail_points=trailing_stop_pips, trail_offset=trailing_step_pips)

strategy.exit("Exit Short", from_entry="SELL", trail_points=trailing_stop_pips, trail_offset=trailing_step_pips)

// === Visualization ===

plot(sma_fast, color=color.blue, title="SMA 10")

plot(sma_slow, color=color.red, title="SMA 200")

hline(rsi_buy_level, title="RSI Buy Level", color=color.green)

hline(rsi_sell_level, title="RSI Sell Level", color=color.red)

hline(adx_min_trend, title="ADX Min Trend Level", color=color.orange)

相关推荐