概述

该策略是一个结合了趋势跟踪和区间交易的自适应交易系统。它通过多个技术指标的协同配合,在不同的市场环境下灵活切换交易模式。策略使用Supertrend、移动均线、ADX、RSI和布林带等指标来识别市场状态并确定交易信号,同时结合VWAP进行价格参考,并设置了止损机制来控制风险。

策略原理

策略的核心逻辑分为两个部分:趋势跟踪和区间交易。在趋势市场中(由ADX>25判定),策略依据Supertrend方向、EMA交叉和VWAP位置产生信号;在震荡市场中,策略利用布林带边界和RSI超买超卖水平进行交易。具体来说: - 趋势跟踪模式:当ADX>25时启用,结合20/50周期EMA的位置关系、Supertrend方向和价格相对VWAP的位置综合判断 - 区间交易模式:当ADX<25时启用,在价格触及布林带边界且RSI达到极值时入场 - 出场条件包括:止损触发、Supertrend反转或RSI达到极值

策略优势

- 自适应性强:能够根据市场状态自动切换交易模式

- 多重确认:采用多个指标交叉验证,提高信号可靠性

- 风险控制完善:设置了固定百分比止损,并利用RSI极值进行动态调整

- 综合性强:既能把握趋势行情,又能在震荡市场中获利

- 可视化支持:提供了重要指标的图形展示,便于分析决策

策略风险

- 参数敏感性:多个指标参数的设置会影响策略表现

- 信号滞后:技术指标本身具有一定滞后性

- 假突破风险:在横盘市场可能产生虚假信号

- 计算复杂度:多个指标的实时计算可能影响执行效率

- 市场适应性:可能在某些特定市场环境下表现不佳

策略优化方向

- 动态参数调整:可以根据波动率自动调整各指标参数

- 引入成交量分析:增加成交量指标来验证信号有效性

- 优化止损机制:可以考虑使用ATR动态止损

- 增加时间过滤:加入交易时间窗口来避免低效时段

- 市场情绪指标:整合市场情绪指标来提高预测准确性

总结

这是一个设计合理、逻辑完整的综合性策略。通过多指标配合和模式切换,在不同市场环境下都能保持一定的适应性。虽然存在一些潜在风险,但通过合理的风险控制和持续优化,该策略具有良好的实战应用价值。建议在实盘使用时进行充分的参数优化和回测验证。

策略源码

/*backtest

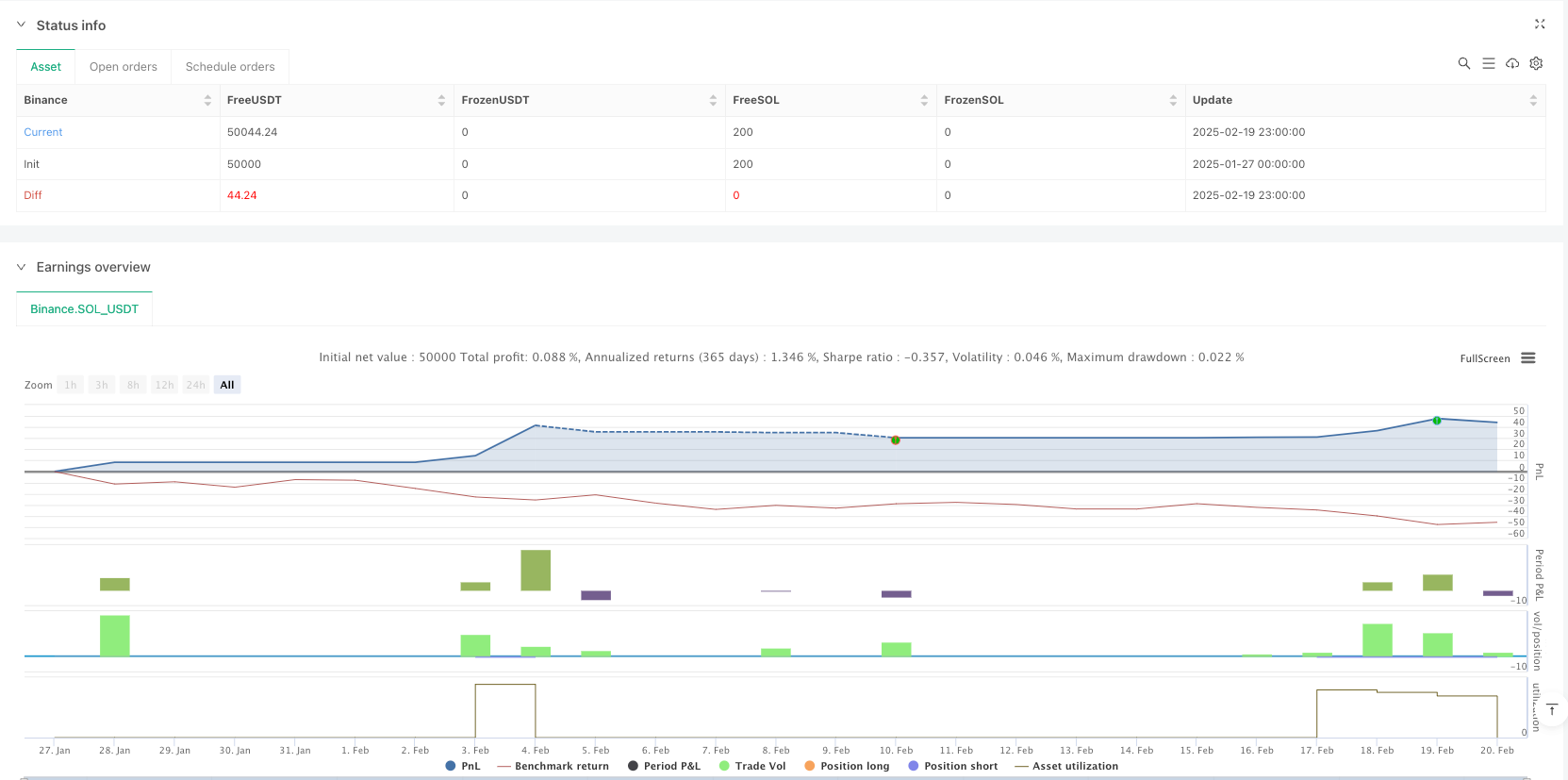

start: 2025-01-27 00:00:00

end: 2025-02-20 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Nifty/BankNifty Multi-Strategy v2", overlay=true, margin_long=100, margin_short=100)

// ———— Inputs ———— //

// Supertrend

atrPeriod = input.int(10, "ATR Period")

supertrendMultiplier = input.float(2.0, "Supertrend Multiplier", step=0.1)

// EMA

ema20Period = input.int(20, "20 EMA Period")

ema50Period = input.int(50, "50 EMA Period")

// ADX/DMI

adxThreshold = input.int(25, "ADX Trend Threshold")

adxLength = input.int(14, "ADX Length")

// RSI

rsiLength = input.int(14, "RSI Length")

rsiOverbought = input.int(70, "RSI Overbought")

rsiOversold = input.int(30, "RSI Oversold")

// Bollinger Bands

bbLength = input.int(20, "BB Length")

bbStdDev = input.float(2.0, "BB Std Dev", step=0.1)

// Stop-Loss

stopLossPerc = input.float(1.0, "Stop-Loss %", step=0.1)

// ———— Calculations ———— //

// Supertrend

[supertrend, direction] = ta.supertrend(supertrendMultiplier, atrPeriod)

// EMAs

ema20 = ta.ema(close, ema20Period)

ema50 = ta.ema(close, ema50Period)

// ADX via DMI (corrected)

[dip, din, adx] = ta.dmi(adxLength, adxLength) // ta.dmi(diLength, adxSmoothing)

// RSI

rsi = ta.rsi(close, rsiLength)

// Bollinger Bands

basis = ta.sma(close, bbLength)

upperBB = basis + ta.stdev(close, bbLength) * bbStdDev

lowerBB = basis - ta.stdev(close, bbLength) * bbStdDev

// VWAP

vwapValue = ta.vwap(hlc3)

// ———— Strategy Logic ———— //

trendingMarket = adx > adxThreshold

// Trend-Following Strategy

emaBullish = ema20 > ema50

priceAboveVWAP = close > vwapValue

longConditionTrend = trendingMarket and direction < 0 and emaBullish and priceAboveVWAP

shortConditionTrend = trendingMarket and direction > 0 and not emaBullish and close < vwapValue

// Range-Bound Strategy

priceNearLowerBB = close <= lowerBB

priceNearUpperBB = close >= upperBB

longConditionRange = not trendingMarket and priceNearLowerBB and rsi < rsiOversold

shortConditionRange = not trendingMarket and priceNearUpperBB and rsi > rsiOverbought

// ———— Entries/Exits ———— //

if (longConditionTrend or longConditionRange)

strategy.entry("Long", strategy.long)

stopPriceLong = strategy.position_avg_price * (1 - stopLossPerc / 100)

strategy.exit("Exit Long", "Long", stop=stopPriceLong)

if (shortConditionTrend or shortConditionRange)

strategy.entry("Short", strategy.short)

stopPriceShort = strategy.position_avg_price * (1 + stopLossPerc / 100)

strategy.exit("Exit Short", "Short", stop=stopPriceShort)

// Exit on Supertrend flip or RSI extremes

if (direction > 0 or rsi >= rsiOverbought)

strategy.close("Long")

if (direction < 0 or rsi <= rsiOversold)

strategy.close("Short")

// ———— Visualization ———— //

plot(supertrend, "Supertrend", color = direction < 0 ? color.green : color.red)

plot(ema20, "20 EMA", color.blue)

plot(ema50, "50 EMA", color.orange)

plot(vwapValue, "VWAP", color.purple)

plot(upperBB, "Upper BB", color.gray)

plot(lowerBB, "Lower BB", color.gray)

相关推荐