Versi JavaScript dari Strategi SuperTrend

16

16

4124

4124

Versi JavaScript dari Strategi SuperTrend

Ada beberapa versi indikator SuperTrend di TV. Saya menemukan algoritma yang lebih mudah dipahami dan menerapkannya. Saya membandingkannya dengan indikator SuperTrend yang dimuat pada grafik TV dari Sistem Backtesting Inventor Quantitative Trading Platform dan menemukan sedikit perbedaan. Saya belum menemukan alasannya. Saya mengharapkan bimbingan dari semua pembaca. Saya hanya akan memberikan beberapa ide.

Algoritma versi JavaScript indikator SuperTrend

// VIA: https://github.com/freqtrade/freqtrade-strategies/issues/30

function SuperTrend(r, period, multiplier) {

// atr

var atr = talib.ATR(r, period)

// baseUp , baseDown

var baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDown

var fiUp = []

var fiDown = []

var prevFiUp = 0

var prevFiDown = 0

for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaN

for (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0

if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} else if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

// 测试指标用的main函数,并非交易策略

function main() {

while (1) {

var r = _C(exchange.GetRecords)

var st = SuperTrend(r, 10, 3)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

Sleep(2000)

}

}

Perbandingan uji coba kode uji coba kembali:

Strategi sederhana menggunakan indikator SuperTrend

Logika perdagangannya relatif sederhana, yaitu membuka posisi panjang ketika tren pendek berubah menjadi tren panjang. Buka posisi short ketika tren bullish berubah menjadi tren bearish.

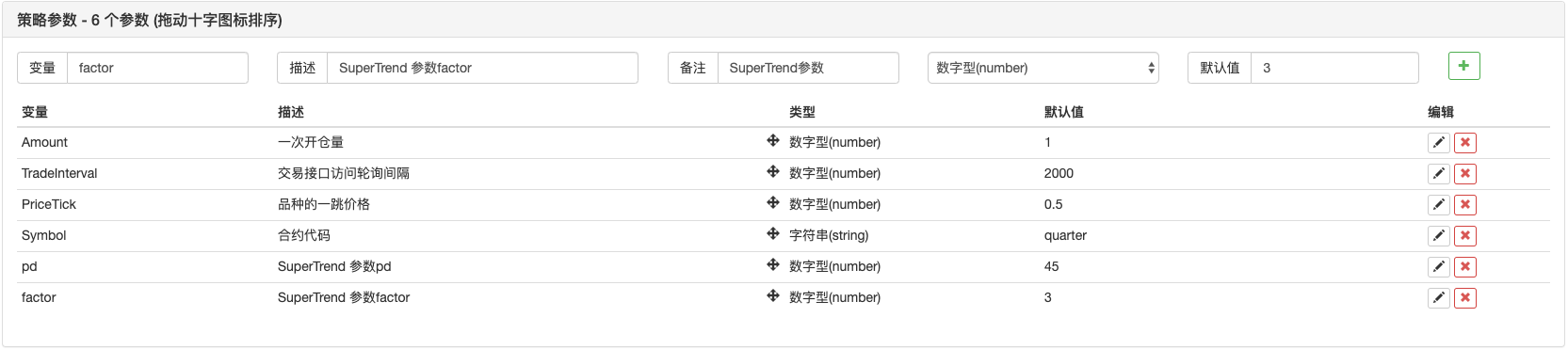

Parameter strategi:

Strategi Perdagangan SuperTrend

/*backtest

start: 2019-08-01 00:00:00

end: 2020-03-11 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

*/

// 全局变量

var OpenAmount = 0 // 开仓后持仓的数量

var KeepAmount = 0 // 保留仓位

var IDLE = 0

var LONG = 1

var SHORT = 2

var COVERLONG = 3

var COVERSHORT = 4

var COVERLONG_PART = 5

var COVERSHORT_PART = 6

var OPENLONG = 7

var OPENSHORT = 8

var State = IDLE

// 交易逻辑部分

function GetPosition(posType) {

var positions = _C(exchange.GetPosition)

/*

if(positions.length > 1){

throw "positions error:" + JSON.stringify(positions)

}

*/

var count = 0

for(var j = 0; j < positions.length; j++){

if(positions[j].ContractType == Symbol){

count++

}

}

if(count > 1){

throw "positions error:" + JSON.stringify(positions)

}

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType == Symbol && positions[i].Type === posType) {

return [positions[i].Price, positions[i].Amount];

}

}

Sleep(TradeInterval);

return [0, 0]

}

function CancelPendingOrders() {

while (true) {

var orders = _C(exchange.GetOrders)

for (var i = 0; i < orders.length; i++) {

exchange.CancelOrder(orders[i].Id);

Sleep(TradeInterval);

}

if (orders.length === 0) {

break;

}

}

}

function Trade(Type, Price, Amount, CurrPos, OnePriceTick){ // 处理交易

if(Type == OPENLONG || Type == OPENSHORT){ // 处理开仓

exchange.SetDirection(Type == OPENLONG ? "buy" : "sell")

var pfnOpen = Type == OPENLONG ? exchange.Buy : exchange.Sell

var idOpen = pfnOpen(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idOpen) {

exchange.CancelOrder(idOpen)

} else {

CancelPendingOrders()

}

} else if(Type == COVERLONG || Type == COVERSHORT){ // 处理平仓

exchange.SetDirection(Type == COVERLONG ? "closebuy" : "closesell")

var pfnCover = Type == COVERLONG ? exchange.Sell : exchange.Buy

var idCover = pfnCover(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idCover){

exchange.CancelOrder(idCover)

} else {

CancelPendingOrders()

}

} else {

throw "Type error:" + Type

}

}

function SuperTrend(r, period, multiplier) {

// atr

var atr = talib.ATR(r, period)

// baseUp , baseDown

var baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDown

var fiUp = []

var fiDown = []

var prevFiUp = 0

var prevFiDown = 0

for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaN

for (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0

if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} else if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

var preTime = 0

function main() {

exchange.SetContractType(Symbol)

while (1) {

var r = _C(exchange.GetRecords)

var currBar = r[r.length - 1]

if (r.length < pd) {

Sleep(5000)

continue

}

var st = SuperTrend(r, pd, factor)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

if(!isNaN(st[0][st[0].length - 2]) && isNaN(st[0][st[0].length - 3])){

if (State == SHORT) {

State = COVERSHORT

} else if(State == IDLE) {

State = OPENLONG

}

}

if(!isNaN(st[1][st[1].length - 2]) && isNaN(st[1][st[1].length - 3])){

if (State == LONG) {

State = COVERLONG

} else if (State == IDLE) {

State = OPENSHORT

}

}

// 执行信号

var pos = null

var price = null

if(State == OPENLONG){ // 开多仓

pos = GetPosition(PD_LONG) // 检查持仓

// 判断是不是 满足状态,如果满足 修改状态

if(pos[1] >= Amount){ // 持仓超过或者等于参数设置的 开仓量

Sleep(1000)

$.PlotFlag(currBar.Time, "开多仓", 'OL') // 标记

OpenAmount = pos[1] // 记录开仓数

State = LONG // 标记为 做多状态

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2 // 计算价格

Trade(OPENLONG, price, Amount - pos[1], pos, PriceTick) // 下单函数 (Type, Price, Amount, CurrPos, PriceTick)

}

if(State == OPENSHORT){ // 开空仓

pos = GetPosition(PD_SHORT) // 检查持仓

if(pos[1] >= Amount){

Sleep(1000)

$.PlotFlag(currBar.Time, "开空仓", 'OS')

OpenAmount = pos[1]

State = SHORT

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(OPENSHORT, price, Amount - pos[1], pos, PriceTick)

}

if(State == COVERLONG){ // 处理平多仓

pos = GetPosition(PD_LONG) // 获取持仓信息

if(pos[1] == 0){ // 判断持仓是否为 0

$.PlotFlag(currBar.Time, "平多仓", '----CL') // 标记

State = IDLE

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(COVERLONG, price, pos[1], pos, PriceTick)

}

if(State == COVERSHORT){ // 处理做多仓

pos = GetPosition(PD_SHORT)

if(pos[1] == 0){

$.PlotFlag(currBar.Time, "平空仓", '----CS')

State = IDLE

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(COVERSHORT, price, pos[1], pos, PriceTick)

}

if(State == COVERLONG_PART) { // 部分平多仓

pos = GetPosition(PD_LONG) // 获取持仓

if(pos[1] <= KeepAmount){ // 持仓小于等于 保持量,本次平仓完成

$.PlotFlag(currBar.Time, "平多仓,保留:" + KeepAmount, '----CL') // 标记

State = pos[1] == 0 ? IDLE : LONG // 更新状态

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(COVERLONG, price, pos[1] - KeepAmount, pos, PriceTick)

}

if(State == COVERSHORT_PART){

pos = GetPosition(PD_SHORT)

if(pos[1] <= KeepAmount){

$.PlotFlag(currBar.Time, "平空仓,保留:" + KeepAmount, '----CS')

State = pos[1] == 0 ? IDLE : SHORT

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(COVERSHORT, price, pos[1] - KeepAmount, pos, PriceTick)

}

LogStatus(_D())

Sleep(1000)

}

}

Alamat strategi: https://www.fmz.com/strategy/201837

Kinerja Uji Ulang

Pengaturan parameter, periode garis K, referensi: homiliSuperTrend V.1–Sistem Garis Tren Super Periode K-line diatur ke 15 menit, dan parameter SuperTrend diatur ke 45,3. Uji ulang kontrak kuartal berjangka OKEX tahun lalu, dengan menetapkan satu kontrak per transaksi. Karena hanya satu kontrak yang diperdagangkan setiap waktu, tingkat pemanfaatan modal sangat rendah dan tidak perlu khawatir tentang nilai Sharpe.

Strategi ini hanya untuk pembelajaran, harap gunakan dengan hati-hati dalam perdagangan nyata.