Strategi Lindung Nilai Dinamis Delta Opsi Deribit

6

6

4076

4076

Strategi Lindung Nilai Dinamis Delta Opsi Deribit

Strategi yang dibawa oleh kuantifikasi FMZ ini adalahStrategi Lindung Nilai Dinamis Delta Opsi Deribit, disebut sebagai strategi DDH (dynamic delta hedging).

Saat mempelajari perdagangan opsi, kita biasanya perlu menguasai konsep-konsep berikut:

Model penetapan harga opsi, model B-S, harga opsi ditentukan berdasarkan [harga aset dasar], [harga kesepakatan], [waktu tersisa hingga kedaluwarsa], [volatilitas (tersirat)], dan [suku bunga bebas risiko].

Paparan opsi:

- Delta — risiko arah suatu opsi. Jika Delta adalah +0,50, maka kinerja untung rugi opsi ini ketika harga dasar naik atau turun dapat dianggap sebagai 0,50 spot.

- Gamma — percepatan risiko arah. Misalnya, untuk opsi panggilan, karena efek Gamma, mulai dari saat harga dasar berada pada harga kesepakatan, saat harga terus naik, Delta secara bertahap akan bergerak dari +0,50 ke +1,00.

- Theta—Pemaparan waktu. Saat Anda membeli opsi, jika harga dasar tidak bergerak, Anda akan membayar biaya yang ditunjukkan oleh jumlah Theta (Deribit dalam USD) untuk setiap hari yang berlalu. Saat Anda menjual opsi, jika harga dasar tidak bergerak, Anda akan menerima biaya yang ditunjukkan oleh jumlah Theta untuk setiap hari yang berlalu.

- Vega — Paparan volatilitas. Ketika Anda membeli opsi, Vega positif, artinya Anda memiliki volatilitas yang panjang. Ketika volatilitas tersirat meningkat, Anda memperoleh keuntungan dari eksposur Vega Anda. Sebaliknya, ketika Anda menjual opsi, volatilitas tersirat menurun dan Anda untung.

Penjelasan strategi DDH:

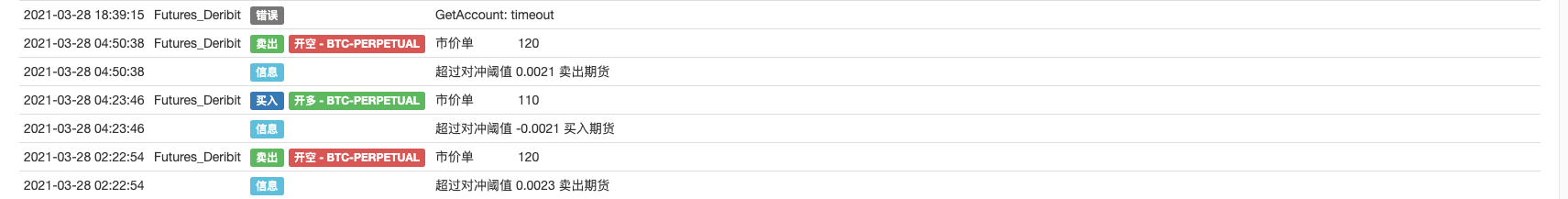

- Penjelasan prinsip DDH Dengan menyeimbangkan Delta opsi dan berjangka, netralitas risiko dalam arah perdagangan dapat dicapai. Karena Delta opsi akan berubah seiring dengan harga aset dasar, Delta kontrak berjangka dan spot tidak berubah. Setelah memegang posisi kontrak opsi dan menggunakan kontrak berjangka untuk melindungi dan menyeimbangkan Delta, Delta secara keseluruhan akan menjadi tidak seimbang lagi karena harga aset dasar berubah. Untuk kombinasi posisi opsi dan posisi berjangka, diperlukan lindung nilai dinamis dan penyeimbangan Delta yang berkelanjutan.

Misalnya: Ketika kita membeli opsi panggilan, kita memegang posisi bullish. Pada saat ini, perlu melakukan short futures untuk melindungi Delta opsi dan mencapai netralitas Delta secara keseluruhan (0 atau mendekati 0). Kami tidak akan mempertimbangkan faktor-faktor seperti sisa waktu hingga berakhirnya kontrak opsi dan volatilitas untuk saat ini. Kasus 1: Ketika harga aset dasar naik, Delta dari porsi opsi meningkat, dan Delta keseluruhan bergerak menuju angka positif. Kontrak berjangka diperlukan untuk melakukan lindung nilai lagi, dan sebagian posisi short harus dibuka untuk melanjutkan shorting kontrak berjangka guna menyeimbangkan keseluruhan Delta lagi. (Sebelum menyeimbangkan kembali, Delta opsi besar, sedangkan Delta berjangka relatif kecil. Keuntungan marjinal opsi beli melebihi kerugian marjinal kontrak pendek, dan seluruh portofolio akan mendapat keuntungan.)

Kasus 2: Ketika harga aset dasar turun, Delta dari porsi opsi menurun, dan Delta keseluruhan bergerak menuju angka negatif, menutup sebagian posisi short futures untuk menyeimbangkan Delta keseluruhan lagi. (Sebelum menyeimbangkan kembali, Delta opsi itu kecil, sedangkan Delta berjangka relatif besar. Kerugian marjinal opsi beli lebih kecil daripada keuntungan marjinal kontrak pendek, sehingga keseluruhan portofolio akan tetap mendapat keuntungan.)

Jadi idealnya, naik turunnya aset dasar akan menghasilkan laba, selama ada fluktuasi pasar.

Namun, faktor lain yang perlu dipertimbangkan meliputi: nilai waktu, biaya transaksi, dll.

Jadi saya mengutip penjelasan para ahli Zhihu:

Gamma Scalping 的关注点并不是delta,dynamic delta hedging 只是过程中规避underlying价格风险的一种做法而已。

Gamma Scalping 关注的是Alpha,此Alpha不是选股的Alpha,这里的Alpha = Gamma/Theta也就是单位Theta的时间损耗换来多少Gamma,

这个是关注的点。可以构建出上涨和下跌都浮盈的组合,但一定伴随时间损耗,那问题就在于性价比了。

作者:许哲

链接:https://www.zhihu.com/question/51630805/answer/128096385

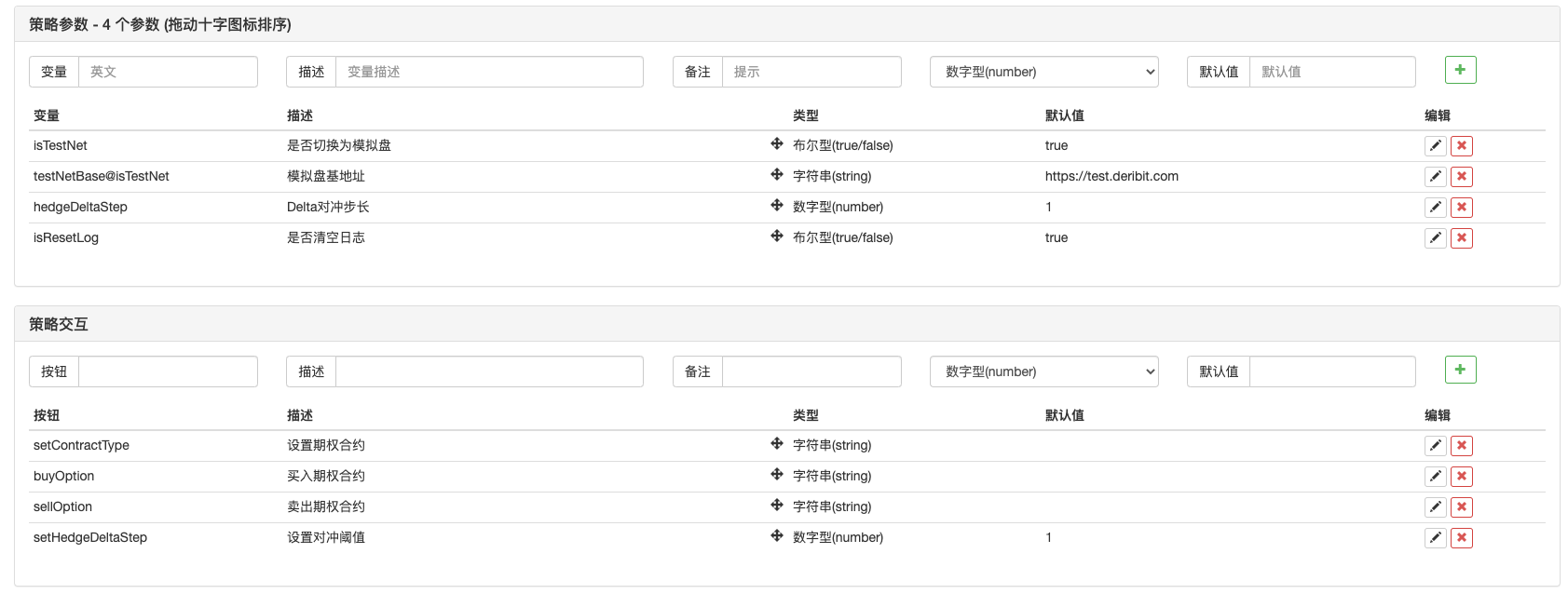

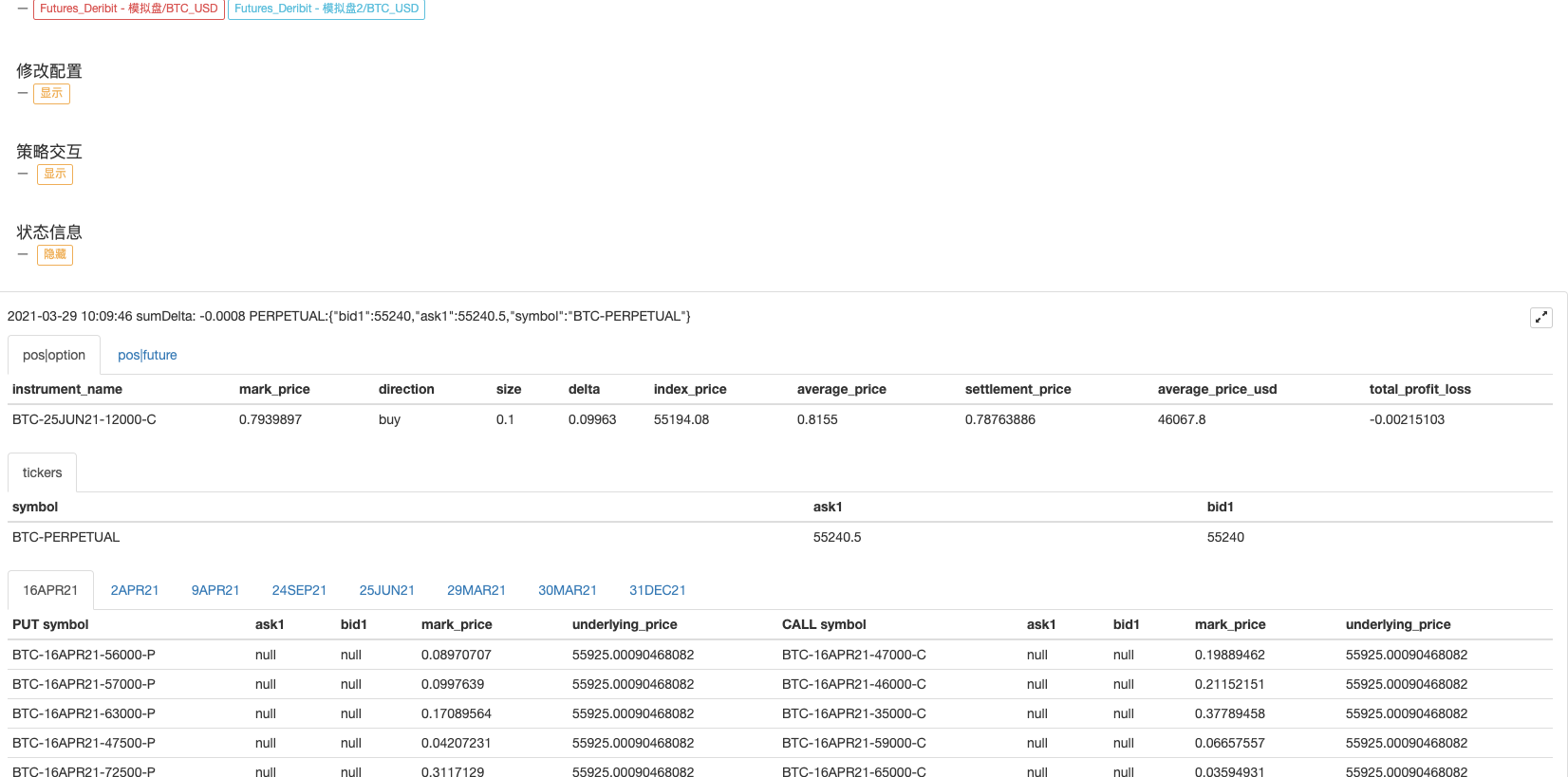

Penjelasan Desain Strategi DDH

- Enkapsulasi antarmuka pasar agregat dan desain kerangka kerja

- Desain UI Strategi

- Desain Interaksi Strategis

- Desain fungsi lindung nilai otomatis

Kode sumber:

// 构造函数

function createManager(e, subscribeList, msg) {

var self = {}

self.supportList = ["Futures_Binance", "Huobi", "Futures_Deribit"] // 支持的交易所的

// 对象属性

self.e = e

self.msg = msg

self.name = e.GetName()

self.type = self.name.includes("Futures_") ? "Futures" : "Spot"

self.label = e.GetLabel()

self.quoteCurrency = ""

self.subscribeList = subscribeList // subscribeList : [strSymbol1, strSymbol2, ...]

self.tickers = [] // 接口获取的所有行情数据,定义数据格式:{bid1: 123, ask1: 123, symbol: "xxx"}}

self.subscribeTickers = [] // 需要的行情数据,定义数据格式:{bid1: 123, ask1: 123, symbol: "xxx"}}

self.accData = null

self.pos = null

// 初始化函数

self.init = function() {

// 判断是否支持该交易所

if (!_.contains(self.supportList, self.name)) {

throw "not support"

}

}

self.setBase = function(base) {

// 切换基地址,用于切换为模拟盘

self.e.SetBase(base)

Log(self.name, self.label, "切换为模拟盘:", base)

}

// 判断数据精度

self.judgePrecision = function (p) {

var arr = p.toString().split(".")

if (arr.length != 2) {

if (arr.length == 1) {

return 0

}

throw "judgePrecision error, p:" + String(p)

}

return arr[1].length

}

// 更新资产

self.updateAcc = function(callBackFuncGetAcc) {

var ret = callBackFuncGetAcc(self)

if (!ret) {

return false

}

self.accData = ret

return true

}

// 更新持仓

self.updatePos = function(httpMethod, url, params) {

var pos = self.e.IO("api", httpMethod, url, params)

var ret = []

if (!pos) {

return false

} else {

// 整理数据

// {"jsonrpc":"2.0","result":[],"usIn":1616484238870404,"usOut":1616484238870970,"usDiff":566,"testnet":true}

try {

_.each(pos.result, function(ele) {

ret.push(ele)

})

} catch(err) {

Log("错误:", err)

return false

}

self.pos = ret

}

return true

}

// 更新行情数据

self.updateTicker = function(url, callBackFuncGetArr, callBackFuncGetTicker) {

var tickers = []

var subscribeTickers = []

var ret = self.httpQuery(url)

if (!ret) {

return false

}

// Log("测试", ret)// 测试

try {

_.each(callBackFuncGetArr(ret), function(ele) {

var ticker = callBackFuncGetTicker(ele)

tickers.push(ticker)

if (self.subscribeList.length == 0) {

subscribeTickers.push(ticker)

} else {

for (var i = 0 ; i < self.subscribeList.length ; i++) {

if (self.subscribeList[i] == ticker.symbol) {

subscribeTickers.push(ticker)

}

}

}

})

} catch(err) {

Log("错误:", err)

return false

}

self.tickers = tickers

self.subscribeTickers = subscribeTickers

return true

}

self.getTicker = function(symbol) {

var ret = null

_.each(self.subscribeTickers, function(ticker) {

if (ticker.symbol == symbol) {

ret = ticker

}

})

return ret

}

self.httpQuery = function(url) {

var ret = null

try {

var retHttpQuery = HttpQuery(url)

ret = JSON.parse(retHttpQuery)

} catch (err) {

// Log("错误:", err)

ret = null

}

return ret

}

self.returnTickersTbl = function() {

var tickersTbl = {

type : "table",

title : "tickers",

cols : ["symbol", "ask1", "bid1"],

rows : []

}

_.each(self.subscribeTickers, function(ticker) {

tickersTbl.rows.push([ticker.symbol, ticker.ask1, ticker.bid1])

})

return tickersTbl

}

// 返回持仓表格

self.returnPosTbl = function() {

var posTbl = {

type : "table",

title : "pos|" + self.msg,

cols : ["instrument_name", "mark_price", "direction", "size", "delta", "index_price", "average_price", "settlement_price", "average_price_usd", "total_profit_loss"],

rows : []

}

/* 接口返回的持仓数据格式

{

"mark_price":0.1401105,"maintenance_margin":0,"instrument_name":"BTC-25JUN21-28000-P","direction":"buy",

"vega":5.66031,"total_profit_loss":0.01226105,"size":0.1,"realized_profit_loss":0,"delta":-0.01166,"kind":"option",

"initial_margin":0,"index_price":54151.77,"floating_profit_loss_usd":664,"floating_profit_loss":0.000035976,

"average_price_usd":947.22,"average_price":0.0175,"theta":-7.39514,"settlement_price":0.13975074,"open_orders_margin":0,"gamma":0

}

*/

_.each(self.pos, function(ele) {

if(ele.direction != "zero") {

posTbl.rows.push([ele.instrument_name, ele.mark_price, ele.direction, ele.size, ele.delta, ele.index_price, ele.average_price, ele.settlement_price, ele.average_price_usd, ele.total_profit_loss])

}

})

return posTbl

}

self.returnOptionTickersTbls = function() {

var arr = []

var arrDeliveryDate = []

_.each(self.subscribeTickers, function(ticker) {

if (self.name == "Futures_Deribit") {

var arrInstrument_name = ticker.symbol.split("-")

var currency = arrInstrument_name[0]

var deliveryDate = arrInstrument_name[1]

var deliveryPrice = arrInstrument_name[2]

var optionType = arrInstrument_name[3]

if (!_.contains(arrDeliveryDate, deliveryDate)) {

arr.push({

type : "table",

title : arrInstrument_name[1],

cols : ["PUT symbol", "ask1", "bid1", "mark_price", "underlying_price", "CALL symbol", "ask1", "bid1", "mark_price", "underlying_price"],

rows : []

})

arrDeliveryDate.push(arrInstrument_name[1])

}

// 遍历arr

_.each(arr, function(tbl) {

if (tbl.title == deliveryDate) {

if (tbl.rows.length == 0 && optionType == "P") {

tbl.rows.push([ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price, "", "", "", "", ""])

return

} else if (tbl.rows.length == 0 && optionType == "C") {

tbl.rows.push(["", "", "", "", "", ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price])

return

}

for (var i = 0 ; i < tbl.rows.length ; i++) {

if (tbl.rows[i][0] == "" && optionType == "P") {

tbl.rows[i][0] = ticker.symbol

tbl.rows[i][1] = ticker.ask1

tbl.rows[i][2] = ticker.bid1

tbl.rows[i][3] = ticker.mark_price

tbl.rows[i][4] = ticker.underlying_price

return

} else if(tbl.rows[i][5] == "" && optionType == "C") {

tbl.rows[i][5] = ticker.symbol

tbl.rows[i][6] = ticker.ask1

tbl.rows[i][7] = ticker.bid1

tbl.rows[i][8] = ticker.mark_price

tbl.rows[i][9] = ticker.underlying_price

return

}

}

if (optionType == "P") {

tbl.rows.push([ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price, "", "", "", "", ""])

} else if(optionType == "C") {

tbl.rows.push(["", "", "", "", "", ticker.symbol, ticker.ask1, ticker.bid1, ticker.mark_price, ticker.underlying_price])

}

}

})

}

})

return arr

}

// 初始化

self.init()

return self

}

function main() {

// 初始化,清空日志

if(isResetLog) {

LogReset(1)

}

var m1 = createManager(exchanges[0], [], "option")

var m2 = createManager(exchanges[1], ["BTC-PERPETUAL"], "future")

// 切换为模拟盘

var base = "https://www.deribit.com"

if (isTestNet) {

m1.setBase(testNetBase)

m2.setBase(testNetBase)

base = testNetBase

}

while(true) {

// 期权

var ticker1GetSucc = m1.updateTicker(base + "/api/v2/public/get_book_summary_by_currency?currency=BTC&kind=option",

function(data) {return data.result},

function(ele) {return {bid1: ele.bid_price, ask1: ele.ask_price, symbol: ele.instrument_name, underlying_price: ele.underlying_price, mark_price: ele.mark_price}})

// 永续期货

var ticker2GetSucc = m2.updateTicker(base + "/api/v2/public/get_book_summary_by_currency?currency=BTC&kind=future",

function(data) {return data.result},

function(ele) {return {bid1: ele.bid_price, ask1: ele.ask_price, symbol: ele.instrument_name}})

if (!ticker1GetSucc || !ticker2GetSucc) {

Sleep(5000)

continue

}

// 更新持仓

var pos1GetSucc = m1.updatePos("GET", "/api/v2/private/get_positions", "currency=BTC&kind=option")

var pos2GetSucc = m2.updatePos("GET", "/api/v2/private/get_positions", "currency=BTC&kind=future")

if (!pos1GetSucc || !pos2GetSucc) {

Sleep(5000)

continue

}

// 交互

var cmd = GetCommand()

if(cmd) {

// 处理交互

Log("交互命令:", cmd)

var arr = cmd.split(":")

// cmdClearLog

if(arr[0] == "setContractType") {

// parseFloat(arr[1])

m1.e.SetContractType(arr[1])

Log("exchanges[0]交易所对象设置合约:", arr[1])

} else if (arr[0] == "buyOption") {

var actionData = arr[1].split(",")

var price = parseFloat(actionData[0])

var amount = parseFloat(actionData[1])

m1.e.SetDirection("buy")

m1.e.Buy(price, amount)

Log("执行价格:", price, "执行数量:", amount, "执行方向:", arr[0])

} else if (arr[0] == "sellOption") {

var actionData = arr[1].split(",")

var price = parseFloat(actionData[0])

var amount = parseFloat(actionData[1])

m1.e.SetDirection("sell")

m1.e.Sell(price, amount)

Log("执行价格:", price, "执行数量:", amount, "执行方向:", arr[0])

} else if (arr[0] == "setHedgeDeltaStep") {

hedgeDeltaStep = parseFloat(arr[1])

Log("设置参数hedgeDeltaStep:", hedgeDeltaStep)

}

}

// 获取期货合约价格

var perpetualTicker = m2.getTicker("BTC-PERPETUAL")

var hedgeMsg = " PERPETUAL:" + JSON.stringify(perpetualTicker)

// 从账户数据中获取delta总值

var acc1GetSucc = m1.updateAcc(function(self) {

self.e.SetCurrency("BTC_USD")

return self.e.GetAccount()

})

if (!acc1GetSucc) {

Sleep(5000)

continue

}

var sumDelta = m1.accData.Info.result.delta_total

if (Math.abs(sumDelta) > hedgeDeltaStep && perpetualTicker) {

if (sumDelta < 0) {

// delta 大于0 对冲期货做空

var amount = _N(Math.abs(sumDelta) * perpetualTicker.ask1, -1)

if (amount > 10) {

Log("超过对冲阈值,当前总delta:", sumDelta, "买入期货")

m2.e.SetContractType("BTC-PERPETUAL")

m2.e.SetDirection("buy")

m2.e.Buy(-1, amount)

} else {

hedgeMsg += ", 对冲下单量小于10"

}

} else {

// delta 小于0 对冲期货做多

var amount = _N(Math.abs(sumDelta) * perpetualTicker.bid1, -1)

if (amount > 10) {

Log("超过对冲阈值,当前总delta:", sumDelta, "卖出期货")

m2.e.SetContractType("BTC-PERPETUAL")

m2.e.SetDirection("sell")

m2.e.Sell(-1, amount)

} else {

hedgeMsg += ", 对冲下单量小于10"

}

}

}

LogStatus(_D(), "sumDelta:", sumDelta, hedgeMsg,

"\n`" + JSON.stringify([m1.returnPosTbl(), m2.returnPosTbl()]) + "`", "\n`" + JSON.stringify(m2.returnTickersTbl()) + "`", "\n`" + JSON.stringify(m1.returnOptionTickersTbls()) + "`")

Sleep(10000)

}

}

Parameter strategi:

Alamat strategi: https://www.fmz.com/strategy/265090

Operasi strategi:

Strategi ini adalah strategi pengajaran, terutama untuk pembelajaran. Harap gunakan dengan hati-hati dalam perdagangan nyata.