概要

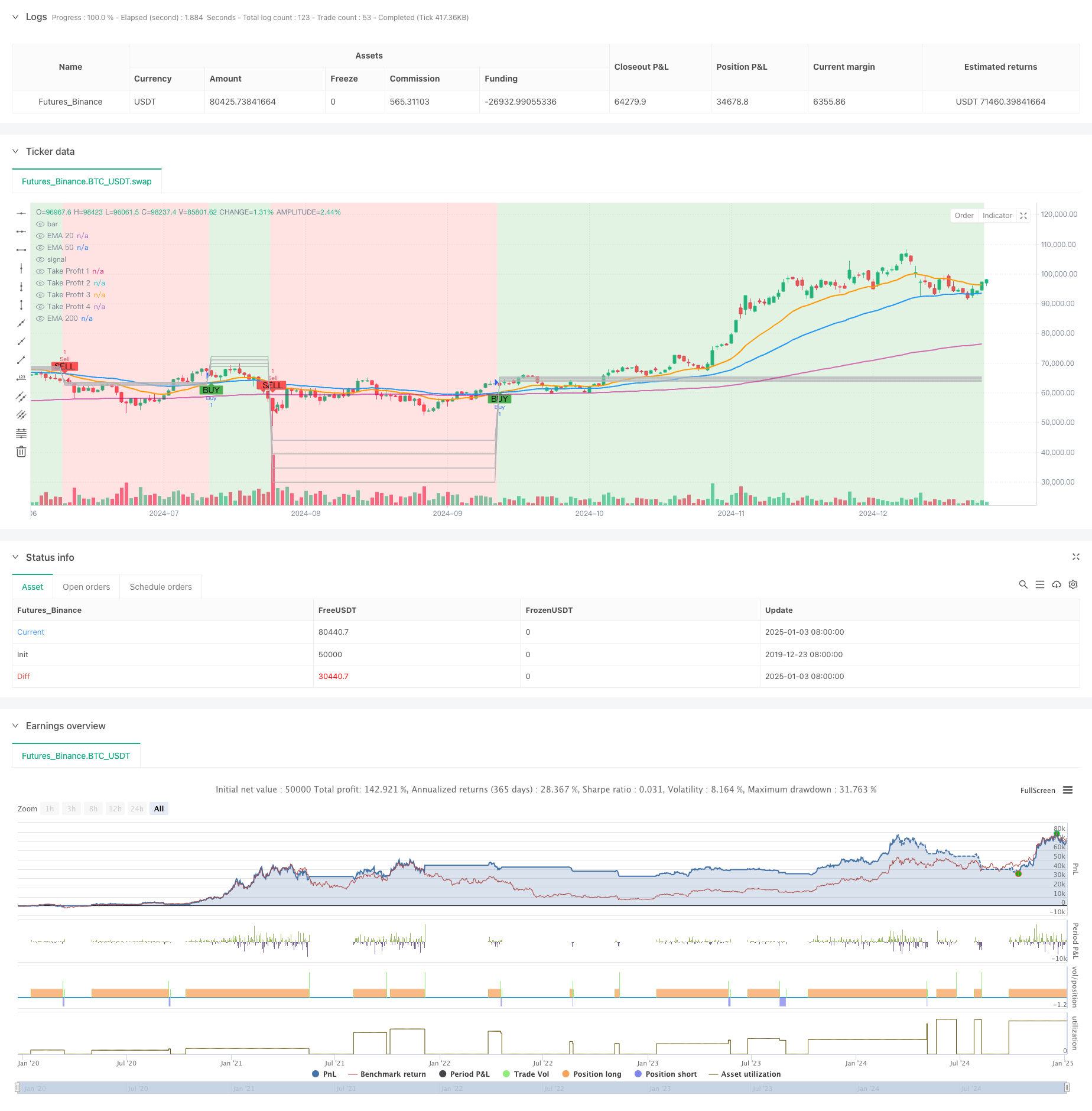

この戦略は、指数移動平均 (EMA) ベースの取引システムであり、主に EMA20 と EMA50 のクロスオーバーを使用して市場トレンドの変化を識別します。この戦略では、動的なマルチレベルの利益ポイントを設計し、ストップロスのメカニズムを組み合わせてリスクを制御します。このシステムは、背景色の変化を通じて市場トレンドの方向を視覚的に表示し、トレーダーが市場トレンドをよりよく把握できるようにします。

戦略原則

戦略の中核となるロジックは、次の側面に基づいています。

- EMA20とEMA50のクロスオーバーを使用してトレンドの方向を決定します。EMA20がEMA50を上回ったときに買いシグナルが生成され、EMA20がEMA50を下回ったときに売りシグナルが生成されます。

- 前回のローソク足の変動範囲に基づいて、4 つの利益目標を動的に設定します。

- TP1は変動範囲の0.5倍に設定される

- TP2は変動範囲の1.0倍に設定される

- TP3は変動幅の1.5倍に設定

- TP4は変動範囲の2.0倍に設定されています

- リスクを管理するために3%のストップロスを設定する

- トレンドの方向はKラインの背景色を変えることで表示されます。上昇トレンドは緑色で表示され、下降トレンドは赤色で表示されます。

戦略的優位性

- 動的な利益ポイント設定:リアルタイムの市場変動に応じて利益目標を自動的に調整し、適応性が高い

- マルチレベルの利益メカニズム:複数の利益ポイントを設定することで、利益の固定を保証するだけでなく、トレンドが完全に発展する余地も与えます。

- 優れた視覚効果:背景色を通じてトレンドの方向が直感的に表示され、市場の状況を素早く判断するのに便利です。

- 完璧なリスク管理:固定のストップロスポイントを設定して、各取引の最大損失を効果的に管理します。

- 柔軟で調整可能なパラメータ:トレーダーはさまざまな市場状況に応じて利益ポイント乗数とストップロス率を調整できます。

戦略リスク

- 移動平均ヒステリシス: EMA自体にヒステリシスがあり、信号が後で生成される可能性があります。

- 不安定な市場のリスク: 横ばいで不安定な市場では、誤ったシグナルが頻繁に発生する可能性があります。

- 固定ストップロス設定: 固定パーセンテージストップロスはすべての市場状況に適しているわけではない

- 利益ポイントの間隔: 変動の激しい市場では、利益ポイントの間隔が大きすぎたり小さすぎたりすることがあります。

戦略最適化の方向性

- 補助指標の導入: RSIやMACDなどの指標をクロスオーバーシグナルの確認として追加できます。

- ストップロスメカニズムを最適化する: ATRを使用してストップロス距離を動的に設定することを検討してください

- 時間フィルターを追加: ボラティリティの高い期間を避けるために取引時間ウィンドウを追加します

- ポジション管理の改善: 市場のボラティリティに応じてポジションサイズを動的に調整

- シグナル確認の最適化: 取引量などの指標を補助的な確認条件として追加できます

要約する

これは、完全な構造と明確なロジックを備えたトレンド追従戦略です。移動平均クロスオーバーを通じてトレンドを捉え、動的利益ポイントを使用してリターンを管理し、ストップロスでリスクを制御します。戦略の視覚的なデザインは直感的で効果的であり、パラメータ設定は柔軟かつ調整可能です。移動平均には本質的に遅延の問題がありますが、最適化と改善によって戦略の安定性と収益性をさらに向上させることができます。

ストラテジーソースコード

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Crossover Strategy with Take Profit and Candle Highlighting", overlay=true)

// Define the EMAs

ema200 = ta.ema(close, 200)

ema50 = ta.ema(close, 50)

ema20 = ta.ema(close, 20)

// Plot the EMAs

plot(ema200, color=#c204898e, title="EMA 200", linewidth=2)

plot(ema50, color=color.blue, title="EMA 50", linewidth=2)

plot(ema20, color=color.orange, title="EMA 20", linewidth=2)

// Define Buy and Sell conditions based on EMA crossover

buySignal = ta.crossover(ema20, ema50) // EMA 20 crosses above EMA 50 (Bullish)

sellSignal = ta.crossunder(ema20, ema50) // EMA 20 crosses below EMA 50 (Bearish)

// Define input values for Take Profit multipliers

tp1_multiplier = input.float(0.5, title="TP1 Multiplier", minval=0.1, maxval=5.0, step=0.1)

tp2_multiplier = input.float(1.0, title="TP2 Multiplier", minval=0.1, maxval=5.0, step=0.1)

tp3_multiplier = input.float(1.5, title="TP3 Multiplier", minval=0.1, maxval=5.0, step=0.1)

tp4_multiplier = input.float(2.0, title="TP4 Multiplier", minval=0.1, maxval=5.0, step=0.1)

// Define Take Profit Levels as float variables initialized with na

var float takeProfit1 = na

var float takeProfit2 = na

var float takeProfit3 = na

var float takeProfit4 = na

// Calculate take profit levels based on the multipliers

if buySignal

takeProfit1 := high + (high - low) * tp1_multiplier // TP1: Set TP at multiplier of previous range above the high

takeProfit2 := high + (high - low) * tp2_multiplier // TP2: Set TP at multiplier of previous range above the high

takeProfit3 := high + (high - low) * tp3_multiplier // TP3: Set TP at multiplier of previous range above the high

takeProfit4 := high + (high - low) * tp4_multiplier // TP4: Set TP at multiplier of previous range above the high

if sellSignal

takeProfit1 := low - (high - low) * tp1_multiplier // TP1: Set TP at multiplier of previous range below the low

takeProfit2 := low - (high - low) * tp2_multiplier // TP2: Set TP at multiplier of previous range below the low

takeProfit3 := low - (high - low) * tp3_multiplier // TP3: Set TP at multiplier of previous range below the low

takeProfit4 := low - (high - low) * tp4_multiplier // TP4: Set TP at multiplier of previous range below the low

// Plot Take Profit Levels on the chart

plot(takeProfit1, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 1")

plot(takeProfit2, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 2")

plot(takeProfit3, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 3")

plot(takeProfit4, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 4")

// Create buy and sell signals on the chart

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")

// Highlight the candles based on trend direction

uptrend = ta.crossover(ema20, ema50) // EMA 20 crosses above EMA 50 (Bullish)

downtrend = ta.crossunder(ema20, ema50) // EMA 20 crosses below EMA 50 (Bearish)

// Highlighting candles based on trend

bgcolor(color = ema20 > ema50 ? color.new(color.green, 80) : ema20 < ema50 ? color.new(color.red, 80) : na)

// Execute buy and sell orders on the chart

strategy.entry("Buy", strategy.long, when=buySignal)

strategy.entry("Sell", strategy.short, when=sellSignal)

// Exit conditions based on Take Profit levels

strategy.exit("Take Profit 1", "Buy", limit=takeProfit1)

strategy.exit("Take Profit 2", "Buy", limit=takeProfit2)

strategy.exit("Take Profit 3", "Buy", limit=takeProfit3)

strategy.exit("Take Profit 4", "Buy", limit=takeProfit4)

strategy.exit("Take Profit 1", "Sell", limit=takeProfit1)

strategy.exit("Take Profit 2", "Sell", limit=takeProfit2)

strategy.exit("Take Profit 3", "Sell", limit=takeProfit3)

strategy.exit("Take Profit 4", "Sell", limit=takeProfit4)

// Optionally, add a stop loss

stopLoss = 0.03 // Example: 3% stop loss

strategy.exit("Stop Loss", "Buy", stop=close * (1 - stopLoss))

strategy.exit("Stop Loss", "Sell", stop=close * (1 + stopLoss))