高度な二重移動平均とスーパートレンドの組み合わせ取引戦略

EMA ATR ST supertrend TREND FOLLOWING momentum

作成日:

2025-02-21 09:28:18

最終変更日:

2025-02-27 17:20:22

コピー:

1

クリック数:

826

2

フォロー

331

フォロワー

概要

これは,双均線システム ((EMA5とEMA20) と超トレンド指標 ((Supertrend)) を組み合わせたトレンド追跡取引戦略である.この戦略は,高速移動平均と遅い移動平均の交差信号を組み合わせて,Supertrend指標が提供するトレンド方向の確認を組み合わせて,信頼性の高い取引システムを形成する.戦略設計は,トレンド確認と動量の変化の2つの重要な要因を十分に考慮し,二重検証機構によって取引の信号信頼性を向上させる.

戦略原則

戦略の核心的な論理は,以下の3つの重要な技術指標の組み合わせに基づいています.

- 短期的な価格変動を捉えるために使用される速度の指数移動平均 ((EMA5))

- スローペース指数移動平均 ((EMA20) は中期トレンド方向を確認するために使用される

- Supertrend指標はATR (実波幅) による計算で,全体的なトレンドを確認するために使用されます.

買取シグナルには2つの条件があります.

- EMA5は EMA20を上向きに通過する

- スーパートレンド指数は上昇傾向を示しています.

売る信号は次の条件を満たす必要があります:

- EMA5は EMA20を横切る

- スーパートレンド指数は下落傾向を示しています.

戦略的優位性

- 双重認証は取引信号の信頼性を大幅に高めています.

- トレンドトラッキングとダイナミックトレードの 利点

- 買い売りシグナル標識とトレンドライン表示を含む明確な視覚指示システム

- 市場状況に関するリアルタイムパネル

- パラメータは,異なる市場環境に応じて柔軟に調整できます

- 中長期トレンド取引に適用される

戦略リスク

- 横軸整理市場では頻繁に誤信号が生じることがあります.

- 急激な反転で大きなリトレースメントが発生する可能性がある

- 固定パラメータは,すべての市場環境に対応しない可能性があります. 解決:

- 日線または4時間線などのより大きな時間枠を使用することをお勧めします.

- 厳格なストップ・ロズ戦略を導入する

- 市場の変動率に合わせて動的に調整するパラメータ

- 他の技術指標と組み合わせた取引確認

戦略最適化の方向性

- パラメータ最適化:

- EMA周期は,異なる市場の変動特性に合わせて調整される

- SupertrendのATR周期と倍数因子を最適化する

- 信号のフィルター:

- ボリューム確認メカニズムを追加

- ボラティリティフィルターの導入

- リスク管理:

- ダイナミック・ストップ・ローズ・ストラテジー

- ポジション管理モジュールを追加

- 取引の実行:

- 入学時の選択を最適化する

- バッチアップと減量機能を追加

要約する

これは,構造が整った,論理が明確なトレンド追跡戦略である.均線システムとスーパートレンド指標を組み合わせることで,信号の正確性と遅滞性を効果的にバランスさせる.戦略の視覚的設計と情報表示システムは,トレーダーが市場の状態を迅速に判断するのを助ける.合理的なパラメータ最適化とリスク管理により,この戦略は,トレンド市場で良好な取引効果を得ることができる.

ストラテジーソースコード

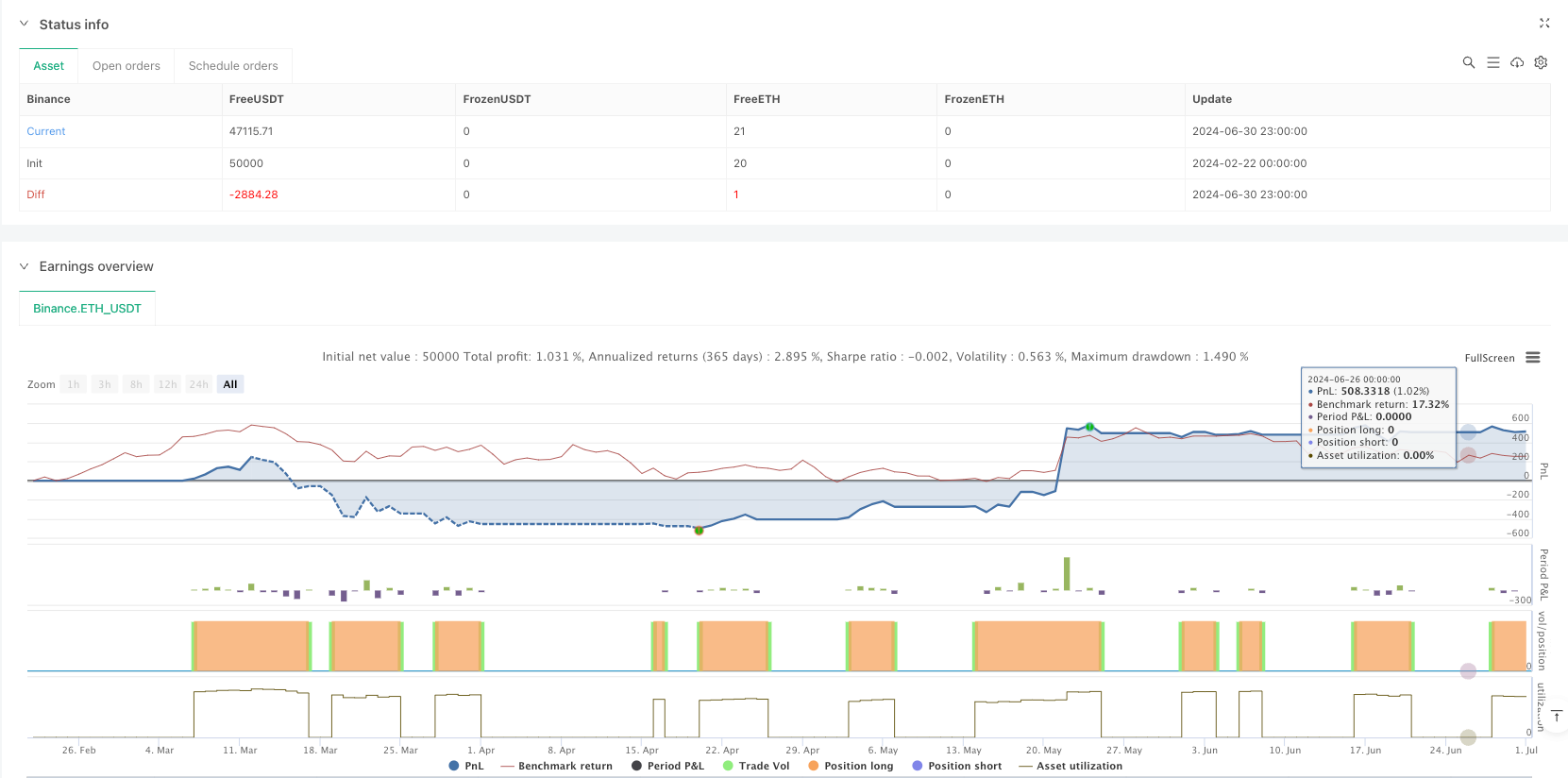

/*backtest

start: 2024-02-22 00:00:00

end: 2024-07-01 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Advanced Supertrend + EMA Strategy", overlay=true)

// =================== PARAMETER INPUTS ===================

// EMA Parameters

emaFastLength = input.int(5, "Fast EMA", minval=1, maxval=50, group="EMA Settings")

emaSlowLength = input.int(20, "Slow EMA", minval=1, maxval=100, group="EMA Settings")

// Supertrend Parameters

atrPeriod = input.int(10, "ATR Period", minval=1, maxval=50, group="Supertrend Settings")

factor = input.float(3.0, "Factor", step=0.1, group="Supertrend Settings")

// =================== CALCULATIONS ===================

// EMA Calculations

emaFast = ta.ema(close, emaFastLength)

emaSlow = ta.ema(close, emaSlowLength)

// Supertrend Calculation

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

// =================== SIGNAL GENERATION ===================

// EMA Crossovers

emaCrossUp = ta.crossover(emaFast, emaSlow)

emaCrossDown = ta.crossunder(emaFast, emaSlow)

// Supertrend Signals

stUp = direction < 0

stDown = direction > 0

// Buy and Sell Conditions

longCondition = emaCrossUp and stUp

shortCondition = emaCrossDown and stDown

// =================== GRAPHICAL INDICATORS ===================

// EMA Lines

plot(emaFast, color=color.new(color.blue, 0), linewidth=2, title="Fast EMA")

plot(emaSlow, color=color.new(color.red, 0), linewidth=2, title="Slow EMA")

// Supertrend Line

supertrendColor = direction < 0 ? color.green : color.red

plot(supertrend, color=supertrendColor, linewidth=2, title="Supertrend")

// Buy-Sell Signals

plotshape(longCondition, title="Buy", text="BUY", location=location.belowbar,

color=color.green, style=shape.labelup, size=size.normal, textcolor=color.white)

plotshape(shortCondition, title="Sell", text="SELL", location=location.abovebar,

color=color.red, style=shape.labeldown, size=size.normal, textcolor=color.white)

// =================== STRATEGY EXECUTIONS ===================

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.close("Long")

// =================== INFORMATION TABLE ===================

var table infoTable = table.new(position.bottom_right, 2, 4, bgcolor=color.new(color.black, 90))

// Signal Status

signalText = ""

signalColor = color.white

if (longCondition)

signalText := "BUY SIGNAL"

signalColor := color.green

if (shortCondition)

signalText := "SELL SIGNAL"

signalColor := color.red

// Table Content

table.cell(infoTable, 0, 0, "CURRENT SIGNAL", bgcolor=color.new(color.blue, 90))

table.cell(infoTable, 1, 0, signalText, text_color=signalColor)

table.cell(infoTable, 0, 1, "EMA TREND")

table.cell(infoTable, 1, 1, emaFast > emaSlow ? "UP" : "DOWN",

text_color=emaFast > emaSlow ? color.green : color.red)

table.cell(infoTable, 0, 2, "SUPERTREND")

table.cell(infoTable, 1, 2, direction < 0 ? "UP" : "DOWN",

text_color=direction < 0 ? color.green : color.red)

// Last Trade Information

table.cell(infoTable, 0, 3, "LAST TRADE")

table.cell(infoTable, 1, 3, longCondition ? "BUY" : shortCondition ? "SELL" : "-",

text_color=longCondition ? color.green : shortCondition ? color.red : color.white)