2

フォロー

365

フォロワー

これは神仙の策略か?

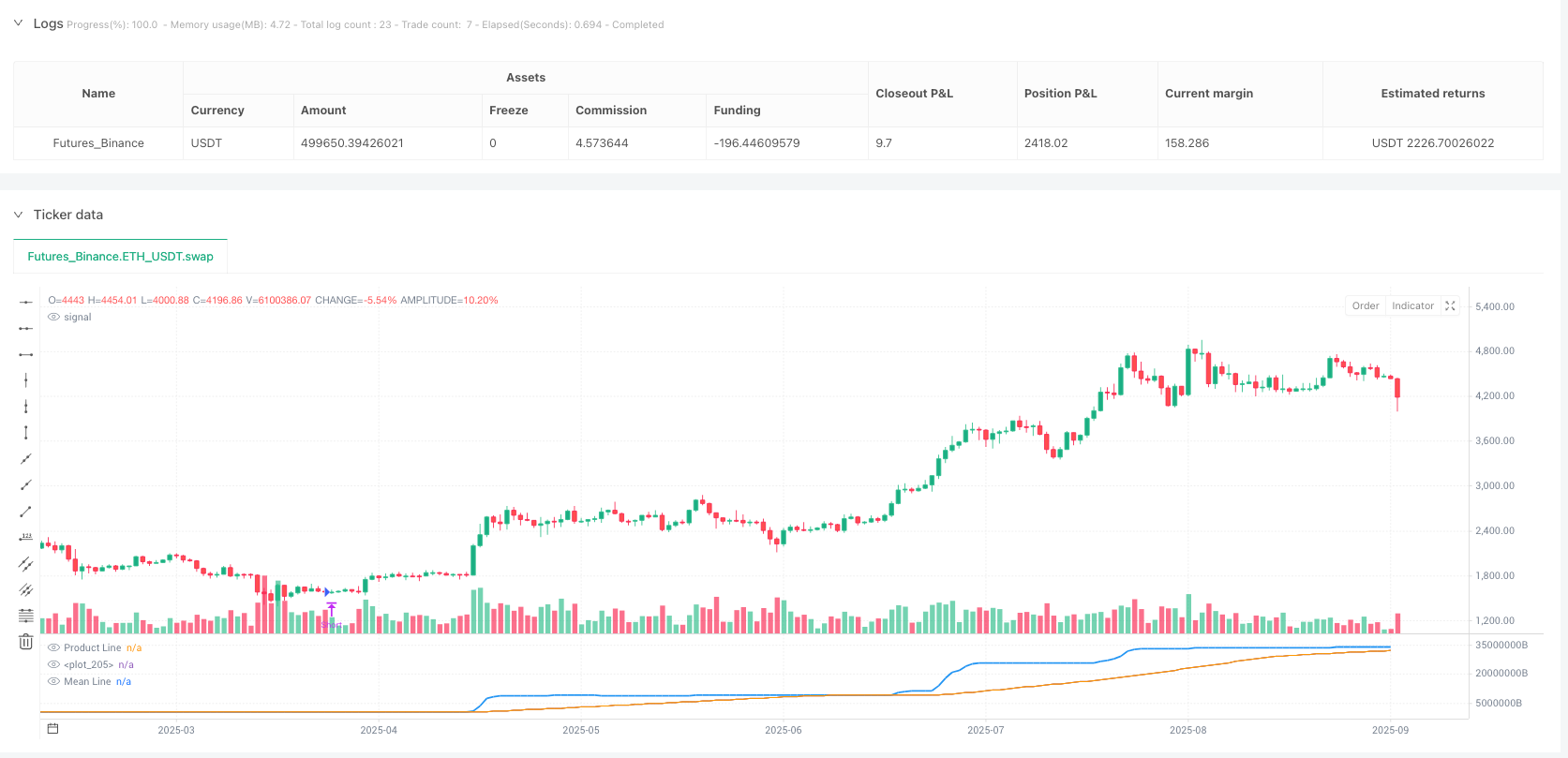

この戦略は,市場に”スーパーレーダー”を装着したようなものです.これは,単に1つまたは2つの指標を見るのではなく,9つの異なる技術指標をバンドのように組み合わせるものです.それぞれの指標は”楽器”であり,それらは和らかな”音”を奏でるときのみ,戦略は取引信号を発信します.

の核となる原理が明らかになった

この戦略の本質は”パラメータの倍数”の概念にあります. RSI,ADX,モーション,変化率,ATR,交差量,加速率,斜率などの指標を同じスケールに標準化し,それらを掛け合わせることで”総合力値”を得ます.料理のように,各調味料には最適な割合があります.この戦略は,市場での様々な”調味料”の完璧な配合を見つけるのに役立ちます.

カスタマイズ可能な取引手段

この戦略の最もクールな点は? あなたはブロックを組み立てるように自由に組み合わせることができます! 特定の指標を使用したくない? 直接オフにしてください. 周期パラメータを調整したいですか? あなたの好きなように.

実戦用ガイド

この戦略は,波動とトレンドが混ざり合っている市場環境に特に適しています. 青の製品ラインがオレンジの均線を上向きに横切るときに多めに,下向きに空いてください. この戦略は,反転信号が表示されたときにポジションを保持するのを防ぐために,自動平衡の仕組みを慎重に設定しています.

ストラテジーソースコード

//@version=5

strategy("Parametric Multiplier Backtester", shorttitle="PMB", overlay=false)

// Author: Script_Algo

// License: MIT

// Permission is hereby granted, free of charge, to any person obtaining a copy

// of this software and associated documentation files (the "Software"), to deal

// in the Software without restriction, including without limitation the rights

// to use, copy, modify, merge, publish, distribute, sublicense, and/or sell

// copies of the Software, subject to the following conditions:

// The above copyright notice and this permission notice shall be included in

// all copies or substantial portions of the Software.

// === Input Parameters ===

// Price

useClose = input.bool(true, "▪ Use Price", group="Parameter Settings")

priceSource = input.source(close, "Price Source", group="Parameter Settings")

// RSI

useRSI = input.bool(true, "▪ Use RSI", group="Parameter Settings")

rsiLength = input.int(8, "RSI Period", minval=1, group="Parameter Settings")

rsiSource = input.source(close, "RSI Source", group="Parameter Settings")

// ADX

useADX = input.bool(true, "▪ Use ADX", group="Parameter Settings")

adxLength = input.int(11, "ADX Period", minval=1, group="Parameter Settings")

// Momentum

useMomentum = input.bool(true, "▪ Use Momentum", group="Parameter Settings")

momLength = input.int(8, "Momentum Period", minval=1, group="Parameter Settings")

momSource = input.source(close, "Momentum Source", group="Parameter Settings")

// ROC

useROC = input.bool(true, "▪ Use ROC", group="Parameter Settings")

rocLength = input.int(3, "ROC Period", minval=1, group="Parameter Settings")

rocSource = input.source(close, "ROC Source", group="Parameter Settings")

// ATR

useATR = input.bool(true, "▪ Use ATR", group="Parameter Settings")

atrLength = input.int(40, "ATR Period", minval=1, group="Parameter Settings")

// Volume

useVolume = input.bool(true, "▪ Use Volume", group="Parameter Settings")

volumeSmoothing = input.int(200, "Volume Smoothing", minval=1, group="Parameter Settings")

// Acceleration

useAcceleration = input.bool(true, "▪ Use Acceleration", group="Parameter Settings")

accLength = input.int(500, "Acceleration Period", minval=1, group="Parameter Settings")

accSource = input.source(close, "Acceleration Source", group="Parameter Settings")

// Slope

useSlope = input.bool(true, "▪ Use Slope", group="Parameter Settings")

slopeLength = input.int(6, "Slope Period", minval=2, group="Parameter Settings")

slopeSource = input.source(close, "Slope Source", group="Parameter Settings")

// Normalization

normalizeValues = input.bool(true, "Normalize Values", group="General Settings")

lookbackPeriod = input.int(20, "Normalization Period", minval=10, group="General Settings")

// Product line smoothing

smoothProduct = input.bool(true, "Smooth Product Line", group="General Settings")

smoothingLength = input.int(200, "Smoothing Period", minval=1, group="General Settings")

// === SMA Trend Filter ===

trendFilter = input.bool(false, "Use SMA Trend Filter", group="Trend Filter")

smaPeriod = input.int(200, "SMA Period for Filter", minval=1, group="Trend Filter")

// === Indicator Calculations ===

// RSI

rsiValue = ta.rsi(rsiSource, rsiLength)

// ADX (correct calculation)

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = ta.tr

plus = fixnan(100 * ta.rma(plusDM, len) / ta.rma(truerange, len))

minus = fixnan(100 * ta.rma(minusDM, len) / ta.rma(truerange, len))

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), len)

[adx, plus, minus]

[adxValue, diPlus, diMinus] = dirmov(adxLength)

// Momentum

momValue = (momSource / momSource[momLength]) * 100

// ROC

rocValue = ((rocSource - rocSource[rocLength]) / rocSource[rocLength]) * 100

// ATR

atrValue = ta.atr(atrLength)

// Volume

smaVolume = ta.sma(volume, volumeSmoothing)

// Acceleration (расчет ускорения цены)

accValue = (accSource / accSource[accLength] - 1) * 100

// Slope (расчет наклона линейной регрессии)

slopeValue = ta.linreg(slopeSource, slopeLength, 0) - ta.linreg(slopeSource, slopeLength, slopeLength)

// Price

priceValue = priceSource

// === Value Normalization ===

normalize_func(_value, _use, _length) =>

if not _use

1

else

if normalizeValues

minVal = ta.lowest(_value, _length)

maxVal = ta.highest(_value, _length)

valueRange = maxVal - minVal

valueRange > 0 ? (_value - minVal) / valueRange * 100 + 1 : 1

else

_value

// Normalized values

normPrice = normalize_func(priceValue, useClose, lookbackPeriod)

normRSI = normalize_func(rsiValue, useRSI, lookbackPeriod)

normADX = normalize_func(adxValue, useADX, lookbackPeriod)

normMomentum = normalize_func(momValue, useMomentum, lookbackPeriod)

normROC = normalize_func(rocValue, useROC, lookbackPeriod)

normATR = normalize_func(atrValue, useATR, lookbackPeriod)

normVolume = normalize_func(smaVolume, useVolume, lookbackPeriod)

normAcceleration = normalize_func(accValue, useAcceleration, lookbackPeriod)

normSlope = normalize_func(slopeValue, useSlope, lookbackPeriod)

// === Product Calculation ===

productValue = 1.0

// Multiply only if parameter is enabled

if useClose

productValue *= normPrice

if useRSI

productValue *= normRSI

if useADX

productValue *= normADX

if useMomentum

productValue *= normMomentum

if useROC

productValue *= normROC

if useATR

productValue *= normATR

if useVolume

productValue *= normVolume

if useAcceleration

productValue *= normAcceleration

if useSlope

productValue *= normSlope

// Product line smoothing

smoothedProduct = smoothProduct ? ta.sma(productValue, smoothingLength) : productValue

// Mean line

meanLine = ta.sma(smoothedProduct, 50)

// SMA trend filter

smaFilter = ta.sma(close, smaPeriod)

// === Trading Conditions ===

// Bullish crossover (product line crosses mean line from below)

bullishCross = ta.crossover(smoothedProduct, meanLine)

// Bearish crossover (product line crosses mean line from above)

bearishCross = ta.crossunder(smoothedProduct, meanLine)

// Entry conditions with trend filter

longCondition = bullishCross and (not trendFilter or close > smaFilter)

shortCondition = bearishCross and (not trendFilter or close < smaFilter)

// === Strategy Execution ===

// Close opposite positions before opening new ones

if (longCondition)

strategy.close("Short", comment="Close Short Entry Long")

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.close("Long", comment="Close Long Entry Short")

strategy.entry("Short", strategy.short)

// Additional exit conditions for more precise control

if (bearishCross and strategy.position_size > 0)

strategy.close("Long", comment="Exit Long")

if (bullishCross and strategy.position_size < 0)

strategy.close("Short", comment="Exit Short")

// === Visualization (as oscillator below chart) ===

// Plot product line and mean line in separate pane

plot(smoothedProduct, color=color.blue, linewidth=2, title="Product Line")

plot(meanLine, color=color.orange, linewidth=1, title="Mean Line")

// Fill area between lines

fill(plot(smoothedProduct), plot(meanLine), color=smoothedProduct > meanLine ? color.new(color.green, 90) : color.new(color.red, 90))

// Information table

var table infoTable = table.new(position.top_right, 1, 1, bgcolor=color.white, border_width=1)

if barstate.islast

table.cell(infoTable, 0, 0, "Current Value: " + str.tostring(smoothedProduct, "#.##"), text_color=color.black)