웨이브 엔진 프로토콜

ATR volatility ACCUMULATION DCA

이것은 평범한 DCA가 아닙니다. 이것은 뇌를 가진 진동 엔진입니다.

반추 자료는 기존의 투자의 정면으로 돌아갑니다: 5%의 하락은 구매를 촉발했고, 3.9%의 상승은 판매를 촉발했습니다.파동 엔진은 ATR의 동적 조정에 따라 하락값을 구매합니다.시장의 변동성이 커질수록 구매 문턱이 높을수록 최대 40%까지 조정할 수 있습니다. 이는 높은 변동성 기간 동안 전략이 더 큰 하락을 기다리는 것을 의미합니다.

전통적인 DCA 전략의 문제는 무심한 구매입니다.진짜 기회의 창을 열 때만。ATR(14) 를 통해 현재 변동률을 계산하고, 동적으로 longThreshPct 파라미터를 조정한다。 예를 들어, 정상적인 5% 하락으로 구매하지만, 현재 변동률이 20%에 달하면 실제 구매 하락값이 6%로 상승한다。

8개의 기본 구성, 각각의 명확한 수익 예상

BTC 주기적 축적 모드: 5% 하락 구매, 6% 포지션, 500 달러의 고정 금액, 장기 보유자에게 적합하다. 3.1% 하락으로 구매, 10% 포지션, 6000 달러의 고정 금액, 75% 이익 문턱에서 판매. ETH 변동 추수: 4.5% 하락 구매, 15% 포지션, 비용 라인 아래 구매를 허용, 30% 이익 문턱.

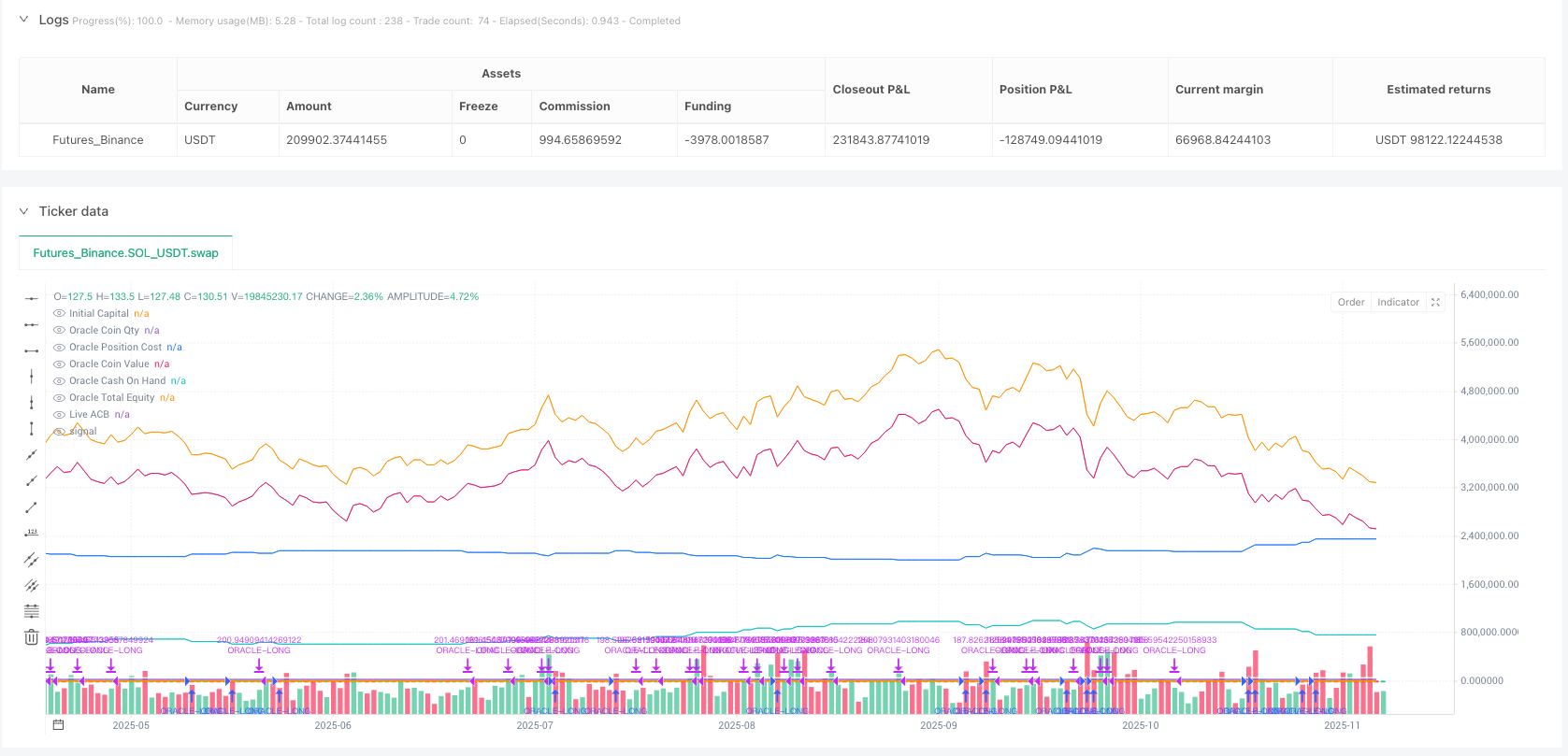

모든 구성은 테스트를 거쳐 검증되었습니다.│SOL는 35%의 수익률 마이너스를, XRP는 10%의 수익률 마이너스를 갖췄으며, 이러한 차이는 서로 다른 자산의 변동성 및 유동성 차이를 반영한다.

집단 봉쇄: DCA 전략의 가장 큰 문제 해결

전통적인 DCA의 가장 큰 문제는 언제 구매를 멈출지 알 수 없다는 것이다. 이 프로토콜은 “클러스터 봉쇄”를 통해 해결한다: 평균 비용에서 3.9%의 가격 상승, 또는 10 회 연속으로 자격이 없는 구매 기회를 봉쇄한다.

봉인 된 평균 비용 라인은 판매 기준이 됩니다.ᄂ) 매각을 촉발하는 것은 가격이 봉쇄 비용선 + 이익 문턱 ((30%-75% 정도) 을 넘으면 됩니다. 이는 끝없는 구매와 조기 수익을 피하는 것입니다.

평온 기둥의 메커니즘은 신에 의해 만들어졌습니다: 만약 10개의 연속적인 주기가 구매 조건을 촉발하지 않는다면, 시장은 안정되어 있고, 계속 축적하는 대신 수확을 준비해야 합니다.

‘비행기’ 효과: 이윤이 다음 번에 서비스를 구매하도록 하는 것

플라이스 모드를 활성화하면 매번 매출이 현금으로 돌아갑니다. 다음 번 총알을 더 구매할 수 있습니다.전략이 황소 시장에서 더 큰 힘을 얻도록。

예를 들어: 초기 $100,000, 첫 번째 라운드에서 20%의 수익을 누리고, 판매 후 현금 은 120,000 달러가 됩니다. 다음 구매 시 6%의 포지션은 7200 달러가 아니라 6000 달러입니다.

그러나, 비행기는 비용이 들기도 합니다. 시가장 후반에는 현금 웅덩이가 너무 커서 너무 많이 구입할 수 있습니다.

위험 통제: 삼중보험

첫 번째: 비용선 위에 구매를 제어한다. 평균 비용 아래에서만 구매를 설정할 수 있으며, 추가를 피한다. 두 번째: 최소 금액 제한. 매번 구매/판매할 때마다 최소 달러 금액이 요구되며, 무의미한 소액 거래가 방지된다. 세 번째 과제: 파동 엔진 조정 ◎ 높은 파동 동안 자동으로 구매 문턱을 높이고 낮은 파동 동안 문턱을 낮추십시오 ◎

하지만 이런 전략은 불안한 시장에서 잘 작동합니다.│ 시장이 장기간에 걸쳐 상반되는 경우, 큰 하락을 유발할 수 없으며, 수익의 문턱을 달성 할 수 없습니다.

실제 전쟁 조언: 시장에 대한 선택이 중요합니다.

이 조치는 명확한 추세가있는 시장, 특히 암호화폐의 주기적 상황에 가장 적합합니다. 곰 시장의 끝에서 축적되기 시작하여 황소 시장의 중반에 수확이 시작되면 가장 효과적입니다.

다음의 상황에서는 사용하지 마십시오: 1) 고 주파수 변동 주식 시장 2) 명확한 추세가없는 외환 시장 3) 유동성이 극히 낮은 소액 통화.

역사적인 재검토에 따르면, 리스크 조정 후의 수익은 단순한 투자보다 우수하지만, 이는 미래의 수익을 보장하지 않습니다.모든 양적 전략에는 실패의 위험이 있으며, 지속적인 모니터링과 조정이 필요합니다.

//@version=6

// ============================================================================

// ORACLE PROTOCOL — ARCH PUBLIC clone (Standalone) — CLEAN-PUB STYLE (derived)

// Variant: v1.9v-standalone (publish-ready) 25/11/2025

// Notes:

// - Keeps your v1.9v canonical script intact (this is a separate modified copy).

// - Single exit mode: ProfitGate + Candle (per-candle) — no selector.

// - Live ACB plot toggle only (sealed ACB still operates internally but is not shown).

// - No freeze-point markers plotted.

// - Sizing: flywheel dynamic sizing remains the primary source but fixed-dollar entry

// and min-$ overrides remain available (as in Arch public PDFs/screenshots).

// - Volatility Engine (VE) applies ONLY to entries; exit-side VE removed.

// - Manual equity top-up removed (flywheel auto-updates cash).

// - VE ATR length and max-vol fields are fixed (not exposed in UI).

// ============================================================================

strategy("Oracle Protocol — Arch Public (Clone) • v1.9v-standalone (publish)",

overlay=true,

initial_capital=100000,

commission_type=strategy.commission.percent,

commission_value=0.1,

pyramiding=9999,

calc_on_every_tick=true,

process_orders_on_close=true)

// ============================================================================

// 1) PRESETS (Arch PDFs)

// ============================================================================

grp_oracle = "Oracle — Core"

oraclePreset = input.string(

"BTC • Cycle Accumulation",

"Recipe Preset",

options = [

"BTC • Cycle Accumulation",

"BTC • Cycle Swing Arbitrage",

"BTC • Short Target Accumulation",

"BTC • Short Target Arbitrage",

"ETH • Volatility Harvesting",

"SOL • Volatility Harvesting",

"XRP • Volatility Harvesting",

"SUI • Volatility Harvesting"

],

group = grp_oracle)

var float longThreshPct = 0.0

var float exitThreshPct = 0.0

var bool onlySellAboveCost = true

var bool recipe_buyBelowACB = false

var float sellProfitGatePct = 0.0

var float entryPct = 0.0

var float exitPct = 0.0

var float fixedEntryUsd = 0.0

var float fixedExitUsd = 0.0

if oraclePreset == "BTC • Cycle Accumulation"

longThreshPct := 5.0

exitThreshPct := 3.9

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 50.0

entryPct := 6.0

exitPct := 1.0

fixedEntryUsd := 500

fixedExitUsd := 500

else if oraclePreset == "BTC • Cycle Swing Arbitrage"

longThreshPct := 5.9

exitThreshPct := 3.5

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 49.0

entryPct := 10.0

exitPct := 50.0

fixedEntryUsd := 10000

fixedExitUsd := 15000

else if oraclePreset == "BTC • Short Target Accumulation"

longThreshPct := 3.1

exitThreshPct := 2.5

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 30.0

entryPct := 10.0

exitPct := 10.0

fixedEntryUsd := 6000

fixedExitUsd := 5000

else if oraclePreset == "BTC • Short Target Arbitrage"

longThreshPct := 3.1

exitThreshPct := 2.5

onlySellAboveCost := true

recipe_buyBelowACB := true

sellProfitGatePct := 75.0

entryPct := 10.0

exitPct := 100.0

fixedEntryUsd := 10000

fixedExitUsd := 5000

else if oraclePreset == "ETH • Volatility Harvesting"

longThreshPct := 4.5

exitThreshPct := 5.0

onlySellAboveCost := true

recipe_buyBelowACB := true

sellProfitGatePct := 30.0

entryPct := 15.0

exitPct := 40.0

fixedEntryUsd := 6000

fixedExitUsd := 20000

else if oraclePreset == "SOL • Volatility Harvesting"

longThreshPct := 5.0

exitThreshPct := 5.0

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 35.0

entryPct := 7.0

exitPct := 5.0

fixedEntryUsd := 5000

fixedExitUsd := 5000

else if oraclePreset == "XRP • Volatility Harvesting"

longThreshPct := 4.5

exitThreshPct := 10.0

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 10.0

entryPct := 17.0

exitPct := 50.0

fixedEntryUsd := 8000

fixedExitUsd := 5000

else if oraclePreset == "SUI • Volatility Harvesting"

longThreshPct := 5.0

exitThreshPct := 5.0

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 10.0

entryPct := 5.0

exitPct := 10.0

fixedEntryUsd := 5000

fixedExitUsd := 15000

// ============================================================================

// 2) EXTRAS & VOLATILITY SPLITS (CLEAN PUBLIC VARIANTS)

// - Volatility engine inputs are fixed and not exposed in the UI

// ============================================================================

// UI group for extras (keeps flywheel toggle visible)

grp_extras = "Oracle — Extras"

useFlywheel = input.bool(true, "Reinvest Realized Profits (Flywheel)", group = grp_extras)

// Volatility engine: ENTRY only (VE params fixed, not shown)

useVolEngineEntry = input.bool(true, "Enable Volatility Engine (Entries only)", group = grp_extras)

// Fixed/hidden VE parameters (not exposed in UI per your request)

atrLen_fixed = 14

maxVolAdjPct_fixed = 40.0

// NOTE: manual_equity_topup removed for publish variant — flywheel handles auto top-up

buyBelowMode = input.string(

"Use Recipe Setting",

"Buy Below ACB Mode",

options = ["Use Recipe Setting", "Force Buy Below ACB", "Allow Buys Above ACB"],

group = grp_extras)

// ============================================================================

// 3) QUIET BARS (cluster seal) — unchanged behavior, UI visible

// ============================================================================

grp_qb = "Oracle — Quiet Bars (Cluster Seal)"

useQuietBars = input.bool(true, "Enable Quiet-Bars Seal", group=grp_qb)

quietBars = input.int(10, "Quiet Bars (no eligible buys)", minval=1, group=grp_qb)

// ============================================================================

// 4) SELL MODE — SINGLE ARCH EXIT (ProfitGate + Candle) ONLY

// (no selector; fixed behavior to match Arch public)

// ============================================================================

grp_sell = "Oracle — Sell Behaviour"

// no sellMode selector in this publish variant — fixed logic below

// ============================================================================

// 5) DISPLAY & PLOTS (simplified)

// - only Live ACB toggle remains visible.

// - sealed ACB and freeze points are intentionally not plotted.

// ============================================================================

grp_display = "Oracle — Display"

showLiveACB = input.bool(true, "Show Live ACB", group = grp_display)

acbColor = input.color(color.new(color.yellow, 0), "ACB Line Color", group = grp_display)

showExitGuides = input.bool(false, "Show Exit Guide Lines", group = grp_display)

// ============================================================================

// 6) 3C SIZING & MINIMUMS / OVERRIDES

// - primary sizing source is flywheel (cash ledger).

// - but fixed-entry USD and min-$ overrides remain (per Arch public).

// ============================================================================

grp_3c_sz = "Oracle — Sizing"

use3C = input.bool(true, "Enable 3Commas JSON Alerts", group = grp_3c_sz)

botTag = input.string("ORACLE", "Bot Tag / Pair Hint", group = grp_3c_sz)

// Keep min$/fixed entry & exit overrides visible (Arch style)

useMinEntry = input.bool(true, "Use Min $ on Entry", group = grp_oracle)

useMinExit = input.bool(true, "Use Min $ on Exit", group = grp_oracle)

manualMinEntry = input.float(0.0, "Manual Min $ Entry (0 = use recipe)", group = grp_oracle, step = 10)

manualMinExit = input.float(0.0, "Manual Min $ Exit (0 = use recipe)", group = grp_oracle, step = 10)

grp_override = "Oracle — Amount Override"

entryUsd_override = input.float(0.0, "Entry USD Override (0 = none)", group = grp_override, step = 10)

exitUsd_override = input.float(0.0, "Exit USD Override (0 = none)", group = grp_override, step = 10)

// ============================================================================

// 7) VOLATILITY ENGINE VALUES (ENTRY only)

// - VE uses fixed internal params (atrLen_fixed, maxVolAdjPct_fixed).

// - VE not applied to exits in this publish variant.

// ============================================================================

atrVal = ta.atr(atrLen_fixed)

volPct = atrVal / close * 100.0

volAdj = math.min(volPct, maxVolAdjPct_fixed)

longThreshEff = longThreshPct * (useVolEngineEntry ? (1 + volAdj/100.0) : 1)

// exit threshold is NOT adjusted by VE in this variant:

exitThreshEff = exitThreshPct

// ============================================================================

// 8) POSITION STATE & HELPERS

// ============================================================================

var float q = 0.0 // live coin quantity

var float cost = 0.0 // live position cost ($)

var float live_acb = 0.0 // live average cost (cost / q)

var float realized = 0.0

// Flywheel cash ledger (realised cash available for reinvest) — auto only

var float cash = na

if na(cash)

cash := strategy.initial_capital

// Cluster / gating state (sealed base) — sealed_acb still used internally but not shown

var bool clusterOpen = false

var float sealed_acb = na // frozen when a cluster seals (sealed accumulation base)

var int lastEntryBar = na

var int lastEligibleBuyBar = na // for quiet-bars seal

var int sell_steps_done = 0 // number of incremental exits already taken since gate armed

var float last_sell_ref = na // last sell price used for pullback re-arm (not used here)

var bool mode_single_sold = false // lock for Single per Rally (internal use)

// Helpers (array returns)

f_add_fill(_qty, _px, _q, _cost) =>

// returns newQty, newCost, newACB

_newCost = _cost + _qty * _px

_newQty = _q + _qty

_newACB = _newQty > 0 ? _newCost / _newQty : 0.0

array.from(_newQty, _newCost, _newACB)

f_reduce_fill(_qty, _px, _q, _cost) =>

// returns newQty, newCost, newACB, sellVal, costReduced, proportion

_sellVal = _qty * _px

_prop = _q > 0 ? _qty / _q : 0.0

_costReduced = _cost * _prop

_newCost = _cost - _costReduced

_newQty = _q - _qty

_newACB = _newQty > 0 ? _newCost / _newQty : 0.0

array.from(_newQty, _newCost, _newACB, _sellVal, _costReduced, _prop)

// ============================================================================

// 9) BUY SIGNALS & BUY-BELOW MODE

// ============================================================================

dropFromPrev = close[1] != 0 ? (close - close[1]) / close[1] * 100.0 : 0.0

wantBuy = dropFromPrev <= -longThreshEff

needBuyBelow = recipe_buyBelowACB

if buyBelowMode == "Force Buy Below ACB"

needBuyBelow := true

else if buyBelowMode == "Allow Buys Above ACB"

needBuyBelow := false

canBuyBelow = not needBuyBelow or (needBuyBelow and (live_acb == 0 or close < live_acb))

// Track “eligible” buys (quiet-bars gate references opportunity, not just fills)

if wantBuy and canBuyBelow

lastEligibleBuyBar := bar_index

// ============================================================================

// 10) SIZING (flywheel-driven; keep fixed/min-dollar options for entry & exit)

// ============================================================================

baseAcct = cash // flywheel only in this variant

// entry as percentage of baseAcct (dynamic) with fixed/min-dollar fallback (Arch-style)

entryUsd = baseAcct * (entryPct / 100.0)

// Entry min floor (keep manual/fixed options per Arch)

if useMinEntry

entryFloor = manualMinEntry > 0 ? manualMinEntry : fixedEntryUsd

entryUsd := math.max(entryUsd, entryFloor)

// override priority

entryUsd := entryUsd_override > 0 ? entryUsd_override : entryUsd

// entry qty

eQty = close > 0 ? entryUsd / close : 0.0

// Exit sizing: percentage of HOLDINGS (Arch) with min-$ fallback (unchanged)

exitQty_pct = q * (exitPct / 100.0)

exitFloorQty = close > 0 ? ( (manualMinExit > 0 ? manualMinExit : fixedExitUsd) / close ) : 0.0

xQty_base = math.max(exitQty_pct, exitFloorQty)

xQty = math.min(xQty_base, q)

xQty := exitUsd_override > 0 and close > 0 ? math.min(exitUsd_override / close, q) : xQty

// ============================================================================

// 11) ENTRY — opens/extends accumulation cluster; resets SELL steps

// Cash gate: only execute buy if cash >= entryUsd and on confirmed bar close

// ============================================================================

newEntry = false

entryCost = eQty * close

hasCash = entryCost > 0 and cash >= entryCost

if barstate.isconfirmed and wantBuy and canBuyBelow and eQty > 0 and hasCash

strategy.entry("ORACLE-LONG", strategy.long, qty=eQty, comment="ORACLE-BUY")

_fill = f_add_fill(eQty, close, q, cost)

q := array.get(_fill, 0)

cost := array.get(_fill, 1)

live_acb := array.get(_fill, 2)

cash -= entryCost

lastEntryBar := bar_index

lastEligibleBuyBar := bar_index

if not clusterOpen

clusterOpen := true

sealed_acb := na

sell_steps_done := 0

mode_single_sold := false

last_sell_ref := na

// set sealed_acb initial for cluster if na

if na(sealed_acb)

sealed_acb := live_acb

newEntry := true

// ============================================================================

// 12) CLUSTER SEAL — Exit-Threshold OR Quiet-Bars

// - On sealing, we freeze sealed_acb internally (not plotted).

// ============================================================================

riseFromLiveACB = live_acb > 0 ? (close - live_acb ) / live_acb * 100.0 : 0.0

sealByThresh = riseFromLiveACB >= exitThreshEff

barsSinceElig = na(lastEligibleBuyBar) ? 10000 : (bar_index - lastEligibleBuyBar)

sealByQuiet = useQuietBars and (barsSinceElig >= quietBars)

sealed_changed = false

if clusterOpen and (sealByThresh or sealByQuiet)

clusterOpen := false

// freeze sealed base as the last live_acb at seal time (preserve cycle anchor)

sealed_acb := live_acb

sell_steps_done := 0

mode_single_sold := false

last_sell_ref := na

sealed_changed := true

// ============================================================================

// 13) SELL LOGIC — SINGLE ARCH EXIT: ProfitGate + Candle (Per-Candle)

// - Profit gate base: use sealed refBase if present, otherwise live_acb (no toggle).

// - VE not applied to exits in this variant.

// ============================================================================

refBase = na(sealed_acb) ? live_acb : sealed_acb

riseFromRef = refBase > 0 ? (close - refBase) / refBase * 100.0 : 0.0

sellAboveOK = not onlySellAboveCost or close > live_acb

profitRefBase = refBase // sealed if available, else live_acb (no UI toggle in this variant)

// Basic profit gate price/boolean (uses profitRefBase)

profitGateLevelPrice = profitRefBase * (1 + sellProfitGatePct / 100.0)

profitGateCrossed = profitRefBase > 0 ? (close >= profitGateLevelPrice) : false

// Candle-based rise (percent move relative to previous close)

riseFromPrev = close[1] != 0 ? (close - close[1]) / close[1] * 100.0 : 0.0

candleRiseOK = riseFromPrev >= exitThreshEff

// Final allow-sell boolean for this publish variant (ProfitGate + Candle)

var bool allowSellThisBar = false

allowSellThisBar := false

allowSellThisBar := profitGateCrossed and candleRiseOK and xQty > 0 and q > 0 and sellAboveOK and barstate.isconfirmed

// Perform sell if allowed

actualExitQty = 0.0

if allowSellThisBar

actualExitQty := xQty

if actualExitQty > 0

strategy.close("ORACLE-LONG", qty = actualExitQty, comment = "ORACLE-SELL")

_r = f_reduce_fill(actualExitQty, close, q, cost)

q := array.get(_r, 0)

cost := array.get(_r, 1)

live_acb := array.get(_r, 2)

sellVal = array.get(_r, 3)

cRed = array.get(_r, 4)

tradePnL = sellVal - cRed

realized += tradePnL

cash += sellVal

sell_steps_done += 1

last_sell_ref := close

mode_single_sold := true

if q <= 0

// fully sold - reset sealed base and steps (internal)

sealed_acb := na

sell_steps_done := 0

mode_single_sold := false

last_sell_ref := na

// Re-arm logic (simplified): allow new sells only after retrace below refBase by exitThreshEff or if fully sold

if barstate.isconfirmed

if mode_single_sold

retrace_condition = not na(refBase) ? (close < refBase * (1 - exitThreshEff/100.0)) : false

if retrace_condition or q == 0

mode_single_sold := false

sell_steps_done := 0

last_sell_ref := na

// ============================================================================

// 14) BALANCES & 3C JSON (flywheel-based sizing)

// ============================================================================

cash_on_hand = math.max(cash, 0)

coin_value = q * close

total_equity = cash_on_hand + coin_value

base_for_3c = cash_on_hand // flywheel only in this publish variant

entryUsd_3c = base_for_3c * (entryPct / 100.0)

if useMinEntry

entryUsd_3c := math.max(entryUsd_3c, (manualMinEntry > 0 ? manualMinEntry : fixedEntryUsd))

entryUsd_3c := entryUsd_override > 0 ? entryUsd_override : entryUsd_3c

// ============================================================================

// 15) PLOTS (Data Window + Live ACB only + optional guides)

// - Sealed ACB and freeze markers intentionally NOT plotted in this variant.

// ============================================================================

plot(strategy.initial_capital, title="Initial Capital", color=color.white)

plot(q, title="Oracle Coin Qty", precision = 6)

plot(cost, title="Oracle Position Cost")

plot(coin_value, title="Oracle Coin Value")

plot(cash_on_hand, title="Oracle Cash On Hand")

plot(total_equity, title="Oracle Total Equity")

plot(live_acb > 0 and showLiveACB ? live_acb : na, title="Live ACB", color=color.new(color.orange,0), linewidth=2, style=plot.style_line)

// Exit guide lines reference refBase but are optional (kept for debugging/visual confirmation)

guide_exit_line = showExitGuides and not na(refBase) ? refBase * (1 + exitThreshEff/100.0) : na

guide_gate_line = showExitGuides and not na(refBase) ? refBase * (1 + sellProfitGatePct/100.0) : na

plot(guide_exit_line, title="Exit Threshold Line", display=showExitGuides ? display.all : display.none, linewidth=1, style=plot.style_linebr)

plot(guide_gate_line, title="Profit Gate Line (ref base)", display=showExitGuides ? display.all : display.none, linewidth=1, style=plot.style_linebr)

// Also plot the profit gate price computed from profitRefBase (if guides enabled)

plot(not na(profitRefBase) and showExitGuides ? profitRefBase * (1 + sellProfitGatePct/100.0) : na, title="Profit Gate (ref base)", display=showExitGuides ? display.all : display.none, linewidth=1, style=plot.style_line)