Gambaran keseluruhan

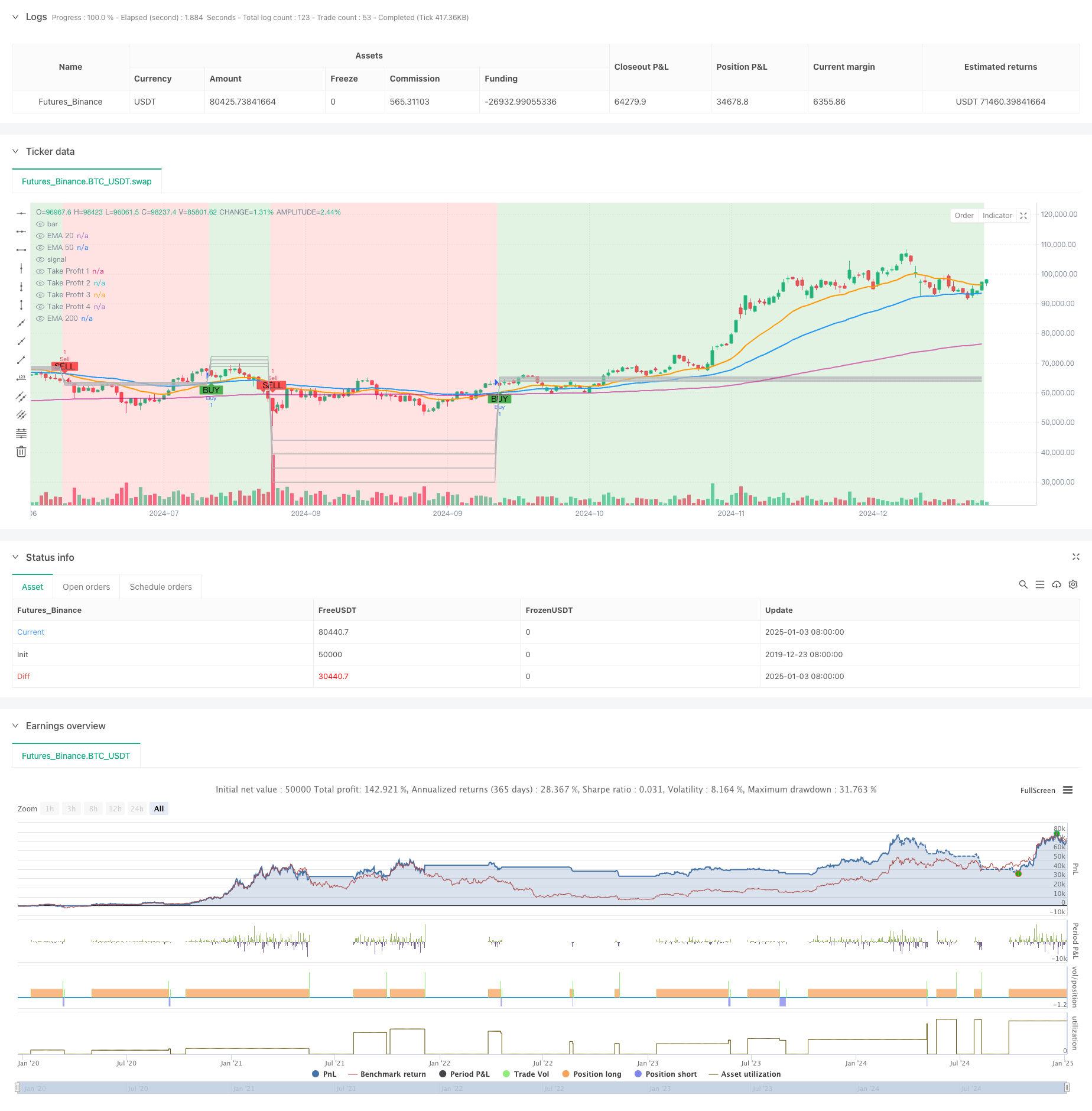

Strategi ini ialah sistem dagangan berasaskan purata bergerak eksponen (EMA) yang terutamanya menggunakan silang EMA20 dan EMA50 untuk mengenal pasti perubahan dalam arah aliran pasaran. Strategi mereka bentuk mata keuntungan berbilang peringkat dinamik dan menggabungkan mekanisme henti rugi untuk mengawal risiko. Sistem ini memaparkan secara visual arah aliran pasaran melalui perubahan dalam warna latar belakang, membantu peniaga memahami arah aliran pasaran dengan lebih baik.

Prinsip Strategi

Logik teras strategi adalah berdasarkan aspek berikut:

- Gunakan silang EMA20 dan EMA50 untuk menentukan arah aliran: isyarat beli dijana apabila EMA20 bersilang di atas EMA50 dan isyarat jual dijana apabila ia melintasi bawah

- Tetapkan empat sasaran keuntungan secara dinamik berdasarkan julat turun naik graf lilin sebelumnya:

- TP1 ditetapkan kepada 0.5 kali julat turun naik

- TP2 ditetapkan kepada 1.0 kali julat turun naik

- TP3 ditetapkan kepada 1.5 kali julat turun naik

- TP4 ditetapkan kepada 2.0 kali julat turun naik

- Tetapkan stop loss 3% untuk mengawal risiko

- Arah aliran dipaparkan dengan menukar warna latar belakang garis K: arah aliran menaik dipaparkan dalam warna hijau dan arah aliran menurun dipaparkan dalam warna merah

Kelebihan Strategik

- Tetapan mata keuntungan dinamik: melaraskan sasaran keuntungan secara automatik mengikut turun naik pasaran masa nyata, sangat boleh disesuaikan

- Mekanisme keuntungan berbilang peringkat: Dengan menetapkan berbilang mata keuntungan, ia bukan sahaja memastikan keuntungan terkunci, tetapi juga memberi ruang untuk trend berkembang sepenuhnya

- Kesan visualisasi yang luar biasa: arah aliran dipaparkan secara intuitif melalui warna latar belakang, yang sesuai untuk penilaian cepat status pasaran

- Kawalan risiko sempurna: tetapkan titik henti kerugian tetap untuk mengawal kerugian maksimum setiap transaksi dengan berkesan

- Parameter fleksibel dan boleh laras: peniaga boleh melaraskan pengganda mata keuntungan dan peratusan hentikan kerugian mengikut keadaan pasaran yang berbeza

Risiko Strategik

- Histeresis purata bergerak: EMA sendiri mempunyai histeresis, yang mungkin menyebabkan isyarat dijana kemudian

- Risiko pasaran tidak menentu: Isyarat palsu yang kerap mungkin berlaku dalam pasaran sisi dan tidak menentu

- Tetapan stop loss tetap: Peratusan tetap stop loss mungkin tidak sesuai untuk semua keadaan pasaran

- Jarak mata untung: Dalam pasaran yang tidak menentu, jarak antara mata keuntungan mungkin terlalu besar atau terlalu kecil

Arah pengoptimuman strategi

- Memperkenalkan penunjuk tambahan: Penunjuk seperti RSI atau MACD boleh ditambah sebagai pengesahan isyarat silang

- Optimumkan mekanisme henti rugi: Pertimbangkan menggunakan ATR untuk menetapkan jarak henti rugi secara dinamik

- Tambah penapis masa: tambah tetingkap masa dagangan untuk mengelakkan tempoh turun naik yang tinggi

- Tingkatkan pengurusan kedudukan: laraskan saiz kedudukan secara dinamik mengikut turun naik pasaran

- Optimumkan pengesahan isyarat: anda boleh menambah penunjuk seperti volum dagangan sebagai syarat pengesahan tambahan

ringkaskan

Ini adalah strategi mengikut arah aliran dengan struktur lengkap dan logik yang jelas. Tangkap arah aliran melalui pindah silang purata bergerak, urus pulangan menggunakan mata keuntungan dinamik dan kawal risiko dengan henti rugi. Reka bentuk visual strategi adalah intuitif dan berkesan, dan tetapan parameter adalah fleksibel dan boleh laras. Walaupun terdapat masalah lag yang wujud dengan purata bergerak, kestabilan dan keuntungan strategi boleh dipertingkatkan lagi melalui pengoptimuman dan penambahbaikan.

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Crossover Strategy with Take Profit and Candle Highlighting", overlay=true)

// Define the EMAs

ema200 = ta.ema(close, 200)

ema50 = ta.ema(close, 50)

ema20 = ta.ema(close, 20)

// Plot the EMAs

plot(ema200, color=#c204898e, title="EMA 200", linewidth=2)

plot(ema50, color=color.blue, title="EMA 50", linewidth=2)

plot(ema20, color=color.orange, title="EMA 20", linewidth=2)

// Define Buy and Sell conditions based on EMA crossover

buySignal = ta.crossover(ema20, ema50) // EMA 20 crosses above EMA 50 (Bullish)

sellSignal = ta.crossunder(ema20, ema50) // EMA 20 crosses below EMA 50 (Bearish)

// Define input values for Take Profit multipliers

tp1_multiplier = input.float(0.5, title="TP1 Multiplier", minval=0.1, maxval=5.0, step=0.1)

tp2_multiplier = input.float(1.0, title="TP2 Multiplier", minval=0.1, maxval=5.0, step=0.1)

tp3_multiplier = input.float(1.5, title="TP3 Multiplier", minval=0.1, maxval=5.0, step=0.1)

tp4_multiplier = input.float(2.0, title="TP4 Multiplier", minval=0.1, maxval=5.0, step=0.1)

// Define Take Profit Levels as float variables initialized with na

var float takeProfit1 = na

var float takeProfit2 = na

var float takeProfit3 = na

var float takeProfit4 = na

// Calculate take profit levels based on the multipliers

if buySignal

takeProfit1 := high + (high - low) * tp1_multiplier // TP1: Set TP at multiplier of previous range above the high

takeProfit2 := high + (high - low) * tp2_multiplier // TP2: Set TP at multiplier of previous range above the high

takeProfit3 := high + (high - low) * tp3_multiplier // TP3: Set TP at multiplier of previous range above the high

takeProfit4 := high + (high - low) * tp4_multiplier // TP4: Set TP at multiplier of previous range above the high

if sellSignal

takeProfit1 := low - (high - low) * tp1_multiplier // TP1: Set TP at multiplier of previous range below the low

takeProfit2 := low - (high - low) * tp2_multiplier // TP2: Set TP at multiplier of previous range below the low

takeProfit3 := low - (high - low) * tp3_multiplier // TP3: Set TP at multiplier of previous range below the low

takeProfit4 := low - (high - low) * tp4_multiplier // TP4: Set TP at multiplier of previous range below the low

// Plot Take Profit Levels on the chart

plot(takeProfit1, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 1")

plot(takeProfit2, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 2")

plot(takeProfit3, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 3")

plot(takeProfit4, color=#b4b4b8, style=plot.style_line, linewidth=1, title="Take Profit 4")

// Create buy and sell signals on the chart

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")

// Highlight the candles based on trend direction

uptrend = ta.crossover(ema20, ema50) // EMA 20 crosses above EMA 50 (Bullish)

downtrend = ta.crossunder(ema20, ema50) // EMA 20 crosses below EMA 50 (Bearish)

// Highlighting candles based on trend

bgcolor(color = ema20 > ema50 ? color.new(color.green, 80) : ema20 < ema50 ? color.new(color.red, 80) : na)

// Execute buy and sell orders on the chart

strategy.entry("Buy", strategy.long, when=buySignal)

strategy.entry("Sell", strategy.short, when=sellSignal)

// Exit conditions based on Take Profit levels

strategy.exit("Take Profit 1", "Buy", limit=takeProfit1)

strategy.exit("Take Profit 2", "Buy", limit=takeProfit2)

strategy.exit("Take Profit 3", "Buy", limit=takeProfit3)

strategy.exit("Take Profit 4", "Buy", limit=takeProfit4)

strategy.exit("Take Profit 1", "Sell", limit=takeProfit1)

strategy.exit("Take Profit 2", "Sell", limit=takeProfit2)

strategy.exit("Take Profit 3", "Sell", limit=takeProfit3)

strategy.exit("Take Profit 4", "Sell", limit=takeProfit4)

// Optionally, add a stop loss

stopLoss = 0.03 // Example: 3% stop loss

strategy.exit("Stop Loss", "Buy", stop=close * (1 - stopLoss))

strategy.exit("Stop Loss", "Sell", stop=close * (1 + stopLoss))