Gambaran keseluruhan

Strategi ini adalah sistem pengesanan trend adaptif yang menggabungkan Nadaraya-Watson Core Regression dan ATR Dynamic Band. Ia meramalkan trend harga melalui fungsi inti kedua yang logik dan menggunakan sokongan dan rintangan dinamik yang berasaskan ATR untuk mengenal pasti peluang perdagangan. Sistem ini mewujudkan pemodelan pasaran yang tepat melalui tetingkap pengulangan dan parameter berat yang boleh dikonfigurasi.

Prinsip Strategi

Pusat strategi adalah pengembalian teras bukan parameter berdasarkan kaedah Nadaraya-Watson, menggunakan fungsi teras binari logik untuk memperhalusi urutan harga. Pengembalian bermula dari bar permulaan yang ditetapkan dan dikira dengan dua parameter utama untuk mengawal tahap kecocokan melalui lookback window ((h) dan berat relatif (®). Di samping itu, dengan menggunakan indikator ATR, binaan dinamika di atas dan bawah, di mana nilai pengembalian dianggarkan dengan kenaikan dan pengurangan ATR berganda.

Kelebihan Strategik

- Pendekatan regresi nuklear mempunyai asas matematik yang baik untuk menangkap trend harga dengan berkesan tanpa terlalu sesuai

- Bentang gelombang dinamik menyesuaikan diri dengan turun naik pasaran, memberikan tahap rintangan sokongan yang lebih wajar

- Parameter yang boleh dikonfigurasi dan boleh disesuaikan dengan ciri-ciri pasaran yang berbeza

- Mekanisme pengenalan trend fleksibel, dengan pilihan mod halus atau sensitif

- Kesan visual intuitif, isyarat dagangan jelas

Risiko Strategik

- Pilihan parameter yang tidak betul boleh menyebabkan overfitting atau lag

- Tanda-tanda perdagangan yang berlebihan dalam pasaran yang bergolak

- Tetapan ATR yang tidak munasabah boleh menyebabkan stop loss terlalu lebar atau terlalu sempit

- Isyarat palsu mungkin muncul semasa peralihan trend Adalah disyorkan untuk mengoptimumkan parameter dengan mengkaji semula sejarah dan menggabungkannya dengan penunjuk lain sebagai pengesahan tambahan.

Arah pengoptimuman strategi

- Memperkenalkan penunjuk kuantiti pertukaran sebagai pengesahan trend

- Membangunkan mekanisme pengoptimuman parameter penyesuaian

- Meningkatkan intensiti penapis trend mengurangkan isyarat palsu pasaran goyah

- Optimumkan mekanisme hentian kerugian untuk meningkatkan kadar keuntungan

- Pertimbangkan untuk memasukkan klasifikasi persekitaran pasaran, menggunakan parameter yang berbeza di pasaran yang berbeza

ringkaskan

Strategi ini menggabungkan kaedah pembelajaran statistik dengan analisis teknikal untuk membina sistem perdagangan yang mempunyai asas teori yang kukuh dan praktikal. Ciri-ciri dan konfigurasi yang dapat disesuaikan dengannya membolehkan ia menyesuaikan diri dengan keadaan pasaran yang berbeza, tetapi perlu berhati-hati dalam pengoptimuman parameter dan kawalan risiko. Dengan peningkatan dan pengoptimuman yang berterusan, strategi ini dijangka memainkan peranan penting dalam perdagangan dalam pertempuran.

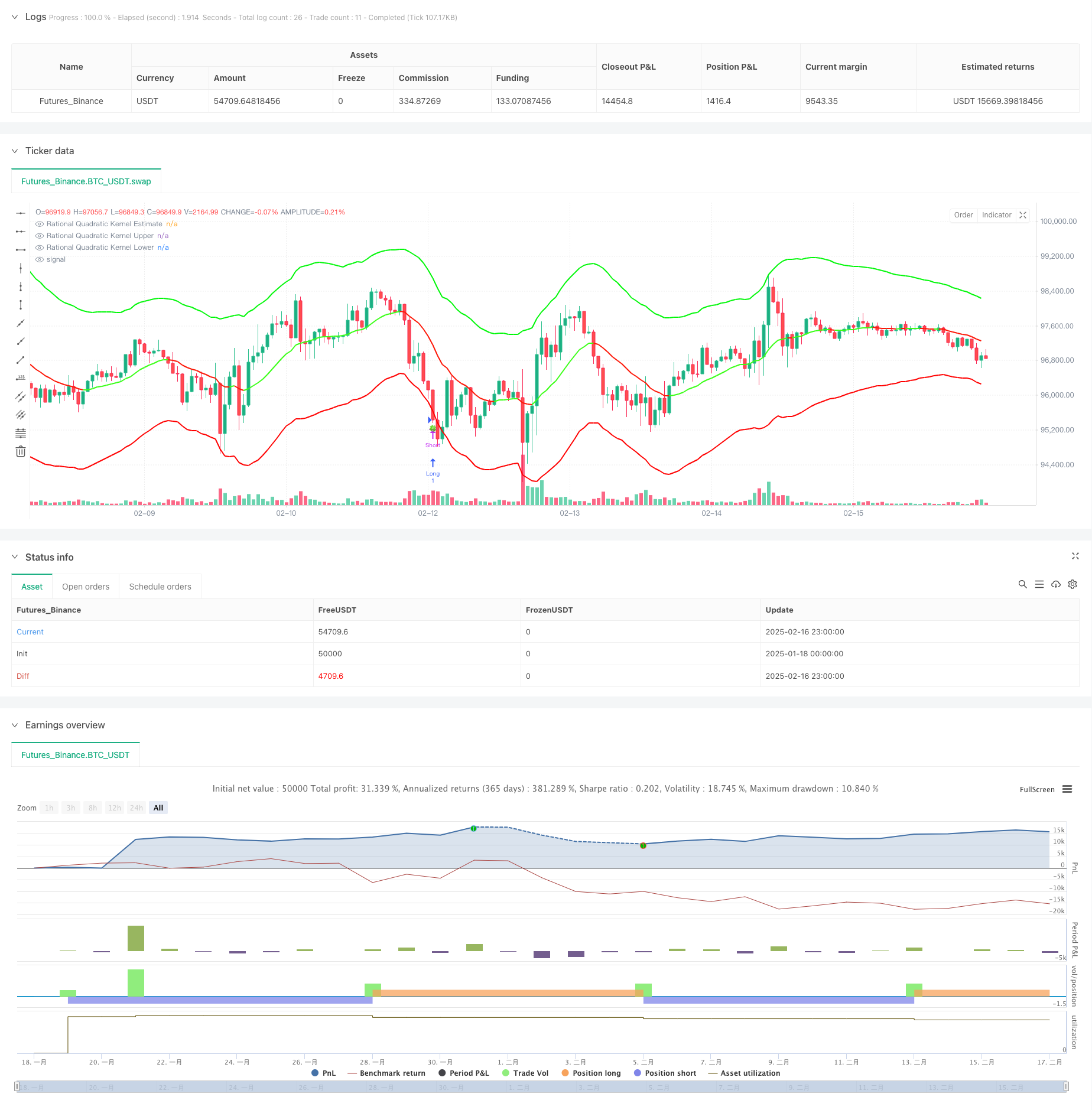

/*backtest

start: 2025-01-18 00:00:00

end: 2025-02-17 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Lupown

//@version=5

strategy("Nadaraya-Watson non repainting Strategy", overlay=true) // PARAMETER timeframe ODSTRÁNENÝ

//--------------------------------------------------------------------------------

// INPUTS

//--------------------------------------------------------------------------------

src = input.source(close, 'Source')

h = input.float(8., 'Lookback Window', minval=3., tooltip='The number of bars used for the estimation. This is a sliding value that represents the most recent historical bars. Recommended range: 3-50')

r = input.float(8., 'Relative Weighting', step=0.25, tooltip='Relative weighting of time frames. As this value approaches zero, the longer time frames will exert more influence on the estimation. As this value approaches infinity, the behavior of the Rational Quadratic Kernel will become identical to the Gaussian kernel. Recommended range: 0.25-25')

x_0 = input.int(25, "Start Regression at Bar", tooltip='Bar index on which to start regression. The first bars of a chart are often highly volatile, and omission of these initial bars often leads to a better overall fit. Recommended range: 5-25')

showMiddle = input.bool(true, "Show middle band")

smoothColors = input.bool(false, "Smooth Colors", tooltip="Uses a crossover based mechanism to determine colors. This often results in less color transitions overall.", inline='1', group='Colors')

lag = input.int(2, "Lag", tooltip="Lag for crossover detection. Lower values result in earlier crossovers. Recommended range: 1-2", inline='1', group='Colors')

lenjeje = input.int(32, "ATR Period", tooltip="Period to calculate upper and lower band", group='Bands')

coef = input.float(2.7, "Multiplier", tooltip="Multiplier to calculate upper and lower band", group='Bands')

//--------------------------------------------------------------------------------

// ARRAYS & VARIABLES

//--------------------------------------------------------------------------------

float y1 = 0.0

float y2 = 0.0

srcArray = array.new<float>(0)

array.push(srcArray, src)

size = array.size(srcArray)

//--------------------------------------------------------------------------------

// KERNEL REGRESSION FUNCTIONS

//--------------------------------------------------------------------------------

kernel_regression1(_src, _size, _h) =>

float _currentWeight = 0.

float _cumulativeWeight = 0.

for i = 0 to _size + x_0

y = _src[i]

w = math.pow(1 + (math.pow(i, 2) / ((math.pow(_h, 2) * 2 * r))), -r)

_currentWeight += y * w

_cumulativeWeight += w

[_currentWeight, _cumulativeWeight]

[currentWeight1, cumulativeWeight1] = kernel_regression1(src, size, h)

yhat1 = currentWeight1 / cumulativeWeight1

[currentWeight2, cumulativeWeight2] = kernel_regression1(src, size, h - lag)

yhat2 = currentWeight2 / cumulativeWeight2

//--------------------------------------------------------------------------------

// TREND & COLOR DETECTION

//--------------------------------------------------------------------------------

// Rate-of-change-based

bool wasBearish = yhat1[2] > yhat1[1]

bool wasBullish = yhat1[2] < yhat1[1]

bool isBearish = yhat1[1] > yhat1

bool isBullish = yhat1[1] < yhat1

bool isBearishChg = isBearish and wasBullish

bool isBullishChg = isBullish and wasBearish

// Crossover-based (for "smooth" color changes)

bool isBullishCross = ta.crossover(yhat2, yhat1)

bool isBearishCross = ta.crossunder(yhat2, yhat1)

bool isBullishSmooth = yhat2 > yhat1

bool isBearishSmooth = yhat2 < yhat1

color c_bullish = input.color(#3AFF17, 'Bullish Color', group='Colors')

color c_bearish = input.color(#FD1707, 'Bearish Color', group='Colors')

color colorByCross = isBullishSmooth ? c_bullish : c_bearish

color colorByRate = isBullish ? c_bullish : c_bearish

color plotColor = smoothColors ? colorByCross : colorByRate

// Middle Estimate

plot(showMiddle ? yhat1 : na, "Rational Quadratic Kernel Estimate", color=plotColor, linewidth=2)

//--------------------------------------------------------------------------------

// UPPER / LOWER BANDS

//--------------------------------------------------------------------------------

upperjeje = yhat1 + coef * ta.atr(lenjeje)

lowerjeje = yhat1 - coef * ta.atr(lenjeje)

plotUpper = plot(upperjeje, "Rational Quadratic Kernel Upper", color=color.rgb(0, 247, 8), linewidth=2)

plotLower = plot(lowerjeje, "Rational Quadratic Kernel Lower", color=color.rgb(255, 0, 0), linewidth=2)

//--------------------------------------------------------------------------------

// SYMBOLS & ALERTS

//--------------------------------------------------------------------------------

plotchar(ta.crossover(close, upperjeje), char="🥀", location=location.abovebar, size=size.tiny)

plotchar(ta.crossunder(close, lowerjeje), char="🍀", location=location.belowbar, size=size.tiny)

// Alerts for Color Changes (estimator)

alertcondition(smoothColors ? isBearishCross : isBearishChg, title="Bearish Color Change", message="Nadaraya-Watson: {{ticker}} ({{interval}}) turned Bearish ▼")

alertcondition(smoothColors ? isBullishCross : isBullishChg, title="Bullish Color Change", message="Nadaraya-Watson: {{ticker}} ({{interval}}) turned Bullish ▲")

// Alerts when price crosses upper and lower band

alertcondition(ta.crossunder(close, lowerjeje), title="Price close under lower band", message="Nadaraya-Watson: {{ticker}} ({{interval}}) crossed under lower band 🍀")

alertcondition(ta.crossover(close, upperjeje), title="Price close above upper band", message="Nadaraya-Watson: {{ticker}} ({{interval}}) Crossed above upper band 🥀")

//--------------------------------------------------------------------------------

// STRATEGY LOGIC (EXAMPLE)

//--------------------------------------------------------------------------------

if ta.crossunder(close, lowerjeje)

// zatvoriť short

strategy.close("Short")

// otvoriť long

strategy.entry("Long", strategy.long)

if ta.crossover(close, upperjeje)

// zatvoriť long

strategy.close("Long")

// otvoriť short

strategy.entry("Short", strategy.short)