Gambaran keseluruhan

Ini adalah strategi perdagangan kuantitatif frekuensi tinggi berdasarkan analisis carta panas dan trend pelbagai kitaran. Strategi ini menggabungkan zon rintangan yang disokong oleh carta panas, purata bergerak berkala dan bulanan, dan sistem isyarat awal untuk menangkap masa masuk ke pasaran yang tepat.

Prinsip Strategi

Strategi ini berdasarkan kepada beberapa komponen utama:

- Kawasan dagangan carta panas: Menggunakan purata bergerak harga tertinggi dan terendah untuk mengira kedudukan rintangan sokongan, membentuk carta panas dagangan.

- Pengesahan trend pelbagai kitaran: Menggunakan purata bergerak garis pusingan dan garis bulan untuk menilai trend besar pasaran.

- Sistem isyarat awal: memberi isyarat awal sebelum isyarat perdagangan sebenar, membantu peniaga bersiap sedia.

- Trajektori ramalan trend: menunjukkan arah pergerakan harga yang mungkin melalui tanda salib ungu.

- Penunjuk pembalikan bullish dan bearish: menunjukkan titik pembalikan trend yang berpotensi melalui penanda berbentuk berlian.

Kelebihan Strategik

- Analisis pelbagai dimensi: menggabungkan carta panas, trend, dan isyarat pembalikan untuk memberikan wawasan pasaran menyeluruh.

- Mekanisme amaran awal: Memberikan amaran awal melalui gelembung amaran awal untuk mengelakkan keputusan tergesa-gesa.

- Kebolehsuaian: boleh beroperasi dalam pelbagai kitaran masa, menyesuaikan diri dengan gaya dagangan yang berbeza.

- Kesan visual: Sistem penunjuk visual yang jelas untuk membuat keputusan cepat.

- Kawalan risiko: Mengurangkan risiko isyarat palsu melalui mekanisme pengesahan berganda.

Risiko Strategik

- Risiko turun naik pasaran: Isyarat palsu mungkin dihasilkan semasa turun naik yang tinggi.

- Sensitiviti parameter: Pilihan sensitiviti carta panas dan kitaran purata bergerak mempunyai kesan yang besar terhadap prestasi strategi.

- Risiko slippage: Perdagangan frekuensi tinggi mungkin menghadapi slippage yang lebih besar.

- Kos urus niaga: Perdagangan yang kerap boleh menyebabkan kos urus niaga yang lebih tinggi.

- Ketergantungan kepada keadaan pasaran: Strategi mungkin tidak berkesan dalam keadaan pasaran tertentu.

Arah pengoptimuman strategi

- Penyesuaian parameter dinamik: memperkenalkan sistem parameter yang menyesuaikan diri, menyesuaikan sensitiviti carta panas mengikut turun naik pasaran.

- Penapisan isyarat: Meningkatkan jumlah lalu lintas dan penapis kadar lonjakan, mengurangkan isyarat palsu.

- Pengurusan risiko: menyertai sistem pengurusan stop-loss dan sasaran keuntungan yang dinamik.

- Pengenalan keadaan pasaran: Membangunkan modul pengenalan keadaan pasaran untuk menghentikan perdagangan secara automatik dalam keadaan pasaran yang tidak sesuai.

- Pengoptimuman pembelajaran mesin: memperkenalkan algoritma pembelajaran mesin untuk mengoptimumkan pemilihan parameter dan pengesahan isyarat.

ringkaskan

Strategi Sniper Hot Chart Multi-Cycle Berkuantiti Frekuensi Tinggi adalah sistem perdagangan komprehensif yang menggabungkan pelbagai petunjuk teknikal. Dengan penggabungan analisis Hot Chart, pengesahan trend multi-cycle dan mekanisme amaran awal, ia menyediakan pedagang dengan alat sokongan keputusan yang boleh dipercayai. Kejayaan strategi bergantung pada tetapan parameter yang betul dan pilihan persekitaran pasaran, disarankan untuk melakukan pengesanan dan pengoptimuman yang mencukupi sebelum perdagangan dalam talian.

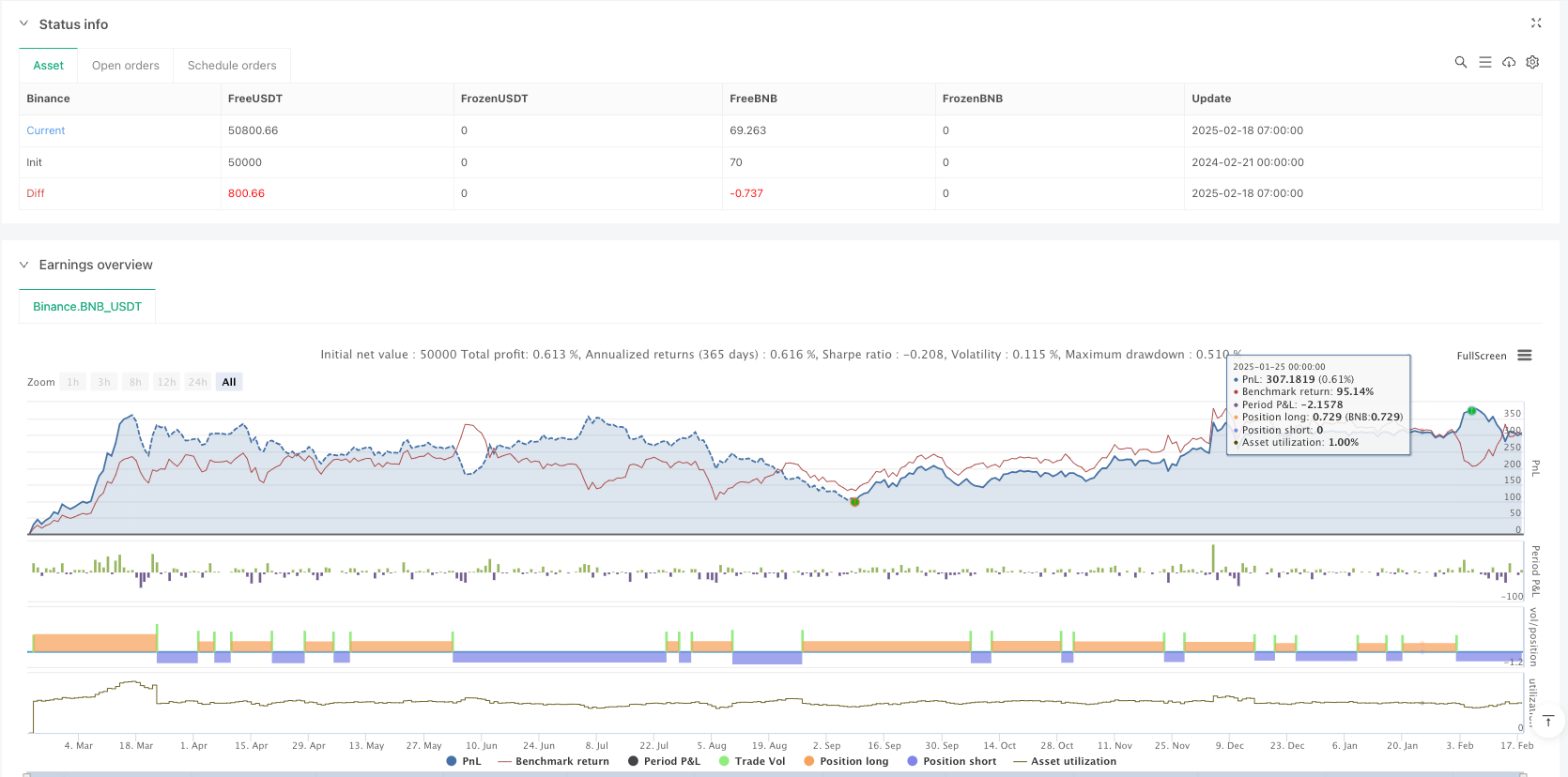

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"BNB_USDT"}]

*/

//@version=6

strategy("Ultimate Heatmap Sniper Bot", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=1)

// Input Parameters

sensitivity = input(50, title="Heatmap Sensitivity")

weekMA = input(50, title="1-Week Moving Average Length")

monthMA = input(200, title="1-Month Moving Average Length")

lookback = input(50, title="Heatmap Lookback")

tradeFrequency = input(6, title="Max Trades Per Day")

// Calculate Heatmap Highs & Lows

highs = ta.highest(high, lookback)

lows = ta.lowest(low, lookback)

heatmapLow = ta.sma(lows, sensitivity)

heatmapHigh = ta.sma(highs, sensitivity)

// Trend Confirmation using Higher Timeframes

weekTrend = ta.sma(close, weekMA)

monthTrend = ta.sma(close, monthMA)

trendDirection = weekTrend > monthTrend ? 1 : -1

// Reversal Signals

bullishReversal = ta.crossover(close, weekTrend)

bearishReversal = ta.crossunder(close, weekTrend)

// Entry Conditions

longEntry = ta.crossover(close, heatmapLow) and trendDirection == 1

shortEntry = ta.crossunder(close, heatmapHigh) and trendDirection == -1

// Execute Trades

if (longEntry)

strategy.entry("Sniper Long", strategy.long)

if (shortEntry)

strategy.entry("Sniper Short", strategy.short)

// Visualization

plot(heatmapLow, color=color.green, linewidth=2, title="Heatmap Low")

plot(heatmapHigh, color=color.red, linewidth=2, title="Heatmap High")

plot(weekTrend, color=color.blue, linewidth=1, title="1-Week Trend")

plot(monthTrend, color=color.orange, linewidth=1, title="1-Month Trend")

// Mark Trades on Chart

plotshape(series=longEntry, location=location.belowbar, color=color.green, style=shape.labelup, title="BUY Signal", text="BUY")

plotshape(series=shortEntry, location=location.abovebar, color=color.red, style=shape.labeldown, title="SELL Signal", text="SELL")

// Warning Bubble Before Execution

preLongWarning = ta.crossover(close, heatmapLow * 1.02) and trendDirection == 1

preShortWarning = ta.crossunder(close, heatmapHigh * 0.98) and trendDirection == -1

plotshape(series=preLongWarning, location=location.belowbar, color=color.new(color.blue, 90), style=shape.labelup, title="BUY WARNING", text="BUY WARNING")

plotshape(series=preShortWarning, location=location.abovebar, color=color.orange, style=shape.labeldown, title="SELL WARNING", text="SELL WARNING")

// Reversal Indicators with Diamonds

plotshape(series=bullishReversal, location=location.belowbar, color=color.green, style=shape.diamond, title="Bullish Reversal", text="Bull Reversal")

plotshape(series=bearishReversal, location=location.abovebar, color=color.red, style=shape.diamond, title="Bearish Reversal", text="Bear Reversal")

// Sparkle Trail Projection

projectedMove = (heatmapHigh + heatmapLow) / 2

plotshape(series=projectedMove, location=location.belowbar, color=color.purple, style=shape.cross, title="Projected Move Cross")