Gambaran keseluruhan

Ini adalah strategi perdagangan pilihan yang dinamik berdasarkan pelbagai petunjuk teknikal yang bertujuan untuk mengenal pasti peluang perdagangan yang berkemungkinan tinggi melalui analisis meluas terhadap turun naik, trend dan dinamik pasaran. Strategi ini menggabungkan beberapa petunjuk teknikal seperti purata gelombang sebenar (ATR), pita Brin (BB), indeks yang agak lemah (RSI) dan purata harga yang ditimbang dengan jumlah transaksi (VWAP) untuk membentuk kerangka keputusan perdagangan yang komprehensif.

Prinsip Strategi

Prinsip teras strategi adalah menggunakan pelbagai isyarat pasaran untuk membina keputusan perdagangan. Ia terdiri daripada langkah-langkah utama berikut:

- Menggunakan Brin untuk melangkau dan melangkau sebagai isyarat harga

- Perbandingan RSI dengan pasaran overbought dan oversold

- Trend yang disahkan melalui pengesanan yang tidak normal

- Menggunakan ATR untuk mengira sasaran hentian dan hentian dinamik

- Tetapkan had maksimum tempoh pegangan

Kelebihan Strategik

- Analisis pelbagai faktor meningkatkan ketepatan isyarat perdagangan

- Mekanisme Hentian dan Penangguhan Dinamik untuk Mengendalikan Risiko

- Tetapan parameter yang fleksibel untuk menyesuaikan diri dengan keadaan pasaran yang berbeza

- Data pengesanan menunjukkan kadar kemenangan dan faktor keuntungan yang lebih tinggi

- Strategi Keluar Berasaskan Masa untuk Mencegah Penyimpanan Terlalu Besar

Risiko Strategik

- Kemunduran dalam penunjuk teknikal boleh menyebabkan isyarat salah

- Pasaran yang sangat tidak menentu boleh meningkatkan kerumitan transaksi

- Pilihan parameter sangat penting untuk prestasi strategi

- Kos transaksi dan titik tergelincir mungkin mempengaruhi pendapatan sebenar

- Keadaan pasaran yang cepat berubah boleh mengurangkan keberkesanan strategi

Arah pengoptimuman strategi

- Memperkenalkan algoritma pembelajaran mesin untuk mengoptimumkan pemilihan parameter

- Menambah lebih banyak penunjuk sentimen pasaran

- Membangunkan mekanisme penyesuaian parameter dinamik

- Mengoptimumkan modul pengurusan risiko

- Memperkenalkan analisis relevansi merentas pasaran

ringkaskan

Strategi ini membina kerangka perdagangan pilihan yang agak kukuh melalui analisis pelbagai faktor. Ia menyediakan pedagang dengan kaedah perdagangan yang sistematik melalui penggunaan komprehensif petunjuk teknikal, kawalan risiko dan mekanisme keluar dinamik. Walau bagaimanapun, strategi perdagangan apa pun memerlukan pengesahan dan pengoptimuman yang berterusan.

Performance Metrics

Tempoh 5 minit:

- Kemenangan: 77.6 peratus

- Factor keuntungan: 3.52

- Maksimum penarikan balik: -8.1%

- Tempoh purata transaksi: 2.7 jam

15 minit:

- Kemenangan: 75.9 peratus

- Faktor pendapatan: 3.09

- Maksimum penarikan balik: 9.4 peratus

- Tempoh purata transaksi: 3.1 jam

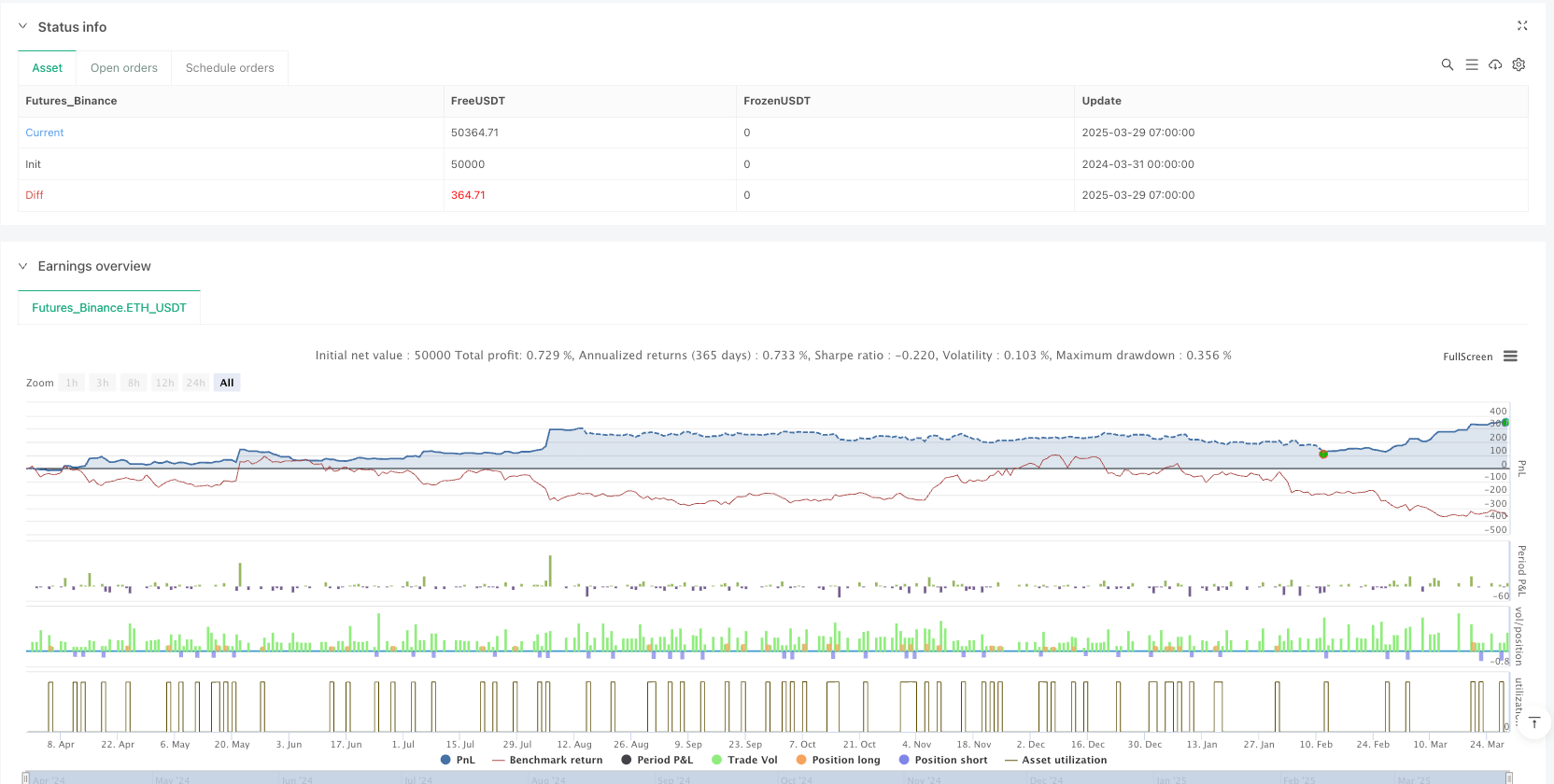

/*backtest

start: 2024-03-31 00:00:00

end: 2025-03-29 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Vinayz Options Stratergy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=2)

// ---- Input Parameters ----

atrPeriod = input(14, title="ATR Period")

bbLength = input(20, title="BB Period")

bbStdDev = input(2, title="BB Std Dev")

rsiPeriod = input(14, title="RSI Period")

atrMultiplier = input(1.5, title="ATR Trailing Stop Multiplier")

vwapLength = input(20, title="VWAP Length")

targetMultiplier = input(2, title="Target Multiplier") // Target set at 2x ATR

maxHoldingBars = input(3, title="Max Holding Period (Bars)")

// ---- Indicator Calculations ----

atrValue = ta.atr(atrPeriod)

smaValue = ta.sma(close, bbLength)

upperBB = smaValue + bbStdDev * ta.stdev(close, bbLength)

lowerBB = smaValue - bbStdDev * ta.stdev(close, bbLength)

rsiValue = ta.rsi(close, rsiPeriod)

vwap = ta.vwma(close, vwapLength)

// ---- Volume Spike/Breakout Detection ----

volSMA = ta.sma(volume, 10)

volSpike = volume > volSMA * 1.5

// ---- ATR Volatility Filter to Avoid Low Volatility Zones ----

atrFilter = atrValue > ta.sma(atrValue, 20) * 0.5

// ---- Long Call Entry Conditions ----

longCE = ta.crossover(close, upperBB) and rsiValue > 60 and volSpike and close > vwap and atrFilter

// ---- Long Put Entry Conditions ----

longPE = ta.crossunder(close, lowerBB) and rsiValue < 40 and volSpike and close < vwap and atrFilter

// ---- Stop Loss and Target Calculation ----

longStopLoss = strategy.position_size > 0 ? strategy.position_avg_price - atrMultiplier * atrValue : na

shortStopLoss = strategy.position_size < 0 ? strategy.position_avg_price + atrMultiplier * atrValue : na

longTarget = strategy.position_size > 0 ? strategy.position_avg_price + targetMultiplier * atrValue : na

shortTarget = strategy.position_size < 0 ? strategy.position_avg_price - targetMultiplier * atrValue : na

// ---- Buy/Sell Logic ----

if (longCE)

strategy.entry("CE Entry", strategy.long)

label.new(bar_index, high, "BUY CE", color=color.green, textcolor=color.white, yloc=yloc.abovebar, size=size.small, tooltip="Buy CE Triggered")

if (longPE)

strategy.entry("PE Entry", strategy.short)

label.new(bar_index, low, "BUY PE", color=color.red, textcolor=color.white, yloc=yloc.belowbar, size=size.small, tooltip="Buy PE Triggered")

// ---- Exit Conditions ----

if (strategy.position_size > 0)

// Exit Long CE on Target Hit

if (close >= longTarget)

strategy.close("CE Entry", comment="CE Target Hit")

// Exit Long CE on Stop Loss

if (close <= longStopLoss)

strategy.close("CE Entry", comment="CE Stop Loss Hit")

// Time-Based Exit after 3 candles

if (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades - 1) >= maxHoldingBars)

strategy.close("CE Entry", comment="CE Timed Exit")

if (strategy.position_size < 0)

// Exit Short PE on Target Hit

if (close <= shortTarget)

strategy.close("PE Entry", comment="PE Target Hit")

// Exit Short PE on Stop Loss

if (close >= shortStopLoss)

strategy.close("PE Entry", comment="PE Stop Loss Hit")

// Time-Based Exit after 3 candles

if (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades - 1) >= maxHoldingBars)

strategy.close("PE Entry", comment="PE Timed Exit")

// ---- Plotting ----

plot(upperBB, color=color.green, title="Upper BB")

plot(lowerBB, color=color.red, title="Lower BB")

plot(rsiValue, title="RSI", color=color.blue, linewidth=1)

hline(60, "Overbought", color=color.blue)

hline(40, "Oversold", color=color.blue)

plot(vwap, color=color.orange, linewidth=1, title="VWAP")

// ---- Plot Volume Breakout/Spike ----

barcolor(volSpike ? color.yellow : na, title="Volume Spike Indicator")

//plotshape(volSpike, title="Volume Breakout", location=location.bottom, style=shape.triangleup, color=color.purple, size=size.small, text="Spike")

// ---- Alerts ----

alertcondition(longCE, "CE Buy Alert", "Bank Nifty CE Buy Triggered!")

alertcondition(longPE, "PE Buy Alert", "Bank Nifty PE Buy Triggered!")