Sorotan utama: Strategi EMA yang lebih daripada sekadar melihat harga

Anda tahu, kebanyakan orang menggunakan EMA hanya untuk melihat harga, tetapi di mana strategi ini hebat? Ia boleh mengira EMA dari 6 sumber data yang berbeza! Ia seperti memasak dengan tidak hanya menggunakan garam, tetapi juga gula, garam, dan minyak sawit untuk memberi anda isyarat perdagangan yang lebih kaya.

Enam sumber data ini ialah: harga biasa, jumlah jualan, kadar perubahan, harga K-line purata, jumlah jualan K-line purata, kadar perubahan K-line purata. Setiap satu mempunyai wawasan pasaran yang berbeza!

Sistem Penapisan Tiga: Meningkatkan ketepatan isyarat

Strategi ini bukan untuk memberi isyarat secara tidak sengaja!

Satu: Ulasan EMA 📈 Seperti melihat ramalan cuaca, anda perlu tahu sama ada cuaca akan cerah atau hujan.

Kedua: Penapisan Kekuatan ADX 💪

ADX adalah seperti alat untuk mengukur angin, hanya apabila trend cukup kuat (default 25 atau lebih), ia akan memberi isyarat.

Jalan Ketiga: Pengesahan jumlah pesanan 🔊 Penjualan yang melonjak seperti saham yang “bersuara kuat”, menunjukkan bahawa isyarat ini serius dan bukan jenaka

Tiga mod keluar: menyesuaikan diri dengan gaya dagangan yang berbeza

Yang paling menarik, strategi ini memberikan tiga pilihan untuk keluar, seperti permainan yang mempunyai tiga tahap kesukaran: mudah, biasa dan sukar:

Mod 1: Keluar dari isyarat terbalik 🔄 Yang paling mudah kasar, isyarat berbilang kepala datang lebih kosong, isyarat berbilang kepala datang lebih kosong

Mod 2: ATR Dinamik Stop Stop Loss 📏 Penyesuaian automatik mengikut turun naik pasaran, titik kelonggaran berhenti apabila turun naik tinggi, titik pengetatan apabila turun naik rendah

Mod 3: Stop loss peratusan tetap 📊 Lebih baik anda faham, jika anda menang 2%, anda akan lari, jika anda kalah 1.5%, anda akan kalah (boleh disesuaikan)

Cadangan untuk kegunaan dalam peperangan

Siklus penggunaanPerdagangan jangka pendek dan sederhana, terutama untuk pasaran yang tidak menentu Panduan untuk mengelakkan lubangPerhatian, ADX Filter Disyorkan Cara untuk maju: Boleh cuba sumber data yang berbeza, sumber kuantiti bertukar sangat berkesan untuk penembusan kuantiti!

Kelebihan utama strategi ini ialah fleksibiliti yang tinggi, anda boleh memilih sumber data yang paling sesuai dan mod keluar mengikut keadaan pasaran yang berbeza. Ingat, tidak ada strategi yang sempurna, hanya strategi yang paling sesuai untuk pasaran semasa!

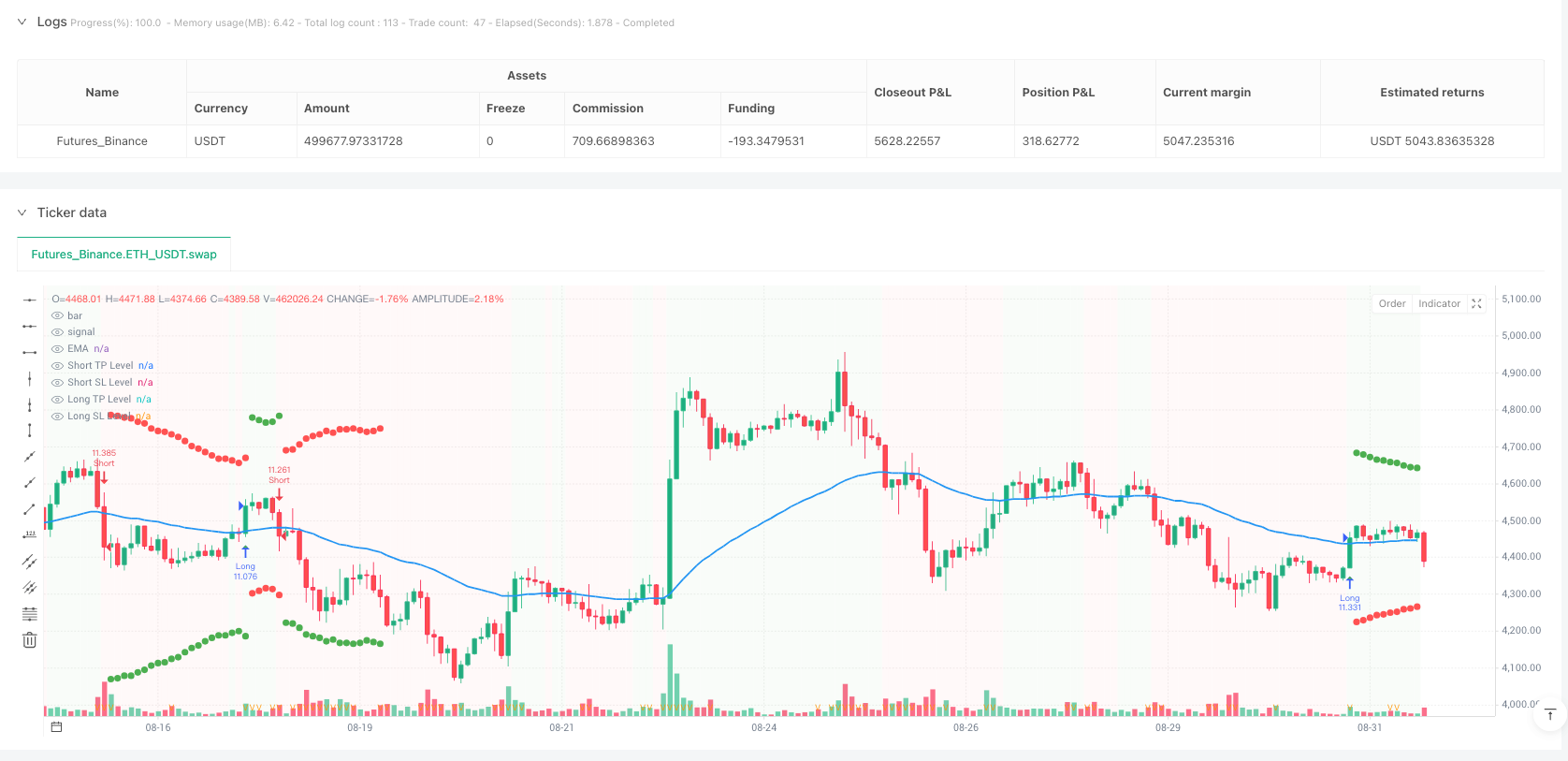

/*backtest

start: 2025-01-01 00:00:00

end: 2025-09-01 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=5

//@fenyesk

strategy("EMA inFusion Pro - Source Selection", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// =============================================

// === INPUT PARAMETERS =======================

// =============================================

// Moving Average Source Selection

maSourceSelection = input.string("Price", "Moving Average Source",

options=["Price", "Volume", "Rate of Change", "Heikin Ashi Price", "Heikin Ashi Volume", "Heikin Ashi Rate of Change"],

tooltip="Select data source for EMA calculation")

// EMA Settings

emaLength = input.int(50, title="EMA Length", minval=1, maxval=200)

rocLength = input.int(1, title="Rate of Change Length", minval=1, maxval=50, tooltip="Length for ROC calculation")

// ADX Filter Settings

useAdxFilter = input.bool(true, title="Use ADX Filter", group="ADX Settings")

adxLength = input.int(14, title="ADX Length", minval=1, maxval=50, group="ADX Settings")

adxThreshold = input.float(25, title="ADX Threshold", minval=10, maxval=50, step=0.5, group="ADX Settings")

// Volume Spike Settings

useVolumeFilter = input.bool(true, title="Use Volume Spike Filter", group="Volume Settings")

volumeMultiplier = input.float(1.0, title="Volume Spike Multiplier", minval=1.0, maxval=5.0, step=0.1, group="Volume Settings")

volumeSmaLength = input.int(20, title="Volume SMA Length", minval=5, maxval=100, group="Volume Settings")

// Trading Exit Mode Selector

tradingMode = input.int(2, title="Trading Exit Mode", minval=1, maxval=3,

tooltip="1: Exit on reverse signal\n2: ATR based TP/SL\n3: Percent based TP/SL",

group="Exit Strategy")

// Mode 3: Percent-Based Settings

takeProfitPercent = input.float(2.0, title="Take Profit %", minval=0.1, maxval=10.0, step=0.1, group="Percent Exit")

stopLossPercent = input.float(1.5, title="Stop Loss %", minval=0.1, maxval=10.0, step=0.1, group="Percent Exit")

// Mode 2: ATR-Based Settings

atrLength = input.int(14, title="ATR Length", minval=1, maxval=50, group="ATR Exit")

atrMultiplierTp = input.float(4.0, title="ATR Take Profit Multiplier", minval=0.1, maxval=10.0, step=0.1, group="ATR Exit")

atrMultiplierSl = input.float(4.0, title="ATR Stop Loss Multiplier", minval=0.1, maxval=10.0, step=0.1, group="ATR Exit")

// =============================================

// === SOURCE CALCULATIONS ====================

// =============================================

// Rate of Change calculation

roc(src, length) =>

change = src - src[length]

src[length] != 0 ? (change / src[length] * 100) : 0

// Standard Rate of Change

rocPrice = roc(close, rocLength)

rocVolume = roc(volume, rocLength)

// Heikin Ashi calculations

haClose = (open + high + low + close) / 4

var float haOpen = na

haOpen := na(haOpen[1]) ? (open + close) / 2 : (haOpen[1] + haClose[1]) / 2

haHigh = math.max(high, math.max(haOpen, haClose))

haLow = math.min(low, math.min(haOpen, haClose))

// Heikin Ashi Rate of Change

haRocPrice = roc(haClose, rocLength)

haRocVolume = roc(volume, rocLength) // Volume remains same for HA

// Define EMA source based on selection

emaSource = switch maSourceSelection

"Price" => close

"Volume" => volume

"Rate of Change" => rocPrice

"Heikin Ashi Price" => haClose

"Heikin Ashi Volume" => volume // Volume doesn't change in HA

"Heikin Ashi Rate of Change" => haRocPrice

=> close // Default fallback

// =============================================

// === INDICATOR CALCULATIONS =================

// =============================================

// Core Indicators

emaValue = ta.ema(emaSource, emaLength)

[diPlus, diMinus, adx] = ta.dmi(adxLength, adxLength)

volumeSma = ta.sma(volume, volumeSmaLength)

volumeSpike = volume > (volumeSma * volumeMultiplier)

atrValue = ta.atr(atrLength)

// Trend Conditions (adjusted for different source types)

bullishTrend = switch maSourceSelection

"Price" => close > emaValue

"Heikin Ashi Price" => haClose > emaValue

"Volume" => volume > emaValue

"Heikin Ashi Volume" => volume > emaValue

"Rate of Change" => rocPrice > emaValue

"Heikin Ashi Rate of Change" => haRocPrice > emaValue

=> close > emaValue

bearishTrend = not bullishTrend

// Cross conditions (adjusted for source type)

emaCrossUp = switch maSourceSelection

"Price" => ta.crossover(close, emaValue)

"Heikin Ashi Price" => ta.crossover(haClose, emaValue)

"Volume" => ta.crossover(volume, emaValue)

"Heikin Ashi Volume" => ta.crossover(volume, emaValue)

"Rate of Change" => ta.crossover(rocPrice, emaValue)

"Heikin Ashi Rate of Change" => ta.crossover(haRocPrice, emaValue)

=> ta.crossover(close, emaValue)

emaCrossDown = switch maSourceSelection

"Price" => ta.crossunder(close, emaValue)

"Heikin Ashi Price" => ta.crossunder(haClose, emaValue)

"Volume" => ta.crossunder(volume, emaValue)

"Heikin Ashi Volume" => ta.crossunder(volume, emaValue)

"Rate of Change" => ta.crossunder(rocPrice, emaValue)

"Heikin Ashi Rate of Change" => ta.crossunder(haRocPrice, emaValue)

=> ta.crossunder(close, emaValue)

// Filters

strongTrend = useAdxFilter ? adx >= adxThreshold : true

volumeConfirm = useVolumeFilter ? volumeSpike : true

// Entry Signals

longCondition = emaCrossUp and strongTrend and volumeConfirm

shortCondition = emaCrossDown and strongTrend and volumeConfirm

// =============================================

// === STRATEGY EXECUTION WITH EXIT MODES =====

// =============================================

// MODE 1: EXIT ON REVERSE SIGNAL

if (tradingMode == 1)

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.close("Short")

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.close("Long")

// MODE 2: ATR-BASED TAKE PROFIT & STOP LOSS

else if (tradingMode == 2)

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Long TP/SL", "Long",

profit=atrMultiplierTp * atrValue / syminfo.mintick,

loss=atrMultiplierSl * atrValue / syminfo.mintick)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Short TP/SL", "Short",

profit=atrMultiplierTp * atrValue / syminfo.mintick,

loss=atrMultiplierSl * atrValue / syminfo.mintick)

// MODE 3: PERCENT-BASED TAKE PROFIT & STOP LOSS

else if (tradingMode == 3)

if (longCondition)

longTpPrice = close * (1 + takeProfitPercent / 100)

longSlPrice = close * (1 - stopLossPercent / 100)

strategy.entry("Long", strategy.long)

strategy.exit("Long TP/SL", "Long", limit=longTpPrice, stop=longSlPrice)

if (shortCondition)

shortTpPrice = close * (1 - takeProfitPercent / 100)

shortSlPrice = close * (1 + stopLossPercent / 100)

strategy.entry("Short", strategy.short)

strategy.exit("Short TP/SL", "Short", limit=shortTpPrice, stop=shortSlPrice)

// =============================================

// === VISUALIZATIONS =========================

// =============================================

// Plot EMA with dynamic color based on source type

emaColor = switch maSourceSelection

"Price" => color.blue

"Volume" => color.orange

"Rate of Change" => color.purple

"Heikin Ashi Price" => color.green

"Heikin Ashi Volume" => color.red

"Heikin Ashi Rate of Change" => color.maroon

=> color.blue

plot(emaValue, title="EMA", color=emaColor, linewidth=2)

// Plot source data for reference (in separate pane when not price-based)

sourceColor = maSourceSelection == "Price" or maSourceSelection == "Heikin Ashi Price" ? na : color.gray

plot(str.contains(maSourceSelection, "Price") ? na : emaSource, title="Source Data", color=sourceColor)

// Background color based on trend

bgcolor(bullishTrend ? color.new(color.green, 95) : color.new(color.red, 95), title="Trend Background")

// Entry signals

plotshape(longCondition, title="Long Signal", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(shortCondition, title="Short Signal", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// Volume spikes

plotchar(useVolumeFilter and volumeSpike, title="Volume Spike", char="V", location=location.bottom, color=color.orange, size=size.tiny)

// ATR-based levels for Mode 2

plot(tradingMode == 2 and strategy.position_size > 0 ? strategy.position_avg_price + (atrMultiplierTp * atrValue) : na,

title="Long TP Level", color=color.green, style=plot.style_circles, linewidth=1)

plot(tradingMode == 2 and strategy.position_size > 0 ? strategy.position_avg_price - (atrMultiplierSl * atrValue) : na,

title="Long SL Level", color=color.red, style=plot.style_circles, linewidth=1)

plot(tradingMode == 2 and strategy.position_size < 0 ? strategy.position_avg_price - (atrMultiplierTp * atrValue) : na,

title="Short TP Level", color=color.green, style=plot.style_circles, linewidth=1)

plot(tradingMode == 2 and strategy.position_size < 0 ? strategy.position_avg_price + (atrMultiplierSl * atrValue) : na,

title="Short SL Level", color=color.red, style=plot.style_circles, linewidth=1)

// Alert conditions

alertcondition(longCondition, title="Long Entry", message="EMA Fusion Pro: Long entry signal")

alertcondition(shortCondition, title="Short Entry", message="EMA Fusion Pro: Short entry signal")