Protokol Enjin Gelombang

ATR volatility ACCUMULATION DCA

Ini bukan DCA biasa, ini adalah enjin gelombang dengan otak.

Data pengesanan kembali secara langsung berhadapan dengan pelaburan tradisional: penurunan 5 peratus mencetuskan pembelian, kenaikan 3.9 peratus mencetuskan penjualan, tetapi perkara utama adalah bahawaEnjin lonjakan akan membeli penurunan nilai berdasarkan ATR yang dinamik。 Semakin besar turun naik pasaran, semakin tinggi ambang pembelian, sehingga 40% boleh disesuaikan. 。 Ini bermakna bahawa semasa turun naik yang tinggi, strategi akan menunggu penurunan yang lebih besar untuk masuk. 。

Masalah dengan strategi DCA tradisional adalah pembelian tanpa otak, dan logik utama protokol ini adalah:Hanya menembak apabila ada peluang yang sebenar。 Mengira kadar turun naik semasa melalui ATR ((14)), kemudian menyesuaikan parameter longThreshPct secara dinamik。 Sebagai contoh, membeli dengan penurunan 5% normal, tetapi jika kadar turun naik semasa mencapai 20%, nilai rugi pembelian sebenar akan meningkat kepada 6%。

8 konfigurasi yang telah ditetapkan, masing-masing mempunyai jangkaan pendapatan yang jelas

Modus akumulasi kitaran BTC: 5% pembelian turun, 6% kedudukan, jumlah tetap \( 500, sesuai untuk pemegang jangka panjang. BTC Short Term Arbitrage Mode: 3.1% penurunan pembelian, 10% kedudukan, \) 6000 jumlah tetap, 75% had keuntungan dijual. ETH turun naik dengan 4.5% penurunan pembelian, 15% kedudukan, membenarkan pembelian di bawah garis kos, 30% had keuntungan.

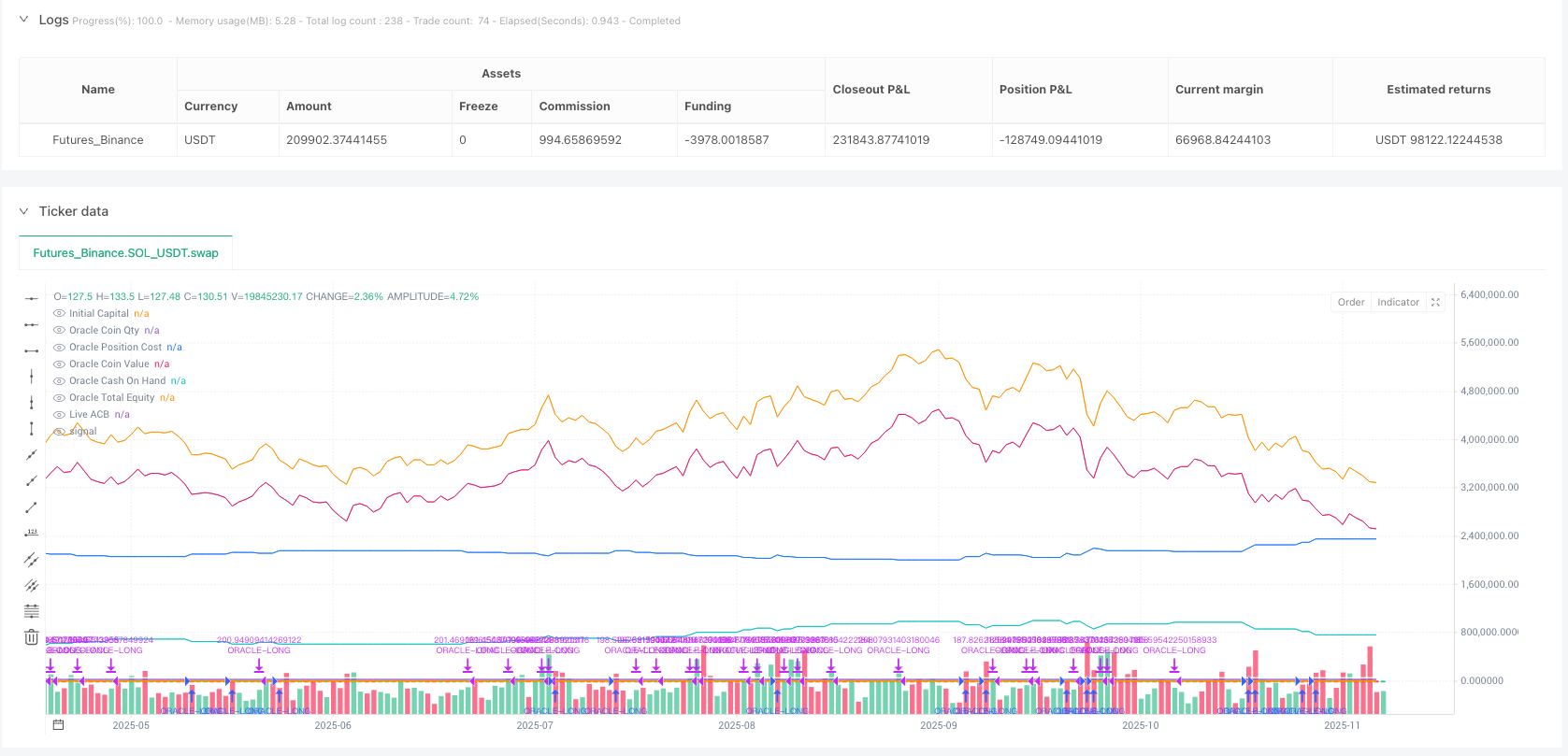

Setiap konfigurasi telah disahkan dengan ujian semula, bukan parameter yang diputuskan oleh kepalaSOL mempunyai margin keuntungan 35% dan XRP mempunyai margin keuntungan 10%. Perbezaan ini mencerminkan sifat turun naik dan kecairan yang berbeza dalam aset yang berbeza.

Mekanisme penutupan kumpulan: mengatasi masalah utama DCA

Masalah terbesar dengan DCA tradisional adalah tidak tahu bila untuk berhenti membeli. Protokol ini diselesaikan dengan “segel kelompok”: sama ada harga naik 3.9% dari kos purata atau 10 kitaran berturut-turut tanpa peluang pembelian yang layak, segel kumpulan yang terkumpul pada masa ini.

Barisan kos purata selepas penutupan menjadi rujukan untuk menjual。 Hanya apabila harga menembusi garisan kos penguncian + had keuntungan ((30%-75% antara lain)), akan mencetuskan penjualan。 Ini mengelakkan pembelian yang tidak berkesudahan dan keuntungan awal.。

Jika 10 kitaran berturut-turut tidak mencetuskan keadaan pembelian, ia menunjukkan bahawa pasaran telah stabil, dan anda harus bersedia untuk menuai daripada terus mengumpul.

Kesan Flirty Flirt: Biarkan Keuntungan Beli Perkhidmatan Lain Kali

Apabila mod Flywheel diaktifkan, setiap keuntungan yang diperoleh dari penjualan akan dimasukkan ke dalam kolam wang tunai, menambah peluru untuk pembelian seterusnya.Strategi untuk mendapatkan lebih banyak tenaga dalam pasaran lembu。

Contohnya: \( 100,000 awal, pusingan pertama memperoleh keuntungan 20% dan kolam tunai selepas dijual menjadi \) 120,000. Apabila anda membeli seterusnya, kedudukan 6% adalah \( 7,200 dan bukan \) 6,000.

Namun, ia juga mempunyai kosnya: pembelian berlebihan dalam tempoh pasaran lembu akan disebabkan oleh jumlah wang yang terlalu banyak, yang memerlukan kawalan ketat ke atas pembelian tunggal.

Kawalan risiko: mekanisme insurans tiga

Pertama: Kawalan pembelian di atas garis kos. Anda boleh menetapkan pembelian hanya di bawah kos purata, untuk mengelakkan kenaikan harga. Kedua: Had jumlah minimum. Setiap pembelian / penjualan memerlukan jumlah minimum dolar untuk mengelakkan transaksi kecil yang tidak masuk akal. Ketiga: Pengaturan enjin bergelombang. Secara automatik menaikkan ambang pembelian semasa bergelombang tinggi, menurunkan ambang semasa bergelombang rendah.

Tetapi ini adalah strategi yang biasa berlaku di pasaran yang bergolak.│ Jika pasaran berada dalam posisi terbalik untuk jangka masa yang panjang, wang akan dikunci untuk jangka masa yang panjang, kerana ia tidak dapat mencetuskan pembelian yang jatuh secara besar-besaran dan tidak dapat mencapai had keuntungan.

Nasihat Perang: Pilihan Pasaran Adalah Kunci

Set perjanjian ini paling sesuai untuk pasaran dengan trend yang jelas, terutamanya dalam keadaan kitaran mata wang kripto. Ia mula terkumpul pada akhir musim beruang dan berbuah pada pertengahan musim lembu.

Jangan gunakan dalam keadaan berikut: 1) pasaran saham yang bergolak dengan frekuensi tinggi 2) pasaran pertukaran asing yang tidak mempunyai trend yang jelas 3) mata wang kecil yang sangat kurang cair.

Pengkajian sejarah menunjukkan bahawa keuntungan yang disesuaikan dengan risiko lebih baik daripada pelaburan sederhana, tetapi ini tidak bermakna keuntungan yang pasti akan datangMana-mana strategi kuantitatif mempunyai risiko kegagalan dan memerlukan pemantauan dan penyesuaian yang berterusan.

//@version=6

// ============================================================================

// ORACLE PROTOCOL — ARCH PUBLIC clone (Standalone) — CLEAN-PUB STYLE (derived)

// Variant: v1.9v-standalone (publish-ready) 25/11/2025

// Notes:

// - Keeps your v1.9v canonical script intact (this is a separate modified copy).

// - Single exit mode: ProfitGate + Candle (per-candle) — no selector.

// - Live ACB plot toggle only (sealed ACB still operates internally but is not shown).

// - No freeze-point markers plotted.

// - Sizing: flywheel dynamic sizing remains the primary source but fixed-dollar entry

// and min-$ overrides remain available (as in Arch public PDFs/screenshots).

// - Volatility Engine (VE) applies ONLY to entries; exit-side VE removed.

// - Manual equity top-up removed (flywheel auto-updates cash).

// - VE ATR length and max-vol fields are fixed (not exposed in UI).

// ============================================================================

strategy("Oracle Protocol — Arch Public (Clone) • v1.9v-standalone (publish)",

overlay=true,

initial_capital=100000,

commission_type=strategy.commission.percent,

commission_value=0.1,

pyramiding=9999,

calc_on_every_tick=true,

process_orders_on_close=true)

// ============================================================================

// 1) PRESETS (Arch PDFs)

// ============================================================================

grp_oracle = "Oracle — Core"

oraclePreset = input.string(

"BTC • Cycle Accumulation",

"Recipe Preset",

options = [

"BTC • Cycle Accumulation",

"BTC • Cycle Swing Arbitrage",

"BTC • Short Target Accumulation",

"BTC • Short Target Arbitrage",

"ETH • Volatility Harvesting",

"SOL • Volatility Harvesting",

"XRP • Volatility Harvesting",

"SUI • Volatility Harvesting"

],

group = grp_oracle)

var float longThreshPct = 0.0

var float exitThreshPct = 0.0

var bool onlySellAboveCost = true

var bool recipe_buyBelowACB = false

var float sellProfitGatePct = 0.0

var float entryPct = 0.0

var float exitPct = 0.0

var float fixedEntryUsd = 0.0

var float fixedExitUsd = 0.0

if oraclePreset == "BTC • Cycle Accumulation"

longThreshPct := 5.0

exitThreshPct := 3.9

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 50.0

entryPct := 6.0

exitPct := 1.0

fixedEntryUsd := 500

fixedExitUsd := 500

else if oraclePreset == "BTC • Cycle Swing Arbitrage"

longThreshPct := 5.9

exitThreshPct := 3.5

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 49.0

entryPct := 10.0

exitPct := 50.0

fixedEntryUsd := 10000

fixedExitUsd := 15000

else if oraclePreset == "BTC • Short Target Accumulation"

longThreshPct := 3.1

exitThreshPct := 2.5

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 30.0

entryPct := 10.0

exitPct := 10.0

fixedEntryUsd := 6000

fixedExitUsd := 5000

else if oraclePreset == "BTC • Short Target Arbitrage"

longThreshPct := 3.1

exitThreshPct := 2.5

onlySellAboveCost := true

recipe_buyBelowACB := true

sellProfitGatePct := 75.0

entryPct := 10.0

exitPct := 100.0

fixedEntryUsd := 10000

fixedExitUsd := 5000

else if oraclePreset == "ETH • Volatility Harvesting"

longThreshPct := 4.5

exitThreshPct := 5.0

onlySellAboveCost := true

recipe_buyBelowACB := true

sellProfitGatePct := 30.0

entryPct := 15.0

exitPct := 40.0

fixedEntryUsd := 6000

fixedExitUsd := 20000

else if oraclePreset == "SOL • Volatility Harvesting"

longThreshPct := 5.0

exitThreshPct := 5.0

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 35.0

entryPct := 7.0

exitPct := 5.0

fixedEntryUsd := 5000

fixedExitUsd := 5000

else if oraclePreset == "XRP • Volatility Harvesting"

longThreshPct := 4.5

exitThreshPct := 10.0

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 10.0

entryPct := 17.0

exitPct := 50.0

fixedEntryUsd := 8000

fixedExitUsd := 5000

else if oraclePreset == "SUI • Volatility Harvesting"

longThreshPct := 5.0

exitThreshPct := 5.0

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 10.0

entryPct := 5.0

exitPct := 10.0

fixedEntryUsd := 5000

fixedExitUsd := 15000

// ============================================================================

// 2) EXTRAS & VOLATILITY SPLITS (CLEAN PUBLIC VARIANTS)

// - Volatility engine inputs are fixed and not exposed in the UI

// ============================================================================

// UI group for extras (keeps flywheel toggle visible)

grp_extras = "Oracle — Extras"

useFlywheel = input.bool(true, "Reinvest Realized Profits (Flywheel)", group = grp_extras)

// Volatility engine: ENTRY only (VE params fixed, not shown)

useVolEngineEntry = input.bool(true, "Enable Volatility Engine (Entries only)", group = grp_extras)

// Fixed/hidden VE parameters (not exposed in UI per your request)

atrLen_fixed = 14

maxVolAdjPct_fixed = 40.0

// NOTE: manual_equity_topup removed for publish variant — flywheel handles auto top-up

buyBelowMode = input.string(

"Use Recipe Setting",

"Buy Below ACB Mode",

options = ["Use Recipe Setting", "Force Buy Below ACB", "Allow Buys Above ACB"],

group = grp_extras)

// ============================================================================

// 3) QUIET BARS (cluster seal) — unchanged behavior, UI visible

// ============================================================================

grp_qb = "Oracle — Quiet Bars (Cluster Seal)"

useQuietBars = input.bool(true, "Enable Quiet-Bars Seal", group=grp_qb)

quietBars = input.int(10, "Quiet Bars (no eligible buys)", minval=1, group=grp_qb)

// ============================================================================

// 4) SELL MODE — SINGLE ARCH EXIT (ProfitGate + Candle) ONLY

// (no selector; fixed behavior to match Arch public)

// ============================================================================

grp_sell = "Oracle — Sell Behaviour"

// no sellMode selector in this publish variant — fixed logic below

// ============================================================================

// 5) DISPLAY & PLOTS (simplified)

// - only Live ACB toggle remains visible.

// - sealed ACB and freeze points are intentionally not plotted.

// ============================================================================

grp_display = "Oracle — Display"

showLiveACB = input.bool(true, "Show Live ACB", group = grp_display)

acbColor = input.color(color.new(color.yellow, 0), "ACB Line Color", group = grp_display)

showExitGuides = input.bool(false, "Show Exit Guide Lines", group = grp_display)

// ============================================================================

// 6) 3C SIZING & MINIMUMS / OVERRIDES

// - primary sizing source is flywheel (cash ledger).

// - but fixed-entry USD and min-$ overrides remain (per Arch public).

// ============================================================================

grp_3c_sz = "Oracle — Sizing"

use3C = input.bool(true, "Enable 3Commas JSON Alerts", group = grp_3c_sz)

botTag = input.string("ORACLE", "Bot Tag / Pair Hint", group = grp_3c_sz)

// Keep min$/fixed entry & exit overrides visible (Arch style)

useMinEntry = input.bool(true, "Use Min $ on Entry", group = grp_oracle)

useMinExit = input.bool(true, "Use Min $ on Exit", group = grp_oracle)

manualMinEntry = input.float(0.0, "Manual Min $ Entry (0 = use recipe)", group = grp_oracle, step = 10)

manualMinExit = input.float(0.0, "Manual Min $ Exit (0 = use recipe)", group = grp_oracle, step = 10)

grp_override = "Oracle — Amount Override"

entryUsd_override = input.float(0.0, "Entry USD Override (0 = none)", group = grp_override, step = 10)

exitUsd_override = input.float(0.0, "Exit USD Override (0 = none)", group = grp_override, step = 10)

// ============================================================================

// 7) VOLATILITY ENGINE VALUES (ENTRY only)

// - VE uses fixed internal params (atrLen_fixed, maxVolAdjPct_fixed).

// - VE not applied to exits in this publish variant.

// ============================================================================

atrVal = ta.atr(atrLen_fixed)

volPct = atrVal / close * 100.0

volAdj = math.min(volPct, maxVolAdjPct_fixed)

longThreshEff = longThreshPct * (useVolEngineEntry ? (1 + volAdj/100.0) : 1)

// exit threshold is NOT adjusted by VE in this variant:

exitThreshEff = exitThreshPct

// ============================================================================

// 8) POSITION STATE & HELPERS

// ============================================================================

var float q = 0.0 // live coin quantity

var float cost = 0.0 // live position cost ($)

var float live_acb = 0.0 // live average cost (cost / q)

var float realized = 0.0

// Flywheel cash ledger (realised cash available for reinvest) — auto only

var float cash = na

if na(cash)

cash := strategy.initial_capital

// Cluster / gating state (sealed base) — sealed_acb still used internally but not shown

var bool clusterOpen = false

var float sealed_acb = na // frozen when a cluster seals (sealed accumulation base)

var int lastEntryBar = na

var int lastEligibleBuyBar = na // for quiet-bars seal

var int sell_steps_done = 0 // number of incremental exits already taken since gate armed

var float last_sell_ref = na // last sell price used for pullback re-arm (not used here)

var bool mode_single_sold = false // lock for Single per Rally (internal use)

// Helpers (array returns)

f_add_fill(_qty, _px, _q, _cost) =>

// returns newQty, newCost, newACB

_newCost = _cost + _qty * _px

_newQty = _q + _qty

_newACB = _newQty > 0 ? _newCost / _newQty : 0.0

array.from(_newQty, _newCost, _newACB)

f_reduce_fill(_qty, _px, _q, _cost) =>

// returns newQty, newCost, newACB, sellVal, costReduced, proportion

_sellVal = _qty * _px

_prop = _q > 0 ? _qty / _q : 0.0

_costReduced = _cost * _prop

_newCost = _cost - _costReduced

_newQty = _q - _qty

_newACB = _newQty > 0 ? _newCost / _newQty : 0.0

array.from(_newQty, _newCost, _newACB, _sellVal, _costReduced, _prop)

// ============================================================================

// 9) BUY SIGNALS & BUY-BELOW MODE

// ============================================================================

dropFromPrev = close[1] != 0 ? (close - close[1]) / close[1] * 100.0 : 0.0

wantBuy = dropFromPrev <= -longThreshEff

needBuyBelow = recipe_buyBelowACB

if buyBelowMode == "Force Buy Below ACB"

needBuyBelow := true

else if buyBelowMode == "Allow Buys Above ACB"

needBuyBelow := false

canBuyBelow = not needBuyBelow or (needBuyBelow and (live_acb == 0 or close < live_acb))

// Track “eligible” buys (quiet-bars gate references opportunity, not just fills)

if wantBuy and canBuyBelow

lastEligibleBuyBar := bar_index

// ============================================================================

// 10) SIZING (flywheel-driven; keep fixed/min-dollar options for entry & exit)

// ============================================================================

baseAcct = cash // flywheel only in this variant

// entry as percentage of baseAcct (dynamic) with fixed/min-dollar fallback (Arch-style)

entryUsd = baseAcct * (entryPct / 100.0)

// Entry min floor (keep manual/fixed options per Arch)

if useMinEntry

entryFloor = manualMinEntry > 0 ? manualMinEntry : fixedEntryUsd

entryUsd := math.max(entryUsd, entryFloor)

// override priority

entryUsd := entryUsd_override > 0 ? entryUsd_override : entryUsd

// entry qty

eQty = close > 0 ? entryUsd / close : 0.0

// Exit sizing: percentage of HOLDINGS (Arch) with min-$ fallback (unchanged)

exitQty_pct = q * (exitPct / 100.0)

exitFloorQty = close > 0 ? ( (manualMinExit > 0 ? manualMinExit : fixedExitUsd) / close ) : 0.0

xQty_base = math.max(exitQty_pct, exitFloorQty)

xQty = math.min(xQty_base, q)

xQty := exitUsd_override > 0 and close > 0 ? math.min(exitUsd_override / close, q) : xQty

// ============================================================================

// 11) ENTRY — opens/extends accumulation cluster; resets SELL steps

// Cash gate: only execute buy if cash >= entryUsd and on confirmed bar close

// ============================================================================

newEntry = false

entryCost = eQty * close

hasCash = entryCost > 0 and cash >= entryCost

if barstate.isconfirmed and wantBuy and canBuyBelow and eQty > 0 and hasCash

strategy.entry("ORACLE-LONG", strategy.long, qty=eQty, comment="ORACLE-BUY")

_fill = f_add_fill(eQty, close, q, cost)

q := array.get(_fill, 0)

cost := array.get(_fill, 1)

live_acb := array.get(_fill, 2)

cash -= entryCost

lastEntryBar := bar_index

lastEligibleBuyBar := bar_index

if not clusterOpen

clusterOpen := true

sealed_acb := na

sell_steps_done := 0

mode_single_sold := false

last_sell_ref := na

// set sealed_acb initial for cluster if na

if na(sealed_acb)

sealed_acb := live_acb

newEntry := true

// ============================================================================

// 12) CLUSTER SEAL — Exit-Threshold OR Quiet-Bars

// - On sealing, we freeze sealed_acb internally (not plotted).

// ============================================================================

riseFromLiveACB = live_acb > 0 ? (close - live_acb ) / live_acb * 100.0 : 0.0

sealByThresh = riseFromLiveACB >= exitThreshEff

barsSinceElig = na(lastEligibleBuyBar) ? 10000 : (bar_index - lastEligibleBuyBar)

sealByQuiet = useQuietBars and (barsSinceElig >= quietBars)

sealed_changed = false

if clusterOpen and (sealByThresh or sealByQuiet)

clusterOpen := false

// freeze sealed base as the last live_acb at seal time (preserve cycle anchor)

sealed_acb := live_acb

sell_steps_done := 0

mode_single_sold := false

last_sell_ref := na

sealed_changed := true

// ============================================================================

// 13) SELL LOGIC — SINGLE ARCH EXIT: ProfitGate + Candle (Per-Candle)

// - Profit gate base: use sealed refBase if present, otherwise live_acb (no toggle).

// - VE not applied to exits in this variant.

// ============================================================================

refBase = na(sealed_acb) ? live_acb : sealed_acb

riseFromRef = refBase > 0 ? (close - refBase) / refBase * 100.0 : 0.0

sellAboveOK = not onlySellAboveCost or close > live_acb

profitRefBase = refBase // sealed if available, else live_acb (no UI toggle in this variant)

// Basic profit gate price/boolean (uses profitRefBase)

profitGateLevelPrice = profitRefBase * (1 + sellProfitGatePct / 100.0)

profitGateCrossed = profitRefBase > 0 ? (close >= profitGateLevelPrice) : false

// Candle-based rise (percent move relative to previous close)

riseFromPrev = close[1] != 0 ? (close - close[1]) / close[1] * 100.0 : 0.0

candleRiseOK = riseFromPrev >= exitThreshEff

// Final allow-sell boolean for this publish variant (ProfitGate + Candle)

var bool allowSellThisBar = false

allowSellThisBar := false

allowSellThisBar := profitGateCrossed and candleRiseOK and xQty > 0 and q > 0 and sellAboveOK and barstate.isconfirmed

// Perform sell if allowed

actualExitQty = 0.0

if allowSellThisBar

actualExitQty := xQty

if actualExitQty > 0

strategy.close("ORACLE-LONG", qty = actualExitQty, comment = "ORACLE-SELL")

_r = f_reduce_fill(actualExitQty, close, q, cost)

q := array.get(_r, 0)

cost := array.get(_r, 1)

live_acb := array.get(_r, 2)

sellVal = array.get(_r, 3)

cRed = array.get(_r, 4)

tradePnL = sellVal - cRed

realized += tradePnL

cash += sellVal

sell_steps_done += 1

last_sell_ref := close

mode_single_sold := true

if q <= 0

// fully sold - reset sealed base and steps (internal)

sealed_acb := na

sell_steps_done := 0

mode_single_sold := false

last_sell_ref := na

// Re-arm logic (simplified): allow new sells only after retrace below refBase by exitThreshEff or if fully sold

if barstate.isconfirmed

if mode_single_sold

retrace_condition = not na(refBase) ? (close < refBase * (1 - exitThreshEff/100.0)) : false

if retrace_condition or q == 0

mode_single_sold := false

sell_steps_done := 0

last_sell_ref := na

// ============================================================================

// 14) BALANCES & 3C JSON (flywheel-based sizing)

// ============================================================================

cash_on_hand = math.max(cash, 0)

coin_value = q * close

total_equity = cash_on_hand + coin_value

base_for_3c = cash_on_hand // flywheel only in this publish variant

entryUsd_3c = base_for_3c * (entryPct / 100.0)

if useMinEntry

entryUsd_3c := math.max(entryUsd_3c, (manualMinEntry > 0 ? manualMinEntry : fixedEntryUsd))

entryUsd_3c := entryUsd_override > 0 ? entryUsd_override : entryUsd_3c

// ============================================================================

// 15) PLOTS (Data Window + Live ACB only + optional guides)

// - Sealed ACB and freeze markers intentionally NOT plotted in this variant.

// ============================================================================

plot(strategy.initial_capital, title="Initial Capital", color=color.white)

plot(q, title="Oracle Coin Qty", precision = 6)

plot(cost, title="Oracle Position Cost")

plot(coin_value, title="Oracle Coin Value")

plot(cash_on_hand, title="Oracle Cash On Hand")

plot(total_equity, title="Oracle Total Equity")

plot(live_acb > 0 and showLiveACB ? live_acb : na, title="Live ACB", color=color.new(color.orange,0), linewidth=2, style=plot.style_line)

// Exit guide lines reference refBase but are optional (kept for debugging/visual confirmation)

guide_exit_line = showExitGuides and not na(refBase) ? refBase * (1 + exitThreshEff/100.0) : na

guide_gate_line = showExitGuides and not na(refBase) ? refBase * (1 + sellProfitGatePct/100.0) : na

plot(guide_exit_line, title="Exit Threshold Line", display=showExitGuides ? display.all : display.none, linewidth=1, style=plot.style_linebr)

plot(guide_gate_line, title="Profit Gate Line (ref base)", display=showExitGuides ? display.all : display.none, linewidth=1, style=plot.style_linebr)

// Also plot the profit gate price computed from profitRefBase (if guides enabled)

plot(not na(profitRefBase) and showExitGuides ? profitRefBase * (1 + sellProfitGatePct/100.0) : na, title="Profit Gate (ref base)", display=showExitGuides ? display.all : display.none, linewidth=1, style=plot.style_line)