Visão geral

A estratégia é uma estratégia de negociação avançada baseada em modelos matemáticos multidimensionais que utilizam múltiplas funções matemáticas e indicadores técnicos para gerar sinais de negociação. A estratégia combina análise de dinâmica, tendências e volatilidade para tomar decisões de negociação mais abrangentes, integrando informações de mercado multidimensionais.

Princípio da estratégia

O princípio central da estratégia é analisar os diferentes aspectos do mercado através de vários modelos matemáticos e indicadores técnicos:

- Utilize o índice de variação (ROC) para calcular a dinâmica e a direção dos preços.

- Aplique regressão linear para identificar tendências de preços de curto prazo.

- Usar a média móvel indexada (EMA) como um filtro de baixa passagem para capturar tendências de longo prazo.

- Ajustar a volatilidade das mudanças de preço através da função sigmoide.

A estratégia leva em consideração estes fatores e emite um sinal de compra quando a dinâmica é positiva, a tendência de curto prazo aumenta, a tendência de longo prazo é confirmada e a volatilidade é moderada. A combinação de condições opostas desencadeia um sinal de venda.

Vantagens estratégicas

- Análise multidimensional: A combinação de vários modelos e indicadores matemáticos permite que a estratégia analise o mercado de diferentes perspectivas, aumentando a abrangência e a precisão das decisões.

- Adaptabilidade: usa a função Sigmoid para ajustar a volatilidade, permitindo que a estratégia se adapte a diferentes condições de mercado.

- A confirmação de tendências, combinada com a análise de tendências de curto e longo prazo, ajuda a reduzir o risco de falsas rupturas.

- Visualização: A estratégia traça um retorno linear e uma linha de baixa passagem no gráfico, para que o comerciante possa entender intuitivamente o movimento do mercado.

Risco estratégico

- O uso de vários indicadores pode fazer com que a estratégia tenha um bom desempenho em dados históricos, mas tenha um mau desempenho em negociações reais.

- Atraso: alguns indicadores, como a EMA, estão atrasados, o que pode levar a uma entrada ou saída insuficiente.

- Condições de mercado sensíveis: a estratégia pode não funcionar bem em mercados com forte volatilidade ou mudanças de tendência.

- Sensibilidade de parâmetros: A configuração de parâmetros de vários indicadores pode ter um impacto significativo na performance da estratégia e precisa ser cuidadosamente otimizada.

Direção de otimização da estratégia

- Ajuste de parâmetros dinâmicos: pode ser considerado o ajuste de parâmetros do indicador de acordo com a dinâmica da volatilidade do mercado, para se adaptar a diferentes condições de mercado.

- Adição de filtros: introdução de condições de filtragem adicionais, como análise de volume de negócios ou indicadores de largura de mercado, para reduzir os falsos sinais.

- Otimização da estratégia de saída: A estratégia atual se concentra principalmente no ponto de entrada, podendo ser desenvolvido um mecanismo de saída mais complexo para otimizar o desempenho geral.

- Introdução ao aprendizado de máquina: Considere o uso de algoritmos de aprendizado de máquina para otimizar o peso do indicador ou identificar as melhores oportunidades de negociação.

Resumir

A estratégia de negociação de modelos matemáticos multidimensionais é uma estratégia de negociação integrada, com uma base sólida na teoria. Combinando vários modelos matemáticos e indicadores técnicos, a estratégia é capaz de analisar o mercado de várias perspectivas e melhorar a precisão das decisões de negociação. No entanto, a complexidade da estratégia também traz riscos como overfitting e sensibilidade a parâmetros.

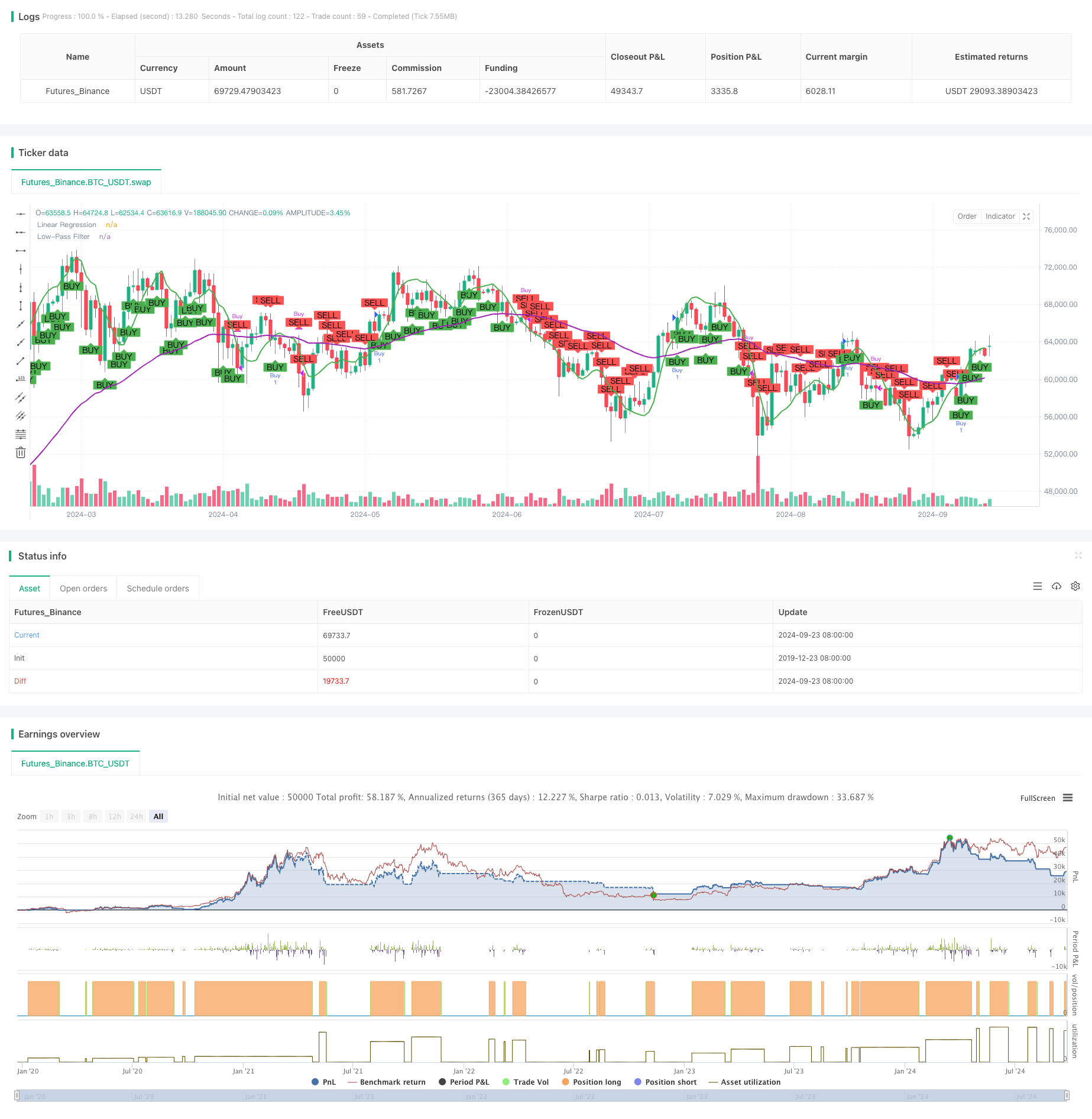

/*backtest

start: 2019-12-23 08:00:00

end: 2024-09-24 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Advanced Math Strategy", overlay=true)

// =======================

// ฟังก์ชันที่ใช้คำนวณเบื้องหลัง

// =======================

// ฟังก์ชันซิกมอยด์

sigmoid(x) =>

1 / (1 + math.exp(-x))

// ฟังก์ชันหาอัตราการเปลี่ยนแปลง (Derivative)

roc = ta.roc(close, 1)

// ฟังก์ชันการถดถอยเชิงเส้น (Linear Regression)

linReg = ta.linreg(close, 14, 0)

// ฟังก์ชันตัวกรองความถี่ต่ำ (Low-pass filter)

lowPass = ta.ema(close, 50)

// =======================

// การคำนวณสัญญาณ Buy/Sell

// =======================

// การคำนวณอนุพันธ์สำหรับทิศทางการเคลื่อนที่ของราคา

derivativeSignal = roc > 0 ? 1 : -1

// ใช้ Linear Regression และ Low-pass Filter เพื่อช่วยในการหาจุดกลับตัว

trendSignal = linReg > lowPass ? 1 : -1

// ใช้ฟังก์ชันซิกมอยด์เพื่อปรับความผันผวนของราคา

priceChange = close - close[1]

volatilityAdjustment = sigmoid(priceChange)

// สร้างสัญญาณ Buy/Sell โดยผสมผลจากการคำนวณเบื้องหลังทั้งหมด

buySignal = derivativeSignal == 1 and trendSignal == 1 and volatilityAdjustment > 0.5

sellSignal = derivativeSignal == -1 and trendSignal == -1 and volatilityAdjustment < 0.5

// =======================

// การสั่ง Buy/Sell บนกราฟ

// =======================

// ถ้าเกิดสัญญาณ Buy

if (buySignal)

strategy.entry("Buy", strategy.long)

// ถ้าเกิดสัญญาณ Sell

if (sellSignal)

strategy.close("Buy")

// =======================

// การแสดงผลบนกราฟ

// =======================

// วาดเส้นถดถอยเชิงเส้นบนกราฟ

plot(linReg, color=color.green, linewidth=2, title="Linear Regression")

// วาดตัวกรองความถี่ต่ำ (Low-pass filter)

plot(lowPass, color=color.purple, linewidth=2, title="Low-Pass Filter")

// วาดจุด Buy/Sell บนกราฟ

plotshape(series=buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")