- 策略名称:高低点突破成交量指数加权策略

- 数据周期:多周期

- 回测可以选择 OKEX期货

- 合约:this_week 当周合约

- 官方网站:www.quantinfo.com

主图: 无

副图 VJQ, 计算公式: VJQ:EMA(V*(C-REF(C,NC)),N);//定义成交量加权指数为VJQ

策略源码

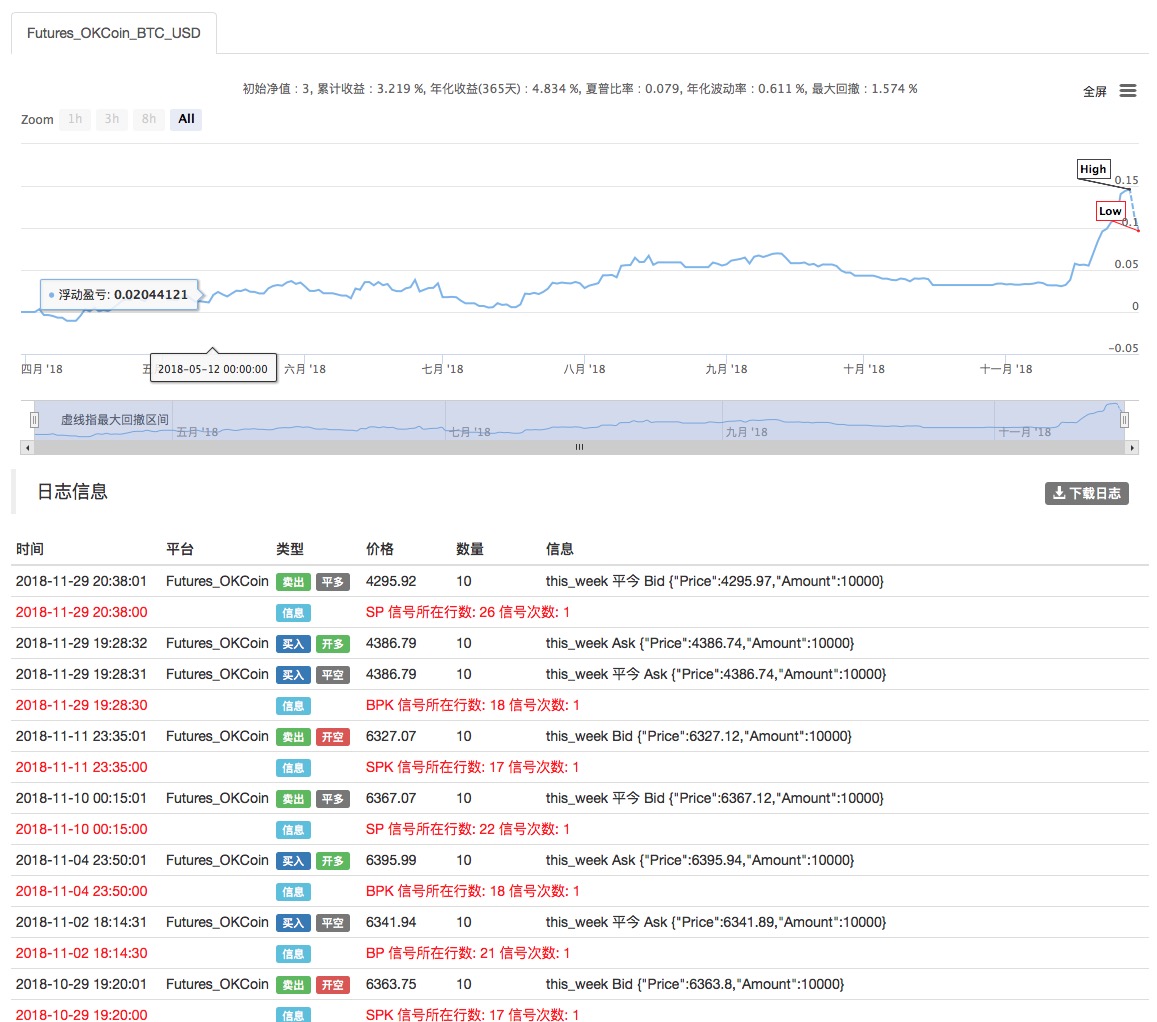

(*backtest

start: 2018-04-01 00:00:00

end: 2018-05-28 00:00:00

period: 1h

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

args: [["N",100],["MINAMOUNT",10],["TradeAmount",10,126961],["ContractType","this_week",126961]]

*)

LOTS:=MAX(MINAMOUNT,INTPART(MONEYTOT/O * 0.8));

VJQ:EMA(V*(C-REF(C,NC)),N);

B:=VJQ>0;

S:=VJQ<0;

BUYPK:=BARPOS>N AND BKVOL=0 AND B AND H>=HHV(H,N);

SELLPK:=BARPOS>N AND SKVOL=0 AND S AND L<=LLV(L,N);

BUYP:=SKVOL>0 AND B;

SELLP:=BKVOL>0 AND S;

// 入场

// Enter

SELLPK,SPK(LOTS);

BUYPK,BPK(LOTS);

// 出场

// Leave

BUYP,BP(SKVOL);

SELLP,SP(BKVOL);

// 止损

// Stop loss

C>=SKPRICE*(1+SLOSS*0.01),BP(SKVOL);

C<=BKPRICE*(1-SLOSS*0.01),SP(BKVOL);

AUTOFILTER;

相关推荐