概述

该策略利用KDJ指标和移动平均线(MA)来识别市场趋势和生成交易信号。当KDJ指标超过超买区域且价格跌破MA时产生做空信号;当KDJ指标低于超卖区域且价格突破MA时产生做多信号。通过结合KDJ指标和MA的趋势确认,该策略能较好把握市场趋势,同时规避震荡行情的虚假信号。

策略原理

- 计算KDJ指标的K值、D值和J值,其中K值为RSV的N日移动平均,D值为K值的M日移动平均,J值由公式”3*K-2*D”计算得出。

- 计算移动平均线MA,用于判断当前价格趋势。

- 判断MA的方向,上穿为看涨信号,下穿为看跌信号。

- 当KDJ的J值大于超买level且价格下穿MA时,产生做空信号;当J值小于超卖level且价格上穿MA时,产生做多信号。

- 根据信号开立固定手数(1手)的多头或空头仓位。

优势分析

- 同时考虑价格的超买超卖状态和趋势方向,能较好把握趋势行情。

- 使用MA作为趋势确认,能有效过滤KDJ指标在震荡行情下的虚假信号。

- 加入了可调整的超买超卖阈值,增加了策略的灵活性。

- 移动平均线颜色会根据趋势方向变化,提供直观的趋势判断。

- 图表上绘制交易信号,便于观察和分析策略表现。

风险分析

- KDJ指标对参数较为敏感,不同参数下效果可能存在较大差异,需要针对不同标的和周期进行优化。

- 在震荡行情下,即使有MA作为趋势确认,策略仍可能产生较多虚假信号,导致亏损。

- 固定仓位大小没有考虑风险管理,在行情剧烈波动时可能承担较大风险。

- 策略缺乏止损和止盈机制,可能错失获利机会或放大亏损。

优化方向

- 对KDJ指标的参数进行优化,找到适合当前标的和周期的最佳参数组合。

- 引入更多技术指标如RSI、MACD等,丰富趋势判断和信号过滤条件,提高信号质量。

- 优化仓位管理,根据市场波动性或账户净值等动态调整仓位大小,控制风险。

- 加入止损和止盈逻辑,在达到预设条件时平仓,以减少单次亏损和锁定利润。

- 对策略进行回测和参数优化,找到最佳的参数组合和市场适应性。

总结

该策略通过KDJ指标和移动平均线的结合,能够较好地把握市场趋势并产生交易信号。合理利用超买超卖信息和趋势方向,可以获得稳健的交易表现。但策略仍存在优化空间,如引入更多过滤条件、动态仓位管理和止损止盈等,以进一步提升策略稳健性和盈利能力。策略在实际应用中需要针对不同市场环境和标的进行调优和测试,以验证其有效性和适用性。

策略源码

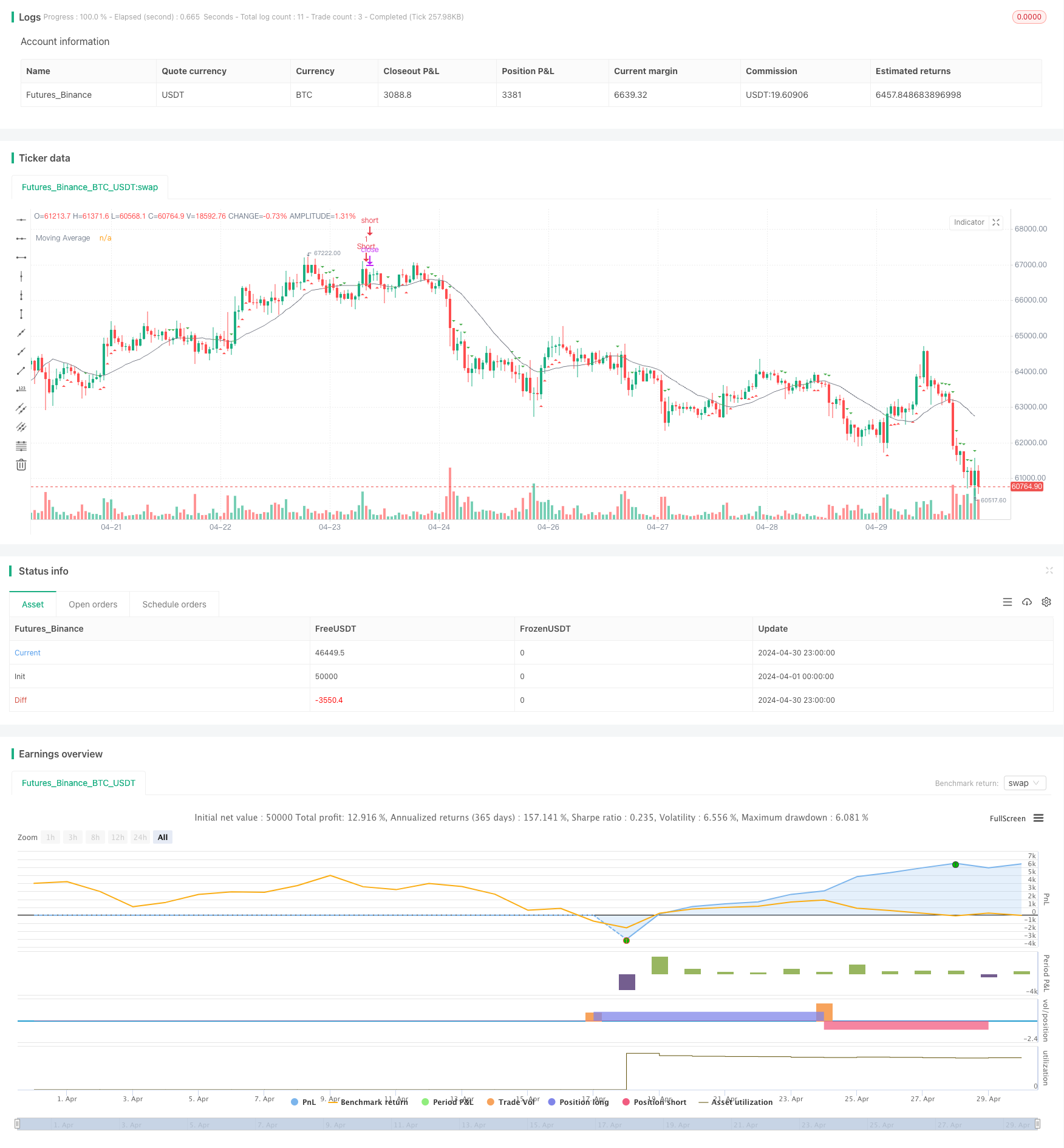

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("KDJ Trending View with Signals and MA Strategy", overlay=true)

// KDJ Settings

kdjLength = input.int(9, title="KDJ Length")

kdjSignal = input.int(3, title="KDJ Signal")

kdjOverbought = input.int(80, title="KDJ Overbought Level")

kdjOversold = input.int(20, title="KDJ Oversold Level")

// Margin Settings

longMargin = input.float(2.0, title="Long Margin", step=0.01)

shortMargin = input.float(2.0, title="Short Margin", step=0.01)

// MA Settings

maLength = input.int(20, title="MA Length")

maType = input.string("SMA", title="MA Type (SMA, EMA, etc.)")

// Calculate KDJ

kdj_highest = ta.highest(high, kdjLength)

kdj_lowest = ta.lowest(low, kdjLength)

kdjRSV = 100 * ((close - kdj_lowest) / (kdj_highest - kdj_lowest))

kdjK = ta.sma(kdjRSV, kdjSignal)

kdjD = ta.sma(kdjK, kdjSignal)

kdjJ = 3 * kdjK - 2 * kdjD

// Calculate Moving Average

ma = ta.sma(close, maLength) // SMA kullanarak ortalama hesaplama

// Determine MA Direction

maCrossUp = ta.crossover(close, ma)

maCrossDown = ta.crossunder(close, ma)

// Plot MA with Direction Color Change

maColor = maCrossUp ? color.green : maCrossDown ? color.red : color.gray

plot(ma, color=maColor, title="Moving Average")

// Plot Trading Signals

plotshape(kdjJ >= kdjOverbought ? low : na, style=shape.triangleup, location=location.belowbar, color=color.red, size=size.small, title="Short Signal")

plotshape(kdjJ <= kdjOversold ? high : na, style=shape.triangledown, location=location.abovebar, color=color.green, size=size.small, title="Long Signal")

// Trading Strategy with Manual Margin and MA Strategy

if (kdjJ >= kdjOverbought and maCrossDown)

strategy.entry("Short", strategy.short, qty=1, comment="Short Entry")

if (kdjJ <= kdjOversold and maCrossUp)

strategy.entry("Long", strategy.long, qty=1, comment="Long Entry")

相关推荐