概述

该策略基于移动平均线(MA)的斜率和价格与MA的相对位置来进行交易决策。当MA斜率大于最小斜率阈值且价格高于MA时,策略进行买入。同时,策略采用追踪止损(Trailing Stop Loss)来管理风险,并在特定条件下重新进场(Re-Entry)。该策略旨在捕捉上升趋势中的机会,同时通过动态止损和重新进场机制来优化收益和风险。

策略原理

- 计算指定周期的简单移动平均线(SMA)作为主要的趋势指标。

- 计算SMA在指定窗口期内的斜率,用于判断当前趋势的强度。

- 当SMA斜率大于最小斜率阈值且价格高于SMA时,认为市场处于上升趋势,策略进行买入。

- 一旦进场,策略使用追踪止损机制,根据当前价格和指定的百分比来动态调整止损价位。

- 如果价格触及追踪止损价位,策略平仓并标记止损发生。

- 当止损发生后,如果价格回撤至SMA下方的特定百分比,策略会重新进场。

- 如果价格跌破SMA,策略直接平仓。

优势分析

- 趋势跟踪:通过SMA斜率和价格与SMA的相对位置来判断趋势,有助于策略在上升趋势中获利。

- 动态止损:采用追踪止损机制,根据价格变化动态调整止损位置,可以更好地保护利润和限制损失。

- 重新进场:在止损发生后,策略会在价格回撤至SMA下方的特定百分比时重新进场,以捕捉潜在的反弹机会。

- 参数灵活:策略提供了多个可调整的参数,如SMA周期、最小斜率阈值、追踪止损百分比等,可以根据不同市场条件进行优化。

风险分析

- 参数敏感性:策略的表现可能对参数设置较为敏感,不恰当的参数选择可能导致策略表现不佳。

- 趋势识别:策略主要依赖于SMA斜率和价格与SMA的相对位置来判断趋势,在某些市场条件下可能出现错误信号。

- 止损频率:追踪止损机制可能导致频繁止损,特别是在市场波动较大的情况下,从而影响策略的整体表现。

- 重新进场风险:重新进场机制可能在某些情况下导致策略再次进场后遭遇进一步下跌,放大损失。

优化方向

- 趋势确认:在判断趋势时,可以结合其他技术指标或价格行为模式来提高趋势识别的准确性。

- 止损优化:可以探索其他止损方法,如基于波动率或支撑/阻力位置的止损,以更好地适应不同市场状况。

- 重新进场条件:可以优化重新进场的条件,如考虑价格回撤的幅度、时间长度等因素,以过滤掉某些不利的重新进场信号。

- 仓位管理:引入仓位管理机制,根据市场波动性或其他风险指标来调整每笔交易的仓位大小,以控制整体风险敞口。

总结

该策略通过移动平均线的斜率和价格与移动平均线的相对位置来判断趋势,并采用追踪止损和有条件重新进场的机制来管理交易。策略的优势在于趋势跟踪能力、动态止损保护和重新进场机会的捕捉。然而,策略也存在参数敏感性、趋势识别误差、止损频率和重新进场风险等潜在问题。可以根据优化方向,如优化趋势识别、止损方法、重新进场条件和仓位管理等,来矫正策略的弊端。在实际应用中,应根据具体市场特点和交易风格谨慎评估和调整。

策略源码

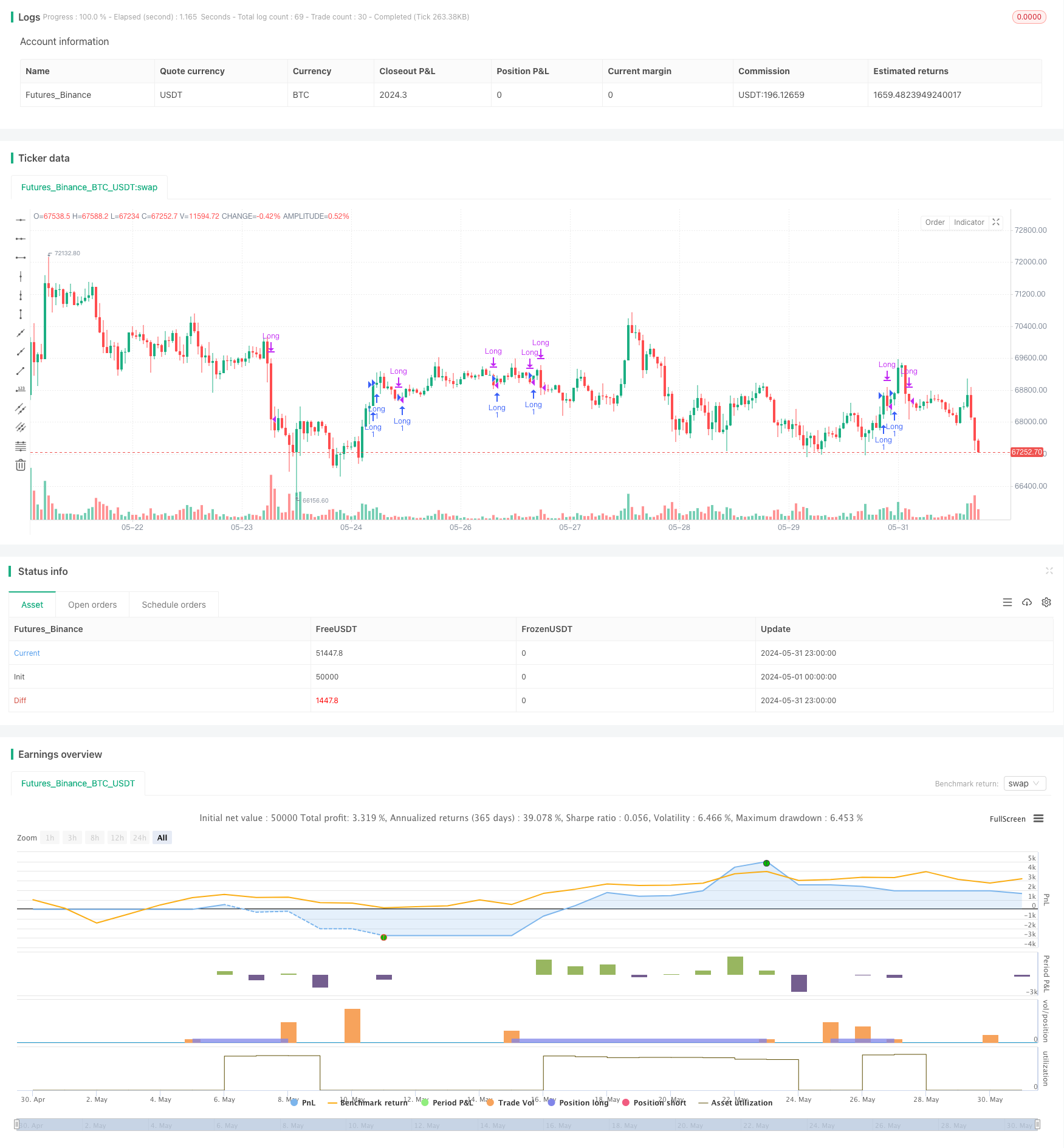

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("MA Incline Strategy with Trailing Stop-Loss and Conditional Re-Entry", overlay=true, calc_on_every_tick=true)

// Input parameters

windowSize = input.int(10, title="Window Size")

maLength = input.int(150, title="Moving Average Length")

minSlope = input.float(0.001, title="Minimum Slope")

trailingStopPercentage = input.float(2.8, title="Trailing Stop Percentage (%)") / 100

reEntryPercentage = input.float(4.2, title="Re-Entry Percentage Above MA (%)") / 100

// Calculate the moving average

ma = ta.sma(close, maLength)

// Calculate the slope of the moving average over the window size

previousMa = ta.sma(close[windowSize], maLength)

slopeMa = (ma - previousMa) / windowSize

// Check conditions

isAboveMinSlope = slopeMa > minSlope

isAboveMa = close > ma

// Variables to track stop loss and re-entry condition

var bool stopLossOccurred = false

var float trailStopPrice = na

// Buy condition

buyCondition = isAboveMinSlope and isAboveMa and ((not stopLossOccurred) or (stopLossOccurred and low < ma * (1 + reEntryPercentage)))

// Execute strategy

if (buyCondition and strategy.opentrades == 0)

if (stopLossOccurred and close < ma * (1 + reEntryPercentage))

strategy.entry("Long", strategy.long)

stopLossOccurred := false

else if (not stopLossOccurred)

strategy.entry("Long", strategy.long)

// Trailing stop-loss

if (strategy.opentrades == 1)

// Calculate the trailing stop price

trailStopPrice := close * (1 - trailingStopPercentage)

// Use the built-in strategy.exit function with the trailing stop

strategy.exit("Trail Stop", "Long", stop=close * (1 - trailingStopPercentage))

// Exit condition

sellCondition = ta.crossunder(close, ma)

if (sellCondition and strategy.opentrades == 1)

strategy.close("Long")

// Check if stop loss occurred

if (strategy.closedtrades > 0)

lastExitPrice = strategy.closedtrades.exit_price(strategy.closedtrades - 1)

if (not na(trailStopPrice) and lastExitPrice <= trailStopPrice)

stopLossOccurred := true

// Reset stop loss flag if the price crosses below the MA

if (ta.crossunder(close, ma))

stopLossOccurred := false

相关推荐