概述

该策略基于相对强弱指数(RSI)的超买和超卖水平来自动化执行交易。当RSI低于用户设定的超卖水平时开仓做多,当RSI高于用户设定的超买水平时开仓做空。持仓一定时间后自动平仓。所有参数都可由用户自行设置,包括RSI周期、超买和超卖水平以及持仓时间。

策略原理

相对强弱指数(RSI)是一个动量指标,用于衡量近期价格变化的幅度。它的取值范围在0到100之间。传统的解释认为,RSI高于70表示超买,低于30表示超卖。该策略利用这一原理,在RSI超卖时买入,超买时卖出,试图捕捉价格的短期反转。同时,为了控制风险,策略在持仓一定时间后自动平仓。

策略优势

简单易懂:该策略基于经典的技术分析指标RSI,逻辑清晰明了,易于理解和实施。

参数灵活:用户可以根据自己的偏好和市场特点,灵活设置RSI周期、超买超卖阈值以及持仓时间等参数。

自动化程度高:策略可以自动监测RSI水平,执行开仓和平仓操作,减少了人为干预和情绪影响。

适应性强:通过调整参数,该策略可以适用于不同的市场环境和交易品种。

策略风险

参数优化难度大:不同市场环境下的最优参数组合可能差异很大,寻找合适的参数需要大量的回测和分析工作。

市场趋势风险:当市场出现强劲的单边趋势时,该策略可能会频繁交易而导致亏损。

假信号风险:RSI可能产生假信号,导致策略进行错误的交易。

黑天鹅事件:策略对极端行情的适应性有限,面对黑天鹅事件可能承受较大损失。

策略优化方向

结合其他指标:仅依靠RSI可能不够稳健,可以考虑结合其他技术指标如移动平均线、MACD等,提高信号的可靠性。

引入止损和止盈:在策略中加入止损和止盈机制,以更好地控制单笔交易的风险和收益。

动态调整参数:根据市场状况的变化,动态调整RSI周期、超买超卖阈值等参数,使策略更具适应性。

市场状态过滤:根据市场波动性、趋势强度等指标,过滤掉不适合交易的市场状态,提高策略的稳健性。

总结

该策略利用RSI指标的超买超卖原理,构建了一个简单易懂的自动化交易系统。用户可以灵活设置各项参数,策略会自动执行交易。但是,策略也存在参数优化难度大、趋势风险和假信号风险等问题。未来可以考虑引入其他指标、止损止盈机制、动态参数调整和市场状态过滤等优化手段,以提升策略的稳健性和盈利能力。

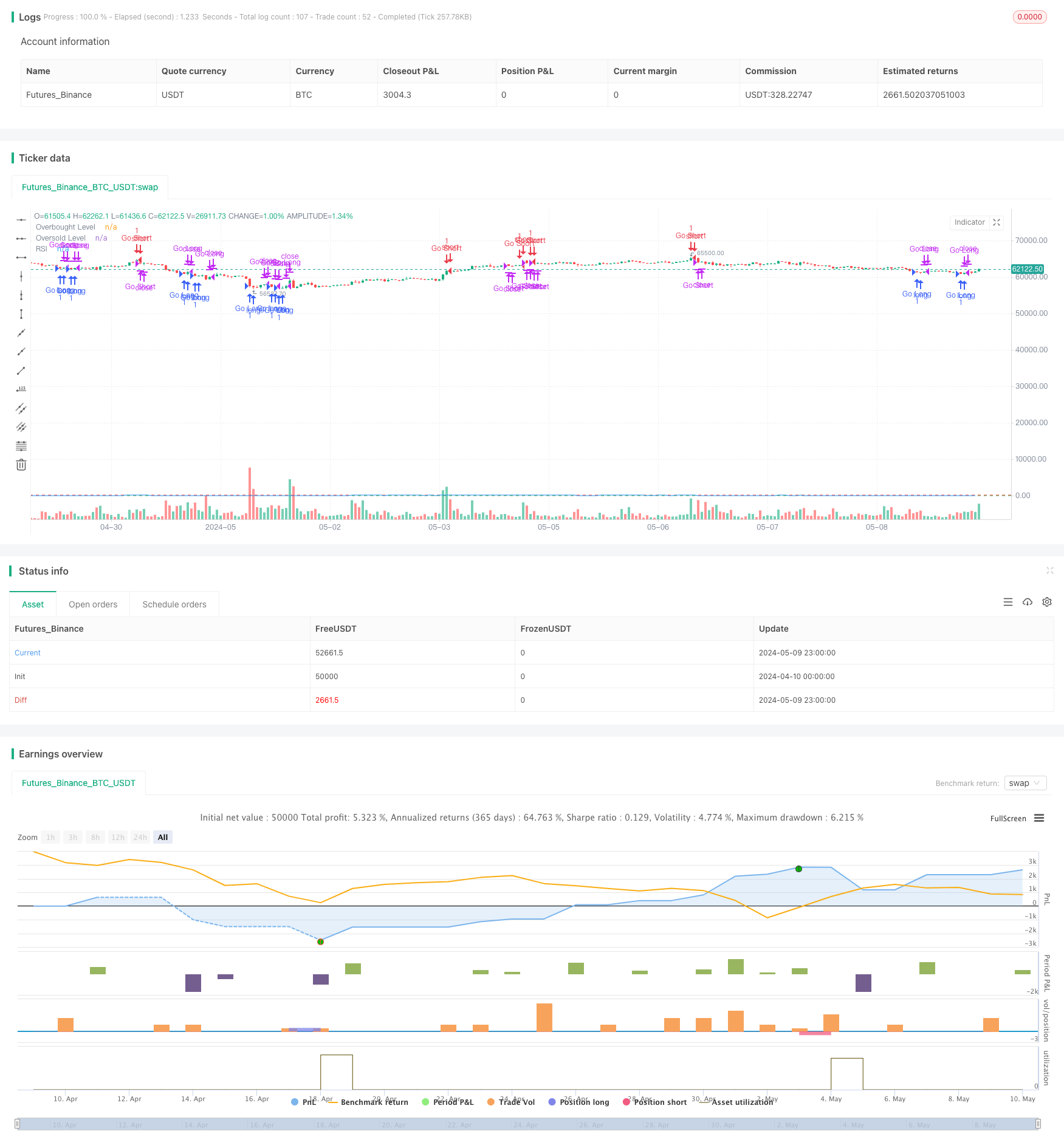

/*backtest

start: 2024-04-10 00:00:00

end: 2024-05-10 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Dougie Trades RSI Strategy V1", overlay=true)

// Inputs for strategy

rsiPeriod = input.int(14, title="RSI Period")

overbought = input.int(70, title="Overbought Level", minval=0, maxval=100)

oversold = input.int(30, title="Oversold Level", minval=0, maxval=100)

exitAfterMinutes = input.int(60, title="Exit After X Minutes", minval=1)

// Calculate RSI

rsi = ta.rsi(close, rsiPeriod)

// Define long and short conditions based on RSI

longCondition = rsi < oversold

shortCondition = rsi > overbought

var float entryTime = na

// Execute trades and track entry time

if (longCondition)

strategy.entry("Go Long", strategy.long)

entryTime := time

if (shortCondition)

strategy.entry("Go Short", strategy.short)

entryTime := time

// Exit logic after 'x' minutes

if (not na(entryTime) and (time - entryTime) / 60000 >= exitAfterMinutes)

strategy.close("Go Long")

strategy.close("Go Short")

entryTime := na // Reset entry time after exit

// Plotting RSI and thresholds

plot(rsi, title="RSI", color=color.blue)

hline(overbought, "Overbought Level", color=color.red)

hline(oversold, "Oversold Level", color=color.green)