概述

该策略基于QQE指标和RSI指标,通过计算RSI指标的平滑移动平均值和动态震荡幅度,构建多空信号区间。当RSI指标突破上轨时产生做多信号,突破下轨时产生做空信号。策略的主要思路是利用RSI指标的趋势特性和QQE指标的波动特性,捕捉市场的趋势变化和波动机会。

策略原理

- 计算RSI指标的平滑移动平均值RsiMa,作为判断趋势的基础。

- 计算RSI指标的绝对偏离值AtrRsi,并计算其平滑移动平均值MaAtrRsi,作为判断波动的基础。

- 根据QQE因子计算动态震荡幅度dar,并与RsiMa结合,构建多空信号区间longband和shortband。

- 判断RSI指标与多空信号区间的关系,当RSI指标上穿longband时产生做多信号,下穿shortband时产生做空信号。

- 根据多空信号进行交易,做多信号触发时开仓买入,做空信号触发时平仓。

策略优势

- 结合了RSI指标和QQE指标的特点,能够较好地捕捉市场趋势和波动机会。

- 采用动态的震荡幅度来构建信号区间,能够自适应市场波动率的变化。

- 平滑处理RSI指标和波动幅度,有效减少了噪音干扰和频繁交易。

- 逻辑清晰,参数较少,适合进行进一步的优化和改进。

策略风险

- 对于震荡市场和波动率较小的市场,该策略的表现可能不够理想。

- 缺乏明确的止损机制,在市场突然反转时可能面临较大回撤风险。

- 参数设置对策略性能影响较大,需要根据不同市场和品种进行调优。

策略优化方向

- 引入明确的止损机制,如固定百分比止损、ATR止损等,以控制回撤风险。

- 优化参数设置,可以通过遗传算法、网格搜索等方法寻找最优参数组合。

- 考虑引入交易量、持仓量等其他指标,丰富交易信号,提高策略稳定性。

- 对于震荡市场,可以考虑引入范围交易或者波段操作的逻辑,增强策略适应性。

总结

该策略基于RSI指标和QQE指标构建多空信号,具有趋势捕捉和波动把握的特点。策略逻辑清晰,参数较少,适合进行进一步的优化和改进。但是策略也存在一定的风险,如回撤控制、参数设置等方面需要进一步完善。未来可以从止损机制、参数优化、信号丰富、不同市场适应性等方面对策略进行优化,以提高策略的稳健性和盈利能力。

策略源码

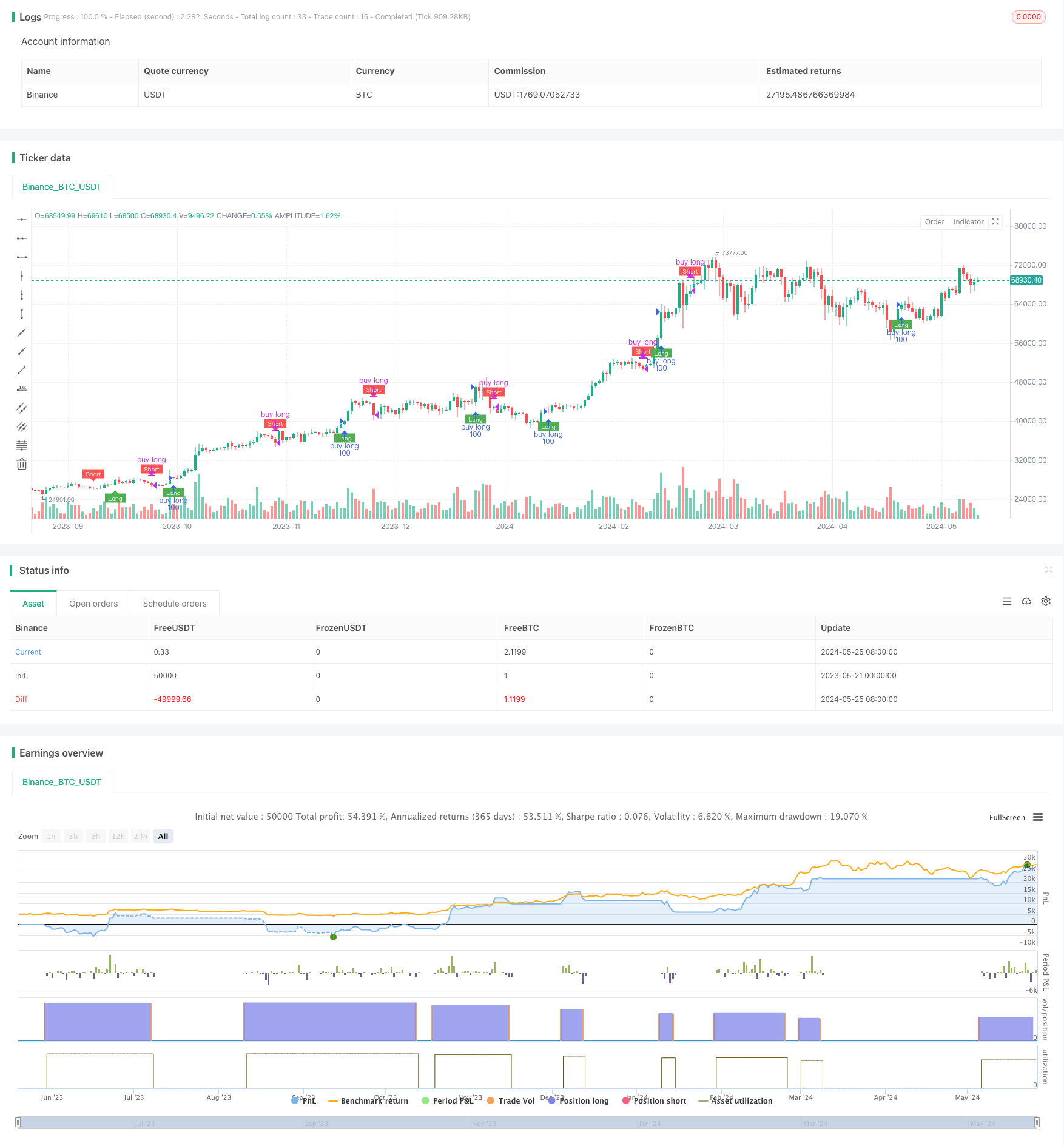

/*backtest

start: 2023-05-21 00:00:00

end: 2024-05-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=4

// modified by swigle

// thanks colinmck

strategy("QQE signals bot", overlay=true)

RSI_Period = input(14, title='RSI Length')

SF = input(5, title='RSI Smoothing')

QQE = input(4.236, title='Fast QQE Factor')

ThreshHold = input(10, title="Thresh-hold")

src = close

Wilders_Period = RSI_Period * 2 - 1

Rsi = rsi(src, RSI_Period)

RsiMa = ema(Rsi, SF)

AtrRsi = abs(RsiMa[1] - RsiMa)

MaAtrRsi = ema(AtrRsi, Wilders_Period)

dar = ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trend = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ? max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? min(shortband[1], newshortband) : newshortband

cross_1 = cross(longband[1], RSIndex)

trend := cross(RSIndex, shortband[1]) ? 1 : cross_1 ? -1 : nz(trend[1], 1)

FastAtrRsiTL = trend == 1 ? longband : shortband

// Find all the QQE Crosses

QQExlong = 0

QQExlong := nz(QQExlong[1])

QQExshort = 0

QQExshort := nz(QQExshort[1])

QQExlong := FastAtrRsiTL < RSIndex ? QQExlong + 1 : 0

QQExshort := FastAtrRsiTL > RSIndex ? QQExshort + 1 : 0

//Conditions

qqeLong = QQExlong == 1 ? FastAtrRsiTL[1] - 50 : na

qqeShort = QQExshort == 1 ? FastAtrRsiTL[1] - 50 : na

// Plotting

plotshape(qqeLong, title="QQE long", text="Long", textcolor=color.white, style=shape.labelup, location=location.belowbar, color=color.green, size=size.tiny)

plotshape(qqeShort, title="QQE short", text="Short", textcolor=color.white, style=shape.labeldown, location=location.abovebar, color=color.red, size=size.tiny)

// trade

//if qqeLong > 0

strategy.entry("buy long", strategy.long, 100, when=qqeLong)

if qqeShort > 0

strategy.close("buy long")

// strategy.exit("close_position", "buy long", loss=1000)

// strategy.entry("sell", strategy.short, 1, when=strategy.position_size > 0)

相关推荐