概述

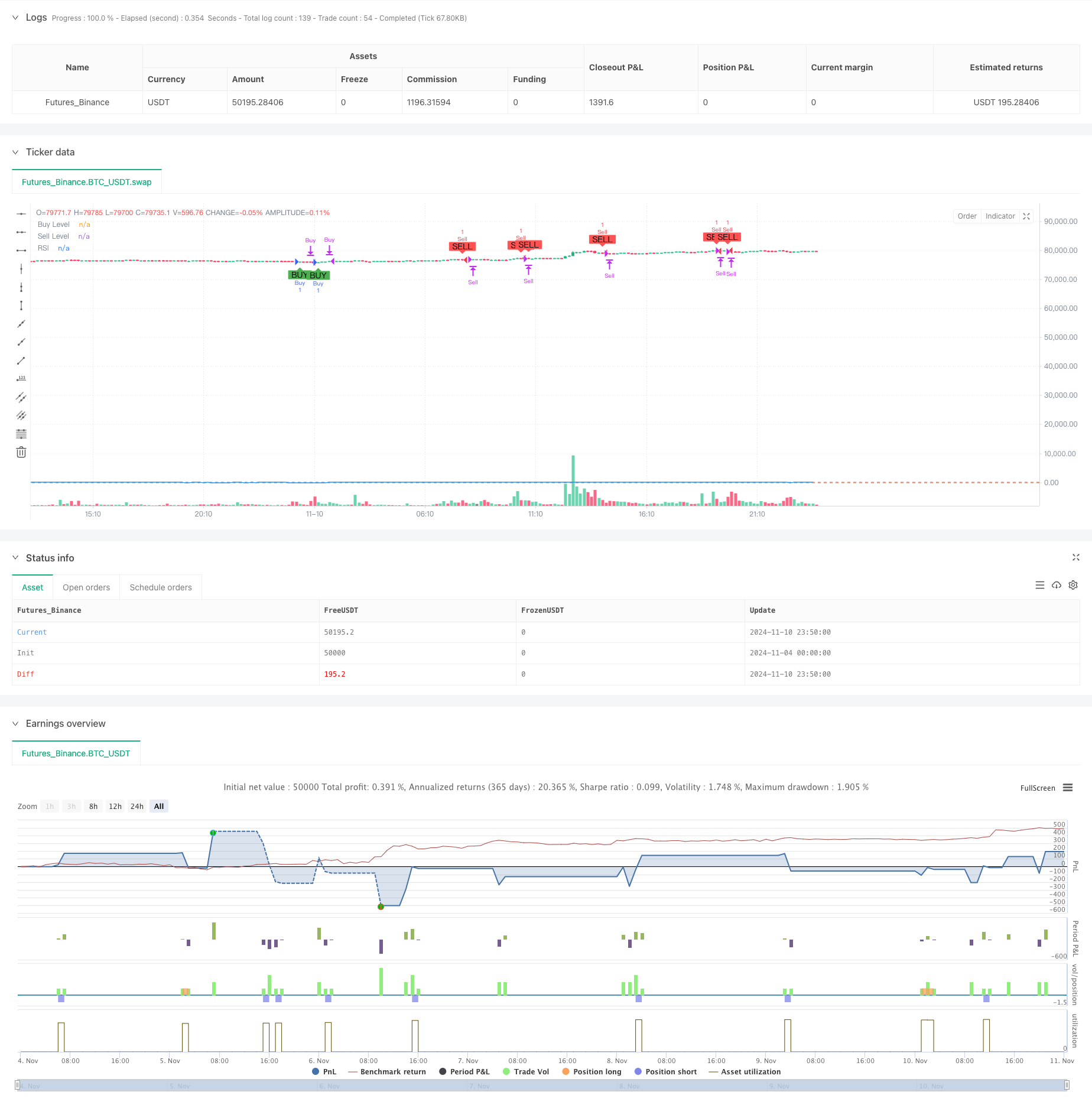

该策略是一个基于相对强弱指数(RSI)的自适应交易系统,通过监测RSI指标的超买超卖区域来捕捉市场动量变化。系统集成了智能的仓位管理机制,包括多层次的止盈止损控制以及自动平仓功能,旨在实现稳健的风险收益比。

策略原理

策略核心基于RSI指标的超买超卖信号,结合了多重交易条件: 1. 入场信号:当RSI突破30位置时产生做多信号;当RSI跌破70位置时产生做空信号 2. 风险管理: - 设置固定止损位(亏损100点)和获利目标(盈利150点) - 实时跟踪持仓状态,确保单向持仓 - 在每日15:25自动平仓以规避隔夜风险 3. 交易执行:系统通过strategy.entry和strategy.close函数自动执行交易指令

策略优势

- 信号明确:基于RSI指标的交叉信号清晰、易于理解和执行

- 风控完善:集成了多层次的风险控制机制

- 自动化程度高:从信号生成到交易执行全程自动化

- 可视化效果好:在图表上清晰展示买卖信号和RSI水平线

- 适应性强:可根据不同市场特征调整参数

策略风险

- RSI信号滞后性可能导致入场时机延迟

- 固定的止盈止损点位可能不适应所有市场环境

- 单一指标依赖可能错过其他重要市场信号

- 频繁交易可能带来较高交易成本 建议:

- 结合其他技术指标进行信号确认

- 动态调整止盈止损水平

- 增加交易频率限制

策略优化方向

- 指标优化:

- 增加移动平均线等趋势指标

- 添加成交量指标确认信号

- 风控优化:

- 实现动态止盈止损

- 加入最大回撤控制

- 执行优化:

- 增加开仓量管理

- 优化交易时间管理

- 参数优化:

- 开发自适应参数体系

- 实现动态RSI阈值

总结

该策略通过RSI指标捕捉市场动量变化,配合完善的风险管理体系,实现了一个全自动化的交易系统。虽然存在一定局限性,但通过建议的优化方向改进后,有望实现更稳定的交易表现。策略的核心优势在于系统的完整性和自动化程度,适合作为基础框架进行进一步开发和优化。

策略源码

/*backtest

start: 2024-11-04 00:00:00

end: 2024-11-11 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Harmony Signal Flow By Arun", overlay=true)

// RSI settings

rsiLength = 14

rsiSource = close

rsiValue = ta.rsi(rsiSource, rsiLength)

// Define RSI levels

buyLevel = 30

sellLevel = 70

// Buy signal: RSI crosses above 30

buyCondition = ta.crossover(rsiValue, buyLevel)

// Sell signal: RSI crosses below 70

sellCondition = ta.crossunder(rsiValue, sellLevel)

// Ensure only one order at a time

if (strategy.position_size == 0) // No open positions

if (buyCondition)

strategy.entry("Buy", strategy.long)

else if (sellCondition)

strategy.entry("Sell", strategy.short)

// Stop-loss and target conditions

var float stopLossBuy = na

var float targetBuy = na

var float stopLossSell = na

var float targetSell = na

if (strategy.position_size > 0) // If there's an open buy position

stopLossBuy := strategy.position_avg_price - 100 // Set stop-loss for buy

targetBuy := strategy.position_avg_price + 150 // Set target for buy

if (close <= stopLossBuy)

strategy.close("Buy", comment="Stoploss Hit")

else if (close >= targetBuy)

strategy.close("Buy", comment="Target Hit")

if (strategy.position_size < 0) // If there's an open sell position

stopLossSell := strategy.position_avg_price + 100 // Set stop-loss for sell

targetSell := strategy.position_avg_price - 150 // Set target for sell

if (close >= stopLossSell)

strategy.close("Sell", comment="Stoploss Hit")

else if (close <= targetSell)

strategy.close("Sell", comment="Target Hit")

// Close all positions by 3:25 PM

if (hour(timenow) == 15 and minute(timenow) == 25)

strategy.close_all(comment="Close all positions at 3:25 PM")

// Plot buy/sell signals on the chart

plotshape(buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plot RSI and levels

hline(buyLevel, "Buy Level", color=color.green)

hline(sellLevel, "Sell Level", color=color.red)

plot(rsiValue, "RSI", color=color.blue)

相关推荐