🤖 这不是普通的定投,这是会思考的定投机器人!

你知道吗?大部分人做定投都是”无脑买买买”,但这个策略就像给你配了个超级聪明的投资助手!它会根据市场情况调整每次买入的金额,从初始的5%逐步递增到最高100%。就像你去菜市场买菜,便宜的时候多买点,贵的时候少买点,简单粗暴但超级有效!

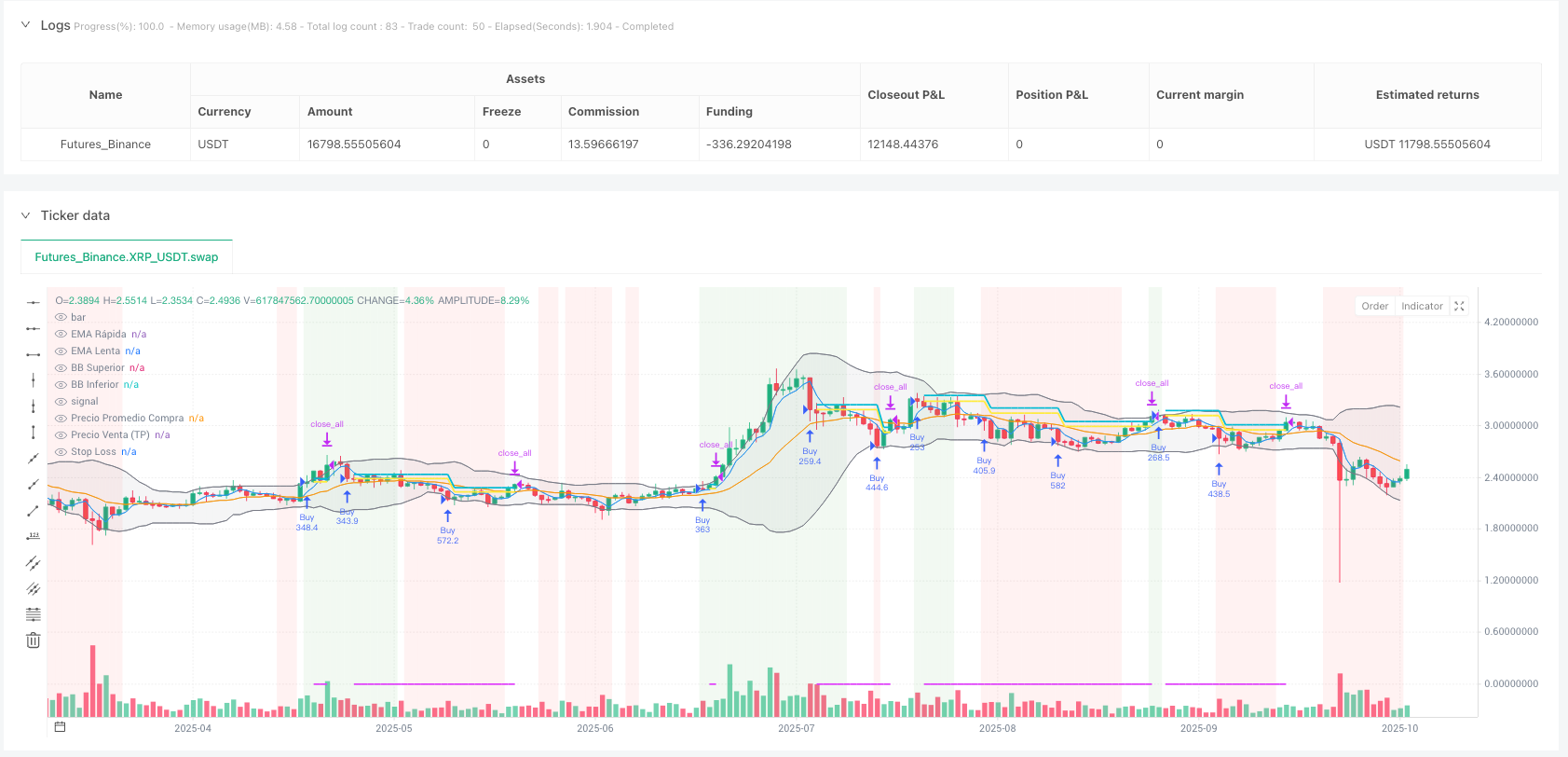

📊 四大技术指标组合拳,市场趋势一目了然

划重点!这个策略用了四个技术指标的组合: - 快慢EMA均线:像市场的”心电图”,告诉你趋势方向 - MACD:市场动量的”晴雨表”,判断买卖时机 - RSI:超买超卖的”温度计”,避免追高杀跌 - 布林带:价格波动的”安全区域”,判断支撑阻力

这四个指标配合起来,就像组了个”复仇者联盟”,各司其职但配合默契!

💡 越跌越买的智能加仓逻辑

避坑指南!普通定投最大的问题是不会控制仓位,这个策略就聪明多了: - 首次买入用5%的资金试水 - 每次加仓增加2.5%的投入 - 价格跌得越多,加仓间隔越大(2%、6%、10%…) - 最多单次投入不超过总资金的100%

就像打游戏升级一样,越到后面投入越大,但风险控制得死死的!

🎯 聪明的止盈止损,让利润奔跑让亏损止步

这个策略的卖出逻辑超级人性化: - 最低2%利润才考虑卖出:不做”辛苦一场白忙活”的冤大头 - 趋势转弱及时止盈:见好就收,落袋为安 - 价格大跌2%触发卖出:保护利润不回吐 - 可设置止损线:虽然默认100%(基本不触发),但你可以根据风险承受能力调整

简单来说,这个策略就是”会赚钱的时候绝不手软,该跑路的时候绝不恋战”!

||

🤖 This Isn’t Ordinary DCA - It’s a Thinking DCA Robot!

You know what? Most people do dollar-cost averaging like mindless “buy-buy-buy” machines, but this strategy is like having a super-smart investment assistant! It adjusts the purchase amount based on market conditions, starting from 5% and gradually increasing up to 100%. It’s like shopping at a farmers market - buy more when it’s cheap, buy less when it’s expensive. Simple, brutal, but incredibly effective!

📊 Four Technical Indicators Working as a Team

Key point! This strategy uses a combination of four technical indicators: - Fast/Slow EMA: Like the market’s “heartbeat monitor,” showing trend direction - MACD: The market momentum “barometer” for timing entries and exits - RSI: The overbought/oversold “thermometer” to avoid chasing highs and selling lows - Bollinger Bands: Price volatility “safety zones” for support and resistance

These four indicators work together like assembling the “Avengers” - each has their role but they coordinate perfectly!

💡 Smart Pyramiding Logic: Buy More as It Drops

Pitfall alert! The biggest problem with regular DCA is poor position sizing control. This strategy is much smarter: - Initial purchase uses 5% of capital to test the waters - Each additional purchase increases by 2.5% - The more price drops, the larger the spacing between purchases (2%, 6%, 10%…) - Maximum single investment never exceeds 100% of total capital

It’s like leveling up in a video game - the investment gets bigger as you progress, but risk is tightly controlled!

🎯 Smart Take-Profit and Stop-Loss: Let Profits Run, Cut Losses Short

This strategy’s exit logic is super user-friendly: - Minimum 2% profit before considering sale: No more “working hard for nothing” - Exit when trend weakens: Take profits while you can, secure the gains - 2% price drop triggers sell signal: Protect profits from giving back - Configurable stop-loss: Though default is 100% (basically never triggered), you can adjust based on risk tolerance

Simply put, this strategy is “ruthless when making money, decisive when it’s time to run”!

[/trans]

// This Pine Script™ code is subject to the terms of the MPL 2.0 at https://mozilla.org/MPL/2.0/

// © MTB by Neurodoc

// By Nicolás Astorga

//@version=5

strategy("Master Trading Bot by Neurodoc",

shorttitle="MTB Adaptation",

overlay=true,

initial_capital=10000,

pyramiding=100,

commission_value=0.1,

commission_type=strategy.commission.percent,

default_qty_type = strategy.cash)

// —————— CONFIGURATION (Based on ve.env) ——————

// Purchase and DCA Percentages

var GRP_DCA = "DCA Configuration"

start_percentage = input.float(5.0, "Initial Buy Percentage (%)", group=GRP_DCA)

increment_percentage = input.float(2.5, "DCA Increment per Buy (%)", group=GRP_DCA)

max_percentage = input.float(100.0, "Maximum Buy Percentage (%)", group=GRP_DCA)

min_profit_percent = input.float(2.0, "Minimum Profit Percentage for Sell (%)", group=GRP_DCA)

// Stop Loss and Drop Signal

var GRP_RISK = "Risk Management"

stop_loss_percent = input.float(100.0, "Stop Loss (%)", group=GRP_RISK, tooltip="A value of 100 means there is effectively no stop loss, as the price would have to go to zero.")

drop_percent_signal = input.float(2.0, "Price Drop Signal (%)", group=GRP_RISK)

// Indicator Parameters

var GRP_INDICATORS = "Indicator Parameters"

ema_fast_period = input.int(3, "Fast EMA", group=GRP_INDICATORS)

ema_mid_period = input.int(7, "Medium EMA", group=GRP_INDICATORS)

ema_slow_period = input.int(18, "Slow EMA", group=GRP_INDICATORS)

bb_length = input.int(20, "Bollinger Bands Length", group=GRP_INDICATORS)

bb_stddev = input.float(2.0, "Bollinger Bands Std Dev", group=GRP_INDICATORS)

macd_fast = input.int(52, "MACD Fast", group=GRP_INDICATORS)

macd_slow = input.int(200, "MACD Slow", group=GRP_INDICATORS)

macd_signal = input.int(3, "MACD Signal", group=GRP_INDICATORS)

rsi_length = input.int(14, "RSI Length", group=GRP_INDICATORS)

rsi_oversold_threshold = input.int(25, "RSI Oversold (for divergence)", group=GRP_INDICATORS)

// —————— INDICATOR CALCULATIONS ——————

// EMAs

ema_fast = ta.ema(open, ema_fast_period)

ema_mid = ta.ema(open, ema_mid_period)

ema_slow = ta.ema(open, ema_slow_period)

// Bollinger Bands

[bb_middle, bb_upper, bb_lower] = ta.bb(close, bb_length, bb_stddev)

bb_width = (bb_upper - bb_lower) / bb_middle * 100

is_bb_expanding = bb_width > bb_width[1]

// MACD

[macd_line, signal_line, _] = ta.macd(close, macd_fast, macd_slow, macd_signal)

// RSI

rsi = ta.rsi(close, rsi_length)

// Price drop signal from recent highest price (equivalent to `cummax` in Python)

highest_price = ta.highest(high, 500) // 500-bar lookback as an approximation of all-time high

price_drop_percent = ((highest_price - close) / highest_price) * 100

is_price_drop_signal = price_drop_percent >= drop_percent_signal

// —————— TRADING LOGIC ——————

// Trend Conditions

is_bullish = ema_fast > ema_slow and macd_line > signal_line and close > bb_middle

is_bearish = ema_fast < ema_slow and macd_line < signal_line and close < bb_middle

is_weakening = rsi < rsi[1]

// Strategy state variables

var bool just_sold = false

var int dca_step = 0

// Determine the capital percentage for the next buy

dca_buy_percentage = start_percentage + (dca_step * increment_percentage)

if dca_buy_percentage > max_percentage

dca_buy_percentage := max_percentage

avg_buy_price = strategy.position_avg_price

// Long Entry Condition

// Initial Buy (no open position)

long_signal_initial = strategy.position_size == 0 and is_bullish and macd_line > signal_line and rsi < 65

// DCA (if already in position)

price_drop_from_avg = ((avg_buy_price - close) / avg_buy_price) * 100

dca_required_drop = 2.0 + (dca_step * 4.0) // Logic equivalent to DCA_PRICE_DROP_START and INCREMENT

long_signal_dca = strategy.position_size > 0 and is_bearish and close < avg_buy_price and price_drop_from_avg >= dca_required_drop

// Manage `just_sold` state

if strategy.position_size > 0

just_sold := false

if strategy.position_size == 0 and strategy.position_size[1] > 0

just_sold := true

// Avoid immediate rebuying after selling unless strong bullish condition

long_signal = (just_sold and is_bullish) ? long_signal_initial : (not just_sold ? (long_signal_initial or long_signal_dca) : false)

// Sell/Close Condition

current_profit_percent = ((close - avg_buy_price) / avg_buy_price) * 100

has_min_profit = current_profit_percent >= min_profit_percent

stop_loss_price = avg_buy_price * (1 - stop_loss_percent / 100)

is_stoploss_triggered = close <= stop_loss_price

short_signal = strategy.position_size > 0 and has_min_profit and ((is_bearish and is_weakening) or is_price_drop_signal or is_stoploss_triggered or (macd_line < signal_line))

// —————— ORDER EXECUTION ——————

if (long_signal)

// Calculate how much money (e.g., USDT) to invest in this trade

cash_to_invest = (strategy.equity * dca_buy_percentage / 100) / close

strategy.entry("Buy", strategy.long, qty=cash_to_invest) // "qty" represents a cash-based position

dca_step := dca_step + 1

if (short_signal)

strategy.close_all(comment="Sell")

dca_step := 0 // Reset DCA counter upon selling

// —————— CHART VISUALIZATION ——————

// Background color by trend

bgcolor(is_bullish ? color.new(color.green, 90) : is_bearish ? color.new(color.red, 90) : na)

// Plot EMAs and Bollinger Bands

plot(ema_fast, "Fast EMA", color.blue)

plot(ema_slow, "Slow EMA", color.orange)

p1 = plot(bb_upper, "Upper BB", color=color.gray)

p2 = plot(bb_lower, "Lower BB", color=color.gray)

fill(p1, p2, color=color.new(color.gray, 90))

// Plot average buy price if position is open

plot(strategy.position_size > 0 ? avg_buy_price : na, "Average Buy Price", color.yellow, style=plot.style_linebr, linewidth=2)

// Plot take-profit target

plot(strategy.position_size > 0 ? avg_buy_price * (1 + min_profit_percent / 100) : na, "Sell Target (TP)", color.aqua, style=plot.style_linebr, linewidth=2)

// Plot stop loss level

plot(strategy.position_size > 0 ? stop_loss_price : na, "Stop Loss", color.fuchsia, style=plot.style_linebr, linewidth=2)