概述

该策略是一个综合性的交易系统,结合了多个经典技术指标,包括移动平均线(MA)、相对强弱指数(RSI)、移动平均线趋同散度指标(MACD)和布林带(BB)。系统通过这些指标的协同配合,在市场中寻找更准确的买卖信号,从而提高交易的成功率。

策略原理

策略采用多层信号验证机制,主要包括以下几个方面: 1. 通过短期(9日)和长期(21日)移动平均线的交叉来确定基础趋势方向 2. 使用RSI(14日)来识别超买超卖区域,设定70和30作为关键水平 3. 运用MACD(12,26,9)来确认趋势的强度和可能的转折点 4. 借助布林带(20日,2倍标准差)来判断价格波动的范围和潜在的反转点

系统在以下条件下产生交易信号: - 主要买入信号:短期MA上穿长期MA - 主要卖出信号:短期MA下穿长期MA - 辅助买入信号:RSI低于30且MACD柱状图为正且价格触及布林带下轨 - 辅助卖出信号:RSI高于70且MACD柱状图为负且价格触及布林带上轨

策略优势

- 多维度分析:通过整合多个技术指标,提供更全面的市场分析视角

- 信号确认机制:主要和辅助信号的配合使用,降低虚假信号的影响

- 风险控制完善:利用布林带和RSI的组合来控制入场点的风险

- 趋势跟踪能力:通过MA和MACD的配合,既能把握主趋势,又能识别趋势转折点

- 可视化效果强:系统提供清晰的图形界面,包括背景颜色提示和形状标记

策略风险

- 信号滞后性:移动平均线本身具有滞后性,可能导致入场点不够理想

- 震荡市场风险:在横盘震荡市场中可能产生频繁的假信号

- 指标冲突:多个指标可能在某些时候产生相互矛盾的信号

- 参数敏感性:策略效果对参数设置较为敏感,需要经过充分的参数优化

策略优化方向

- 动态参数调整:可以根据市场波动率自动调整各指标的参数

- 市场环境分类:增加对不同市场环境的识别机制,在不同市场条件下使用不同的信号组合

- 止损机制完善:加入更灵活的止损方案,如跟踪止损或基于ATR的止损

- 仓位管理优化:根据信号强度和市场波动性动态调整仓位大小

- 时间框架协同:考虑添加多时间框架分析,提高信号的可靠性

总结

这是一个设计完善的多维度交易策略系统,通过多个技术指标的协同作用提供交易信号。策略的主要优势在于其全面的分析框架和严谨的信号确认机制,但同时也需要注意参数优化和市场环境适应性的问题。通过建议的优化方向,该策略还有较大的提升空间。

策略源码

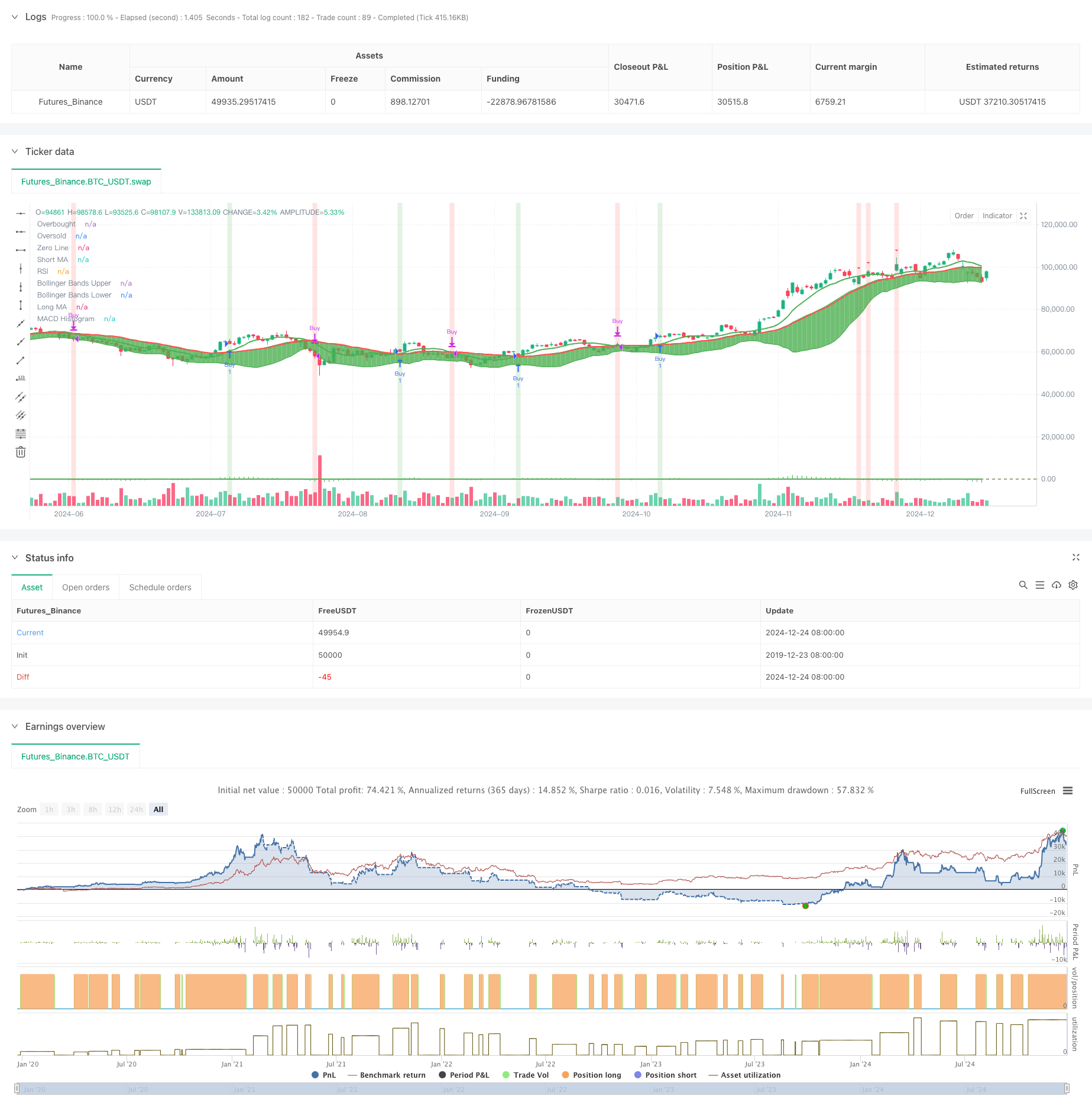

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ultimate Buy/Sell Indicator", overlay=true)

// Inputs for Moving Averages

shortMaLength = input.int(9, title="Short MA Length", minval=1)

longMaLength = input.int(21, title="Long MA Length", minval=1)

// Inputs for RSI

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=1, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=1, maxval=100)

// Inputs for MACD

macdShortLength = input.int(12, title="MACD Short EMA Length", minval=1)

macdLongLength = input.int(26, title="MACD Long EMA Length", minval=1)

macdSignalSmoothing = input.int(9, title="MACD Signal Smoothing", minval=1)

// Inputs for Bollinger Bands

bbLength = input.int(20, title="Bollinger Bands Length", minval=1)

bbMultiplier = input.float(2.0, title="Bollinger Bands Multiplier", minval=0.1)

// Calculate Moving Averages

shortMa = ta.sma(close, shortMaLength)

longMa = ta.sma(close, longMaLength)

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdShortLength, macdLongLength, macdSignalSmoothing)

macdHist = macdLine - signalLine

// Calculate Bollinger Bands

[bbUpper, bbBasis, bbLower] = ta.bb(close, bbLength, bbMultiplier)

// Define colors

colorPrimary = color.new(color.green, 0)

colorSecondary = color.new(color.red, 0)

colorBackgroundBuy = color.new(color.green, 80)

colorBackgroundSell = color.new(color.red, 80)

colorTextBuy = color.new(color.green, 0)

colorTextSell = color.new(color.red, 0)

// Plot Moving Averages

plot(shortMa, color=colorPrimary, linewidth=2, title="Short MA")

plot(longMa, color=colorSecondary, linewidth=2, title="Long MA")

// Plot Bollinger Bands

bbUpperLine = plot(bbUpper, color=colorPrimary, linewidth=1, title="Bollinger Bands Upper")

bbLowerLine = plot(bbLower, color=colorPrimary, linewidth=1, title="Bollinger Bands Lower")

fill(bbUpperLine, bbLowerLine, color=color.new(colorPrimary, 90))

// Buy/Sell Conditions based on MA cross

buySignal = ta.crossover(shortMa, longMa)

sellSignal = ta.crossunder(shortMa, longMa)

// Execute Buy/Sell Orders

if buySignal

strategy.entry("Buy", strategy.long, 1)

strategy.close("Sell", qty_percent=1) // Close all positions when selling

if sellSignal

strategy.close("Sell", qty_percent=1) // Close all positions when selling

strategy.close("Buy") // Close any remaining buy positions

// Plot Buy/Sell Signals for MA crossovers

plotshape(series=buySignal, location=location.belowbar, color=colorTextBuy, style=shape.triangleup, size=size.small, title="Buy Signal")

plotshape(series=sellSignal, location=location.abovebar, color=colorTextSell, style=shape.triangledown, size=size.small, title="Sell Signal")

// Background Color based on Buy/Sell Signal for MA crossovers

bgcolor(buySignal ? colorBackgroundBuy : na, title="Buy Signal Background")

bgcolor(sellSignal ? colorBackgroundSell : na, title="Sell Signal Background")

// Plot RSI with Overbought/Oversold Levels

hline(rsiOverbought, "Overbought", color=colorSecondary, linestyle=hline.style_dashed, linewidth=1)

hline(rsiOversold, "Oversold", color=colorPrimary, linestyle=hline.style_dashed, linewidth=1)

plot(rsi, color=colorPrimary, linewidth=2, title="RSI")

// Plot MACD Histogram

plot(macdHist, color=colorPrimary, style=plot.style_histogram, title="MACD Histogram", linewidth=2)

hline(0, "Zero Line", color=color.new(color.gray, 80))

// Additional Buy/Sell Conditions based on RSI, MACD, and Bollinger Bands

additionalBuySignal = rsi < rsiOversold and macdHist > 0 and close < bbLower

additionalSellSignal = rsi > rsiOverbought and macdHist < 0 and close > bbUpper

// Plot Additional Buy/Sell Signals

plotshape(series=additionalBuySignal and not buySignal, location=location.belowbar, color=colorTextBuy, style=shape.triangleup, size=size.small, title="Additional Buy Signal")

plotshape(series=additionalSellSignal and not sellSignal, location=location.abovebar, color=colorTextSell, style=shape.triangledown, size=size.small, title="Additional Sell Signal")

// Background Color based on Additional Buy/Sell Signal

bgcolor(additionalBuySignal and not buySignal ? colorBackgroundBuy : na, title="Additional Buy Signal Background")

bgcolor(additionalSellSignal and not sellSignal ? colorBackgroundSell : na, title="Additional Sell Signal Background")

相关推荐