概述

这是一个基于多周期均线交叉的趋势跟踪策略。策略主要依据20、50和200周期指数移动平均线(EMA)的交叉关系及价格与均线的关系来判断入场时机,同时设置了基于百分比的止盈止损来控制风险。该策略特别适用于较大的时间周期,如1小时、日线和周线图表,能有效捕捉中长期趋势性行情。

策略原理

策略的核心逻辑基于多重均线系统和价格行为分析: 1. 使用三条不同周期(20、50、200)的指数移动平均线构建趋势判断系统 2. 入场条件要求满足以下全部条件: - 价格突破并收于20周期EMA之上 - 20周期EMA位于50周期EMA之上 - 50周期EMA位于200周期EMA之上 3. 风险控制采用固定百分比方式: - 止盈设置在入场价格上方10%处 - 止损设置在入场价格下方5%处

策略优势

- 多重确认机制提高可靠性

- 通过三重均线和价格突破提供多重验证

- 避免虚假信号干扰

- 完善的风险控制体系

- 预设止盈止损位置

- 风险收益比合理(1:2)

- 适应性强

- 可应用于多个时间周期

- 特别适合中长期趋势交易

策略风险

- 横盘行情表现欠佳

- 在震荡市场可能频繁触发止损

- 建议在明确趋势时使用

- 滞后性风险

- 均线系统具有一定滞后性

- 可能错过一些行情起点

- 固定止盈止损限制

- 百分比固定可能不适合所有市场环境

- 建议根据波动率动态调整

策略优化方向

- 引入波动率指标

- 使用ATR动态调整止盈止损

- 提高策略对市场适应性

- 增加趋势强度过滤

- 添加ADX等趋势强度指标

- 提高入场信号质量

- 优化均线周期

- 根据不同市场特征调整均线参数

- 提供参数优化范围建议

总结

这是一个设计合理、逻辑清晰的趋势跟踪策略。通过多重技术指标的配合使用,既保证了策略的可靠性,又提供了清晰的风险控制方案。策略特别适合在大周期图表上运行,对于把握中长期趋势具有独特优势。通过建议的优化方向,策略还有进一步提升空间。建议交易者在实盘使用前,先在回测系统中充分测试,并根据具体交易品种特点适当调整参数。

策略源码

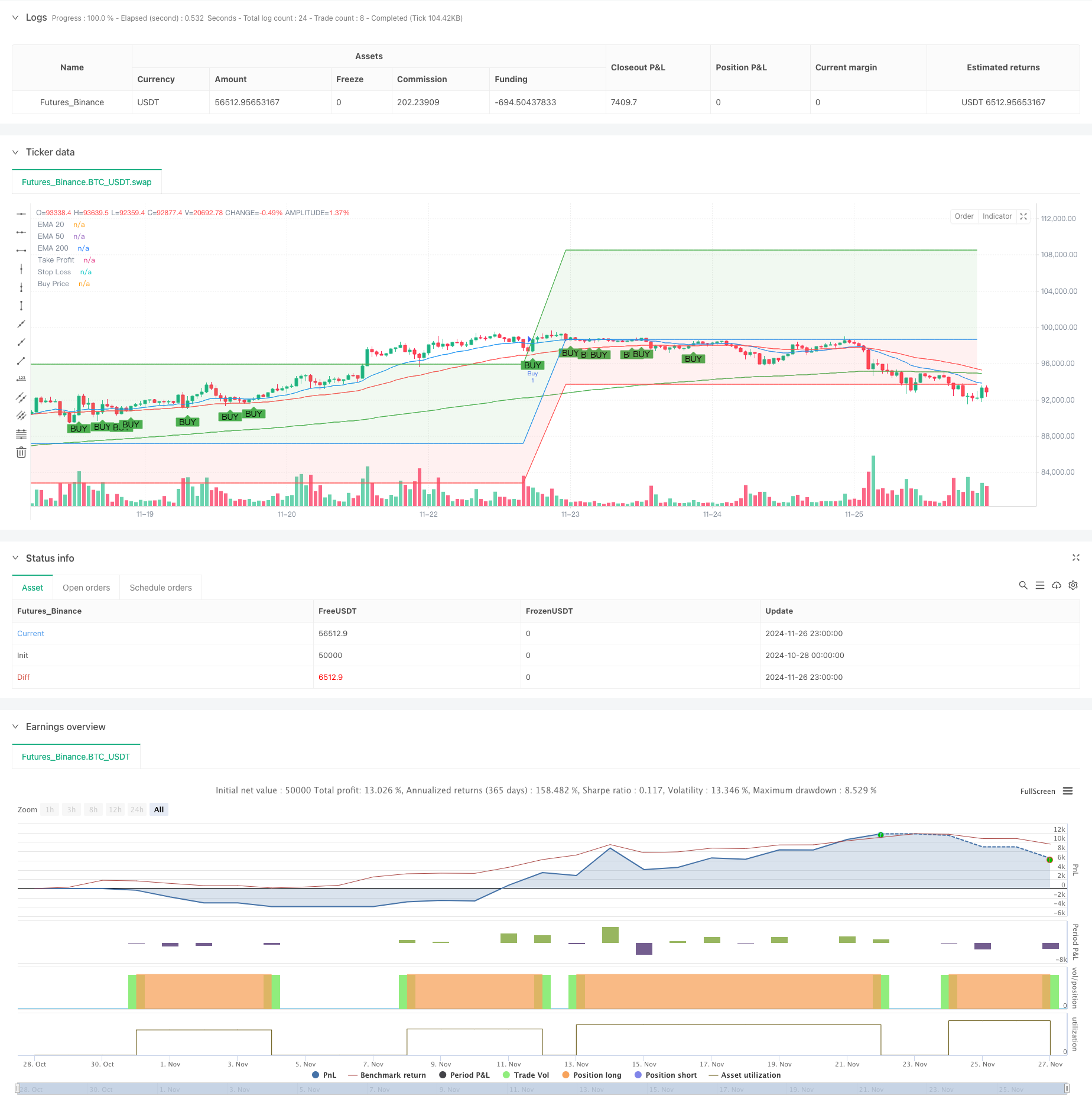

/*backtest

start: 2024-10-28 00:00:00

end: 2024-11-27 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Cross Strategy with Targets and Fill", overlay=true)

// Define EMAs

ema20 = ta.ema(close, 20)

ema50 = ta.ema(close, 50)

ema200 = ta.ema(close, 200)

// Plot EMAs (hidden)

plot(ema20, color=color.blue, title="EMA 20", display=display.none)

plot(ema50, color=color.red, title="EMA 50", display=display.none)

plot(ema200, color=color.green, title="EMA 200", display=display.none)

// Define the conditions

priceCrossAboveEMA20 = ta.crossover(close, ema20)

priceCloseAboveEMA20 = close > ema20

ema20AboveEMA50 = ema20 > ema50

ema50AboveEMA200 = ema50 > ema200

// Buy condition

buyCondition = priceCrossAboveEMA20 and priceCloseAboveEMA20 and ema20AboveEMA50 and ema50AboveEMA200

// Plot buy signals

plotshape(series=buyCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

// Declare and initialize variables for take profit and stop loss levels

var float longTakeProfit = na

var float longStopLoss = na

var float buyPrice = na

// Update levels and variables on buy condition

if (buyCondition)

// Enter a new buy position

strategy.entry("Buy", strategy.long)

// Set new take profit and stop loss levels

longTakeProfit := strategy.position_avg_price * 1.10 // Target is 10% above the buy price

longStopLoss := strategy.position_avg_price * 0.95 // Stop loss is 5% below the buy price

buyPrice := strategy.position_avg_price

// Plot levels for the new trade

plotTakeProfit = plot(longTakeProfit, color=color.green, title="Take Profit", linewidth=1, offset=-1)

plotStopLoss = plot(longStopLoss, color=color.red, title="Stop Loss", linewidth=1, offset=-1)

plotBuyPrice = plot(buyPrice, color=color.blue, title="Buy Price", linewidth=1, offset=-1)

// Fill areas between buy price and take profit/stop loss levels

fill(plotBuyPrice, plotTakeProfit, color=color.new(color.green, 90), title="Fill to Take Profit") // Light green fill to target

fill(plotBuyPrice, plotStopLoss, color=color.new(color.red, 90), title="Fill to Stop Loss") // Light red fill to stop loss

// Exit conditions

strategy.exit("Take Profit/Stop Loss", from_entry="Buy", limit=longTakeProfit, stop=longStopLoss)

相关推荐