🚀 这个策略到底有多厉害?

你知道吗?这个策略就像是给你的交易装上了”火眼金睛”!它专门为1分钟和5分钟的超短线交易设计,把5个最强大的技术指标组合在一起:快慢EMA、RSI、MACD、布林带,还有成交量过滤器。简单来说,就是让你在市场的每一个小波动中都能精准捕捉机会!

💡 划重点!这套组合拳怎么打?

想象一下,这个策略就像是一个超级严格的”面试官”,只有同时满足多个条件的交易机会才能通过筛选:

多头信号必须满足:价格在快速EMA之上、MACD金叉且为正、突破布林带上轨、RSI在50-80之间,还要有足够的成交量支撑。这就像是要求一个人既要颜值高、又要有才华、还要性格好一样严格!

空头信号则相反:所有条件都要反向满足,确保每一笔交易都有充分的技术面支撑。

⚡ 避坑指南:为什么选择超短线?

这个策略最聪明的地方在于它的风险控制!止损设置在0.5%,止盈设置在1.0%,风险收益比达到1:2。就像是”小赌怡情”的完美诠释 - 每次亏损都很小,但盈利却能翻倍!

而且它还有一个贴心的设计:在1分钟图上会自动关闭蜡烛图形态识别,因为超短线的K线形态噪音太大,容易误导判断。这就像是在嘈杂的环境中自动降噪一样智能!

🎯 实战应用:这个策略能帮你解决什么问题?

适合人群:想要在加密货币市场进行日内交易的朋友们,特别是那些希望通过小而频繁的交易积累收益的交易者。

解决痛点:告别单一指标的假信号困扰!通过多重确认机制,大大提高了信号的可靠性。同时,严格的风险控制让你即使判断错误,损失也在可控范围内。

记住,这个策略就像是一把精密的手术刀,需要在高流动性的加密货币对上使用效果最佳。配合良好的资金管理,它能成为你交易武器库中的得力助手!

策略源码

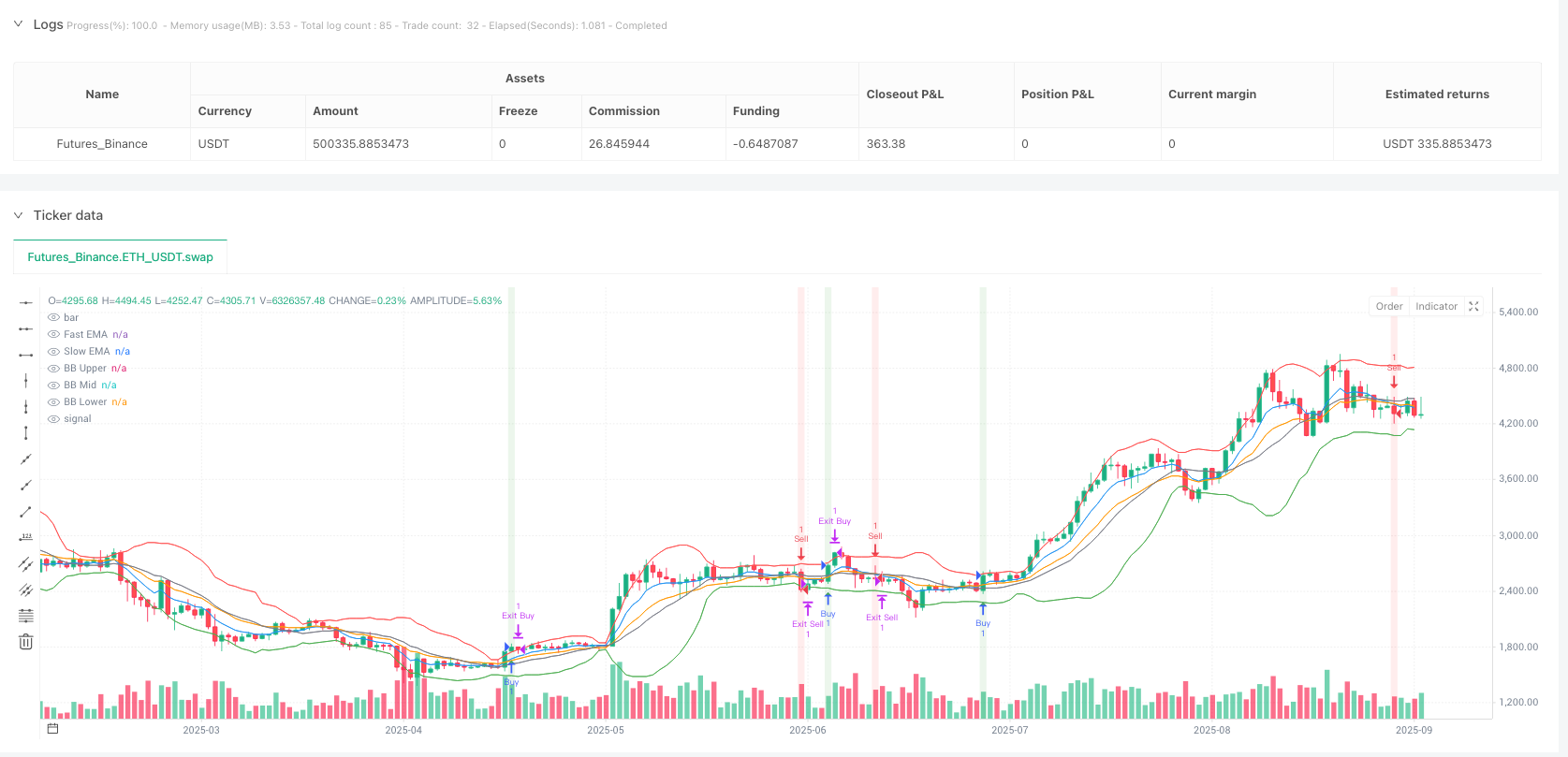

/*backtest

start: 2024-09-08 00:00:00

end: 2025-09-06 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=5

strategy("Advanced Crypto Scalping Strategy - 1 & 5 Min Charts", overlay=true, margin_long=100, margin_short=100)

// Inputs for customization (optimized for 1-min and 5-min timeframes)

emaFastLen = input.int(7, "Fast EMA Length", minval=1, tooltip="Use 5-8 for 1-min, 7-10 for 5-min")

emaSlowLen = input.int(14, "Slow EMA Length", minval=1, tooltip="Use 10-15 for 1-min, 14-21 for 5-min")

rsiLen = input.int(10, "RSI Length", minval=1, tooltip="Use 8-12 for 1-min, 10-14 for 5-min")

rsiOverbought = input.int(80, "RSI Overbought", minval=50, maxval=100, tooltip="Use 80-85 for 1-min, 75-80 for 5-min")

rsiOversold = input.int(20, "RSI Oversold", minval=0, maxval=50, tooltip="Use 15-20 for 1-min, 20-25 for 5-min")

macdFast = input.int(8, "MACD Fast Length", minval=1, tooltip="Use 6-10 for 1-min, 8-12 for 5-min")

macdSlow = input.int(21, "MACD Slow Length", minval=1, tooltip="Use 15-21 for 1-min, 21-26 for 5-min")

macdSignal = input.int(5, "MACD Signal Smoothing", minval=1, tooltip="Use 4-6 for 1-min, 5-9 for 5-min")

bbLen = input.int(15, "Bollinger Bands Length", minval=1, tooltip="Use 10-15 for 1-min, 15-20 for 5-min")

bbMult = input.float(1.8, "Bollinger Bands Multiplier", minval=0.1, step=0.1, tooltip="Use 1.5-1.8 for 1-min, 1.8-2.0 for 5-min")

slPerc = input.float(0.5, "Stop Loss %", minval=0.1, step=0.1, tooltip="Use 0.3-0.6 for 1-min, 0.5-0.8 for 5-min")

tpPerc = input.float(1.0, "Take Profit %", minval=0.5, step=0.1, tooltip="Use 0.8-1.2 for 1-min, 1.0-1.5 for 5-min")

useCandlePatterns = input.bool(false, "Use Candlestick Patterns", tooltip="Disable for 1-min to reduce noise, enable for 5-min")

useVolumeFilter = input.bool(true, "Use Volume Filter", tooltip="Enable for both timeframes to filter low-volume signals")

signalSize = input.float(2.0, "Signal Arrow Size", minval=1.0, maxval=3.0, step=0.5, tooltip="1.0=tiny, 2.0=small, 3.0=normal")

bgTransparency = input.int(85, "Background Highlight Transparency", minval=0, maxval=100)

labelOffset = input.float(0.8, "Label Offset %", minval=0.5, maxval=5, step=0.1)

// Calculate indicators

emaFast = ta.ema(close, emaFastLen)

emaSlow = ta.ema(close, emaSlowLen)

rsi = ta.rsi(close, rsiLen)

[macdLine, signalLine, _] = ta.macd(close, macdFast, macdSlow, macdSignal)

[bbMid, bbUpper, bbLower] = ta.bb(close, bbLen, bbMult)

volMa = ta.sma(volume, 15)

// Trend determination

bullTrend = close > emaFast and emaFast > emaSlow

bearTrend = close < emaFast and emaFast < emaSlow

// EMA crossover signals

emaCrossBuy = ta.crossover(emaFast, emaSlow)

emaCrossSell = ta.crossunder(emaFast, emaSlow)

// Momentum signals

bullMacd = ta.crossover(macdLine, signalLine) and macdLine > 0

bearMacd = ta.crossunder(macdLine, signalLine) and macdLine < 0

// Channel breakouts

bullBreak = ta.crossover(close, bbUpper)

bearBreak = ta.crossunder(close, bbLower)

// RSI conditions

bullRsi = rsi > 50 and rsi < rsiOverbought

bearRsi = rsi < 50 and rsi > rsiOversold

// Candlestick patterns (optional, less reliable on 1-min)

bullEngulf = close > open and open < low[1] and close > high[1] and useCandlePatterns

bearEngulf = close < open and open > high[1] and close < low[1] and useCandlePatterns

hammer = (high - low) > 2 * (close - open) and close > open and (close - low) / (high - low) > 0.6 and useCandlePatterns

shootingStar = (high - low) > 2 * (open - close) and close < open and (high - close) / (high - low) > 0.6 and useCandlePatterns

bullCandle = bullEngulf or hammer

bearCandle = bearEngulf or shootingStar

// Volume filter

volFilter = volume > volMa * 1.8 or not useVolumeFilter

// Combined buy/sell conditions

mainBuyCondition = bullTrend and bullMacd and bullBreak and bullRsi and bullCandle and volFilter

mainSellCondition = bearTrend and bearMacd and bearBreak and bearRsi and bearCandle and volFilter

buyCondition = mainBuyCondition or emaCrossBuy

sellCondition = mainSellCondition or emaCrossSell

// Strategy entries

var bool isBuyActive = false

var bool isSellActive = false

if (buyCondition and strategy.position_size == 0 and not isBuyActive)

strategy.entry("Buy", strategy.long)

label.new(bar_index, low * (1 - labelOffset / 100), emaCrossBuy ? "EMA BUY" : "BUY", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.large)

isBuyActive := true

isSellActive := false

if (sellCondition and strategy.position_size == 0 and not isSellActive)

strategy.entry("Sell", strategy.short)

label.new(bar_index, high * (1 + labelOffset / 100), emaCrossSell ? "EMA SELL" : "SELL", color=color.red, style=label.style_label_down, textcolor=color.white, size=size.large)

isSellActive := true

isBuyActive := false

// Exits

if (strategy.position_size > 0) // Long position

strategy.exit("Exit Buy", "Buy", stop=strategy.position_avg_price * (1 - slPerc / 100), limit=strategy.position_avg_price * (1 + tpPerc / 100))

if (strategy.position_size == 0)

isBuyActive := false

if (strategy.position_size < 0) // Short position

strategy.exit("Exit Sell", "Sell", stop=strategy.position_avg_price * (1 + slPerc / 100), limit=strategy.position_avg_price * (1 - tpPerc / 100))

if (strategy.position_size == 0)

isSellActive := false

// Plot indicators

plot(emaFast, color=color.blue, title="Fast EMA")

plot(emaSlow, color=color.orange, title="Slow EMA")

plot(bbUpper, color=color.red, title="BB Upper")

plot(bbMid, color=color.gray, title="BB Mid")

plot(bbLower, color=color.green, title="BB Lower")

// Plot signals with fixed size to avoid type mismatch

plotshape(buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.normal)

plotshape(sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.normal)

// Background highlights

bgcolor(buyCondition ? color.new(color.green, bgTransparency) : sellCondition ? color.new(color.red, bgTransparency) : na)

相关推荐