概述

这是一个结合了多周期简单移动平均线(SMA)交叉和波动率过滤器的量化交易策略。该策略利用短期和长期SMA的交叉来产生交易信号,同时使用平均真实波幅(ATR)指标作为波动率过滤器,以减少虚假信号。策略还包含了基于200日均线的动态止损和固定盈利目标,旨在优化风险管理和提高盈利能力。

策略原理

均线交叉信号:策略使用短期(10日)和长期(200日)SMA的交叉来产生买入和卖出信号。当短期SMA上穿长期SMA时产生做多信号,下穿时产生做空信号。

波动率过滤:使用14日ATR作为波动率指标。只有当当前ATR高于其14日均值的特定倍数(由用户设定的ATR乘数决定)时,才执行交易信号。这有助于过滤掉低波动期的潜在虚假信号。

动态止损:策略使用200日SMA作为动态止损基准。多头仓位的止损设置在200日SMA的99.9%,空头仓位的止损设置在200日SMA的100.1%。

固定盈利目标:策略为每个交易设置了固定的盈利目标。多头交易的盈利目标是入场价格加上7.5个价格单位,空头交易则是入场价格减去7.5个价格单位。

策略优势

多重信号确认:通过结合均线交叉和波动率过滤,策略降低了虚假信号的风险,提高了交易的可靠性。

动态风险管理:使用基于200日SMA的动态止损,使策略能够适应市场条件的变化,提供更灵活的风险控制。

明确的盈利目标:固定的盈利目标有助于保护已实现的利润,防止过度贪婪导致的回撤。

适应性强:策略参数可以根据不同市场和交易品种进行调整,提高了策略的versatility。

可视化辅助:策略在图表上绘制了各种SMA线、止损和盈利目标,为交易者提供直观的市场分析工具。

策略风险

均线滞后性:SMA本质上是滞后指标,可能在快速变化的市场中产生延迟信号,导致入场或出场不及时。

过度交易:在高波动但无明确趋势的市场中,策略可能产生过多的交易信号,增加交易成本。

固定盈利目标的局限性:固定的盈利目标可能在强劲趋势中过早平仓,限制了潜在利润。

对特定市场条件的依赖:策略在趋势明显的市场中表现较好,但在横盘或快速反转的市场中可能表现欠佳。

参数敏感性:策略的性能很大程度上依赖于所选择的参数,不当的参数设置可能导致策略表现不佳。

策略优化方向

动态参数调整:可以考虑根据市场状况动态调整SMA周期和ATR乘数,以适应不同的市场环境。

增加趋势强度过滤:引入额外的趋势强度指标(如ADX),以确保只在强趋势市场中进行交易。

优化盈利目标:考虑使用动态的盈利目标,如基于ATR或近期价格波动范围设置,以更好地适应市场波动。

引入部分平仓机制:在达到某些盈利水平时执行部分平仓,既可以锁定部分利润,又可以让剩余仓位继续获利。

增加市场regime识别:开发算法来识别不同的市场状态(如趋势、区间、高波动等),并相应地调整策略参数或暂停交易。

优化止损机制:考虑使用trailing stop或基于支撑/阻力水平的止损,以提供更灵活的风险管理。

总结

这个多周期均线交叉与波动率过滤动态策略结合了技术分析中的经典元素和现代风险管理技术。通过整合SMA交叉信号、ATR波动率过滤、动态止损和固定盈利目标,策略旨在捕捉市场趋势while同时控制风险。尽管存在一些固有的局限性,但通过持续优化和适应性调整,该策略有潜力成为一个robust的交易系统。交易者在使用此策略时,应当注意参数的选择和回测,并根据特定的市场条件和个人风险偏好进行customization。

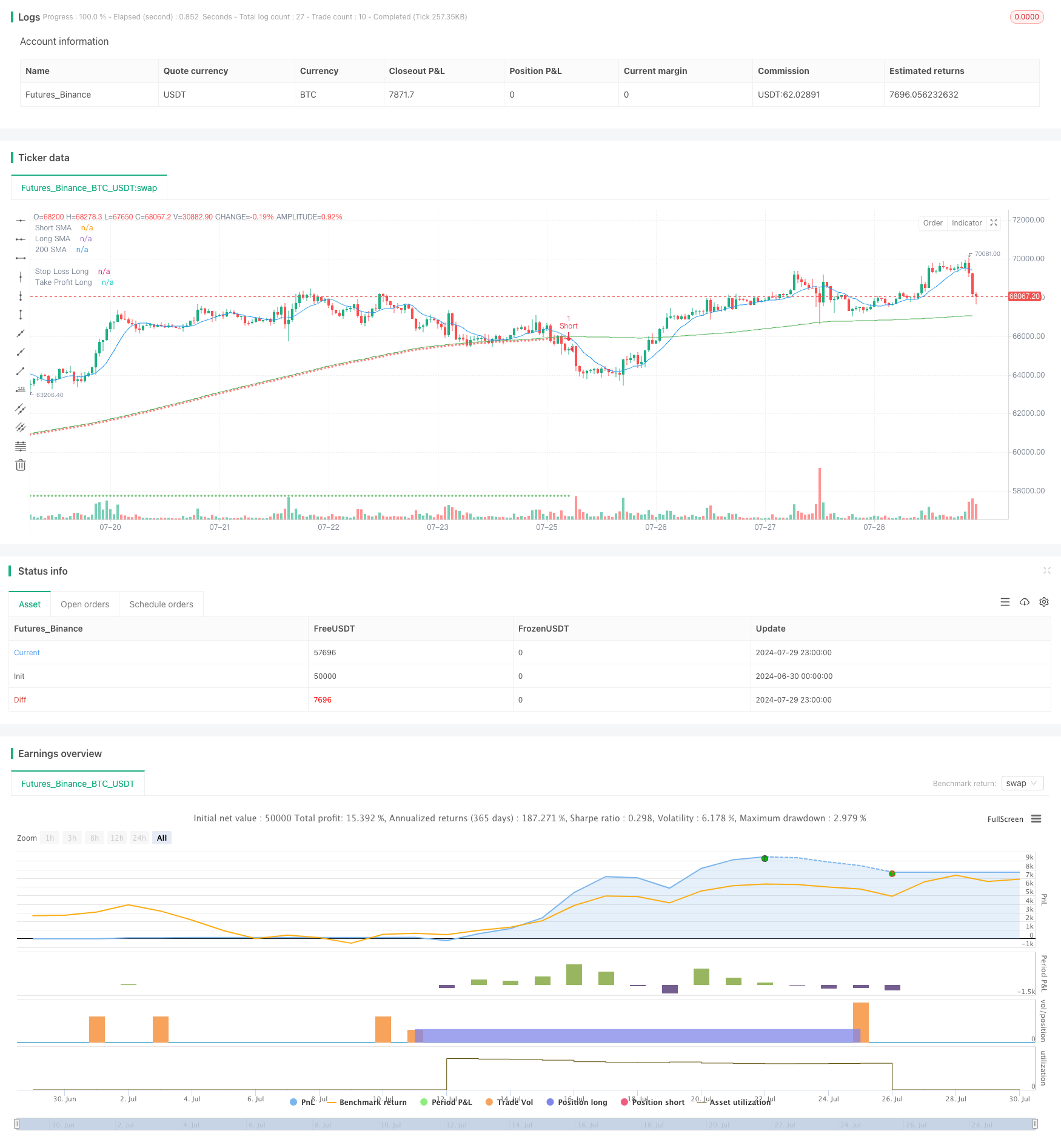

/*backtest

start: 2024-06-30 00:00:00

end: 2024-07-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SMA Crossover Strategy with Volatility Filter", overlay=true)

// Define input parameters

shortSMA = input.int(10, title="Short SMA Length", minval=1)

longSMA = input.int(200, title="Long SMA Length", minval=1)

sma200Length = 200

atrLength = input.int(14, title="ATR Length", minval=1)

atrMultiplier = input.float(1.0, title="ATR Multiplier", minval=0.1)

// Calculate SMAs

smaShort = ta.sma(close, shortSMA)

smaLong = ta.sma(close, longSMA)

sma200 = ta.sma(close, sma200Length)

// Calculate ATR for volatility

atr = ta.atr(atrLength)

// Plot SMAs

plot(smaShort, color=color.blue, title="Short SMA")

plot(smaLong, color=color.red, title="Long SMA")

plot(sma200, color=color.green, title="200 SMA")

// Calculate stop loss levels

stopLossLong = sma200 * 0.999

stopLossShort = sma200 * 1.001

// Initialize take profit levels

var float takeProfitLong = na

var float takeProfitShort = na

// Generate buy/sell signals

longCondition = ta.crossover(smaShort, smaLong) and atr > atrMultiplier * ta.sma(atr, atrLength)

shortCondition = ta.crossunder(smaShort, smaLong) and atr > atrMultiplier * ta.sma(atr, atrLength)

// Execute trades with stop loss and take profit

if (longCondition)

strategy.entry("Long", strategy.long)

takeProfitLong := close + 7.5

strategy.exit("Long Exit", "Long", stop=stopLossLong, limit=takeProfitLong)

if (shortCondition)

strategy.entry("Short", strategy.short)

takeProfitShort := close - 7.5

strategy.exit("Short Exit", "Short", stop=stopLossShort, limit=takeProfitShort)

// Plot stop loss and take profit levels on chart

plot(strategy.position_size > 0 ? stopLossLong : na, style=plot.style_cross, color=color.red, title="Stop Loss Long")

plot(strategy.position_size > 0 ? takeProfitLong : na, style=plot.style_cross, color=color.green, title="Take Profit Long")

plot(strategy.position_size < 0 ? stopLossShort : na, style=plot.style_cross, color=color.red, title="Stop Loss Short")

plot(strategy.position_size < 0 ? takeProfitShort : na, style=plot.style_cross, color=color.green, title="Take Profit Short")