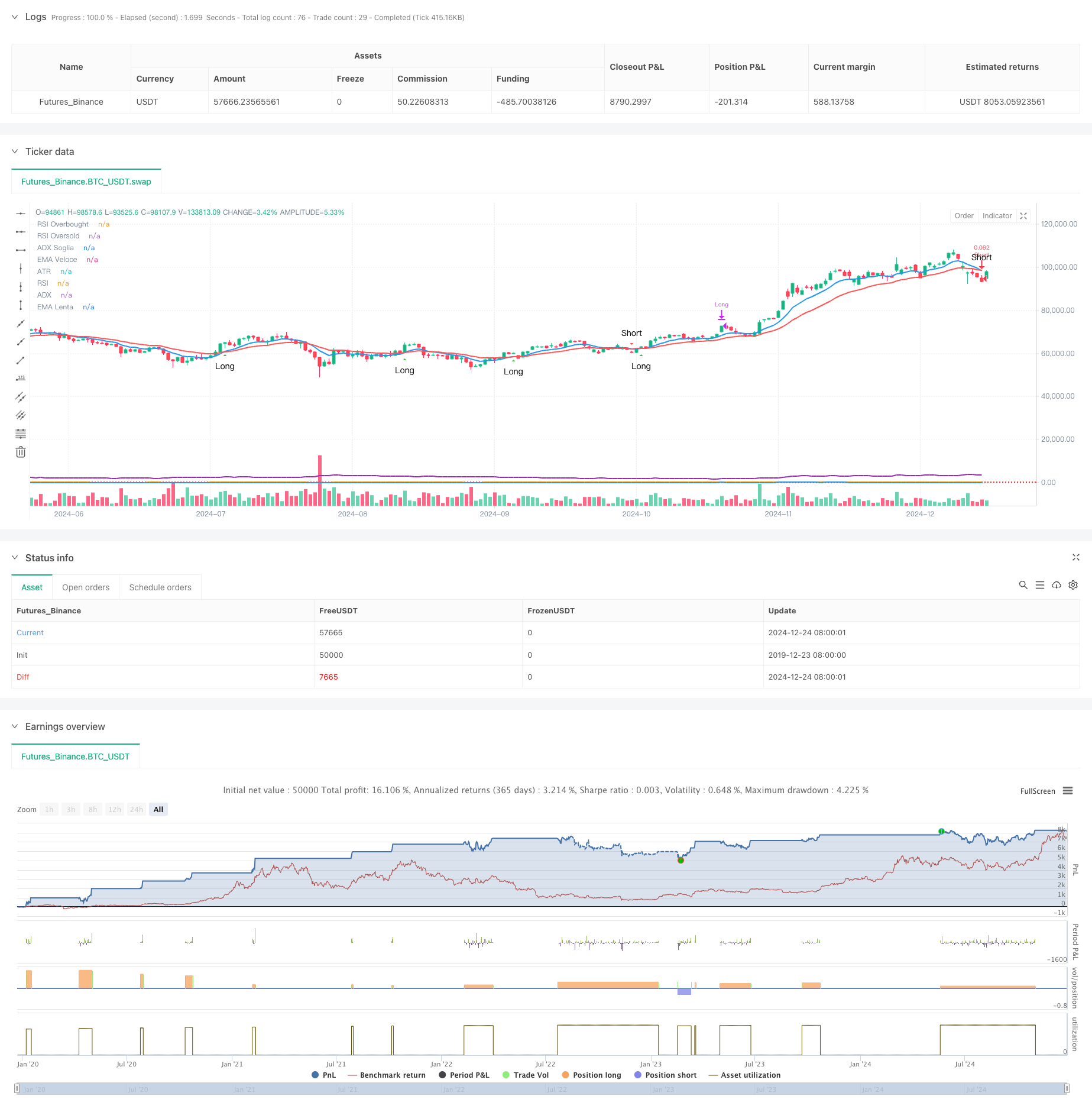

概述

本策略是一个基于15分钟时间框架的高频交易策略。该策略结合了多个技术指标,包括指数移动平均线(EMA)、相对强弱指标(RSI)、平均趋向指数(ADX)和平均真实波幅(ATR),通过这些指标的协同作用实现交易信号的精确捕捉和风险的动态管理。策略采用了清晰的可视化设计,便于交易者实时监控市场状况和交易信号。

策略原理

策略的核心逻辑基于快速EMA(9周期)和慢速EMA(21周期)的交叉产生交易信号。RSI(14周期)用于过滤过度买卖区域,ADX(14周期)用于确认趋势强度,ATR(14周期)则用于动态设置止损和获利目标。多重技术指标的结合确保了交易信号的可靠性。进场条件包括:多头-快速EMA上穿慢速EMA且RSI低于70,ADX高于20;空头-快速EMA下穿慢速EMA且RSI高于30,ADX高于20。出场采用基于ATR的动态止损和获利目标设置。

策略优势

- 信号可靠性高: 多重技术指标的交叉验证显著提高了交易信号的准确性

- 风险管理灵活: 基于ATR的动态止损和获利目标设置,能够根据市场波动性自动调整

- 交易机会充分: 15分钟时间框架提供了充足的交易机会

- 可视化程度高: 清晰的图表布局和信号显示便于快速决策

- 自动化程度高: 完整的信号系统支持自动化交易执行

策略风险

- 市场波动风险: 高频交易在剧烈波动市场中可能面临滑点风险

- 假突破风险: 短周期可能产生虚假信号,需要通过ADX进行过滤

- 资金管理风险: 频繁交易可能导致手续费累积,需要合理控制仓位

- 技术风险: 多重指标可能在某些市场条件下产生矛盾信号

- 执行风险: 自动化交易系统需要稳定的网络环境和执行条件

策略优化方向

- 指标参数优化: 可以通过回测优化各指标参数,使其更适应特定市场条件

- 信号过滤增强: 可以添加成交量指标作为辅助过滤条件

- 风险控制改进: 可以引入动态仓位管理系统,根据市场波动调整交易规模

- 时间窗口优化: 可以根据不同市场阶段动态调整交易时间窗口

- 止损策略优化: 可以引入追踪止损机制,提高盈利水平的保护能力

总结

该策略通过多重技术指标的协同作用,实现了高频交易中信号捕捉和风险控制的平衡。清晰的可视化设计和完善的自动化支持使其具有较好的实用性。通过持续优化和风险管理的改进,策略有望在不同市场环境下保持稳定的表现。虽然存在一定的风险,但通过合理的参数设置和风险控制措施,这些风险是可控的。策略的成功运行需要交易者对市场有深入的理解,并保持对风险的持续关注。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Scalping BTC Ottimizzato - Grafica Chiara", shorttitle="Scalp BTC Opt", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === 📊 INPUTS ===

// 📈 Medie Mobili

emaFastLength = input.int(9, title="EMA Veloce", minval=1)

emaSlowLength = input.int(21, title="EMA Lenta", minval=1)

// 💡 RSI

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought")

rsiOversold = input.int(30, title="RSI Oversold")

// 📊 ATR (Stop Loss e Take Profit)

atrLength = input.int(14, title="ATR Length", minval=1)

stopATR = input.float(1.5, title="Stop Loss (ATR Multiplo)", step=0.1)

takeProfitATR = input.float(2.0, title="Take Profit (ATR Multiplo)", step=0.1)

// 🔀 ADX

adxLength = input.int(14, title="ADX Length", minval=1)

adxSmoothing = input.int(14, title="ADX Smoothing", minval=1)

adxThreshold = input.int(20, title="Soglia ADX per Trend Forte", minval=1)

// === 📊 CALCOLI PRINCIPALI ===

// 📈 Medie Mobili

emaFast = ta.ema(close, emaFastLength)

emaSlow = ta.ema(close, emaSlowLength)

// 💡 RSI

rsi = ta.rsi(close, rsiLength)

// 📊 ATR

atr = ta.atr(atrLength)

// 🔀 ADX tramite DMI con Smoothing

[adx, diPlus, diMinus] = ta.dmi(adxLength, adxSmoothing)

// === 📊 CONDIZIONI LONG E SHORT ===

// ✅ Long: EMA Veloce incrocia EMA Lenta al rialzo, RSI sotto 70, ADX > 20

longCondition = (ta.crossover(emaFast, emaSlow)) and (rsi < rsiOverbought) and (adx > adxThreshold)

// 🔻 Short: EMA Veloce incrocia EMA Lenta al ribasso, RSI sopra 30, ADX > 20

shortCondition = (ta.crossunder(emaFast, emaSlow)) and (rsi > rsiOversold) and (adx > adxThreshold)

// 📉 Stop Loss e Take Profit Dinamici

longStop = strategy.position_avg_price - (atr * stopATR)

longTarget = strategy.position_avg_price + (atr * takeProfitATR)

shortStop = strategy.position_avg_price + (atr * stopATR)

shortTarget = strategy.position_avg_price - (atr * takeProfitATR)

// === 🚀 INGRESSO E USCITA ===

// 🚦 Ingresso LONG

if (longCondition and strategy.position_size == 0)

strategy.entry("Long", strategy.long)

strategy.exit("TakeProfit/StopLoss Long", stop=longStop, limit=longTarget)

// 🚦 Ingresso SHORT

if (shortCondition and strategy.position_size == 0)

strategy.entry("Short", strategy.short)

strategy.exit("TakeProfit/StopLoss Short", stop=shortStop, limit=shortTarget)

// 🛑 USCITA MANUALE BASATA SU RSI

if (rsi > rsiOverbought and strategy.position_size > 0)

strategy.close("Long", comment="RSI Overbought Exit")

if (rsi < rsiOversold and strategy.position_size < 0)

strategy.close("Short", comment="RSI Oversold Exit")

// === 📊 VISUALIZZAZIONE GRAFICA OTTIMIZZATA ===

// 📈 MEDIE MOBILI ANCORATE ALLE CANDELE

plot(emaFast, title="EMA Veloce", color=color.blue, linewidth=2)

plot(emaSlow, title="EMA Lenta", color=color.red, linewidth=2)

// 📊 SEGNALI VISIVI ANCORATI ALLE CANDELE

plotshape(longCondition, title="Segnale Long", style=shape.triangleup, location=location.belowbar, color=color.green, text="Long", size=size.small)

plotshape(shortCondition, title="Segnale Short", style=shape.triangledown, location=location.abovebar, color=color.red, text="Short", size=size.small)

// 📊 RSI (Pannello Separato)

var float rsiPanel = na

rsiPanel := rsi

plot(rsiPanel, title="RSI", color=color.orange, linewidth=2)

hline(rsiOverbought, "RSI Overbought", color=color.red, linestyle=hline.style_dotted)

hline(rsiOversold, "RSI Oversold", color=color.green, linestyle=hline.style_dotted)

// 📊 ADX (Pannello Separato)

var float adxPanel = na

adxPanel := adx

plot(adxPanel, title="ADX", color=color.blue, linewidth=2)

hline(adxThreshold, "ADX Soglia", color=color.gray, linestyle=hline.style_dotted)

// 📊 ATR (Pannello Separato)

var float atrPanel = na

atrPanel := atr

plot(atrPanel, title="ATR", color=color.purple, linewidth=2)

// 🔔 ALERT

alertcondition(longCondition, title="Segnale Long", message="Entra Long Manualmente!")

alertcondition(shortCondition, title="Segnale Short", message="Entra Short Manualmente!")

相关推荐