概述

这是一个结合了指数移动平均线(EMA)和相对强弱指标(RSI)的趋势跟踪策略。策略通过监测快速和慢速EMA的交叉,同时结合RSI指标的超买超卖水平以及RSI背离来确定交易信号,实现对市场趋势的有效把握。策略在1小时时间周期上运行,通过多重技术指标的验证来提高交易的准确性。

策略原理

策略的核心逻辑包含以下几个关键要素: 1. 使用9周期和26周期的EMA来确定趋势方向,快线在慢线上方视为上升趋势,反之为下降趋势 2. 采用14周期的RSI指标,设定65和35作为多空信号的触发阈值 3. 在1小时时间周期上检测RSI背离,通过对比价格高低点与RSI高低点来识别潜在的趋势转折 4. 多头交易信号需满足:快速EMA在慢速EMA上方、RSI大于65、且无RSI看跌背离 5. 空头交易信号需满足:快速EMA在慢速EMA下方、RSI小于35、且无RSI看涨背离

策略优势

- 多重技术指标的交叉验证提高了交易信号的可靠性

- 通过RSI背离的检测降低了假突破带来的风险

- 结合了趋势跟踪和超买超卖的优势,既能把握大趋势又不错过短期交易机会

- 参数可根据不同市场特征进行优化调整

- 策略逻辑清晰,易于理解和执行

策略风险

- EMA作为滞后指标可能导致入场点不够理想

- RSI在震荡市场可能产生过多交易信号

- 背离判断可能出现误判,尤其在高波动市场

- 市场快速转向时可能造成较大回撤 缓解措施:

- 可增加止损止盈设置

- 考虑加入成交量指标验证

- 在震荡市调整RSI阈值

策略优化方向

- 引入自适应的RSI阈值,根据市场波动情况动态调整

- 加入成交量指标作为信号确认

- 开发更精确的背离检测算法

- 增加止损止盈管理机制

- 考虑添加市场波动率过滤器

总结

该策略通过结合均线系统、动量指标和背离分析,构建了一个相对完整的交易系统。策略注重信号的多重验证,有效降低了误判风险。虽然存在一定的滞后性,但通过参数优化和风险管理的改进,策略具有较好的实战应用价值。

策略源码

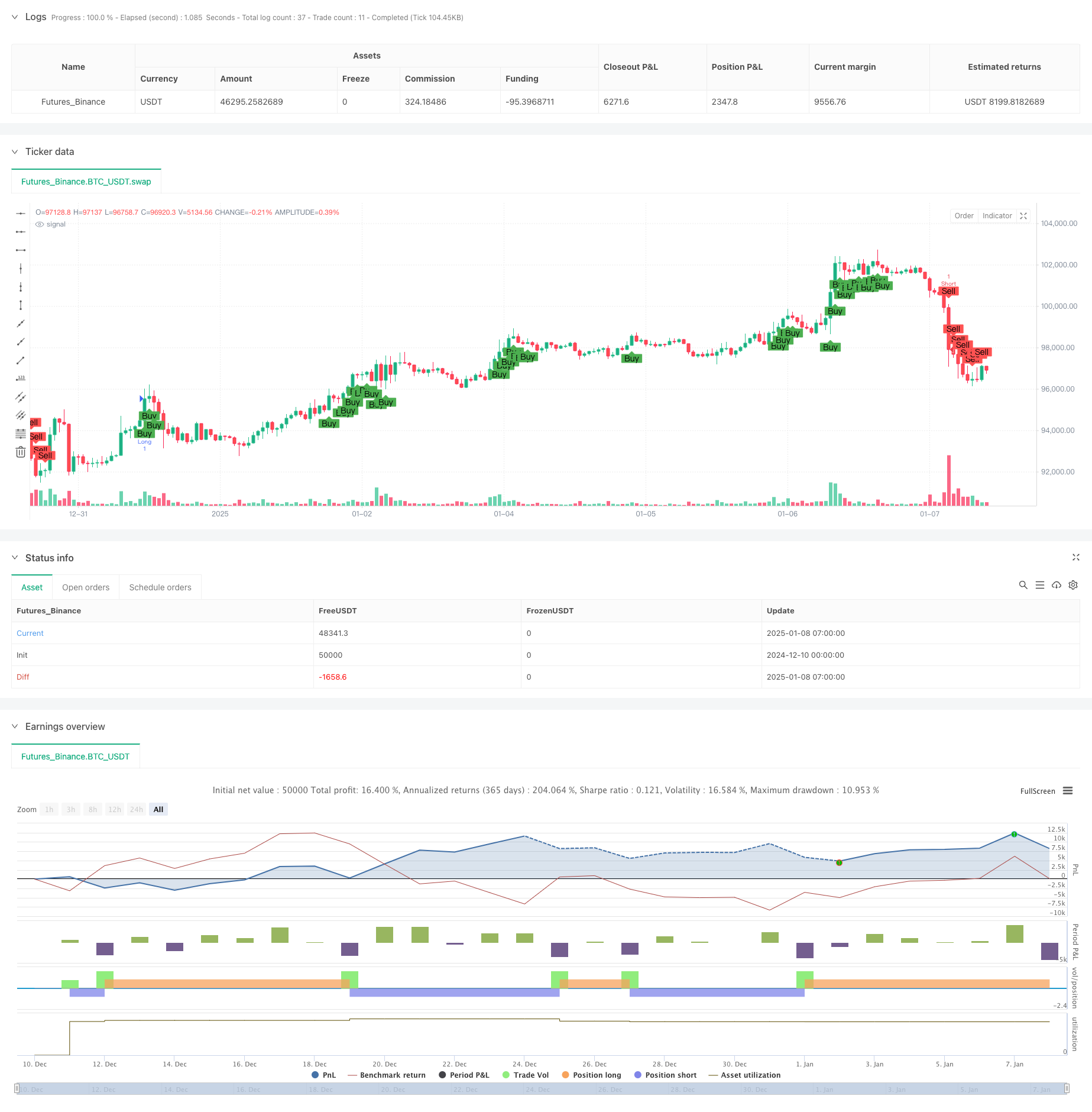

/*backtest

start: 2024-12-10 00:00:00

end: 2025-01-08 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA9_RSI_Strategy_LongShort", overlay=true)

// Parameters

fastLength = input.int(9, minval=1, title="Fast EMA Length")

slowLength = input.int(26, minval=1, title="Slow EMA Length")

rsiPeriod = input.int(14, minval=1, title="RSI Period")

rsiLevelLong = input.int(65, minval=1, title="RSI Level (Long)")

rsiLevelShort = input.int(35, minval=1, title="RSI Level (Short)")

// Define 1-hour timeframe

timeframe_1h = "60"

// Fetch 1-hour data

high_1h = request.security(syminfo.tickerid, timeframe_1h, high)

low_1h = request.security(syminfo.tickerid, timeframe_1h, low)

rsi_1h = request.security(syminfo.tickerid, timeframe_1h, ta.rsi(close, rsiPeriod))

// Current RSI

rsi = ta.rsi(close, rsiPeriod)

// Find highest/lowest price and corresponding RSI in the 1-hour timeframe

highestPrice_1h = ta.highest(high_1h, 1) // ราคาสูงสุดใน 1 ช่วงของ timeframe 1 ชั่วโมง

lowestPrice_1h = ta.lowest(low_1h, 1) // ราคาต่ำสุดใน 1 ช่วงของ timeframe 1 ชั่วโมง

highestRsi_1h = ta.valuewhen(high_1h == highestPrice_1h, rsi_1h, 0)

lowestRsi_1h = ta.valuewhen(low_1h == lowestPrice_1h, rsi_1h, 0)

// Detect RSI Divergence for Long

bearishDivLong = high > highestPrice_1h and rsi < highestRsi_1h

bullishDivLong = low < lowestPrice_1h and rsi > lowestRsi_1h

divergenceLong = bearishDivLong or bullishDivLong

// Detect RSI Divergence for Short (switch to low price for divergence check)

bearishDivShort = low > lowestPrice_1h and rsi < lowestRsi_1h

bullishDivShort = high < highestPrice_1h and rsi > highestRsi_1h

divergenceShort = bearishDivShort or bullishDivShort

// Calculate EMA

emaFast = ta.ema(close, fastLength)

emaSlow = ta.ema(close, slowLength)

// Long Conditions

longCondition = emaFast > emaSlow and rsi > rsiLevelLong and not divergenceLong

// Short Conditions

shortCondition = emaFast < emaSlow and rsi < rsiLevelShort and not divergenceShort

// Plot conditions

plotshape(longCondition, title="Buy", location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(shortCondition, title="Sell", location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

// Execute the strategy

if (longCondition)

strategy.entry("Long", strategy.long, comment="entry long")

if (shortCondition)

strategy.entry("Short", strategy.short, comment="entry short")

// Alert

alertcondition(longCondition, title="Buy Signal", message="Buy signal triggered!")

alertcondition(shortCondition, title="Sell Signal", message="Sell signal triggered!")

相关推荐