概述

该策略是一个基于分形理论和自适应网格的短线交易系统,结合了波动率阈值来优化交易时机。系统通过动态调整网格水平,在高波动期间捕捉市场微观结构变化,同时在低波动期间避免过度交易。策略集成了多重技术指标,包括平均真实波幅(ATR)、简单移动平均线(SMA)和分形突破点,构建了一个全面的交易决策框架。

策略原理

策略的核心是通过分形识别和波动率聚类来建立动态交易网格。具体实现包括以下几个关键步骤: 1. 使用枢轴高点(Pivot High)和枢轴低点(Pivot Low)识别局部极值点作为分形突破信号 2. 利用ATR指标度量市场波动性,并设定最小波动阈值作为交易触发条件 3. 基于ATR值和用户定义的乘数动态调整网格水平 4. 使用SMA确定趋势方向,为交易决策提供方向性偏差 5. 在网格水平设置限价订单,并根据ATR值调整止损和获利点位

策略优势

- 自适应性强 - 网格水平会根据市场波动性自动调整,适应不同市场环境

- 风险控制完善 - 集成了波动率阈值和追踪止损机制,有效控制风险

- 交易机会精准 - 通过分形突破和趋势方向双重确认,提高交易质量

- 可视化支持 - 提供分形点位和网格水平的图形化展示,便于监控

- 参数灵活 - 允许交易者根据个人风险偏好和市场条件调整各项参数

策略风险

- 参数敏感性 - 不同参数组合可能导致策略表现差异较大,需要充分测试

- 市场环境依赖 - 在波动性极低的市场中可能出现交易机会减少的情况

- 假突破风险 - 分形突破信号可能出现假突破,需要结合其他指标确认

- 滑点影响 - 在执行限价订单时可能遇到滑点,影响实际执行效果

- 资金管理要求 - 需要合理设置资金规模,避免过度承担风险

策略优化方向

- 引入更多技术指标 - 可以考虑添加RSI、MACD等指标进行信号确认

- 优化止损机制 - 可以开发更复杂的动态止损算法,提高风险控制效率

- 完善波动率模型 - 考虑使用更先进的波动率预测模型,如GARCH族模型

- 增加市场环境过滤 - 添加市场环境识别模块,在不同市场阶段采用不同参数

- 开发自适应参数系统 - 实现参数的自动优化,提高策略适应性

总结

这是一个结合了分形理论、网格交易和波动率过滤的综合性策略系统。通过多重技术指标的配合使用,实现了对市场微观结构的有效捕捉。策略的优势在于其自适应性和风险控制能力,但同时也需要注意参数优化和市场环境适应性的问题。通过持续优化和完善,该策略有望在不同市场环境下保持稳定的表现。

策略源码

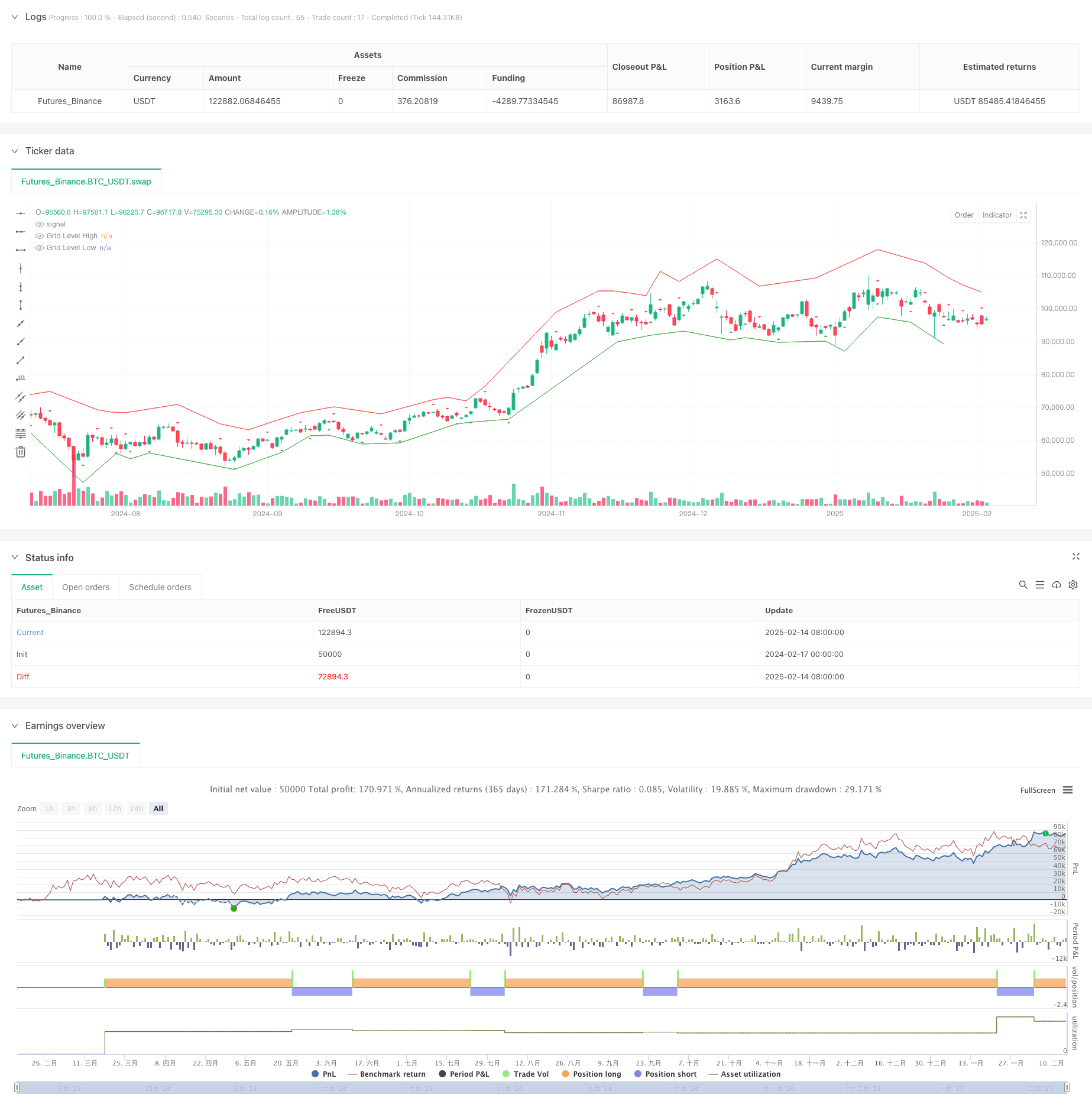

/*backtest

start: 2024-02-17 00:00:00

end: 2025-02-15 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Adaptive Fractal Grid Scalping Strategy", overlay=true)

// Inputs

atrLength = input.int(14, title="ATR Length")

smaLength = input.int(50, title="SMA Length")

gridMultiplierHigh = input.float(2.0, title="Grid Multiplier High")

gridMultiplierLow = input.float(0.5, title="Grid Multiplier Low")

trailStopMultiplier = input.float(0.5, title="Trailing Stop Multiplier")

volatilityThreshold = input.float(1.0, title="Volatility Threshold (ATR)")

// Calculate Fractals

fractalHigh = ta.pivothigh(high, 2, 2)

fractalLow = ta.pivotlow(low, 2, 2)

// Calculate ATR and SMA

atrValue = ta.atr(atrLength)

smaValue = ta.sma(close, smaLength)

// Determine Trend Direction

isBullish = close > smaValue

isBearish = close < smaValue

// Calculate Grid Levels

gridLevelHigh = fractalHigh + atrValue * gridMultiplierHigh

gridLevelLow = fractalLow - atrValue * gridMultiplierLow

// Plot Fractals and Grid Levels

plotshape(not na(fractalHigh), style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

plotshape(not na(fractalLow), style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plot(gridLevelHigh, color=color.red, linewidth=1, title="Grid Level High")

plot(gridLevelLow, color=color.green, linewidth=1, title="Grid Level Low")

// Trade Execution Logic with Volatility Threshold

if (atrValue > volatilityThreshold)

if (isBullish and not na(fractalLow))

strategy.entry("Buy", strategy.long, limit=gridLevelLow)

if (isBearish and not na(fractalHigh))

strategy.entry("Sell", strategy.short, limit=gridLevelHigh)

// Profit-Taking and Stop-Loss

strategy.exit("Take Profit/Stop Loss", "Buy", limit=gridLevelHigh, stop=fractalLow - atrValue * trailStopMultiplier)

strategy.exit("Take Profit/Stop Loss", "Sell", limit=gridLevelLow, stop=fractalHigh + atrValue * trailStopMultiplier)

相关推荐