概述

这个策略利用双指数移动均线(EMA)形成的价格带来识别高概率的反转机会。它不是简单的均线穿越策略,而是寻找价格从EMA带反弹并形成强势动量的时机。该策略使用12周期和21周期的EMA来构建交易区间,并结合蜡烛图形态、趋势一致性和精确的风险管理系统来捕捉市场动量。

策略原理

该策略的核心原理是通过识别价格从EMA带反弹的情况来寻找入场信号。它使用12周期和21周期的EMA来创建上下交易带,根据EMA的相对位置确定市场趋势方向。

当EMA12 > EMA21时,市场处于看涨环境(绿色带),我们寻找做多机会。做多条件包括:价格下影线触及EMA带、形成强势看涨蜡烛(实体大于下影线)、上影线最小化(小于蜡烛范围的2%)、收盘价高于两条EMA、前一蜡烛未收于下带之下,以及连续若干根蜡烛保持看涨趋势一致性。

当EMA12 < EMA21时,市场处于看跌环境(红色带),我们寻找做空机会。做空条件包括:价格上影线触及EMA带、形成强势看跌蜡烛(实体大于上影线)、下影线最小化(小于蜡烛范围的2%)、收盘价低于两条EMA、前一蜡烛未收于上带之上,以及连续若干根蜡烛保持看跌趋势一致性。

策略内置固定风险回报比的风险管理系统,默认为3:1,止损设置在前一蜡烛的高点/低点,止盈根据风险回报比自动计算。

策略优势

该策略具有多项显著优势:

高胜率潜力:通过捕捉EMA带反弹后的强势动量行情,该策略能够识别具有高概率成功的交易机会。

明确的入场与出场规则:策略提供了清晰的交易条件,减少了主观判断和情绪化决策的影响。

优秀的风险管理:采用固定风险回报比和自动止损止盈设置,确保每笔交易的风险受控。

趋势跟随优势:策略只在主导趋势方向上交易,避免逆势操作的高风险。

适用于多个时间周期:该策略可在各种时间周期上有效运行,提供灵活的交易选择。

全面的提醒系统:内置详细的交易信号提醒功能,确保不会错过交易机会。

可视化辅助:通过背景颜色变化和标签提示,直观展示交易信号和条件状态。

策略风险

尽管该策略设计精良,但仍存在以下潜在风险:

震荡市场风险:在横盘或震荡市场中,EMA带可能变得紧密,产生频繁但低质量的信号,导致连续止损。

剧烈行情跳空风险:在重大新闻或事件后,市场可能出现跳空,使止损点失效,造成超出预期的损失。

参数优化过度:过度优化策略参数可能导致曲线拟合,使策略在实盘交易中表现不佳。

趋势识别延迟:EMA作为滞后指标,在趋势转折点可能反应较慢,导致错过最佳入场点或延迟退出。

止损触发风险:市场噪音可能导致止损被触发后,价格又回到预期方向,造成不必要的损失。

解决方法包括:在震荡市场暂停交易;使用波动率过滤器避免低质量信号;结合其他指标确认趋势;定期回测和优化参数;考虑使用追踪止损。

策略优化方向

该策略可在以下几个方向进行优化:

动态风险管理:根据市场波动率自动调整风险回报比和仓位大小,在高波动环境下降低风险敞口。

高级过滤器引入:结合ATR(平均真实波幅)指标来过滤低波动期的信号;加入成交量确认以验证价格反弹的有效性。

多时间周期分析:整合更高时间周期的趋势方向作为额外过滤条件,只在多个时间周期趋势一致时入场。

机器学习优化:使用机器学习算法动态调整参数,根据不同市场环境自适应最优参数组合。

追踪止损实现:在盈利达到一定水平后,实施追踪止损机制,锁定部分利润的同时允许趋势继续发展。

部分获利策略:实施分批获利策略,在不同目标价位逐步减仓,优化整体风险回报表现。

这些优化方向可以提高策略的稳健性、适应性和长期盈利能力。

总结

双指数移动均线带反弹动量交易策略是一个结合了技术分析、蜡烛图形态识别和严格风险管理的综合交易系统。它通过识别价格从EMA带反弹的高概率反转点,捕捉具有爆发性动量的市场机会。该策略的核心优势在于其清晰的交易规则、固定的风险回报框架和趋势一致性要求,使其适合各类市场环境和时间周期。

尽管存在一些潜在风险,但通过实施建议的优化措施,交易者可以进一步提高策略的稳健性和盈利能力。该策略特别适合那些寻求系统化、纪律化和风险可控交易方法的交易者,无论是短线还是中长期投资者都能从中受益。

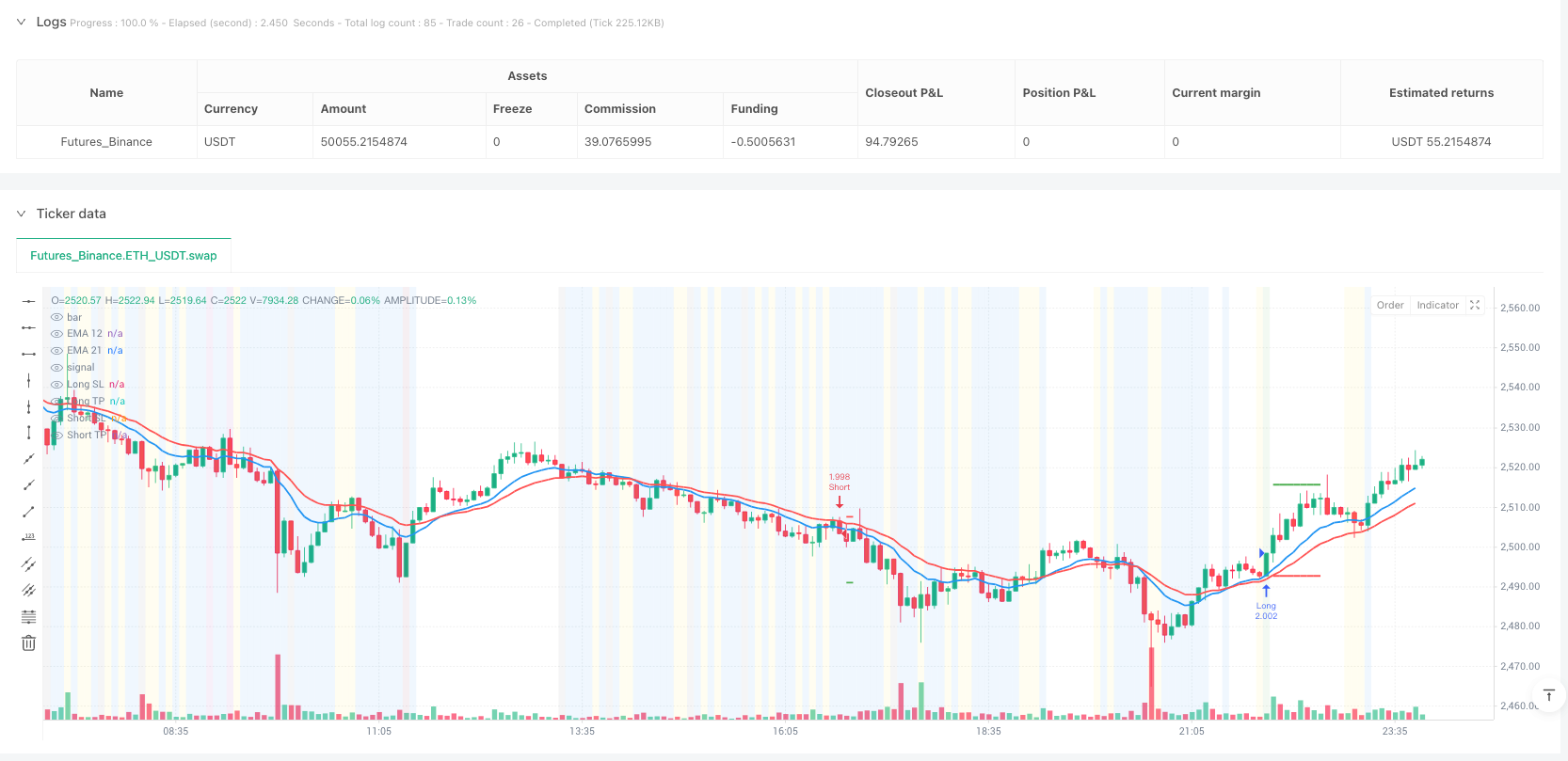

/*backtest

start: 2025-05-26 00:00:00

end: 2025-06-02 00:00:00

period: 5m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Enhanced EMA Band Rejection Strategy", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Input parameters

ema12_length = input.int(12, title="EMA 12 Length")

ema21_length = input.int(21, title="EMA 21 Length")

max_wick_percent = input.float(2.0, title="Max Wick % at High/Low", minval=0.0, maxval=10.0)

risk_reward_ratio = input.float(3.0, title="Risk/Reward Ratio (R)", minval=1.0, maxval=10.0)

trend_consistency_bars = input.int(5, title="Trend Consistency Required (Bars)", minval=1, maxval=20)

// Notification Settings

enable_notifications = input.bool(true, title="Enable Notifications", group="Notifications")

notify_on_entry = input.bool(true, title="Notify on Trade Entry", group="Notifications")

notify_on_exit = input.bool(true, title="Notify on Trade Exit", group="Notifications")

notify_on_setup = input.bool(false, title="Notify on Potential Setup (Pre-Entry)", group="Notifications")

notify_on_failed_conditions = input.bool(false, title="Notify on Failed Conditions", group="Notifications")

// Calculate EMAs

ema12 = ta.ema(close, ema12_length)

ema21 = ta.ema(close, ema21_length)

// Determine upper and lower EMA bands

ema_upper = math.max(ema12, ema21)

ema_lower = math.min(ema12, ema21)

// Plot EMAs

plot(ema12, color=color.blue, linewidth=2, title="EMA 12")

plot(ema21, color=color.red, linewidth=2, title="EMA 21")

// Calculate candle components

body_size = math.abs(close - open)

upper_wick = high - math.max(open, close)

lower_wick = math.min(open, close) - low

candle_range = high - low

// Calculate wick percentages

upper_wick_percent = candle_range > 0 ? (upper_wick / candle_range) * 100 : 0

lower_wick_percent = candle_range > 0 ? (lower_wick / candle_range) * 100 : 0

// Determine EMA trend direction

ema_bullish = ema12 > ema21 // Green bands - bullish trend

ema_bearish = ema12 < ema21 // Red bands - bearish trend

// Check trend consistency for required number of bars

bullish_consistency_check = true

bearish_consistency_check = true

for i = 0 to trend_consistency_bars - 1

ema12_past = ta.ema(close[i], ema12_length)

ema21_past = ta.ema(close[i], ema21_length)

if ema12_past <= ema21_past

bullish_consistency_check := false

if ema12_past >= ema21_past

bearish_consistency_check := false

// Final trend conditions with consistency requirement

ema_bullish_consistent = ema_bullish and bullish_consistency_check

ema_bearish_consistent = ema_bearish and bearish_consistency_check

// NEW RULE: Previous candle close position relative to bands

prev_close_above_upper_band = close[1] > ema_upper[1]

prev_close_below_lower_band = close[1] < ema_lower[1]

prev_close_within_bands = close[1] >= ema_lower[1] and close[1] <= ema_upper[1]

// Long setup conditions (only when EMAs are bullish/green consistently)

long_wick_condition = low <= ema_lower or (low <= ema_upper and low >= ema_lower)

long_body_condition = body_size >= lower_wick

long_wick_percent_condition = upper_wick_percent <= max_wick_percent

long_bullish_candle = close > open

long_trend_condition = ema_bullish_consistent // Only long when bands are consistently green

long_close_above_bands = close > ema_upper // NEW: Close must be above both EMAs

// Previous candle must not have closed below the lower band

long_prev_close_condition = not prev_close_below_lower_band

long_setup = long_wick_condition and long_body_condition and long_wick_percent_condition and long_bullish_candle and long_trend_condition and long_close_above_bands and long_prev_close_condition

// Short setup conditions (only when EMAs are bearish/red consistently)

short_wick_condition = high >= ema_upper or (high >= ema_lower and high <= ema_upper)

short_body_condition = body_size >= upper_wick

short_wick_percent_condition = lower_wick_percent <= max_wick_percent

short_bearish_candle = close < open

short_trend_condition = ema_bearish_consistent // Only short when bands are consistently red

short_close_below_bands = close < ema_lower // NEW: Close must be below both EMAs

// Previous candle must not have closed above the upper band

short_prev_close_condition = not prev_close_above_upper_band

short_setup = short_wick_condition and short_body_condition and short_wick_percent_condition and short_bearish_candle and short_trend_condition and short_close_below_bands and short_prev_close_condition

// Entry conditions

var float long_sl = na

var float short_sl = na

var float long_tp = na

var float short_tp = na

if long_setup and strategy.position_size == 0

strategy.entry("Long", strategy.long)

long_sl := low

risk_amount = close - long_sl

long_tp := close + (risk_amount * risk_reward_ratio)

label.new(bar_index, low, "LONG", style=label.style_label_up, color=color.green, size=size.small)

// Entry Notification

if enable_notifications and notify_on_entry

alert("🟢 LONG ENTRY SIGNAL\n" +

"Symbol: " + syminfo.ticker + "\n" +

"Price: " + str.tostring(close, "#.####") + "\n" +

"Stop Loss: " + str.tostring(long_sl, "#.####") + "\n" +

"Take Profit: " + str.tostring(long_tp, "#.####") + "\n" +

"Risk/Reward: " + str.tostring(risk_reward_ratio, "#.##") + "R\n" +

"Time: " + str.tostring(time), alert.freq_once_per_bar)

if short_setup and strategy.position_size == 0

strategy.entry("Short", strategy.short)

short_sl := high

risk_amount = short_sl - close

short_tp := close - (risk_amount * risk_reward_ratio)

label.new(bar_index, high, "SHORT", style=label.style_label_down, color=color.red, size=size.small)

// Entry Notification

if enable_notifications and notify_on_entry

alert("🔴 SHORT ENTRY SIGNAL\n" +

"Symbol: " + syminfo.ticker + "\n" +

"Price: " + str.tostring(close, "#.####") + "\n" +

"Stop Loss: " + str.tostring(short_sl, "#.####") + "\n" +

"Take Profit: " + str.tostring(short_tp, "#.####") + "\n" +

"Risk/Reward: " + str.tostring(risk_reward_ratio, "#.##") + "R\n" +

"Time: " + str.tostring(time), alert.freq_once_per_bar)

// Exit conditions with fixed R:R

if strategy.position_size > 0

// Long position - fixed stop loss and take profit

strategy.exit("Long Exit", "Long", stop=long_sl, limit=long_tp)

// Exit Notifications

if enable_notifications and notify_on_exit

if close <= long_sl

alert("🛑 LONG STOP LOSS HIT\n" +

"Symbol: " + syminfo.ticker + "\n" +

"Exit Price: " + str.tostring(close, "#.####") + "\n" +

"Loss: " + str.tostring(close - strategy.position_avg_price, "#.####") + "\n" +

"Time: " + str.tostring(time), alert.freq_once_per_bar)

if close >= long_tp

alert("🎯 LONG TAKE PROFIT HIT\n" +

"Symbol: " + syminfo.ticker + "\n" +

"Exit Price: " + str.tostring(close, "#.####") + "\n" +

"Profit: " + str.tostring(close - strategy.position_avg_price, "#.####") + "\n" +

"Time: " + str.tostring(time), alert.freq_once_per_bar)

if strategy.position_size < 0

// Short position - fixed stop loss and take profit

strategy.exit("Short Exit", "Short", stop=short_sl, limit=short_tp)

// Exit Notifications

if enable_notifications and notify_on_exit

if close >= short_sl

alert("🛑 SHORT STOP LOSS HIT\n" +

"Symbol: " + syminfo.ticker + "\n" +

"Exit Price: " + str.tostring(close, "#.####") + "\n" +

"Loss: " + str.tostring(strategy.position_avg_price - close, "#.####") + "\n" +

"Time: " + str.tostring(time), alert.freq_once_per_bar)

if close <= short_tp

alert("🎯 SHORT TAKE PROFIT HIT\n" +

"Symbol: " + syminfo.ticker + "\n" +

"Exit Price: " + str.tostring(close, "#.####") + "\n" +

"Profit: " + str.tostring(strategy.position_avg_price - close, "#.####") + "\n" +

"Time: " + str.tostring(time), alert.freq_once_per_bar)

// Plot stop levels and take profit levels

plot(strategy.position_size > 0 ? long_sl : na, color=color.red, linewidth=2, style=plot.style_line, title="Long SL")

plot(strategy.position_size < 0 ? short_sl : na, color=color.red, linewidth=2, style=plot.style_line, title="Short SL")

plot(strategy.position_size > 0 ? long_tp : na, color=color.green, linewidth=2, style=plot.style_line, title="Long TP")

plot(strategy.position_size < 0 ? short_tp : na, color=color.green, linewidth=2, style=plot.style_line, title="Short TP")

// Additional Notification Logic

// Potential Setup Notifications (when most conditions are met but not all)

long_potential_setup = long_wick_condition and long_body_condition and long_wick_percent_condition and long_bullish_candle and long_trend_condition and long_prev_close_condition and not long_close_above_bands

short_potential_setup = short_wick_condition and short_body_condition and short_wick_percent_condition and short_bearish_candle and short_trend_condition and short_prev_close_condition and not short_close_below_bands

if enable_notifications and notify_on_setup and strategy.position_size == 0

if long_potential_setup

alert("⚠️ POTENTIAL LONG SETUP\n" +

"Symbol: " + syminfo.ticker + "\n" +

"Price: " + str.tostring(close, "#.####") + "\n" +

"Status: Close needs to be above " + str.tostring(ema_upper, "#.####") + "\n" +

"Current Close: " + str.tostring(close, "#.####") + "\n" +

"Time: " + str.tostring(time), alert.freq_once_per_bar)

if short_potential_setup

alert("⚠️ POTENTIAL SHORT SETUP\n" +

"Symbol: " + syminfo.ticker + "\n" +

"Price: " + str.tostring(close, "#.####") + "\n" +

"Status: Close needs to be below " + str.tostring(ema_lower, "#.####") + "\n" +

"Current Close: " + str.tostring(close, "#.####") + "\n" +

"Time: " + str.tostring(time), alert.freq_once_per_bar)

// Failed Conditions Notifications (for debugging)

if enable_notifications and notify_on_failed_conditions and strategy.position_size == 0

if long_wick_condition and long_body_condition and long_wick_percent_condition and long_bullish_candle and not long_trend_condition

alert("❌ LONG SETUP FAILED\n" +

"Symbol: " + syminfo.ticker + "\n" +

"Reason: " + (not ema_bullish ? "EMA trend bearish" : "EMA trend not consistent") + "\n" +

"EMA12: " + str.tostring(ema12, "#.####") + "\n" +

"EMA21: " + str.tostring(ema21, "#.####") + "\n" +

"Time: " + str.tostring(time), alert.freq_once_per_bar)

if short_wick_condition and short_body_condition and short_wick_percent_condition and short_bearish_candle and not short_trend_condition

alert("❌ SHORT SETUP FAILED\n" +

"Symbol: " + syminfo.ticker + "\n" +

"Reason: " + (not ema_bearish ? "EMA trend bullish" : "EMA trend not consistent") + "\n" +

"EMA12: " + str.tostring(ema12, "#.####") + "\n" +

"EMA21: " + str.tostring(ema21, "#.####") + "\n" +

"Time: " + str.tostring(time), alert.freq_once_per_bar)

bgcolor(long_setup ? color.new(color.green, 90) : na, title="Long Setup")

bgcolor(short_setup ? color.new(color.red, 90) : na, title="Short Setup")

// Show when previous close condition fails

bgcolor(long_wick_condition and long_body_condition and long_wick_percent_condition and long_bullish_candle and long_trend_condition and prev_close_below_lower_band ? color.new(color.orange, 95) : na, title="Long Rejected by Prev Close")

bgcolor(short_wick_condition and short_body_condition and short_wick_percent_condition and short_bearish_candle and short_trend_condition and prev_close_above_upper_band ? color.new(color.orange, 95) : na, title="Short Rejected by Prev Close")

// Detailed debugging for failed conditions

long_all_conditions_except_prev = long_wick_condition and long_body_condition and long_wick_percent_condition and long_bullish_candle and long_trend_condition and long_close_above_bands

bgcolor(long_all_conditions_except_prev and prev_close_below_lower_band ? color.new(color.purple, 90) : na, title="Long Failed: Prev Close Below Band")

bgcolor(long_wick_condition and not long_body_condition ? color.new(color.yellow, 90) : na, title="Long Failed: Body Too Small")

bgcolor(long_wick_condition and long_body_condition and not long_wick_percent_condition ? color.new(color.blue, 90) : na, title="Long Failed: Upper Wick Too Big")

bgcolor(long_wick_condition and long_body_condition and long_wick_percent_condition and not long_bullish_candle ? color.new(color.gray, 90) : na, title="Long Failed: Not Bullish Candle")

bgcolor(long_wick_condition and long_body_condition and long_wick_percent_condition and long_bullish_candle and ema_bullish and not ema_bullish_consistent ? color.new(color.fuchsia, 90) : na, title="Long Failed: Trend Not Consistent")

bgcolor(long_wick_condition and long_body_condition and long_wick_percent_condition and long_bullish_candle and not ema_bullish ? color.new(color.maroon, 90) : na, title="Long Failed: EMA Trend Bearish")

bgcolor(long_wick_condition and long_body_condition and long_wick_percent_condition and long_bullish_candle and long_trend_condition and not long_close_above_bands ? color.new(color.lime, 90) : na, title="Long Failed: Close Not Above Bands")

// Similar debugging for shorts

short_all_conditions_except_prev = short_wick_condition and short_body_condition and short_wick_percent_condition and short_bearish_candle and short_trend_condition and short_close_below_bands

bgcolor(short_all_conditions_except_prev and prev_close_above_upper_band ? color.new(color.purple, 90) : na, title="Short Failed: Prev Close Above Band")

bgcolor(short_wick_condition and short_body_condition and short_wick_percent_condition and short_bearish_candle and short_trend_condition and not short_close_below_bands ? color.new(color.aqua, 90) : na, title="Short Failed: Close Not Below Bands")

// Enhanced table for debugging

if barstate.islast

var table debug_table = table.new(position.top_right, 2, 19, bgcolor=color.white, border_width=1)

table.cell(debug_table, 0, 0, "Condition", text_color=color.black, bgcolor=color.gray)

table.cell(debug_table, 1, 0, "Value", text_color=color.black, bgcolor=color.gray)

table.cell(debug_table, 0, 1, "Body Size", text_color=color.black)

table.cell(debug_table, 1, 1, str.tostring(body_size, "#.##"), text_color=color.black)

table.cell(debug_table, 0, 2, "Upper Wick", text_color=color.black)

table.cell(debug_table, 1, 2, str.tostring(upper_wick, "#.##"), text_color=color.black)

table.cell(debug_table, 0, 3, "Lower Wick", text_color=color.black)

table.cell(debug_table, 1, 3, str.tostring(lower_wick, "#.##"), text_color=color.black)

table.cell(debug_table, 0, 4, "Upper Wick %", text_color=color.black)

table.cell(debug_table, 1, 4, str.tostring(upper_wick_percent, "#.##") + "%", text_color=color.black)

table.cell(debug_table, 0, 5, "Lower Wick %", text_color=color.black)

table.cell(debug_table, 1, 5, str.tostring(lower_wick_percent, "#.##") + "%", text_color=color.black)

table.cell(debug_table, 0, 6, "EMA Upper", text_color=color.black)

table.cell(debug_table, 1, 6, str.tostring(ema_upper, "#.##"), text_color=color.black)

table.cell(debug_table, 0, 7, "EMA Lower", text_color=color.black)

table.cell(debug_table, 1, 7, str.tostring(ema_lower, "#.##"), text_color=color.black)

table.cell(debug_table, 0, 8, "R:R Ratio", text_color=color.black)

table.cell(debug_table, 1, 8, str.tostring(risk_reward_ratio, "#.##") + "R", text_color=color.black)

table.cell(debug_table, 0, 9, "Position", text_color=color.black)

table.cell(debug_table, 1, 9, strategy.position_size > 0 ? "LONG" : strategy.position_size < 0 ? "SHORT" : "NONE", text_color=color.black)

// NEW DEBUG INFO

table.cell(debug_table, 0, 10, "Prev Close", text_color=color.black)

table.cell(debug_table, 1, 10, str.tostring(close[1], "#.##"), text_color=color.black)

table.cell(debug_table, 0, 11, "Prev Above Upper", text_color=color.black)

table.cell(debug_table, 1, 11, prev_close_above_upper_band ? "YES" : "NO", text_color=color.black)

table.cell(debug_table, 0, 12, "Prev Below Lower", text_color=color.black)

table.cell(debug_table, 1, 12, prev_close_below_lower_band ? "YES" : "NO", text_color=color.black)

table.cell(debug_table, 0, 13, "Prev Within Bands", text_color=color.black)

table.cell(debug_table, 1, 13, prev_close_within_bands ? "YES" : "NO", text_color=color.black)

// NEW: Trend consistency info

table.cell(debug_table, 0, 14, "Bullish Consistent", text_color=color.black)

table.cell(debug_table, 1, 14, ema_bullish_consistent ? "YES" : "NO", text_color=color.black)

table.cell(debug_table, 0, 15, "Bearish Consistent", text_color=color.black)

table.cell(debug_table, 1, 15, ema_bearish_consistent ? "YES" : "NO", text_color=color.black)

table.cell(debug_table, 0, 16, "Consistency Bars", text_color=color.black)

table.cell(debug_table, 1, 16, str.tostring(trend_consistency_bars), text_color=color.black)

// NEW: Close position relative to bands

table.cell(debug_table, 0, 17, "Close Above Upper", text_color=color.black)

table.cell(debug_table, 1, 17, close > ema_upper ? "YES" : "NO", text_color=color.black)

table.cell(debug_table, 0, 18, "Close Below Lower", text_color=color.black)

table.cell(debug_table, 1, 18, close < ema_lower ? "YES" : "NO", text_color=color.black)