概述

双时框随机震荡指标套利交易策略是一种基于随机震荡指标(Stochastic Oscillator)的日内高频交易系统,该策略核心利用两个不同参数设置的随机震荡指标在15秒时间框架上进行交易信号生成和确认。主要逻辑为通过主要随机指标的%K线与%D线的交叉来识别潜在入场点,同时参考次要随机指标的%D值作为市场状态过滤器,结合移动平均线和市场时间过滤条件,构建了一个多层确认机制的交易系统。该策略还包含了高低模式识别功能,可以捕捉牛市和熊市延续形态,并设置了多种风险控制参数以减少假信号。

策略原理

策略采用双重随机震荡指标系统,分别称为主要指标和参考指标:

主要随机震荡指标设置:

- 时间框架:15秒

- K线长度:12

- K线平滑度:12

- D线长度:12

参考随机震荡指标设置:

- 时间框架:15秒

- K线长度:12

- K线平滑度:15

- D线长度:30

入场逻辑设计精细,多层次确认信号有效性: - 多头入场条件: - 主要指标%K线上穿%D线,且 - 参考指标%D值≥50或<20,或 - 主要指标%K接近参考指标%D(差值在0.15以内) - 价格位于移动平均线之上(如果启用MA过滤) - 交易时间必须在常规市场时段(9:30 AM - 4:00 PM ET)

- 空头入场条件:

- 主要指标%K线下穿%D线,且

- 位于参考指标%D的容差范围内,或满足特定下穿条件

- 价格位于移动平均线之下

- 交易时间必须在常规市场时段

退出逻辑基于时间和技术信号的组合: - 时间退出: - 在东部时间下午3:30(常规市场时段结束前) - 技术退出: - 多头仓位:当主要指标%K下穿参考指标%D - 空头仓位:当主要指标%K上穿参考指标%D且参考指标%D>20

策略还集成了形态识别功能: - 更高低点形态:当前上穿点的%K值高于前一上穿点的%K值(看涨延续形态) - 更低高点形态:当前下穿点的%K值低于前一下穿点的%K值(看跌延续形态)

策略优势

多层确认机制:通过两个不同配置的随机震荡指标相互确认,减少单一指标产生的假信号,提高信号可靠性。

精确的入场和退出规则:策略定义了明确的入场和退出条件,消除交易决策的主观性,实现完全系统化交易。

形态识别能力:能够识别市场中的”更高低点”和”更低高点”形态,捕捉趋势延续机会,这是很多简单策略无法实现的功能。

时间过滤器:通过限制交易时间在常规市场时段,避开了开盘和收盘前的高波动低流动性时段,减少滑点和成本。

移动平均线过滤:可选的移动平均线过滤功能增加了趋势确认层,确保交易方向与整体趋势一致。

价格差异和容差参数:策略引入了多种参数控制价格变动幅度和指标差异范围,有效过滤了微小波动产生的噪音信号。

动态逻辑转换:系统能够基于市场状态动态调整从多头到空头和从空头到多头的转换条件,适应性更强。

全面的警报系统:策略集成了丰富的警报条件,便于实时监控和执行交易。

策略风险

短时间框架的高频交易风险:策略使用15秒时间框架可能产生过多信号,导致交易频繁,增加交易成本,在市场波动大的情况下可能产生大量假信号。

缺乏止损机制:代码中没有明确的止损实现,在趋势突然逆转时可能面临较大亏损风险。缺少风险控制是策略的主要弱点之一。

参数敏感性:策略使用的多个精确参数(如0.15的差异阈值,0.1%的价格差异上限等)可能对不同市场条件过于敏感,需要频繁调整。

时间限制的机会成本:仅在常规市场时段交易可能错过一些重要的盘前和盘后机会,特别是在重大新闻发布后的市场反应。

对流动性依赖:高频策略在低流动性市场可能面临滑点问题,实际执行价格可能与信号生成时的价格有显著差异。

技术指标延迟:随机震荡指标本身具有一定滞后性,尤其在快速反转市场中,可能无法及时捕捉转折点。

过度拟合风险:策略参数精细调整可能导致对历史数据过度拟合,在未来市场环境中表现不佳。

策略优化方向

增加止损机制:最关键的优化点是实现智能止损系统,可考虑基于ATR(平均真实波动范围)的止损策略,或使用技术水平(如前期高低点)作为止损点,以限制单笔交易的最大亏损。

引入仓位管理:基于市场波动性和账户风险承受能力动态调整交易规模,在不同信号强度下使用不同的仓位配置,以优化资金利用率和风险收益比。

加入成交量确认:将成交量指标整合到系统中,要求重要的入场信号必须有足够的成交量支持,可以过滤掉低成交量环境下不可靠的信号。

多指标融合:考虑结合RSI、MACD或布林带等其他动量和趋势指标,构建更全面的市场视角,提高系统稳健性。

优化时间框架:测试不同的基础时间框架,如1分钟或5分钟,可能会减少噪音同时保留足够的交易机会,找到信号质量和数量的最佳平衡点。

增加回测统计跟踪:实现更全面的回测性能指标,如最大回撤、夏普比率、胜率、盈亏比等,以便更科学地评估策略表现。

自适应参数:将固定参数转变为基于市场波动性动态调整的自适应参数,使策略能够适应不同市场环境。

增加市场环境过滤:加入VIX(波动率指数)或类似指标作为市场环境过滤条件,在高波动环境下调整策略参数或暂停交易。

总结

双时框随机震荡指标套利交易策略是一个精心设计的短期高频交易系统,通过双重随机震荡指标、移动平均线过滤和时间过滤等多层确认机制,提高了交易信号的可靠性。该策略在规则市场时段内,识别短期超买超卖转折点和趋势延续形态,适合具有足够流动性和适度波动性的市场。

尽管策略设计结构完善,但仍存在高频交易固有的风险和缺少止损等关键风险管理机制的不足。为了提高策略的稳健性和长期盈利能力,建议加入止损机制、仓位管理系统、成交量确认和多指标融合等优化措施。此外,将固定参数转变为自适应参数,并增加全面的回测统计跟踪,将有助于策略在不同市场环境中保持稳定表现。

随着交易者对该策略的深入理解和持续优化,这一交易系统有潜力成为日内交易工具箱中的有效组成部分,尤其适合对技术指标有深入理解并能及时监控市场的交易者使用。

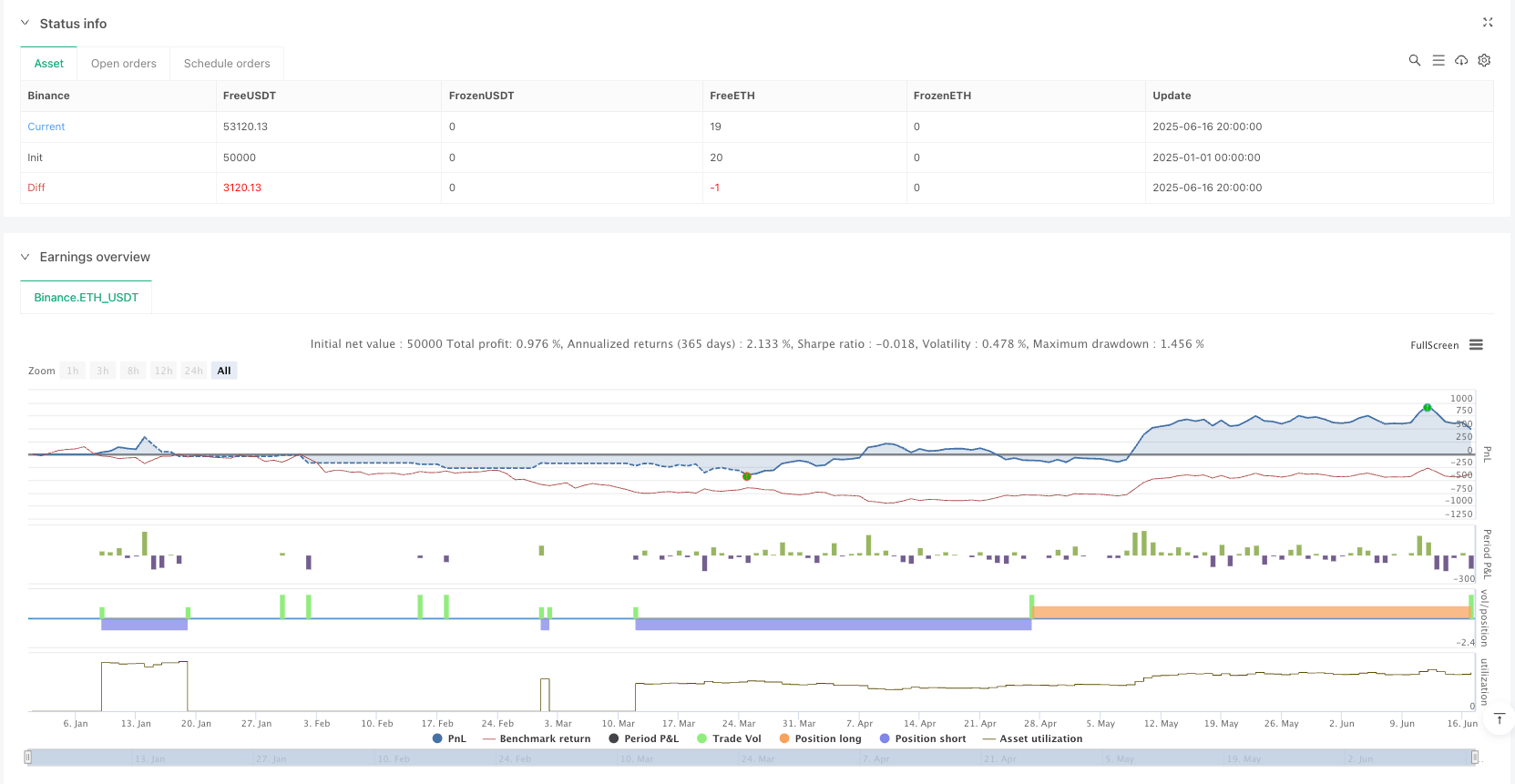

/*backtest

start: 2025-01-01 00:00:00

end: 2025-06-17 00:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Dual TF Stochastic Strategy", overlay=false)

// Input parameters with updated defaults

primaryLen = input.int(12, "Primary Stoch K Length", minval=1) // Changed from 14 to 12

primarySmooth = input.int(12, "Primary Stoch K Smoothing", minval=1) // Changed from 3 to 12

primaryDLen = input.int(12, "Primary Stoch D Length", minval=1) // Changed from 3 to 12

primaryRes = input.timeframe("15S", "Primary Timeframe") // Changed from "" to "15S"

refLen = input.int(12, "Reference Stoch K Length", minval=1) // Changed from 14 to 12

refSmooth = input.int(15, "Reference Stoch K Smoothing", minval=1) // Changed from 3 to 15

refDLen = input.int(30, "Reference Stoch D Length", minval=1) // Changed from 3 to 30

refRes = input.timeframe("15S", "Reference Timeframe") // Changed from "D" to "15S"

tolerance = input.float(0.1, "Ref D Tolerance %", minval=0.1, maxval=10.0, step=0.1) // Changed from 1.0 to 0.1

maxPriceDiff = input.float(0.1, "Maximum Price % Difference", minval=0.1, maxval=5.0, step=0.1) // Changed from 1.0 to 0.1

closeKThreshold = input.float(0.7, "Close %K Tolerance %", minval=0.1, maxval=10.0, step=0.1) // Changed from 5.0 to 0.7

minPriceDiffShort = input.float(0.1, "Min Price % Diff for Close %K Short", minval=0.1, maxval=5.0, step=0.1) // Changed from 0.5 to 0.1

showLabels = input.bool(true, "Show Crossover/Crossunder Labels")

// Time Filters (America/New_York timezone, UTC-4)

is_premarket = hour(time, "America/New_York") < 9

is_postmarket = hour(time, "America/New_York") >= 16

is_regular_hours = hour(time, "America/New_York") >= 9 and hour(time, "America/New_York") < 16

is_exit_time = hour(time, "America/New_York") >= 15 and minute(time, "America/New_York") >= 30 // 3:30 PM ET

// Moving Average Settings

useMAFilter = input.bool(true, "Use Moving Average Filter")

maLength = input.int(200, "Moving Average Length", minval=1)

maType = input.string("SMA", "Moving Average Type", options=["SMA", "EMA", "WMA", "VWMA"])

maTimeframe = input.timeframe("", "Moving Average Timeframe")

// Stochastic Calculations

primaryHighest = ta.highest(high, primaryLen)

primaryLowest = ta.lowest(low, primaryLen)

primaryK_raw = 100 * (close - primaryLowest) / (primaryHighest - primaryLowest)

primaryK = ta.sma(primaryK_raw, primarySmooth)

primaryD = ta.sma(primaryK, primaryDLen)

[primaryK_tf, primaryD_tf] = request.security(syminfo.tickerid, primaryRes, [primaryK, primaryD])

refHighest = ta.highest(high, refLen)

refLowest = ta.lowest(low, refLen)

refK_raw = 100 * (close - refLowest) / (refHighest - refLowest)

refK = ta.sma(refK_raw, refSmooth)

refD = ta.sma(refK, refDLen)

[refK_tf, refD_tf] = request.security(syminfo.tickerid, refRes, [refK, refD])

// Calculate Moving Average

var float ma = na

if useMAFilter

if maType == "SMA"

ma := request.security(syminfo.tickerid, maTimeframe, ta.sma(close, maLength))

else if maType == "EMA"

ma := request.security(syminfo.tickerid, maTimeframe, ta.ema(close, maLength))

else if maType == "WMA"

ma := request.security(syminfo.tickerid, maTimeframe, ta.wma(close, maLength))

else if maType == "VWMA"

ma := request.security(syminfo.tickerid, maTimeframe, ta.vwma(close, maLength))

// Price relative to MA

priceAboveMA = not useMAFilter or close > ma

priceBelowMA = not useMAFilter or close < ma

// Crossover Detection and Tracking

crossOver = ta.crossover(primaryK_tf, primaryD_tf)

crossUnder = ta.crossunder(primaryK_tf, primaryD_tf)

// Separate tracking for crossover and crossunder %K and price

var float lastCrossOverK = na

var float lastCrossOverPrice = na

var float currentCrossOverK = na

var float currentCrossOverPrice = na

var float lastCrossUnderK = na

var float lastCrossUnderPrice = na

var float currentCrossUnderK = na

var float currentCrossUnderPrice = na

// Update crossover tracking variables

if crossOver

lastCrossOverK := nz(currentCrossOverK, primaryK_tf[1])

lastCrossOverPrice := nz(currentCrossOverPrice, close[1])

currentCrossOverK := primaryK_tf

currentCrossOverPrice := close

// Update crossunder tracking variables

if crossUnder

lastCrossUnderK := nz(currentCrossUnderK, primaryK_tf[1])

lastCrossUnderPrice := nz(currentCrossUnderPrice, close[1])

currentCrossUnderK := primaryK_tf

currentCrossUnderPrice := close

// Calculate differences separately

crossOverPriceDiffPercent = math.abs((currentCrossOverPrice - lastCrossOverPrice) / lastCrossOverPrice * 100)

crossOverKDiffPercent = math.abs((currentCrossOverK - lastCrossOverK) / lastCrossOverK * 100)

crossUnderPriceDiffPercent = math.abs((currentCrossUnderPrice - lastCrossUnderPrice) / lastCrossUnderPrice * 100)

crossUnderKDiffPercent = math.abs((currentCrossUnderK - lastCrossUnderK) / lastCrossUnderK * 100)

isKCloseCrossUnder = crossUnderKDiffPercent <= closeKThreshold and not na(lastCrossUnderK)

// New condition for long entry based on %K and refD_tf difference

kAndRefDDiffClose = crossOver and math.abs(currentCrossOverK - refD_tf) <= 0.15

// Labels for crossover and crossunder (optional)

if showLabels

if crossOver

diffKandRefD = math.abs(currentCrossOverK - refD_tf)

label.new(bar_index, 50, "CrossOver\nDiff K-RefD: " + str.tostring(diffKandRefD, "#.###"), color=color.green, textcolor=color.black, style=label.style_label_up)

if crossUnder

diffKandRefD = math.abs(currentCrossUnderK - refD_tf)

label.new(bar_index, 50, "CrossUnder\nDiff K-RefD: " + str.tostring(diffKandRefD, "#.###"), color=color.red, textcolor=color.black, style=label.style_label_down)

// Entry Conditions

longKCondition = crossOver and (na(lastCrossOverK) or currentCrossOverK > lastCrossOverK)

shortKCondition = crossUnder and (crossUnderPriceDiffPercent <= maxPriceDiff)

closeKShortCondition = crossUnder and isKCloseCrossUnder and (crossUnderPriceDiffPercent > minPriceDiffShort)

crossUnderBetween50and45 = crossUnder and currentCrossUnderK <= 50 and currentCrossUnderK > 45

// Long to Short if crossunder %K > 80 OR < 60

longToShortCondition = crossUnder and (currentCrossUnderK > 80 or currentCrossUnderK < 60) and strategy.position_size > 0 and is_regular_hours

upperLimit = refD_tf * (1 + tolerance/100)

lowerLimit = refD_tf * (1 - tolerance/100)

withinToleranceLong = primaryK_tf >= lowerLimit and primaryK_tf <= upperLimit

withinToleranceShort = primaryK_tf >= lowerLimit and primaryK_tf <= upperLimit

// Final Entry Conditions with MA filter

longCondition = ((longKCondition and (refD_tf >= 50 or refD_tf < 20)) or kAndRefDDiffClose) and is_regular_hours and not is_exit_time and priceAboveMA

shortCondition = (shortKCondition or (crossUnder and withinToleranceShort and (crossUnderPriceDiffPercent <= maxPriceDiff)) or closeKShortCondition or longToShortCondition or crossUnderBetween50and45) and is_regular_hours and not is_exit_time and priceBelowMA

// Short-to-Long Transition Condition with MA filter

shortToLongCondition = crossOver and currentCrossOverK < 25 and strategy.position_size < 0 and is_regular_hours and not is_exit_time and priceAboveMA

// Tracking for %K crossing under refD_tf

var float lastPrimaryKCrossUnderRefD = na

var float currentPrimaryKCrossUnderRefD = na

var bool isPrimaryKCrossUnderRefD = false

// Check if primary %K crosses under reference %D

isPrimaryKCrossUnderRefD := ta.crossunder(primaryK_tf, refD_tf)

// Update tracking for %K crossing under refD

if isPrimaryKCrossUnderRefD

lastPrimaryKCrossUnderRefD := currentPrimaryKCrossUnderRefD

currentPrimaryKCrossUnderRefD := primaryK_tf

// Exit Conditions

if is_exit_time

strategy.close("Long")

strategy.close("Short")

else if isPrimaryKCrossUnderRefD and not na(lastPrimaryKCrossUnderRefD) and currentPrimaryKCrossUnderRefD < lastPrimaryKCrossUnderRefD

strategy.close("Long")

else if (ta.crossunder(primaryK_tf, primaryD_tf) and primaryK_tf < refD_tf and refD_tf < 60)

strategy.close("Long")

if (ta.crossover(primaryK_tf, primaryD_tf) and primaryK_tf > refD_tf and refD_tf > 20) and not is_exit_time

strategy.close("Short")

// Track if crossunder happens above 85

var bool crossUnderAbove85 = false

// Detect crossunder above 85

if crossUnder and currentCrossUnderK > 85

crossUnderAbove85 := true

// Reset condition if %K crosses over %D

if ta.crossover(primaryK_tf, primaryD_tf)

crossUnderAbove85 := false

// Track previous crossover/crossunder values for Higher Low/Lower High detection

var float prevCrossOverK = na

var float prevCrossUnderK = na

// Update previous values on new crossovers/crossunders

if crossOver

prevCrossOverK := currentCrossOverK

if crossUnder

prevCrossUnderK := currentCrossUnderK

// Higher Low and Lower High conditions

higherLowCondition = crossOver and not na(prevCrossOverK) and currentCrossOverK > prevCrossOverK

lowerHighCondition = crossUnder and not na(prevCrossUnderK) and currentCrossUnderK < prevCrossUnderK

// Strategy Entries and Transitions

if longCondition

strategy.entry("Long", strategy.long)

if shortCondition

if strategy.position_size > 0 // If in a long position, close it first

strategy.close("Long")

strategy.entry("Short", strategy.short)

if shortToLongCondition

strategy.close("Short")

if ((longKCondition and (refD_tf >= 50 or refD_tf < 20)) or kAndRefDDiffClose) // Check full longCondition minus time (already checked)

strategy.entry("Long", strategy.long)

// Add label for Short to Long Transition

if shortToLongCondition

label.new(bar_index, na, "T", color=color.green, textcolor=color.white, style=label.style_label_up)

// Add label for Long to Short Transition

if longToShortCondition

label.new(bar_index, na, "T", color=color.red, textcolor=color.white, style=label.style_label_down)

// Plotting

plot(primaryK_tf, "Primary %K", color=color.white, linewidth=1)

plot(primaryD_tf, "Primary %D", color=color.orange, linewidth=1)

plot(refK_tf, "Reference %K", color=color.navy, linewidth=1)

plot(refD_tf, "Reference %D", color=color.rgb(33, 233, 243), linewidth=2)

// Plot current and last %K only for crossUnder when isKCloseCrossUnder is true and currentCrossUnderK < lastCrossUnderK

plot(crossUnder and isKCloseCrossUnder and currentCrossUnderK < lastCrossUnderK ? currentCrossUnderK : na, "Current CrossUnder %K (Close)", color=color.green, style=plot.style_cross, linewidth=2)

plot(crossUnder and isKCloseCrossUnder and currentCrossUnderK < lastCrossUnderK ? lastCrossUnderK : na, "Last CrossUnder %K (Close)", color=color.red, style=plot.style_cross, linewidth=2)

h0 = hline(85, "Upper Band", color=color.rgb(242, 187, 21))

hline(50, "Middle Band", color=#eaff04)

h1 = hline(20, "Lower Band", color=color.rgb(242, 187, 21))

h2 = hline(40, "Lower Band", color=#787B86)

h3 = hline(60, "Lower Band", color=#787B86)

h = hline(0, "Lower Band", color=#787B86)

h5 = hline(100, "Lower Band", color=#787B86)

fill(h0, h1, color=color.rgb(33, 150, 243, 90), title="Background")

fill(h, h1, color=#1be2781d, title="Background")

fill(h0, h5, color=#e21b742d, title="Background")

// Plot the MA if enabled

plot(useMAFilter ? ma : na, "Moving Average", color=color.yellow, linewidth=2)

// Add plot for visualization (optional)

plot(isPrimaryKCrossUnderRefD ? primaryK_tf : na, "Primary %K CrossUnder RefD", color=color.purple, style=plot.style_cross, linewidth=2)

plot(isPrimaryKCrossUnderRefD and not na(lastPrimaryKCrossUnderRefD) ? lastPrimaryKCrossUnderRefD : na, "Last Primary %K CrossUnder RefD", color=color.fuchsia, style=plot.style_cross, linewidth=2)

// Add new alert conditions

alertcondition(higherLowCondition, title="Stoch Higher Low", message="Stoch Higher Low Pattern Detected")

alertcondition(lowerHighCondition, title="Stoch Lower High", message="Stoch Lower High Pattern Detected")

// Plot markers for Higher Low and Lower High patterns

plot(higherLowCondition ? currentCrossOverK : na, "Higher Low", color=color.green, style=plot.style_cross, linewidth=2)

plot(lowerHighCondition ? currentCrossUnderK : na, "Lower High", color=color.red, style=plot.style_cross, linewidth=2)

// Alert conditions

alertcondition(crossOver, title="Stochastic %K Crossed Over %D", message="Stochastic %K crossed over %D")

alertcondition(crossUnder, title="Stochastic %K Crossed Under %D", message="Stochastic %K crossed under %D")

alertcondition(crossOver and primaryK_tf > 50, title="Stochastic %K Crossed Over %D Above 50", message="Stochastic %K crossed over %D above 50")

alertcondition(crossOver and primaryK_tf > refD_tf, title="Stochastic %K Crossed Over %D Above Reference %D", message="Stochastic %K crossed over %D above Reference %D")

alertcondition(longCondition, title="Long Entry Signal", message="Long entry signal triggered")

alertcondition(shortCondition, title="Short Entry Signal", message="Short entry signal triggered")

alertcondition(shortToLongCondition, title="Short to Long Transition", message="Short to Long transition triggered")

alertcondition(longToShortCondition, title="Long to Short Transition", message="Long to Short transition triggered")

alertcondition(isPrimaryKCrossUnderRefD, title="Primary %K Crossed Under Reference %D", message="Primary %K crossed under Reference %D")

alertcondition(crossOver and primaryK_tf > refD_tf, title="Bullish Crossover Above Ref %D", message="Bull: Dual Stoch")

alertcondition(crossUnder and primaryK_tf < refD_tf, title="Bearish Crossunder Below Ref %D", message="Bear: Dual Stoch")