概述

多指标趋势线交叉动态止损量化交易策略是一种结合趋势线分析、技术指标和风险管理的综合性交易系统。该策略核心是通过线性回归法构建动态趋势线,结合RSI、MACD、成交量和市场结构分析来识别高概率交易机会。策略采用ATR动态止损,利用风险百分比方法进行仓位管理,并设置双重获利目标。该策略特别适用于波动性较大的市场,通过多重确认机制和严格的风险控制提高交易成功率。

策略原理

该策略基于以下几个核心原理:

动态趋势线识别:使用线性回归(Linear Regression)技术构建支撑和阻力趋势线,通过分析价格与趋势线的关系识别潜在的反弹和拒绝点。

多指标共振确认:

- RSI(相对强弱指标)用于识别超买超卖状态

- MACD用于确认动量方向

- 成交量突破用于确认市场参与度

- 市场结构分析(更高的低点/更低的高点)用于确认整体趋势

突破交易机制:当价格伴随成交量突破阻力或支撑位时,触发突破交易信号。

风险管理系统:

- 使用账户风险百分比法确定仓位大小

- 采用ATR倍数设置动态止损

- 实施分段获利策略,在不同价格目标分批平仓

交易执行逻辑:

- 多头入场:价格在支撑位反弹 + RSI超卖 + MACD柱状图上升 + 成交量突破 + 看涨市场结构

- 空头入场:价格在阻力位拒绝 + RSI超买 + MACD柱状图下降 + 成交量突破 + 看跌市场结构

- 突破入场:价格突破关键趋势线 + 成交量确认

策略优势

全面的市场分析:结合了多种技术分析方法,包括趋势线、震荡指标、动量指标和成交量分析,提供更全面的市场视角,减少假信号。

动态适应市场条件:趋势线通过线性回归动态计算,能够适应不同市场环境,相比静态支撑阻力位更具灵活性。

多重确认机制:要求多个条件同时满足才会触发交易信号,显著提高了信号质量,减少了错误交易。

完善的风险管理:

- 每笔交易风险限制在账户的固定百分比

- ATR动态止损适应市场波动性

- 分段获利策略优化了风险回报比

- 杠杆限制防止过度风险

视觉化反馈:策略提供趋势线、信号和市场状态的视觉反馈,帮助交易者更好地理解市场环境和策略执行情况。

灵活的参数设置:策略允许用户根据交易品种和个人风险偏好调整各项参数,增强了适应性。

策略风险

参数敏感性:策略依赖多个参数设置,包括趋势线长度、RSI阈值和MACD参数等。不恰当的参数设置可能导致过度交易或错过机会。解决方法是通过回测优化参数,并为不同市场条件设置不同参数配置。

多条件限制交易频率:多重确认机制虽然提高了信号质量,但也可能导致交易机会减少,在某些市场环境下可能长时间无法触发信号。解决方法是考虑增加条件权重系统,允许在某些条件特别强烈时放宽其他条件要求。

趋势线计算复杂性:线性回归趋势线在某些极端市场条件下可能不准确,特别是在剧烈波动或突然转向的市场中。解决方法是结合其他支撑阻力识别方法,如关键价位或移动平均线。

仓位计算依赖止损点:策略中仓位大小计算依赖于止损点位置,如果ATR计算的止损距离过大,可能导致仓位过小,影响盈利潜力。解决方法是设置最大止损距离限制,或考虑混合仓位计算方法。

回撤风险:尽管有风险管理机制,但在极端市场条件下,如闪崩或价格跳空,实际亏损可能超过预期。解决方法是增加额外的市场波动性过滤器,在极端波动时降低仓位或暂停交易。

策略优化方向

机器学习增强:引入机器学习算法自动优化参数,基于不同市场环境动态调整RSI阈值、MACD参数和趋势线长度。这可以克服固定参数在不同市场阶段的局限性,提高策略适应性。

市场环境分类:实现市场环境识别系统,将市场分为趋势型、区间型和转型三种状态,并针对每种状态使用不同的交易规则。这样可以避免在不适合的市场环境下过度交易。

指标权重系统:建立动态指标权重系统,允许在某些指标信号特别强烈时降低其他指标的重要性。这可以在保持多重确认优势的同时,增加交易频率。

改进趋势线算法:使用更复杂的趋势线识别算法,如多项式回归或支持向量机(SVM),提高趋势线在各种市场条件下的准确性。

增强风险管理:

- 实现动态风险百分比,基于市场波动性调整每笔交易风险

- 增加盈利追踪止损功能,保护已实现利润

- 引入相关性分析,控制同方向交易的总体风险敞口

情绪指标整合:引入市场情绪指标,如波动率指数(VIX)或资金流向数据,作为额外的过滤条件,避免在极端市场情绪下交易。

总结

多指标趋势线交叉动态止损量化交易策略是一个设计全面的交易系统,通过结合趋势线分析、技术指标和严格的风险管理,为交易者提供高质量的交易信号。该策略最大的优势在于其多重确认机制和完善的风险控制系统,但也需要注意参数敏感性和交易频率限制等潜在问题。

通过优化趋势线算法、实现动态参数调整、引入市场环境分类和增强风险管理系统,该策略可以进一步提高其稳定性和适应性。对于有一定经验的交易者,这是一个值得考虑的全面交易框架,特别适合那些注重风险管理并愿意等待高质量交易信号的交易者。

该策略结合了技术分析的多个维度,包括价格形态、指标共振和成交量确认,形成了一个统一的交易决策系统。通过严格的入场条件和明确的风险管理规则,它提供了一种有纪律的交易方法,有助于交易者在波动市场中保持情绪稳定,执行一致的交易计划。

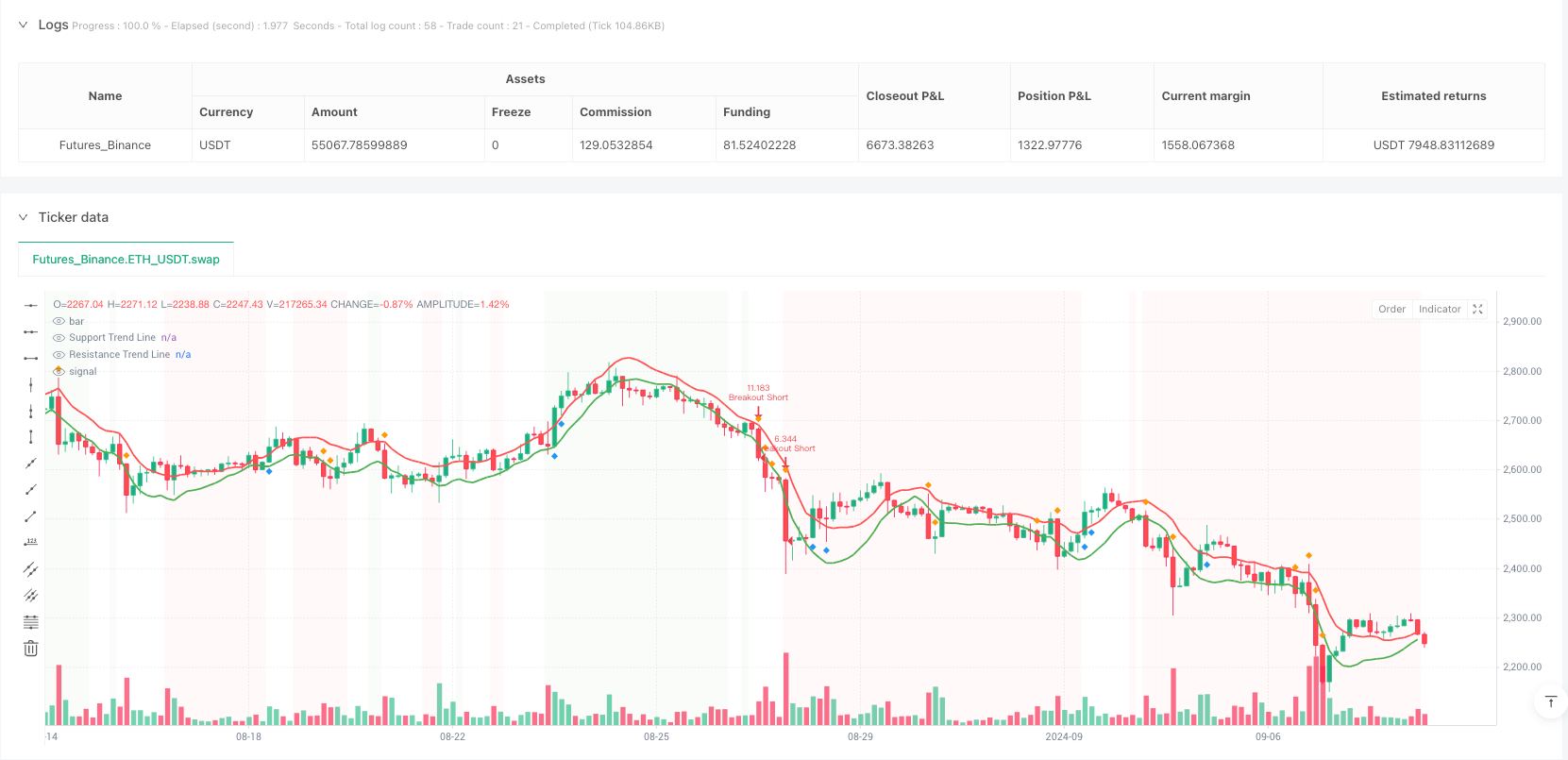

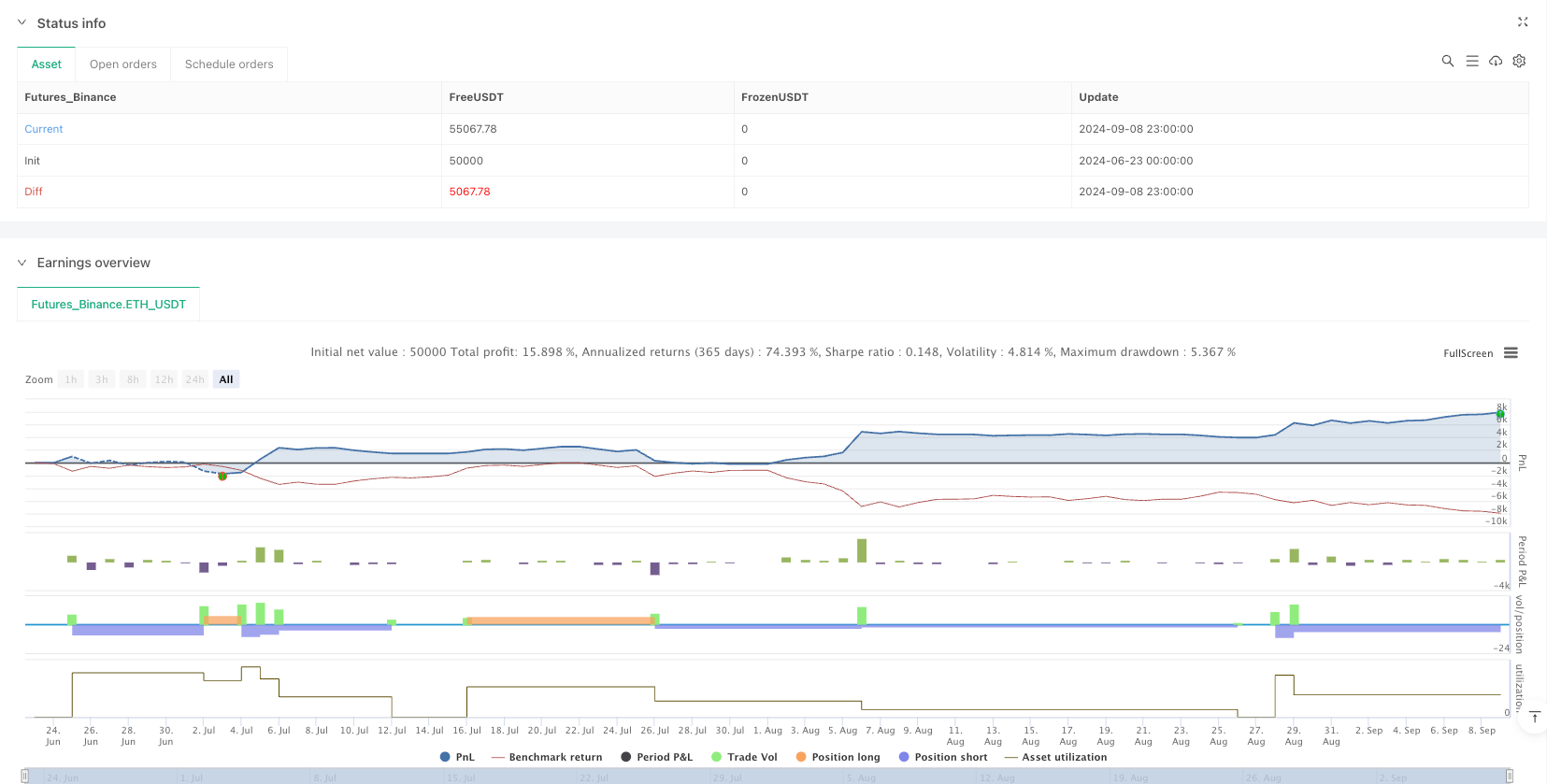

/*backtest

start: 2024-06-23 00:00:00

end: 2024-09-09 00:00:00

period: 3h

basePeriod: 3h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Advanced Crypto Trend Line Strategy", overlay=true, margin_long=100, margin_short=100)

// ================================

// INPUT PARAMETERS

// ================================

// Crypto Selection

crypto_type = input.string("BTC", "Cryptocurrency", options=["BTC", "SOL", "AUTO"])

// Trend Line Parameters

trendline_length = input.int(20, "Trend Line Calculation Length", minval=10, maxval=50)

min_touches = input.int(2, "Minimum Trend Line Touches", minval=2, maxval=5)

breakout_threshold = input.float(0.5, "Breakout Threshold %", minval=0.1, maxval=2.0) / 100

// Risk Management

risk_percent = input.float(2.0, "Risk Per Trade %", minval=0.5, maxval=5.0) / 100

tp1_ratio = input.float(2.0, "Take Profit 1 Ratio", minval=1.0, maxval=5.0)

tp2_ratio = input.float(3.0, "Take Profit 2 Ratio", minval=2.0, maxval=6.0)

max_leverage = crypto_type == "BTC" ? 5 : crypto_type == "SOL" ? 10 : 7

// Technical Indicators

rsi_length = input.int(14, "RSI Length", minval=5, maxval=30)

rsi_oversold = input.int(35, "RSI Oversold Level", minval=20, maxval=40)

rsi_overbought = input.int(70, "RSI Overbought Level", minval=60, maxval=80)

macd_fast = input.int(12, "MACD Fast Length", minval=5, maxval=20)

macd_slow = input.int(26, "MACD Slow Length", minval=20, maxval=40)

macd_signal = input.int(9, "MACD Signal Length", minval=5, maxval=15)

volume_multiplier = input.float(1.5, "Volume Spike Multiplier", minval=1.1, maxval=3.0)

// ATR for Dynamic Stops

atr_length = input.int(14, "ATR Length for Stops", minval=5, maxval=30)

atr_multiplier = input.float(2.0, "ATR Stop Multiplier", minval=1.0, maxval=4.0)

// ================================

// TECHNICAL INDICATORS

// ================================

// RSI

rsi = ta.rsi(close, rsi_length)

// MACD

[macd_line, signal_line, macd_histogram] = ta.macd(close, macd_fast, macd_slow, macd_signal)

// Volume

volume_avg = ta.sma(volume, 20)

volume_spike = volume > volume_avg * volume_multiplier

// ATR for dynamic stops

atr = ta.atr(atr_length)

// ================================

// TREND LINE CALCULATION

// ================================

// Function to calculate trend line slope and intercept

get_trend_line(src, len, min_touch) =>

var float slope = na

var float intercept = na

var int touches = 0

var array<float> highs = array.new<float>()

var array<float> lows = array.new<float>()

var array<int> high_bars = array.new<int>()

var array<int> low_bars = array.new<int>()

// Find pivots

ph = ta.pivothigh(high, 5, 5)

pl = ta.pivotlow(low, 5, 5)

// Store pivot points

if not na(ph)

array.push(highs, ph)

array.push(high_bars, bar_index - 5)

if array.size(highs) > len

array.shift(highs)

array.shift(high_bars)

if not na(pl)

array.push(lows, pl)

array.push(low_bars, bar_index - 5)

if array.size(lows) > len

array.shift(lows)

array.shift(low_bars)

[slope, intercept, touches]

// Calculate trend lines

[up_slope, up_intercept, up_touches] = get_trend_line(low, trendline_length, min_touches)

[down_slope, down_intercept, down_touches] = get_trend_line(high, trendline_length, min_touches)

// ================================

// TREND LINE VALUES

// ================================

// Simplified trend line calculation using linear regression

uptrend_line = ta.linreg(low, trendline_length, 0)

downtrend_line = ta.linreg(high, trendline_length, 0)

// Dynamic trend line based on recent pivots

recent_low = ta.lowest(low, 10)

recent_high = ta.highest(high, 10)

// Support and Resistance levels

support_level = uptrend_line

resistance_level = downtrend_line

// ================================

// MARKET STRUCTURE

// ================================

// Higher lows and lower highs detection

higher_low = low > ta.lowest(low[1], 5) and low[1] > ta.lowest(low[2], 5)

lower_high = high < ta.highest(high[1], 5) and high[1] < ta.highest(high[2], 5)

// Overall trend determination

uptrend = close > ta.sma(close, 50) and ta.sma(close, 20) > ta.sma(close, 50)

downtrend = close < ta.sma(close, 50) and ta.sma(close, 20) < ta.sma(close, 50)

// ================================

// ENTRY CONDITIONS

// ================================

// Long entry conditions

long_trend_bounce = close > support_level and low <= support_level * 1.01

long_rsi = rsi < rsi_oversold or (rsi > rsi_oversold and rsi[1] < rsi_oversold)

long_macd = macd_histogram > macd_histogram[1]

long_volume = volume_spike

long_structure = higher_low or uptrend

long_condition = long_trend_bounce and long_rsi and long_macd and long_volume and long_structure

// Short entry conditions

short_trend_reject = close < resistance_level and high >= resistance_level * 0.99

short_rsi = rsi > rsi_overbought or (rsi < rsi_overbought and rsi[1] > rsi_overbought)

short_macd = macd_histogram < macd_histogram[1]

short_volume = volume_spike

short_structure = lower_high or downtrend

short_condition = short_trend_reject and short_rsi and short_macd and short_volume and short_structure

// ================================

// BREAKOUT CONDITIONS

// ================================

// Uptrend breakout (bearish)

uptrend_break = close < support_level * (1 - breakout_threshold) and volume_spike

// Downtrend breakout (bullish)

downtrend_break = close > resistance_level * (1 + breakout_threshold) and volume_spike

// ================================

// POSITION SIZING

// ================================

// Calculate position size based on risk

account_size = strategy.equity

risk_amount = account_size * risk_percent

// ================================

// STRATEGY EXECUTION

// ================================

// Long entries

if long_condition and strategy.position_size == 0

stop_loss = support_level - (atr * atr_multiplier)

take_profit_1 = close + (close - stop_loss) * tp1_ratio

take_profit_2 = close + (close - stop_loss) * tp2_ratio

// Position sizing

risk_per_share = close - stop_loss

position_size = risk_amount / risk_per_share

position_size := math.min(position_size, account_size * max_leverage / close)

strategy.entry("Long", strategy.long, qty=position_size)

strategy.exit("Long TP1", "Long", limit=take_profit_1, stop=stop_loss, qty=position_size * 0.5)

strategy.exit("Long TP2", "Long", limit=take_profit_2, stop=stop_loss, qty=position_size * 0.5)

// Short entries

if short_condition and strategy.position_size == 0

stop_loss = resistance_level + (atr * atr_multiplier)

take_profit_1 = close - (stop_loss - close) * tp1_ratio

take_profit_2 = close - (stop_loss - close) * tp2_ratio

// Position sizing

risk_per_share = stop_loss - close

position_size = risk_amount / risk_per_share

position_size := math.min(position_size, account_size * max_leverage / close)

strategy.entry("Short", strategy.short, qty=position_size)

strategy.exit("Short TP1", "Short", limit=take_profit_1, stop=stop_loss, qty=position_size * 0.5)

strategy.exit("Short TP2", "Short", limit=take_profit_2, stop=stop_loss, qty=position_size * 0.5)

// Breakout entries

if downtrend_break and strategy.position_size == 0

stop_loss = resistance_level - (atr * atr_multiplier)

take_profit = close + (close - stop_loss) * 2.0

risk_per_share = close - stop_loss

position_size = risk_amount / risk_per_share

position_size := math.min(position_size, account_size * max_leverage / close)

strategy.entry("Breakout Long", strategy.long, qty=position_size)

strategy.exit("Breakout Long Exit", "Breakout Long", limit=take_profit, stop=stop_loss)

if uptrend_break and strategy.position_size == 0

stop_loss = support_level + (atr * atr_multiplier)

take_profit = close - (stop_loss - close) * 2.0

risk_per_share = stop_loss - close

position_size = risk_amount / risk_per_share

position_size := math.min(position_size, account_size * max_leverage / close)

strategy.entry("Breakout Short", strategy.short, qty=position_size)

strategy.exit("Breakout Short Exit", "Breakout Short", limit=take_profit, stop=stop_loss)

// ================================

// VISUALIZATION

// ================================

// Plot trend lines

plot(support_level, "Support Trend Line", color=color.green, linewidth=2)

plot(resistance_level, "Resistance Trend Line", color=color.red, linewidth=2)

// Plot entry signals

plotshape(long_condition, "Long Signal", shape.triangleup, location.belowbar, color.green, size=size.small)

plotshape(short_condition, "Short Signal", shape.triangledown, location.abovebar, color.red, size=size.small)

// Plot breakout signals

plotshape(downtrend_break, "Bullish Breakout", shape.diamond, location.belowbar, color.blue, size=size.small)

plotshape(uptrend_break, "Bearish Breakout", shape.diamond, location.abovebar, color.orange, size=size.small)

// Background color for trend

bgcolor(uptrend ? color.new(color.green, 95) : downtrend ? color.new(color.red, 95) : na)

// ================================

// ALERTS

// ================================

// Entry alerts

alertcondition(long_condition, "Long Entry", "Long entry signal detected")

alertcondition(short_condition, "Short Entry", "Short entry signal detected")

alertcondition(downtrend_break, "Bullish Breakout", "Bullish breakout detected")

alertcondition(uptrend_break, "Bearish Breakout", "Bearish breakout detected")

// ================================

// TABLE FOR INFORMATION

// ================================

// Create info table

var table info_table = table.new(position.top_right, 2, 8, bgcolor=color.white, border_width=1)

if barstate.islast

table.cell(info_table, 0, 0, "Metric", text_color=color.black, bgcolor=color.gray)

table.cell(info_table, 1, 0, "Value", text_color=color.black, bgcolor=color.gray)

table.cell(info_table, 0, 1, "RSI", text_color=color.black)

table.cell(info_table, 1, 1, str.tostring(math.round(rsi, 2)), text_color=color.black)

table.cell(info_table, 0, 2, "MACD", text_color=color.black)

table.cell(info_table, 1, 2, str.tostring(math.round(macd_line, 4)), text_color=color.black)

table.cell(info_table, 0, 3, "Volume Spike", text_color=color.black)

table.cell(info_table, 1, 3, volume_spike ? "YES" : "NO", text_color=color.black)

table.cell(info_table, 0, 4, "Trend", text_color=color.black)

table.cell(info_table, 1, 4, uptrend ? "UP" : downtrend ? "DOWN" : "SIDEWAYS", text_color=color.black)

table.cell(info_table, 0, 5, "Support", text_color=color.black)

table.cell(info_table, 1, 5, str.tostring(math.round(support_level, 2)), text_color=color.black)

table.cell(info_table, 0, 6, "Resistance", text_color=color.black)

table.cell(info_table, 1, 6, str.tostring(math.round(resistance_level, 2)), text_color=color.black)

table.cell(info_table, 0, 7, "ATR", text_color=color.black)

table.cell(info_table, 1, 7, str.tostring(math.round(atr, 2)), text_color=color.black)