🎯 这个策略到底有多厉害?

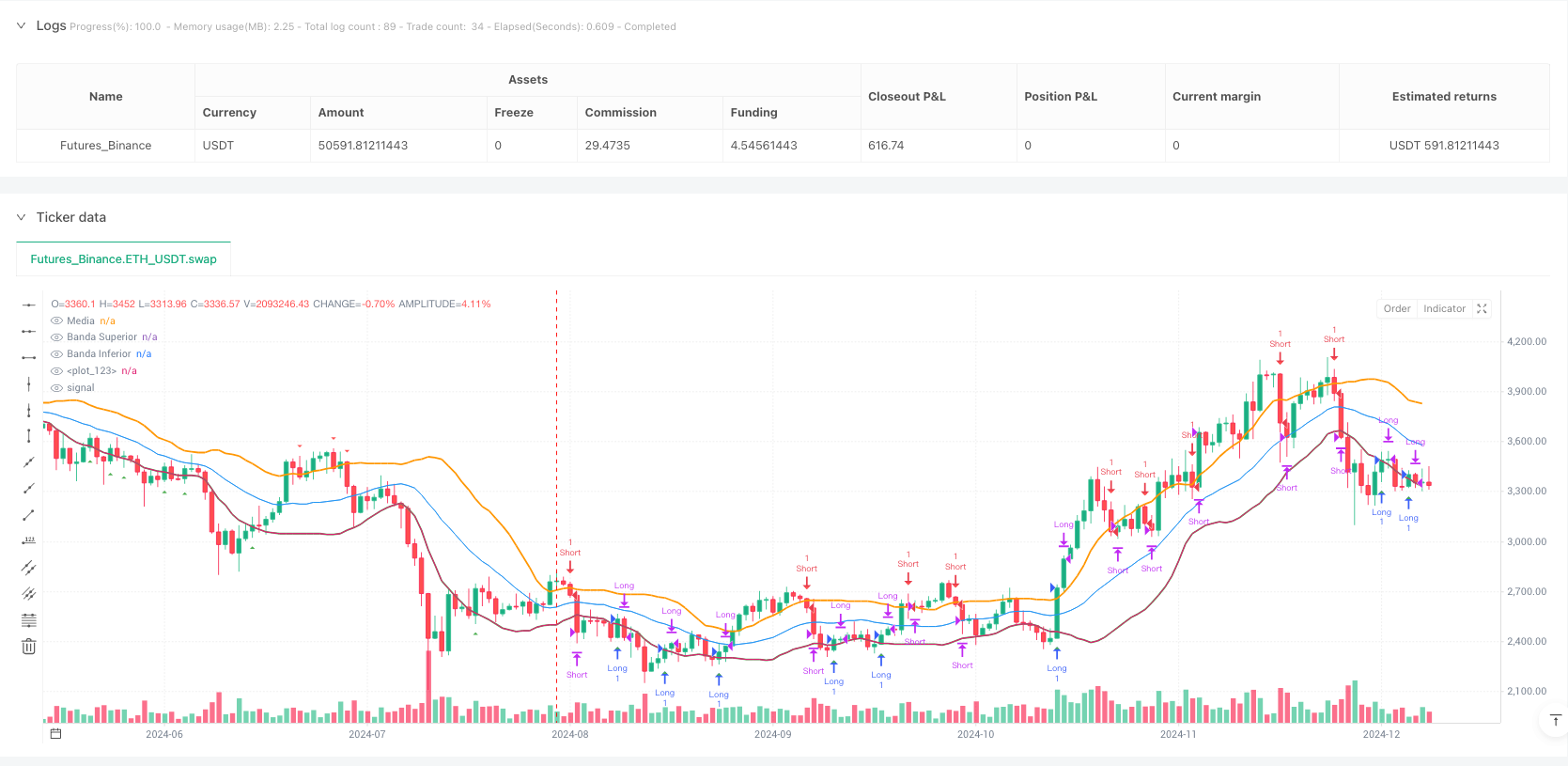

你知道吗?这个”布林强盗”策略就像是市场里的狙击手!📈 它不是随便开枪的那种,而是专门瞄准布林带边缘的”越界分子”。当价格像调皮的孩子一样跑出布林带的”安全区域”时,这个策略就会立刻出手抓住反弹机会!

💡 核心逻辑超简单

划重点!这个策略的精髓就是”逆向思维”: - 价格跌破下轨 = 超卖了,准备做多!🚀 - 价格冲破上轨 = 超买了,准备做空!📉 就像弹簧一样,压得越狠反弹越猛。布林带就是这个”弹簧”的可视化工具,20日均线是中轴,上下轨是极限位置。

🎪 分级止盈的神奇魅力

这里最亮眼的设计是什么?分级止盈!不像传统策略”一刀切”,这个策略更像精明的商人: - TP1达到时,先落袋50%利润(3个点)💰 - 剩下50%继续持有,等TP2(5个点)🎯 - 如果行情不给力,还有5个点的止损保护🛡️

这就像卖现货,先卖一半回本,剩下的等更好价格!

🔧 实战配置建议

避坑指南来了!📋 - 周期选择:20日是经典配置,但你可以根据交易品种调整 - 倍数设置:1.0倍标准差适合大多数情况,波动大的品种可以调到1.5-2.0 - 止盈止损:3/5/5的配置很保守,激进一点可以试试5/8/10

记住:这个策略最适合震荡行情,单边趋势中要小心被”假突破”坑!

🚀 为什么选择这个策略?

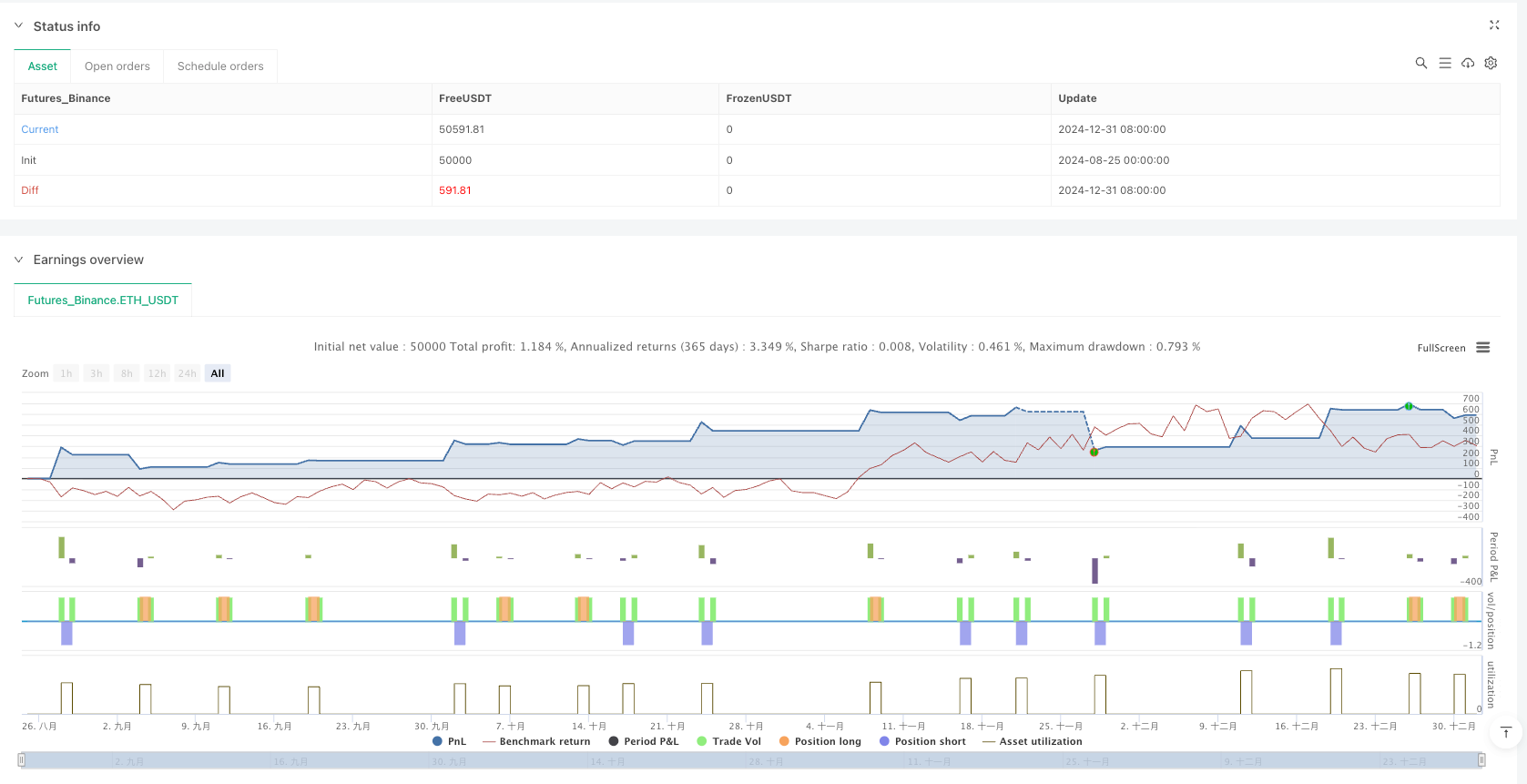

如果你是那种喜欢”稳中求胜”的交易者,这个策略简直是为你量身定制的!它不会让你一夜暴富,但能帮你在市场的波动中稳定获利。就像开餐厅一样,不求每天爆满,但要保证每天都有稳定客流!

策略源码

/*backtest

start: 2024-08-25 00:00:00

end: 2025-01-01 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Bollinger Bandit + TP Escalonado", overlay=true)

// Configuración básica

length = input.int(20, "Periodo", minval=1)

mult = input.float(1.0, "Multiplicador", minval=0.1, maxval=3.0)

source = input(close, "Fuente")

// Opción para cierre en media

close_on_ma = input.bool(true, "Cierre en Media Móvil")

// SL/TP CONFIGURABLE CON NIVELES FIJOS

use_sltp = input.bool(true, "Usar SL/TP Personalizado", group="Gestión de Riesgo")

sl_points = input.int(5, "Puntos para SL", minval=1, group="Gestión de Riesgo")

tp1_points = input.int(3, "Puntos para TP1", minval=1, group="Gestión de Riesgo")

tp2_points = input.int(5, "Puntos para TP2", minval=1, group="Gestión de Riesgo")

// MOSTRAR TEXTO DE PRECIO

show_price_text = input.bool(true, "Mostrar Precio SL/TP", group="Visualización")

// Cálculo de las Bandas de Bollinger

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

upper = basis + dev

lower = basis - dev

// Detección de cruces

longCondition = ta.crossover(close, lower)

shortCondition = ta.crossunder(close, upper)

// Cálculo de SL/TP con niveles FIJOS EXACTOS - CORREGIDO

var float last_sl_price = na

var float last_tp1_price = na

var float last_tp2_price = na

var int last_entry_bar = 0

var float last_entry_price = na

var bool last_is_long = false

if longCondition or shortCondition

last_entry_price := close

last_is_long := longCondition

if longCondition

// COMPRA: SL = entrada - 5 puntos, TP1 = entrada + 3 puntos, TP2 = entrada + 5 puntos

last_sl_price := last_entry_price - sl_points

last_tp1_price := last_entry_price + tp1_points

last_tp2_price := last_entry_price + tp2_points

else

// VENTA: SL = entrada + 5 puntos, TP1 = entrada - 3 puntos, TP2 = entrada - 5 puntos

last_sl_price := last_entry_price + sl_points

last_tp1_price := last_entry_price - tp1_points

last_tp2_price := last_entry_price - tp2_points

last_entry_bar := bar_index

// Entradas

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// DETECCIÓN DE CIERRES CON TEXTO PERSONALIZADO

var bool long_closed_by_sl = false

var bool long_closed_by_tp1 = false

var bool long_closed_by_tp2 = false

var bool short_closed_by_sl = false

var bool short_closed_by_tp1 = false

var bool short_closed_by_tp2 = false

// Para posiciones LARGAS

if (use_sltp and strategy.position_size > 0)

if low <= last_sl_price

strategy.close("Long", comment="LongSL")

long_closed_by_sl := true

else if high >= last_tp1_price and not long_closed_by_tp1

strategy.close("Long", qty_percent=50, comment="LongTP1")

long_closed_by_tp1 := true

else if high >= last_tp2_price and not long_closed_by_tp2

strategy.close("Long", comment="LongTP2")

long_closed_by_tp2 := true

else if (strategy.position_size > 0)

if (ta.crossunder(close, upper))

strategy.close("Long", comment="STOP")

if (close_on_ma and ta.crossunder(close, basis))

strategy.close("Long", comment="STOPMedia")

// Para posiciones CORTAS

if (use_sltp and strategy.position_size < 0)

if high >= last_sl_price

strategy.close("Short", comment="ShortSL")

short_closed_by_sl := true

else if low <= last_tp1_price and not short_closed_by_tp1

strategy.close("Short", qty_percent=50, comment="ShortTP1")

short_closed_by_tp1 := true

else if low <= last_tp2_price and not short_closed_by_tp2

strategy.close("Short", comment="ShortTP2")

short_closed_by_tp2 := true

else if (strategy.position_size < 0)

if (ta.crossover(close, lower))

strategy.close("Short", comment="STOP")

if (close_on_ma and ta.crossover(close, basis))

strategy.close("Short", comment="STOPMedia")

// Reset flags cuando no hay posición

if strategy.position_size == 0

long_closed_by_sl := false

long_closed_by_tp1 := false

long_closed_by_tp2 := false

short_closed_by_sl := false

short_closed_by_tp1 := false

short_closed_by_tp2 := false

// Visualización (manteniendo tus colores y estilo)

plot(basis, "Media", color=color.blue, linewidth=1)

plot(upper, "Banda Superior", color=color.orange, linewidth=2)

plot(lower, "Banda Inferior", color=color.green, linewidth=2)

// Señales de entrada

plotshape(longCondition, "↑ Compra", shape.triangleup, location.belowbar, color=color.green, size=size.tiny)

plotshape(shortCondition, "↓ Venta", shape.triangledown, location.abovebar, color=color.red, size=size.tiny)

// Relleno entre bandas (manteniendo tu estilo)

bgcolor = color.new(color.yellow,80)

fill(plot(upper), plot(lower), bgcolor)

相关推荐