🎯 策略核心亮点:三重保险的趋势突破神器

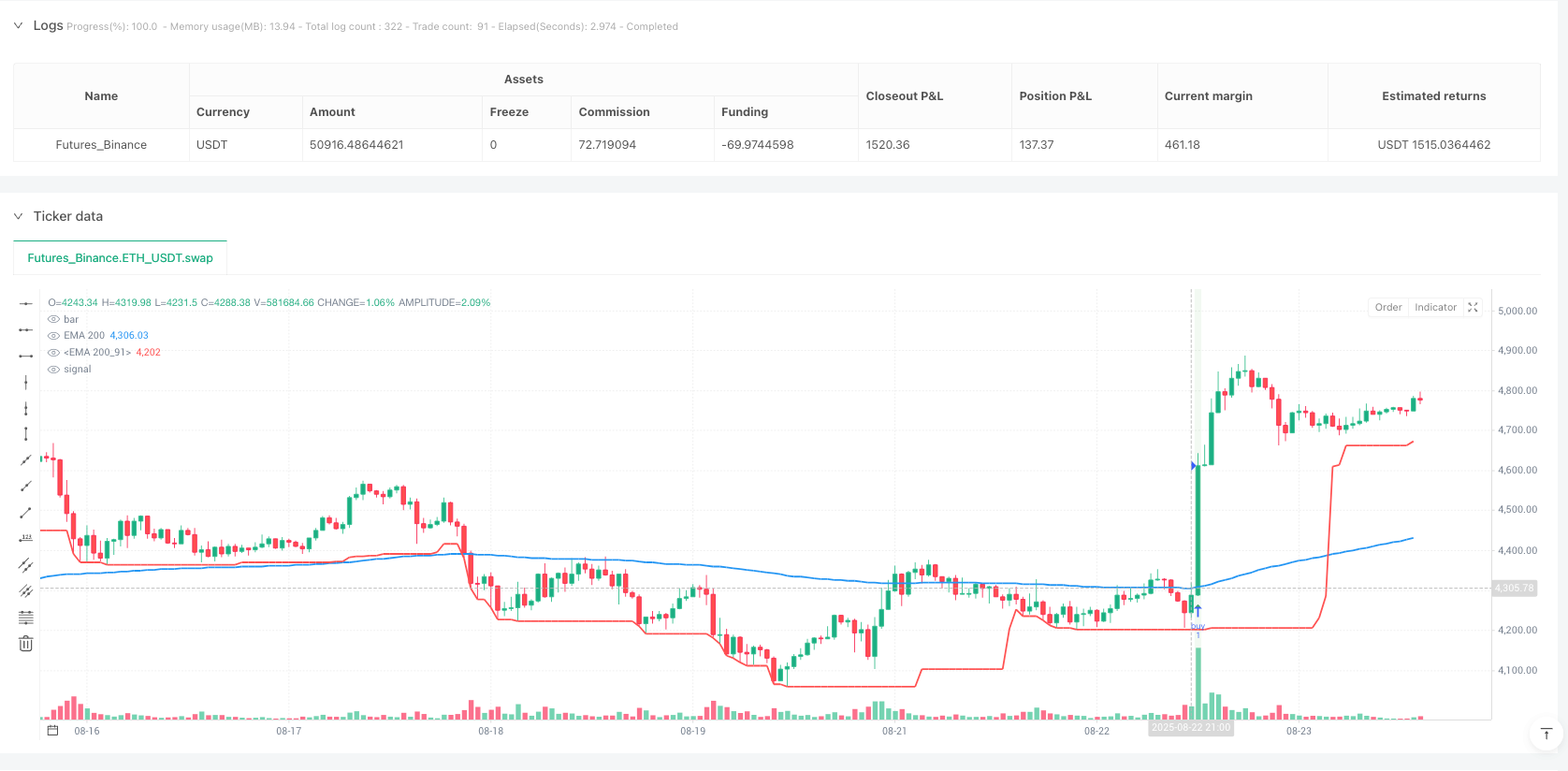

你知道吗?这个策略就像是给你的交易装了三重保险!📊 首先用EMA200判断大趋势方向,然后用成交量确认突破的真实性,最后用ATR动态止损保护利润。简单来说,就是”看准方向+确认信号+保护资金”的完美组合!

划重点!这不是那种一根筋的机械交易,而是会”察言观色”的智能策略。当价格突破EMA200时,它还要检查成交量是否足够大(默认1.5倍于平均值),避免假突破的坑。

🛡️ 动态止损机制:会”爬楼梯”的保护神

最精彩的部分来了!这个策略的止损不是死板的固定数值,而是会”爬楼梯”的动态保护。💪

工作原理超简单: - 入场时:止损设在入场价下方2倍ATR距离 - 持仓中:止损会跟随20周期最低点向上调整 - 出场时:价格跌破动态止损线就平仓

就像你爬楼梯时,每上一层就把安全绳往上提一格,永远不会往下退!这样既保护了利润,又给了趋势足够的发展空间。

📈 成交量确认:避坑指南的核心武器

避坑指南来了!💡 很多突破策略最大的问题就是假突破,就像”狼来了”的故事。这个策略通过成交量确认来解决这个痛点:

成交量必须达到20日平均的1.5倍以上,才算有效突破。想象一下,如果一个消息只有几个人在传,可能是假的;但如果全城的人都在讨论,那就值得关注了!

这个设计帮你过滤掉那些”虚张声势”的假突破,只抓取真正有资金推动的趋势机会。

🎪 实战应用:这个策略能帮你解决什么问题

适合人群: - 想要跟随中长期趋势的投资者 📈 - 害怕假突破被套的谨慎派 - 希望有系统化止损保护的理性派

解决的核心问题: 1. 方向迷茫:EMA200帮你判断大趋势 2. 假突破困扰:成交量确认过滤噪音 3. 止损难题:动态ATR止损既保护又灵活 4. 情绪交易:全自动执行,告别人性弱点

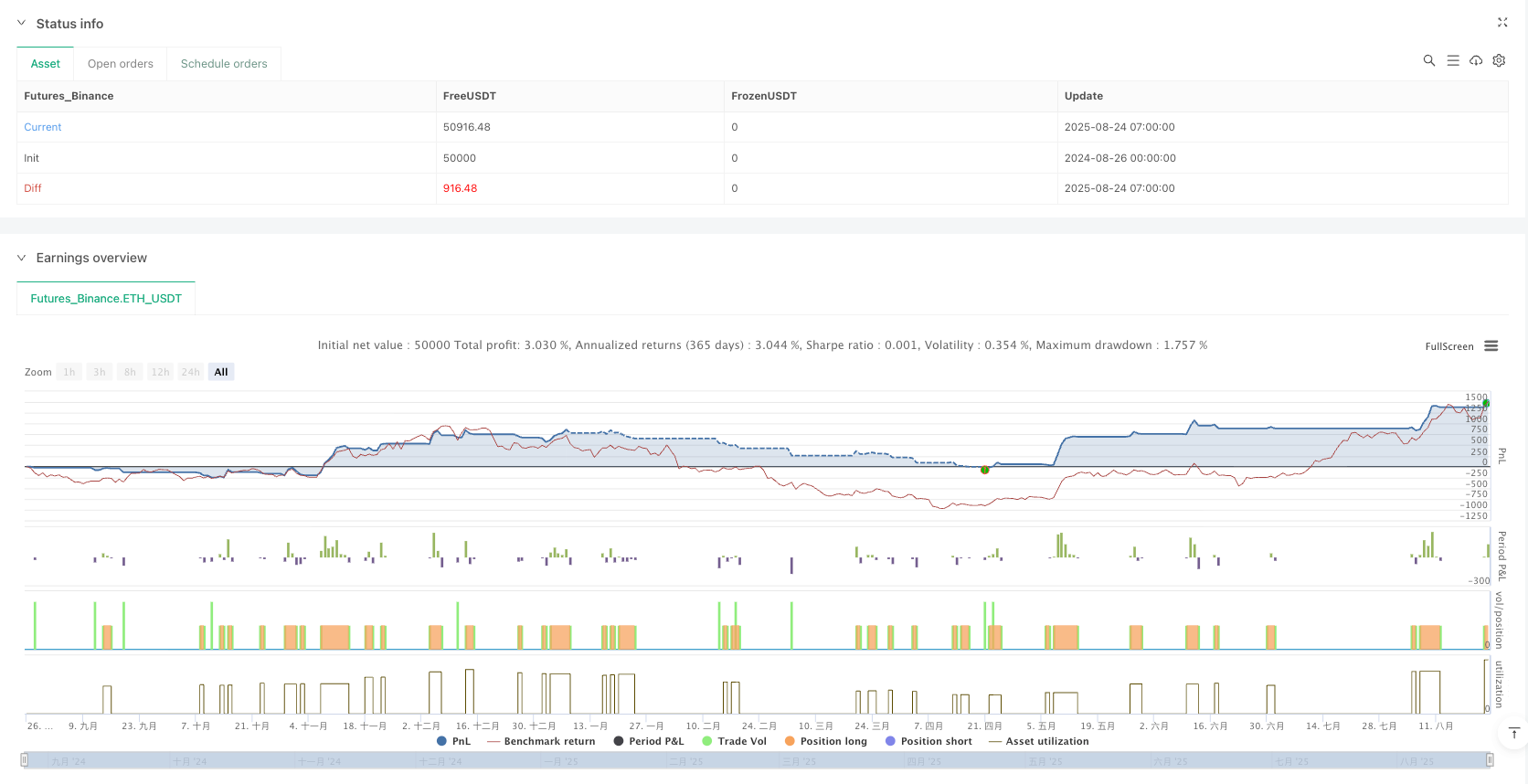

记住,这个策略最大的价值不是让你一夜暴富,而是帮你在趋势市场中稳健获利,同时最大化保护你的资金安全。就像给你的交易装上了GPS导航+安全气囊+防撞系统!🚗

策略源码

/*backtest

start: 2024-08-26 00:00:00

end: 2025-08-24 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("EMA Break + Stop ATR", overlay = true)

// =============================================================================

// STRATEGY PARAMETERS

// =============================================================================

// User inputs for strategy customization

shortPeriod = input.int(20, title = "Stop Period", minval = 1, maxval = 100, tooltip = "Period for lowest low calculation")

atrPeriod = 1 // ATR period always set to 1

initialStopLoss = 0.0 // Initial stop loss always set to 0 (auto based on ATR)

// Confirmation indicator settings

useVolumeConfirmation = input.bool(true, title = "Use Volume Confirmation", tooltip = "Require volume above average for breakout confirmation")

volumeMultiplier = input.float(1.5, title = "Volume Multiplier", minval = 1.0, maxval = 5.0, step = 0.1, tooltip = "Volume must be this times above average")

// Strategy variables

var float STOP_LOSS = 0.0 // Dynamic stop loss value

var float TRAILING_STOP = na // Trailing stop based on lowest low

// =============================================================================

// TECHNICAL INDICATORS

// =============================================================================

// Calculate True Range and its Simple Moving Average

trueRange = ta.tr(true)

smaTrueRange = ta.sma(trueRange, atrPeriod)

// Calculate 200-period Exponential Moving Average

ema200 = ta.ema(close, 200)

// Calculate lowest low over the short period

lowestLow = ta.lowest(input(low), shortPeriod)

// Calculate potential stop loss level (always available)

potentialStopLoss = close - 2 * smaTrueRange

// Volume confirmation for breakout validation

volumeSMA = ta.sma(volume, 20) // 20-period average volume

isVolumeConfirmed = not useVolumeConfirmation or volume > volumeSMA * volumeMultiplier

// =============================================================================

// STOP LOSS MANAGEMENT

// =============================================================================

// Update trailing stop based on lowest low (always, not just when in position)

if na(TRAILING_STOP) or lowestLow > TRAILING_STOP

TRAILING_STOP := lowestLow

// Update stop loss if we have an open position and new lowest low is higher

if (strategy.position_size > 0) and (STOP_LOSS < lowestLow)

strategy.cancel("buy_stop")

STOP_LOSS := lowestLow

// Soft stop loss - exit only when close is below stop level

if (strategy.position_size > 0) and (close < STOP_LOSS)

strategy.close("buy", comment = "Soft Stop Loss")

alert("Position closed: Soft Stop Loss triggered at " + str.tostring(close), alert.freq_once_per_bar)

// =============================================================================

// ENTRY CONDITIONS

// =============================================================================

// Enhanced entry signal with volume confirmation to avoid false breakouts

isEntrySignal = ta.crossover(close, ema200) and (strategy.position_size == 0) and isVolumeConfirmed

if isEntrySignal

// Cancel any pending orders

strategy.cancel("buy")

strategy.cancel("sell")

// Enter long at market on crossover

strategy.entry("buy", strategy.long)

// Set initial stop loss (2 * ATR below close, or use custom value if specified)

if initialStopLoss > 0

STOP_LOSS := initialStopLoss

else

STOP_LOSS := close - 2 * smaTrueRange

// Alert for position opened

alert("Position opened: Long entry at " + str.tostring(close) + " with stop loss at " + str.tostring(STOP_LOSS), alert.freq_once_per_bar)

// =============================================================================

// PLOTTING

// =============================================================================

// Plot EMA 200

plot(ema200, color = color.blue, title = "EMA 200", linewidth = 2)

// Plot Stop Loss

plot(strategy.position_size > 0 ? STOP_LOSS : lowestLow, color = color.red, title = "Stop Loss", linewidth = 2)

// Plot confirmation signals

plotshape(isEntrySignal, title="Confirmed Breakout", location=location.belowbar,

color=color.green, style=shape.triangleup, size=size.normal)

// Plot volume confirmation (only if enabled)

bgcolor(useVolumeConfirmation and isVolumeConfirmed and ta.crossover(close, ema200) ? color.new(color.green, 90) : na, title="Volume Confirmed")

相关推荐