in the last 10 logs and clear the rest

LogReset(10)

}

```Python

def main():

LogReset(10)

void main() {

LogReset(10);

}

LogVacuum()

LogVacuum(), after calling the LogReset() function to clear the log, recovers the storage space occupied by SQLite when deleting data. The function has no return value.

The reason is that SQLite does not reclaim the occupied space when deleting data, so you need to perform VACUUM to clean up the table, and release the space. When this function is called, the file move operation will occur with a large delay. It is recommended to call it at an appropriate time interval.

Market Quotes API

The main market interface functions:

| Function Name | Description |

|---|---|

| GetTicker | Get tick quotes data |

| GetRecords | Get K-line data |

| GetDepth | Get order book data (order depth data) |

| GetTrades | Get the latest trading records in the market |

The following functions can be called through exchange or exchanges[0] objects; for example: functions, likeexchange.GetTicker(); or exchanges[0].GetTicker();, return the market quotes of the current trading pairs and setting contracts.

Important tips for calling API functions with network access:

When calling any API function that accesses a platform interface (such as exchange.GetTicker(), exchange.Buy(Price, Amount), exchange.CancelOrder(Id), etc.), the failure of access is probably caused by various reasons. Therefore, we must do fault-tolerant processing for the call of these functions. For example: the exchange.GetTicker() function for obtaining market data may, due to platform server problems and network transmission problems, etc., cause result that the return value of the exchange.GetTicker() function is null. Then, the return value of exchange.GetTicker() must be dealt with by fault-tolerant processing.

The data returned by the exchange.GetTicker() function in the following code is assigned to the ticker variable, and we need to deal with fault tolerance before using the ticker variable.

function main() {

var ticker = exchange.GetTicker()

if(!ticker){

// Recall once, or use other processing logic

ticker = exchange.GetTicker()

}

}

def main():

ticker = exchange.GetTicker()

if not ticker:

ticker = exchange.GetTicker()

void main() {

auto ticker = exchange.GetTicker();

if(!ticker.Valid) {

ticker = exchange.GetTicker();

Log("Test");

}

}

In addition, for the fault-tolerant performance testing of the strategy, FMZ has specifically added a unique fault-tolerant mode backtest. The backtest system can randomly return some API calls that will occur when the network is accessed according to the set parameters, and return the return values of some failed calls. You can quickly test the robustness of the program in the bot. Switch to the backtest system page on the strategy editing page, click the inverted triangle drop-down control on the right side of the “Start Backtest” button, and the “Backtest Fault Tolerant” button will pop up.

exchange.GetTicker()

exchange.GetTicker() gets the current market quotes of current trading pairs and contracts, with the return value: Ticker structure.

In the backtest system, the Ticker data returned by the exchange.GetTicker() function, where High and Low are simulated values, taken from current time of “sell 1” and “buy 1” in the bot. The cryptocurrency in the real running is the highest price and the lowest price in a certain period defined by the exchange Tick interface.

function main(){

var ticker = exchange.GetTicker()

/*

The platform interface may not be accessible due to network problems (even if the device's docker program can open the platform website, the API may not be accessible)

At this time, ticker is null, when accessing ticker. When it is "High", it will cause an error; so when testing, ensure that you can access the platform interface

*/

Log("High:", ticker.High, "Low:", ticker.Low, "Sell:", ticker.Sell, "Buy:", ticker.Buy, "Last:", ticker.Last, "Volume:", ticker.Volume)

}

def main():

ticker = exchange.GetTicker()

Log("High:", ticker["High"], "Low:", ticker["Low"], "Sell:", ticker["Sell"], "Buy:", ticker["Buy"], "Last:", ticker["Last"], "Volume:", ticker["Volume"])

void main() {

auto ticker = exchange.GetTicker();

Log("High:", ticker.High, "Low:", ticker.Low, "Sell:", ticker.Sell, "Buy:", ticker.Buy, "Last:", ticker.Last, "Volume:", ticker.Volume);

}

In the real bot (not backtest), the Info attribute in the return value of the exchange.GetTicker() function stores the original data returned when the interface is called.

exchange.GetDepth()

exchange.GetDepth() gets the exchange order book data of current trading pairs and contracts. Return value: Depth structure.

Depth structure contains two arrays of structures, namely Asks[] and Bids[], Asks and Bids contain the following structure variables:

| Data Type | Variable Name | Description |

|---|---|---|

| number | Price | price |

| number | Amount | amount |

For example, if I want to get the current sell second price, I can write the code like this:

function main(){

var depth = exchange.GetDepth()

/*

The platform interface may not be accessible due to network reasons (even if the device's docker program can open the platform website, the API may not be accessible)

At this time, depth is null. When accessing depth.Asks[1].Price, it will cause an error; so when testing, ensure that you can access the platform interface

*/

var price = depth.Asks[1].Price

Log("Sell 2 price is:", price)

}

def main():

depth = exchange.GetDepth()

price = depth["Asks"][1]["Price"]

Log("Sell 2 price is:", price)

void main() {

auto depth = exchange.GetDepth();

auto price = depth.Asks[1].Price;

Log("Sell 2 price is:", price);

}

exchange.GetTrades()

exchange.GetTrades() gets platform trading history (not your own). Return value: Trade structure array. Some exchanges do not support it. The specific data returned depends on the trading records within the range, according to specific circumstances.

The returned data is an array, where the time sequence of each element is the same as the return data sequence of the exchange.GetRecords function, that is, the last element of the array is the data closest to the current time.

// In the simulated backtest, the data is empty; to have a trading history, there must be a real bot running

function main(){

var trades = exchange.GetTrades()

/*

The platform interface may not be accessible due to network reasons (even if the device's docker program can open the platform website, the API may not be accessible)

At this time, "trades" is null. When accessing trades[0].Id, it will cause an error; so when testing, ensure that you can access the platform interface

*/

Log("id:", trades[0].Id, "time:", trades[0].Time, "Price:", trades[0].Price, "Amount:", trades[0].Amount, "type:", trades[0].Type)

}

def main():

trades = exchange.GetTrades()

Log("id:", trades[0]["Id"], "time:", trades[0]["Time"], "Price:", trades[0]["Price"], "Amount:", trades[0]["Amount"], "type:", trades[0]["Type"])

void main() {

auto trades = exchange.GetTrades();

Log("id:", trades[0].Id, "time:", trades[0].Time, "Price:", trades[0].Price, "Amount:", trades[0].Amount, "type:", trades[0].Type);

}

exchange.GetRecords()

exchange.GetRecords(Period) returns K-line data. K-line period is specified when creating the bot; if you specify the parameters when the exchange.GetRecords() function is called, the obtained data will be the K-line data corresponding to the parameter period. If there is no specified parameter, the K-line data is returned according to the K-line period set on the bot parameters or the K-line period set on the backtest page.

Parameter Period:

- PERIOD_M1: refers to 1 minute

- PERIOD_M5: refers to 5 minutes

- PERIOD_M15: refers to 15 minutes

- PERIOD_M30: refers to 30 minutes

- PERIOD_H1: refers to 1 hour

- PERIOD_D1: refers to 1 day

The parameter value of

Periodonly can pass the standard periods defined above, but also can pass numbers, in the unit of second.

The return value of exchange.GetRecords(Period) function:

The return value is an array of Record structures, the returned K-line data will be accumulated over time, the upper limit of the accumulated K-line bars is affected by the exchange.SetMaxBarLen function setting. The default upper limit is 5000 K-line bars when it is not set. When the K-Line data reaches the K-Line bar accumulation limit, it will be updated by adding a K-Line bar and deleting the earliest K-Line bar (e.g. queue in/out). Some exchanges do not provide a K-line interface, then the docker collects the market transaction record data in real time to generate K-lines.

Number of K-line bars fetched when the GetRecords function is initially called.

- The first 1000 K-line bars at the starting moment of the backtesting period are taken in advance in the backtesting system as the initial K-line data.

- The specific number of K-line bars to be acquired during real bot is based on the maximum amount of data that can be acquired by the K-line interface of the exchange.

For the exchange.GetRecords(Period) function, the bot and backtest of cryptocurrency both support custom periods, and the parameter Period is the number of seconds. For example:

function main() {

// Print K-line data with a K-line period of 120 seconds (2 minutes)

Log(exchange.GetRecords(60 * 2))

// Print K-line data with a K-line period of 5 minutes

Log(exchange.GetRecords(PERIOD_M5))

}

def main():

Log(exchange.GetRecords(60 * 2))

Log(exchange.GetRecords(PERIOD_M5))

void main() {

Log(exchange.GetRecords(60 * 2)[0]);

Log(exchange.GetRecords(PERIOD_M5)[0]);

}

Setting Period parameter to 5 is to request K-line data with a period of 5 seconds.

If the Period parameter is not evenly divided by 60 (that is, the period represented is a period of unavailable minutes), the bottom layer of the system uses the relevant interface of GetTrades to obtain trading record data and synthesize the required K-line data.

If the Period parameter is evenly divided by 60, then the required K-line data is synthesized by using a minimum of 1-minute K-line data (using a larger period to synthesize the required K-line data if possible).

function main(){

var records = exchange.GetRecords(PERIOD_H1)

/*

The platform interface may not be accessible due to network reasons (even if the device's docker program can open the platform website, the API may not be accessible)

At this time, "records" is null. When accessing records[0].Time, it will cause an error; so when testing, ensure that you can access the platform interface

*/

Log("The first k-line data is, Time:", records[0].Time, "Open:", records[0].Open, "High:", records[0].High)

Log("The second k-line data is, Time:", records[1].Time ,"Close:", records[1].Close)

Log("Current K-line (latest)", records[records.length-1], "Current K-line (latest)", records[records.length-2])

}

def main():

records = exchange.GetRecords(PERIOD_H1)

Log("The first k-line data is, Time:", records[0]["Time"], "Open:", records[0]["Open"], "High:", records[0]["High"])

Log("The second k-line data is, Time:", records[1]["Time"], "Close:", records[1]["Close"])

Log("Current K-line (latest)", records[-1], "Current K-line (latest)", records[-2])

void main() {

auto records = exchange.GetRecords(PERIOD_H1);

Log("The first k-line data is, Time:", records[0].Time, "Open:", records[0].Open, "High:", records[0].High);

Log("The second k-line data is, Time:", records[1].Time, "Close:", records[1].Close);

Log("Current K-line (latest)", records[records.size() - 1], "Current K-line (latest)", records[records.size() - 2]);

}

exchange.GetRecords() function has two conditions for obtaining K-line data:

-

The exchange provides a K-line data interface. In this case, the acquired data is the data directly returned by the exchange.

-

The exchange does not provide a K-line data interface. The FMZ docker program obtains the latest trading records of the exchange each time the strategy program calls

exchange.GetRecords(), that is, it calls theexchange.GetTrades()function to obtain data and synthesize K-line data.

The simulation-level backtest in the system needs to set the underlying K-line period (when the backtesting system simulates the level of back-testing, the corresponding K-line data is used to generate tick data according to the set underlying K-line period); it should be noted that the period of the K-line data obtained in the strategy cannot be less than the underlying K-line period. Because in the simulation-level backtest, the K-line data of each period is synthesized by the K-line data corresponding to the underlying K-line periods in the backtest system.

In cpp language, if you need to construct your own K-line data, there are the following code examples:

#include <sstream>

void main() {

Records r;

r.Valid = true;

for (auto i = 0; i < 10; i++) {

Record ele;

ele.Time = i * 100000;

ele.High = i * 10000;

ele.Low = i * 1000;

ele.Close = i * 100;

ele.Open = i * 10;

ele.Volume = i * 1;

r.push_back(ele);

}

// Output display: Records[10]

Log(r);

auto ma = TA.MA(r,10);

// Output display: [nan,nan,nan,nan,nan,nan,nan,nan,nan,450]

Log(ma);

}

exchange.GetPeriod()

The exchange.GetPeriod() function returns the K-line period set on the FMZ platform website page when running strategies in backtest and bot. The return value is an integer in the unit of second. Return value: numeric type.

function main() {

// For example, in the backtest and bot, set the K-line period on the website page of FMZ platform to 1 hour

var period = exchange.GetPeriod()

Log("K-line period:", period / (60 * 60), "hour")

}

def main():

period = exchange.GetPeriod()

Log("K-line period:", period / (60 * 60), "hour")

void main() {

auto period = exchange.GetPeriod();

Log("K-line period:", period / (60 * 60.0), "hour");

}

exchange.SetMaxBarLen(Len)

The exchange.SetMaxBarLen(Len) function affects two aspects during the runtime of the cryptocurrency strategy:

- Affecting the number of K-line bars (BAR) obtained for the first time.

- Affecting the upper limit of K-line bars (BAR).

function main() {

exchange.SetMaxBarLen(50)

var records = exchange.GetRecords()

Log(records.length, records)

}

def main():

exchange.SetMaxBarLen(50)

r = exchange.GetRecords()

Log(len(r), r)

void main() {

exchange.SetMaxBarLen(50);

auto r = exchange.GetRecords();

Log(r.size(), r[0]);

}

exchange.GetRawJSON()

exchange.GetRawJSON() returns the raw content (strings) returned by the last REST request, which can be used to parse data by yourself. Return value: string type, only valid in the cryptocurrency live trading environment. Backtest does not support the function.

Strategies in cpp language do not support the function.

function main(){

exchange.GetAccount();

var obj = JSON.parse(exchange.GetRawJSON());

Log(obj);

}

import json

def main():

exchange.GetAccount()

obj = json.loads(exchange.GetRawJSON())

Log(obj)

void main() {

auto obj = exchange.GetAccount();

// C++ doe not support "GetRawJSON" function

Log(obj);

}

exchange.GetRate()

exchange.GetRate() returns the exchange rates of the currency currently used in the exchange and the currently displayed pricing currency, and a return value of 1 indicates that exchange rate conversion is disabled. Return value: numeric type.

Note:

- If

exchange.SetRate()has not been called to set exchange rate, the exchange rate value returned byexchange.GetRate()is 1 by default, that is, the exchange rate conversion currently displayed has not been exchanged. - If the

exchange.SetRate()has been used to set an exchange rate value, such as,exchange.SetRate(7), then all price information of the current exchange object representing the circulating currency of the trading platform, such as quotes, depth, order prices, etc., will be multiplied by the previously set exchange rate 7 for conversion. - If the

exchangecorresponds to an exchange with USD as the pricing currency, after callingexchange.SetRate(7), all prices of the bot will be converted to prices close to CNY by multiplying by 7. At this time, the exchange rate value obtained by usingexchange.GetRate()is 7.

exchange.GetUSDCNY()

exchange.GetUSDCNY() returns the latest exchange rate of the US dollar (data source provided by yahoo). The return value: numeric type.

exchange.SetData(Key, Value)

The exchange.SetData(Key, Value) function is used to set the data loaded at the time when the strategy is running, which can be any economic indicator, industry data, relevant index, etc. It can be used to quantify all quantifiable information for trading strategies and also support using in the backtest system.

Calling method of exchange.SetData(Key, Value) function:

-

Write data directly into the strategy The data format is required as the

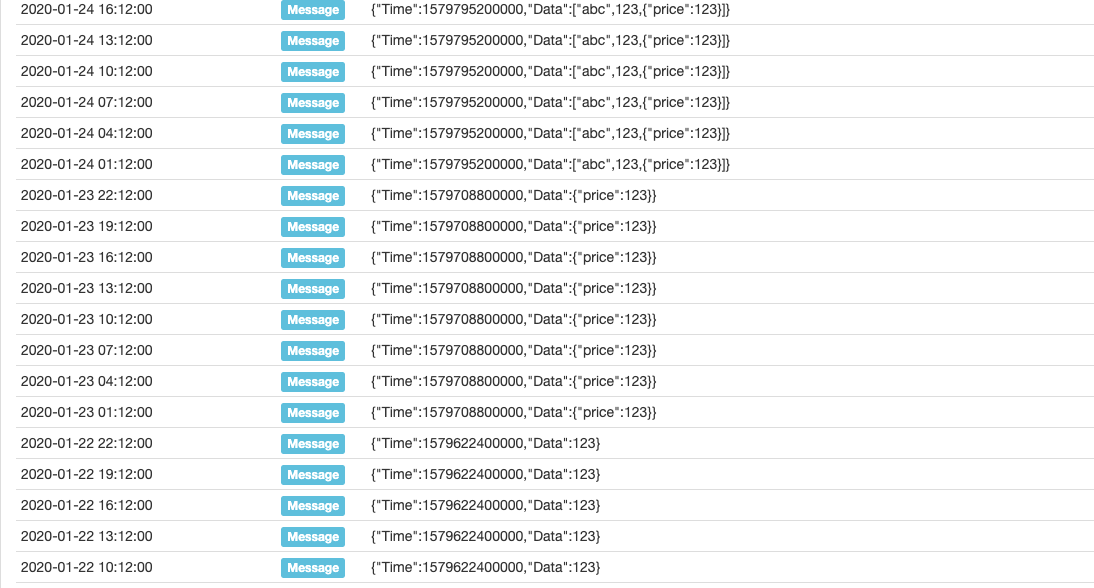

datavariable in the following example./*backtest start: 2020-01-21 00:00:00 end: 2020-02-12 00:00:00 period: 1d basePeriod: 1d exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}] */ function main() { var data = [ [1579536000000, "abc"], [1579622400000, 123], [1579708800000, {"price": 123}], [1579795200000, ["abc", 123, {"price": 123}]] ] exchange.SetData("test", data) while(true) { Log(exchange.GetData("test")) Sleep(1000) } }'''backtest start: 2020-01-21 00:00:00 end: 2020-02-12 00:00:00 period: 1d basePeriod: 1d exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}] ''' def main(): data = [ [1579536000000, "abc"], [1579622400000, 123], [1579708800000, {"price": 123}], [1579795200000, ["abc", 123, {"price": 123}]] ] exchange.SetData("test", data) while True: Log(exchange.GetData("test")) Sleep(1000)/*backtest start: 2020-01-21 00:00:00 end: 2020-02-12 00:00:00 period: 1d basePeriod: 1d exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}] */ void main() { json data = R"([ [1579536000000, "abc"], [1579622400000, 123], [1579708800000, {"price": 123}], [1579795200000, ["abc", 123, {"price": 123}]] ])"_json; exchange.SetData("test", data); while(true) { Log(exchange.GetData("test")); Sleep(1000); } }When the above test code is run, the corresponding data will be obtained at the corresponding time, as shown in the figure:

As we can see, the corresponding time of timestamp

1579622400000is2020-01-22 00: 00: 00; when the strategy program runs after this time, before the next data timestamp1579708800000, that is, before the time of2020-01-23 00: 00: 00, call theexchange.GetData(Source)function to get the data. All obtained is the content of[1579622400000, 123]. As the program continues to run and time changes, obtain data piece by piece data like this. -

Request data through external links

Requested data format

{ "schema":["time","data"], "data":[ [1579536000000, "abc"], [1579622400000, 123], [1579708800000, {"price": 123}], [1579795200000, ["abc", 123, {"price": 123}]] ] }Where

schemais the data format of each record in the main body of the loaded data, the format is fixed as["time", "data"], corresponding to thedataattribute format of the data one by one. Thedataattribute stores the main body of the data, and each piece of the data is composed of millisecond-level timestamps and data content (the data content can be any JSON encoded data).The service program for testing is written in

Golanguage:package main import ( "fmt" "net/http" "encoding/json" ) func Handle (w http.ResponseWriter, r *http.Request) { defer func() { fmt.Println("req:", *r) ret := map[string]interface{}{ "schema": []string{"time","data"}, "data": []interface{}{ []interface{}{1579536000000, "abc"}, []interface{}{1579622400000, 123}, []interface{}{1579708800000, map[string]interface{}{"price":123}}, []interface{}{1579795200000, []interface{}{"abc", 123, map[string]interface{}{"price":123}}}, }, } b, _ := json.Marshal(ret) w.Write(b) }() } func main () { fmt.Println("listen http://localhost:9090") http.HandleFunc("/data", Handle) http.ListenAndServe(":9090", nil) }After receiving the request, the program responds to the data:

{ "schema":["time","data"], "data":[ [1579536000000, "abc"], [1579622400000, 123], [1579708800000, {"price": 123}], [1579795200000, ["abc", 123, {"price": 123}]] ] }Test strategy code:

/*backtest start: 2020-01-21 00:00:00 end: 2020-02-12 00:00:00 period: 1d basePeriod: 1d exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}] */ function main() { while(true) { Log(exchange.GetData("http://xxx.xx.x.xx:9090/data")) Sleep(1000) } }'''backtest start: 2020-01-21 00:00:00 end: 2020-02-12 00:00:00 period: 1d basePeriod: 1d exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}] ''' def main(): while True: Log(exchange.GetData("http://xxx.xx.x.xx:9090/data")) Sleep(1000)/*backtest start: 2020-01-21 00:00:00 end: 2020-02-12 00:00:00 period: 1d basePeriod: 1d exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}] */ void main() { while(true) { Log(exchange.GetData("http://xxx.xx.x.xx:9090/data")); Sleep(1000); } }

exchange.GetData(Source)

The exchange.GetData(Source) function is used to get the data loaded by the exchange.SetData(Key, Value) function or the data provided by the external link, it can be used in the backtest system. The data is obtained at one time during the backtest, and the data is cached for one minute during the actual trading.

-

Obtaining the calling method of data written directly

/*backtest start: 2020-01-21 00:00:00 end: 2020-02-12 00:00:00 period: 1d basePeriod: 1d exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}] */ function main() { exchange.SetData("test", [[1579536000000, _D(1579536000000)], [1579622400000, _D(1579622400000)], [1579708800000, _D(1579708800000)]]) while(true) { Log(exchange.GetData("test")) Sleep(1000 * 60 * 60 * 24) } }'''backtest start: 2020-01-21 00:00:00 end: 2020-02-12 00:00:00 period: 1d basePeriod: 1d exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}] ''' def main(): exchange.SetData("test", [[1579536000000, _D(1579536000000/1000)], [1579622400000, _D(1579622400000/1000)], [1579708800000, _D(1579708800000/1000)]]) while True: Log(exchange.GetData("test")) Sleep(1000 * 60 * 60 * 24)/*backtest start: 2020-01-21 00:00:00 end: 2020-02-12 00:00:00 period: 1d basePeriod: 1d exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}] */ void main() { json arr = R"([[1579536000000, ""], [1579622400000, ""], [1579708800000, ""]])"_json; arr[0][1] = _D(1579536000000); arr[1][1] = _D(1579622400000); arr[2][1] = _D(1579708800000); exchange.SetData("test", arr); while(true) { Log(exchange.GetData("test")); Sleep(1000 * 60 * 60 * 24); } } -

Method of calling data from external links

function main() { Log(exchange.GetData("http://xxx.xx.x.xx:9090/data")) Log(exchange.GetData("https://www.fmz.com/upload/asset/32bf73a69fc12d36e76.json")) }def main(): Log(exchange.GetData("http://xxx.xx.x.xx:9090/data")) Log(exchange.GetData("https://www.fmz.com/upload/asset/32bf73a69fc12d36e76.json"))void main() { Log(exchange.GetData("http://xxx.xx.x.xx:9090/data")); Log(exchange.GetData("https://www.fmz.com/upload/asset/32bf73a69fc12d36e76.json")); } -

Use the fundamental data of the platform data center Use the

exchange.GetData(Source)function to get Fundamental Data.

When calling the exchange.GetData(Source) function, you can pass in the second parameter to set the cache timeout in milliseconds. The default is one-minute cache timeout in real bot. In the backtest system, when using the access interface to request data, the backtest system will add parameters “from” (timestamp seconds), to (timestamp seconds), period (underlying K-line period, timestamp milliseconds) and other parameters automatically to the request, to determine the time range of the data to be obtained.

Trading API

The following functions can be called through the exchange or exchanges[0] object. For example: exchange.Sell(100, 1); indicates the next order is a sell order with a price of 100 and a quantity of 1 on the exchange.

exchange.Buy(Price, Amount)

exchange.Buy(Price, Amount) is used to place a buy order and return an order ID. Parameter value: Price is the order price in type of number, and Amount is the order amount in type of number. Return value: string type or numeric type (the specific type depends on the return type of each exchange platform).

The returned order number can be used to query order information and cancel orders.

function main() {

var id = exchange.Buy(100, 1);

Log("id:", id);

}

def main():

id = exchange.Buy(100, 1)

Log("id:", id)

void main() {

auto id = exchange.Buy(100, 1);

Log("id:", id);

}

-

Futures orders

When placing orders for futures, we must pay attention to whether the trading direction is set correctly. If the trading direction and trading function do not match, an error will be reported. The number of orders placed on a cryptocurrency futures exchange is the number of contracts unless otherwise specified. For example:

// The following is the wrong call function main() { exchange.SetContractType("quarter") // Set short direction exchange.SetDirection("sell") // Place a buy order, and you will get an error, so you can only sell short var id = exchange.Buy(50, 1) // Set short direction exchange.SetDirection("buy") // Place a sell order, and you will get an error, so you can only buy long var id2 = exchange.Sell(60, 1) // Set close long position direction exchange.SetDirection("closebuy") // Place a buy order, and you will get an error, so you can only sell short var id3 = exchange.Buy(-1, 1) // Set close short position direction exchange.SetDirection("closesell") // Place a sell order, and you will get an error, so you can only buy long var id4 = exchange.Sell(-1, 1) }# The following is the wrong call def main(): exchange.SetContractType("quarter") exchange.SetDirection("sell") id = exchange.Buy(50, 1) exchange.SetDirection("buy") id2 = exchange.Sell(60, 1) exchange.SetDirection("closebuy") id3 = exchange.Buy(-1, 1) exchange.SetDirection("closesell") id4 = exchange.Sell(-1, 1)// The following is the wrong call void main() { exchange.SetContractType("quarter"); exchange.SetDirection("sell"); auto id = exchange.Buy(50, 1); exchange.SetDirection("buy"); auto id2 = exchange.Sell(60, 1); exchange.SetDirection("closebuy"); auto id3 = exchange.Buy(-1, 1); exchange.SetDirection("closesell"); auto id4 = exchange.Sell(-1, 1); }Error messages:

direction is sell, invalid order type Buy direction is buy, invalid order type Sell direction is closebuy, invalid order type Buy direction is closesell, invalid order type Sell -

Market order

Note: The exchange order interface is required to support market orders (when the order type is a buy order, the order amount parameter is the amount in quote currency), and the market order method of cryptocurrency futures is used to place orders, and the unit of the quantity parameter is the number of contracts. A few live trading exchanges for digital currencies do not support market order interfaces.

// For example, trading pairs: ETH_BTC, bought in by market order function main() { // Buy a market order, and buy ETH coins equal to 0.1 BTC (quote currency) exchange.Buy(-1, 0.1) }def main(): exchange.Buy(-1, 0.1)void main() { exchange.Buy(-1, 0.1); }

exchange.Sell(Price, Amount)

exchange.Sell(Price, Amount) places a sell order and returns an order ID. Parameter value: Price is the order price, numeric type. Amount is the order amount, numeric type. Return value: string type or numeric type (the specific type depends on the return type of each exchange).

Returned order number, which can be used to query order information and cancel orders.

function main(){

var id = exchange.Sell(100, 1)

Log("id:", id)

}

def main():

id = exchange.Sell(100, 1)

Log("id:", id)

void main() {

auto id = exchange.Sell(100, 1);

Log("id:", id);

}

-

Futures orders

When placing orders for futures, you must pay attention to whether the trading direction is set correctly. If the trading direction and trading function do not match, an error will be reported. The order amount of cryptocurrency futures platforms is the number of contracts unless otherwise specified.

-

Market orders

Note: platform order placement interface is required to support market orders. (When the order type is a sell order, the order amount parameter is the number of operating coins sold), and cryptocurrency futures place orders by market orders form, and the order amount parameter unit is the number of contracts. A few digital currency exchanges in real trading do not support market order interfaces.

// For example, trading pairs: ETH_BTC, sold out by market order function main() { // Note: Sell by a market order, and sell 0.2 ETH coins exchange.Sell(-1, 0.2) }def main(): exchange.Sell(-1, 0.2)void main() { exchange.Sell(-1, 0.2); }

exchange.CancelOrder(Id)

exchange.CancelOrder(orderId), the purpose of this function is to cancel an order with Id. Parameter value: Id is the order number, in string type or numeric type (the specific type depends on the return type when placing an order on each platform); return value: bool type.

Return the operation result; true means that the order cancellation request was sent successfully; false means that the cancel order request fails to send (the return value only indicates whether sending request is successful or not, so it is best to call exchange.GetOrders() to check if the platform cancels the order).

function main(){

var id = exchange.Sell(99999, 1)

exchange.CancelOrder(id)

}

def main():

id = exchange.Sell(99999, 1)

exchange.CancelOrder(id)

void main() {

auto id = exchange.Sell(99999, 1);

exchange.CancelOrder(id);

}

The API function of FMZ, which can generate log output functions, such as Log(...), exchange.Buy(Price, Amount) and exchange.CancelOrder(Id). You can follow the necessary parameters with some additional output parameters, such as exchange.CancelOrder(orders[j].Id, orders[j]). In this way, it is canceling orders[j] order that is accompanied by the output of this order information, namely the Order structure of orders[j].

function main() {

Log("data1", "data2", "data3", "...")

var data2 = 200

var id = exchange.Sell(100000, 0.1, "Incidental data1", data2, "...")

exchange.CancelOrder(id, "Incidental data1", data2, "...")

LogProfit(100, "Incidental data1", data2, "...")

}

def main():

Log("data1", "data2", "data3", "...")

data2 = 200

id = exchange.Sell(100000, 0.1, "Incidental data1", data2, "...")

exchange.CancelOrder(id, "Incidental data1", data2, "...")

LogProfit(100, "Incidental data1", data2, "...")

void main() {

Log("data1", "data2", "data3", "...");

int data2 = 200;

auto id = exchange.Sell(100000, 0.1, "Incidental data1", data2, "...");

exchange.CancelOrder(id, "Incidental data1", data2, "...");

LogProfit(100, "Incidental data1", data2, "...");

}

exchange.GetOrder(Id)

exchange.GetOrder(orderId) gets the order details according to the order number. Parameter value: Id is the order number to be obtained, and Id is of string or numeric type (the specific type depends on the return type of each exchange). Return value: Order structure.

(Not supported by some exchanges)

OrderstructureAvgPriceindicates average executed price (some exchanges do not support this field; set it to 0 if they do not support).

function main(){

var id = exchange.Sell(1000, 1)

// The parameter id is the order number, you need to fill in the number of the order you want to query

var order = exchange.GetOrder(id)

Log("Id:", order.Id, "Price:", order.Price, "Amount:", order.Amount, "DealAmount:",

order.DealAmount, "Status:", order.Status, "Type:", order.Type)

}

def main():

id = exchange.Sell(1000, 1)

order = exchange.GetOrder(id)

Log("Id:", order["Id"], "Price:", order["Price"], "Amount:", order["Amount"], "DealAmount:",

order["DealAmount"], "Status:", order["Status"], "Type:", order["Type"])

void main() {

auto id = exchange.Sell(1000, 1);

auto order = exchange.GetOrder(id);

Log("Id:", order.Id, "Price:", order.Price, "Amount:", order.Amount, "DealAmount:",

order.DealAmount, "Status:", order.Status, "Type:", order.Type);

}

exchange.GetOrders()

exchange.GetOrders() gets all unfinished orders. Return value: Order structure array.

For Order structure, please refer to exchange.GetOrder() function description. When the account represented by the exchange object exchange has no pending orders, call exchange.GetOrders() to return an empty array, namely: [].

function main(){

exchange.Sell(1000, 1)

exchange.Sell(1000, 1)

var orders = exchange.GetOrders()

Log("Information for unfinished order 1, ID:", orders[0].Id, "Price:", orders[0].Price, "Amount:", orders[0].Amount,

"DealAmount:", orders[0].DealAmount, "type:", orders[0].Type)

Log("Information for unfinished order 2, ID:", orders[1].Id, "Price:", orders[1].Price, "Amount:", orders[1].Amount,

"DealAmount:", orders[1].DealAmount, "type:", orders[1].Type)

}

def main():

exchange.Sell(1000, 1)

exchange.Sell(1000, 1)

orders = exchange.GetOrders()

Log("Information for unfinished order 1, ID:", orders[0]["Id"], "Price:", orders[0]["Price"], "Amount:", orders[0]["Amount"],

"DealAmount:", orders[0]["DealAmount"], "type:", orders[0]["Type"])

Log("Information for unfinished order 2, ID:", orders[1]["Id"], "Price:", orders[1]["Price"], "Amount:", orders[1]["Amount"],

"DealAmount:", orders[1]["DealAmount"], "type:", orders[1]["Type"])

void main() {

exchange.Sell(1000, 1);

exchange.Sell(1000, 1);

auto orders = exchange.GetOrders();

Log("Information for unfinished order 1, ID:", orders[0].Id, "Price:", orders[0].Price, "Amount:", orders[0].Amount,

"DealAmount:", orders[0].DealAmount, "type:", orders[0].Type);

Log("Information for unfinished order 2, ID:", orders[1].Id, "Price:", orders[1].Price, "Amount:", orders[1].Amount,

"DealAmount:", orders[1].DealAmount, "type:", orders[1].Type);

}

The exchange.GetOrders() function obtains the unfinished order information of the currently set trading pair. It should be noted that the cryptocurrency futures have differences between not only trading pairs but also contract codes.

// Test OKX contract tradings, to know whether "GetOrders" gets all unfinished contract orders

function main(){

// The next weekly buy order; the price of the order minus 50 guarantees no execution; pending orders

exchange.SetContractType("this_week")

exchange.SetDirection("buy")

var ticker = exchange.GetTicker()

Log(ticker)

exchange.Buy(ticker.Last - 50, 1)

// The next quarterly sell order; the price plus 50 guarantees that it will not be executed, and the pending order has been switched to a quarterly contract

exchange.SetContractType("quarter")

exchange.SetDirection("sell")

ticker = exchange.GetTicker()

Log(ticker)

exchange.Sell(ticker.Last + 50, 1)

// Get the unfinished orders

Log("orders", exchange.GetOrders())

}

def main():

exchange.SetContractType("this_week")

exchange.SetDirection("buy")

ticker = exchange.GetTicker()

Log(ticker)

exchange.Buy(ticker["Last"] - 50, 1)

exchange.SetContractType("quarter")

exchange.SetDirection("sell")

ticker = exchange.GetTicker()

Log(ticker)

exchange.Sell(ticker["Last"] + 50, 1)

Log("orders", exchange.GetOrders())

void main() {

exchange.SetContractType("this_week");

exchange.SetDirection("buy");

auto ticker = exchange.GetTicker();

Log(ticker);

exchange.Buy(ticker.Last - 50, 1);

exchange.SetContractType("quarter");

exchange.SetDirection("sell");

ticker = exchange.GetTicker();

Log(ticker);

exchange.Sell(ticker.Last + 50, 1);

Log("orders", exchange.GetOrders());

}

The obtained unfinished order information:

[{"Id":17116430886,"Amount":1,"Price":808.4,"DealAmount":0,"AvgPrice":0,"Status":0,"Type":1,"ContractType":"quarter"}]

It can be seen that in cryptocurrency trading, the orders obtained by exchange.GetOrders() are only the unfinished orders of the currently set contract.

exchange.SetPrecision(…)

exchange.SetPrecision(PricePrecision, AmountPrecision) sets the decimal precision of the price and the symbol order amount; it will be truncated automatically after setting. Parameter value: PricePrecision is of number type, used to control the number of decimal places in price data; AmountPrecision is of number type, used to control the decimal point after the order amount. Both PricePrecision and AmountPrecision must be integer numbers. The backtest does not support the function, and the backtest numerical precision will be processed automatically.

function main(){

// Set the decimal precision of the price to 2 digits, and set the precision of the quantity of the symbol order to 3 digits

exchange.SetPrecision(2, 3)

}

def main():

exchange.SetPrecision(2, 3)

void main() {

exchange.SetPrecision(2, 3);

}

exchange.SetRate(Rate)

exchange.SetRate(Rate) sets the exchange rate of the circulation currency in the exchange. Parameter value: Rate is of number type. Return value: number type.

function main(){

Log(exchange.GetTicker())

// Set the exchange rate conversion

exchange.SetRate(7)

Log(exchange.GetTicker())

// Set to 1, without conversion

exchange.SetRate(1)

}

def main():

Log(exchange.GetTicker())

exchange.SetRate(7)

Log(exchange.GetTicker())

exchange.SetRate(1)

void main() {

Log(exchange.GetTicker());

exchange.SetRate(7);

Log(exchange.GetTicker());

exchange.SetRate(1);

}

Note:

-

If you have set an exchange rate value by using

exchange.SetRate(Rate), such as 7, then, all price information, including the current market price, depth, and order price, of the circulation currency represented by the currentexchangeobjects, will be multiplied by the set exchange rate of 7 for conversion. -

For example,

exchangeis an exchange rate denominated in US dollars. Afterexchange.SetRate(7)is called, all prices of the real trading will be multiplied by 7 and converted to prices close to CNY.

exchange.IO(…)

exchange.IO("api", httpMethod, resource, params, raw), call other functional interfaces of the exchange. Parameter value: httpMehod is of string type; it fills in the request type, such as POST or GET. resource is of string type, it fills in the request path. params is of string type, it fills in the request parameters. raw is the original JSON string parameter and it can be omitted. exchange.IO("api", httpMethod, resource, params, raw) function call will access the exchange interface. When an error occurs and the call fails, it returns a null value (the function with the network request, such as GetTicker() and GetAccount(), etc., return null values when calls fail). Only live trading supports calling the exchange.IO("api", ...) function.

For the example of OKX batch order, use the parameter raw to pass order parameters:

function main() {

var arrOrders = [

{"instId":"BTC-USDT-SWAP","tdMode":"cross","side":"buy","ordType":"limit","px":"16000","sz":"1","posSide":"long"},

{"instId":"BTC-USDT-SWAP","tdMode":"cross","side":"buy","ordType":"limit","px":"16000","sz":"2","posSide":"long"}

]

// Call exchange.IO to directly access the platform batch ordering interface

var ret = exchange.IO("api", "POST", "/api/v5/trade/batch-orders", "", JSON.stringify(arrOrders))

Log(ret)

}

import json

def main():

arrOrders = [

{"instId":"BTC-USDT-SWAP","tdMode":"cross","side":"buy","ordType":"limit","px":"16000","sz":"1","posSide":"long"},

{"instId":"BTC-USDT-SWAP","tdMode":"cross","side":"buy","ordType":"limit","px":"16000","sz":"2","posSide":"long"}

]

ret = exchange.IO("api", "POST", "/api/v5/trade/batch-orders", "", json.dumps(arrOrders))

Log(ret)

void main() {

json arrOrders = R"([

{"instId":"BTC-USDT-SWAP","tdMode":"cross","side":"buy","ordType":"limit","px":"16000","sz":"1","posSide":"long"},

{"instId":"BTC-USDT-SWAP","tdMode":"cross","side":"buy","ordType":"limit","px":"16000","sz":"2","posSide":"long"}

])"_json;

auto ret = exchange.IO("api", "POST", "/api/v5/trade/batch-orders", "", arrOrders.dump());

Log(ret);

}

To use this function, you need to go to the exchange to understand the API interface of the exchange to extend the functions that FMZ has not added (you do not have to worry about the process of parameter encryption, signature and verification when you submit a POST request. FMZ has processed completely at the bottom layer, so you only need to fill in the corresponding parameters).

Note:

If the key value in the params parameter (that is, the Http request parameter) is a string, it needs to be wrapped with single quotes (symbol') on both sides of the parameter value.

For example: bitfinex exchange.

var amount = 1

var price = 10

var basecurrency = "ltc"

function main () {

// Notice that amount.toString() and price.toString() both have a ' character on the left and right

var message = "symbol=" + basecurrency + "&amount='" + amount.toString() + "'&price='" + price.toString() + "'&side=buy" + "&type=limit"

var id = exchange.IO("api", "POST", "/v1/order/new", message)

}

amount = 1

price = 10

basecurrency = "ltc"

def main():

message = "symbol=" + basecurrency + "&amount='" + str(amount) + "'&price='" + str(price) + "'&side=buy" + "&type=limit"

id = exchange.IO("api", "POST", "/v1/order/new", message)

void main() {

auto amount = 1.0;

auto price = 10.0;

auto basecurrency = "ltc";

string message = format("symbol=%s&amount=\"%.1f\"&price=\"%.1f\"&side=buy&type=limit", basecurrency, amount, price);

auto id = exchange.IO("api", "POST", "/v1/order/new", message);

}

Example of accessing OKX interface:

function main(){

var ret = exchange.IO("api", "GET", "/api/v5/trade/orders-pending", "instType=SPOT")

Log(ret)

}

def main():

ret = exchange.IO("api", "GET", "/api/v5/trade/orders-pending", "instType=SPOT")

Log(ret)

void main() {

auto ret = exchange.IO("api", "GET", "/api/v5/trade/orders-pending", "instType=SPOT");

Log(ret);

}

Returned data during testing:

{"code":"0","data":[],"msg":""}

Other settings of the exchange.IO function:

-

Switch the trading pairs of the current exchange

exchange.IO("currency", "ETH_BTC")function main() { // For example, set the current trading pair of the exchange object on the bot to BTC_USDT, and print the current trading pair market Log(exchange.GetTicker()) // Switch trading pair to LTC_BTC exchange.IO("currency", "LTC_BTC") Log(exchange.GetTicker()) }def main(): Log(exchange.GetTicker()) exchange.IO("currency", "LTC_BTC") Log(exchange.GetTicker())void main() { Log(exchange.GetTicker()); exchange.IO("currency", "LTC_BTC"); Log(exchange.GetTicker()); }In this way, the trading pairs configured when the bot is added or the backtest is run will be switched through the codes.

Note:

-

- The backtest system now supports switching trading pairs (only the spot exchange objects of cryptocurrency). During backtest, it should be noted that only trading pairs of the same quote currency can be switched. For example, the current trading pair is

ETH_BTC, which can only be switched toLTC_BTC, notLTC_USDT.

- The backtest system now supports switching trading pairs (only the spot exchange objects of cryptocurrency). During backtest, it should be noted that only trading pairs of the same quote currency can be switched. For example, the current trading pair is

-

- If the

websocketprotocol mode is switched on the Huobi spot exchange objects, you cannot useexchange.IO("currency", "XXX_YYY")to switch currencies.

- If the

-

- For cryptocurrency futures exchanges, if the trading pairs are switched, you need to set up the contract again to determine which contract you want to trade with.

-

- You can also use the new

exchange.SetCurrency(Symbol)function to switch trading pairs, and useexchange.IO("currency","XXX_YYY")method to keep compatibility.

- You can also use the new

-

-

exchange.IOfunction switch the exchange API base address (RESET contract; some exchanges do not support that). Now the use ofexchange.SetBase(Base)function has been supported to switch the exchange API base address, and useexchange.IO("base","https://xxx.xxx.xxx")method to keep compatibility.For example: When the exchange object is encapsulated, the default base address is

https://api.huobipro.com, to switch to:https://api.huobi.pro, use the following code.function main () { // exchanges[0] is the first exchange object added when the bot is added exchanges[0].IO("base", "https://api.huobi.pro") }def main(): exchanges[0].IO("base", "https://api.huobi.pro")void main() { exchanges[0].IO("base", "https://api.huobi.pro"); }Switch the base address back to:

https://api.huobipro.com.function main () { exchanges[0].IO("base", "https://api.huobipro.com") }def main(): exchanges[0].IO("base", "https://api.huobipro.com")