Let Martin's strategy be your home base for a steady aluminum mine

Author: MightyTeam, Created: 2021-04-12 14:37:44, Updated: 2021-04-12 14:42:34The Martin strategy, which is based on the principle of double-spending, losses are made up, if you have unlimited funds, the Martin win rate is 100%. But in reality, funds cannot be unlimited, and many times, after a certain number of times, Martin may not have enough money to continue to make up, which leads to a bullish position.

But based on years of strategic research by our team, the Martin strategy has the highest win rate and payoff of all strategies, and the most important one is the Martin strategy, which starts when you don't have to, starts when you do, makes money when you do, which many other strategies don't.

Here we share the results of our team's research on Martin's strategy from a probabilistic perspective.

Change the multiplication factorMartin's strategy prototype is a doubling, but doubling results in fewer replenishment problems and reduced risk resistance. If replenishment is changed to other factors, then Martin's risk resistance increases significantly.

Timely profitsThe return on investment, although it is considerable, is also terrible, and if Martin keeps returning profits, as soon as the stock goes up, it will lead to a total zero-down disaster.

Let Martin be your mining machineAssuming that in extreme markets, Martin's strategy will explode, and we will make a profit on time, the problem we have to solve becomes how to get Martin's strategy to make enough profit for us before it explodes. Using 40x leverage as an example, the re-tested currency is LTC/USDT, taking the time interval between two major declines in the study cycle, in the case of complete unprofitability.

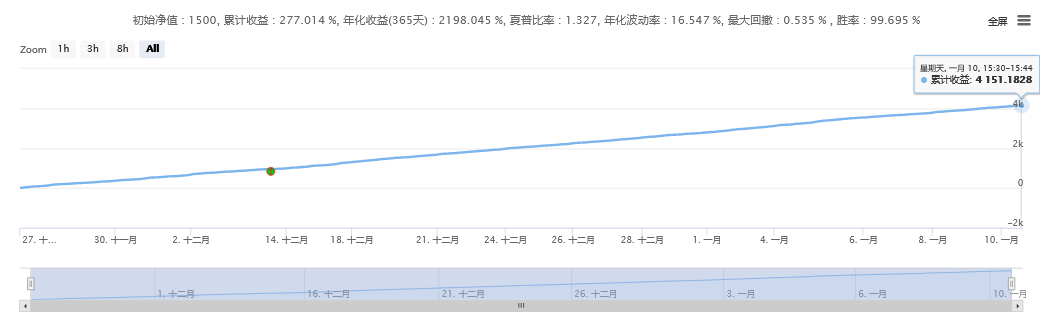

20201127~20210112(The time is between the last two big falls, starting with 1500u) Profit was 4151u, net profit was 4151-1500 = 2651u, with a yield of 176.7%

Profit was 4151u, net profit was 4151-1500 = 2651u, with a yield of 176.7%

20210112~ 20210224(The time is between the last two big falls, starting with 1500u) Profit was 3263u, net profit was 3263-1500 = 1763u, yield was 117.5%

Profit was 3263u, net profit was 3263-1500 = 1763u, yield was 117.5%

20210224~20210411(The last time it was down so far, starting at 1500u) Profit was 2084u, which was not a time to trigger a bull market, with a yield of 138.9%.

Profit was 2084u, which was not a time to trigger a bull market, with a yield of 138.9%.

The above is the earnings data for the last few months, and in addition to the 11.26 mentioned above, there are also 3.12 and 9.4 in 2020, which are larger in the interval between these days, leaving more profit space for the Martin strategy. Even if 20210112-20210, the 2 times of the fall are the smallest, but the yield is still 117.5%.

In this case, someone will ask, should you do more or less when you run the marathon? I'll share a detail with you here. First of all, let me explain a little bit, the above retest data, has always been doing more, our team has found through a lot of historical data analysis, doing more than doing more has a higher chance of winning, lower risk, and the U-Byte contract doing more than doing nothing has a more inherent advantage. (1) If you do more, as the price drops, the number of contracts in the over-equation replenishes, less usdt is needed, which means more replenishes, more hedging falls. (2) In the case of a short, as the price rises, the number of contracts in the short equation is filled, the required usdt is more, which means that the number of fillings is less and the hedge is less. This confirms Buffett's quote: "Don't look away, and don't do away with it!"

With the timely extraction of profits, Martin's strategy is like a mining machine that keeps you mining and yields substantial returns. (Disclaimer: historical data does not represent future data, much less strategic future gains)

More real-time data, and welcome to the Martin Real-time data that our amazing team has released.https://www.fmz.cn/robot/272504(Leverage 40x + timely profit)

- Why is it that GetTicker and GetDepth get a different buy and sell price?

- Binance is going from low to close to 2s, slippage is serious, is there a way to make it work?

- How much capital does a marketing strategy need?

- My friends, who are exhausted and don't like to program, who like to study digital currencies, came to me and gave me free code and proofreading.

- The MACD deviates from the algorithm of sharing

- Did your older brother help you make a Binance cashless robot?

- Please teach me a problem, real disk error type error: not a function at _N (__FILE__)

- Sleep function caused subscription failure

- Futures_Deribit error Futures_OP 4: argument error This is the default

- How to get a cash account with Binance Contract API

- b

- Where is the real disk in the video?

- Why the Binance Perpetual Contract Failed

- c

- Requesting tokens Cash automatically deferred contract collateral

- Customized checklist software

- How much is the minimum capital required for the grid strategy?

- How long will the shark strategy, the official strategy there, take to open?

- In the event that you are not able to access your account, you may be able to access your account with the help of a web browser.

- Richfield Securities failed to sign up for the review.