Foresight for the common man

Author: Little white cabbage, Created: 2022-06-09 14:31:17, Updated:1. The PrincipleFutures and spot commodities are often referred to as futures and spot commodities. Futures and spot commodities are often referred to as spot commodities.

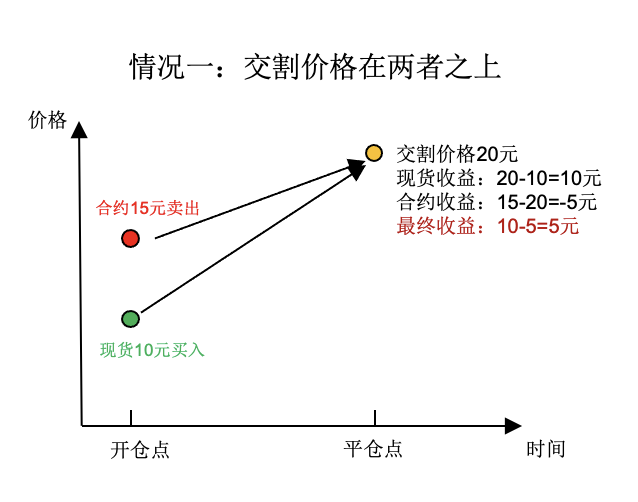

Due to the nature of the futures contract itself, its price must be the same as the spot price on the day of delivery at the latest. Thus, risk-free arbitrage is possible when there is a price difference between the futures contract and the spot price.2. TypeTo give a simple example, let's say that the spot price is now 10 yuan, the contract is 50% higher than the spot price, and the contract is 15 yuan. So we buy one spot at this time and make a blank futures. We invest 10 yuan of capital in total. At some point in the future, let's say that the futures and the spot price have risen, but the same price has become 20 yuan. Then we buy 10 yuan of spot goods and make 10 yuan.

Of course, the price of the final return may be higher than the current price, or it may be lower than the current price.

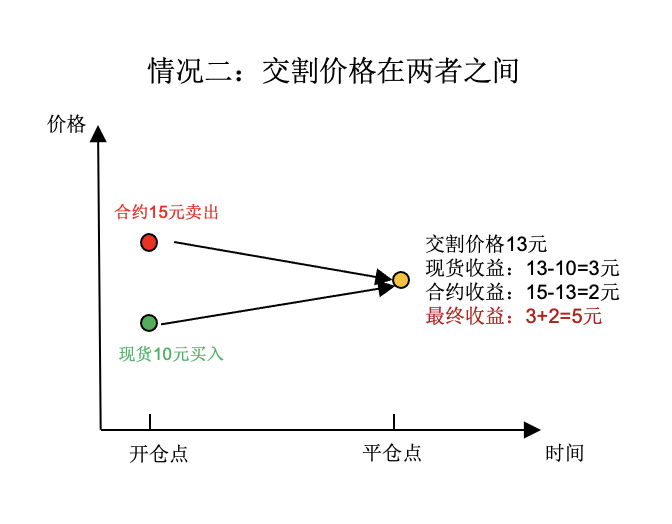

The spot price is 10 yuan, the contract is 50% higher than the spot price, 15 yuan. So we buy 1 spot at this time, and make a blank futures. We invest 10 yuan in total. At some point in the future, let's say that the futures are down, the spot price is up, but the price is the same, it becomes 13 yuan.

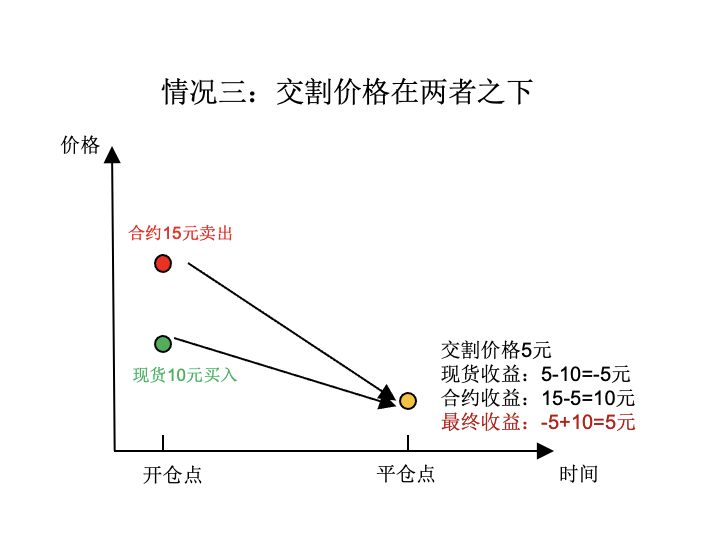

The spot price is 10 yuan, the contract is 50 percent higher than the spot price; the contract is 15 yuan. So we buy 1 spot at this time, and make a blank futures. We invest 10 yuan in total. At some point in the future, let's say the futures and the spot price both fall, but the price is the same, both become 5 yuan. Then we buy 10 yuan of spot is a loss of 5 yuan.

If you look closely, it is easy to see that the final yield of all three scenarios is 5 yuan. The yield is stable and completely unaffected by price movements.

3. Sources of income

In fact, the profit on the spot dividend is only related to the difference between the price of the purchase and the price of the sale and is not related to the price change. For example, in the example above, the price difference at the opening point is 5 yuan, the price difference at the breakeven point is 0 yuan, then the final profit is 5-0 = 5 yuan.

The price difference divided by the spot price is the price difference: 5/10 = 50% Generally, we use the price difference to measure whether the combination is worth investing in. The combination is stable when the price difference can cover the transaction fee. The price difference = (contract price - spot price) / contract price.

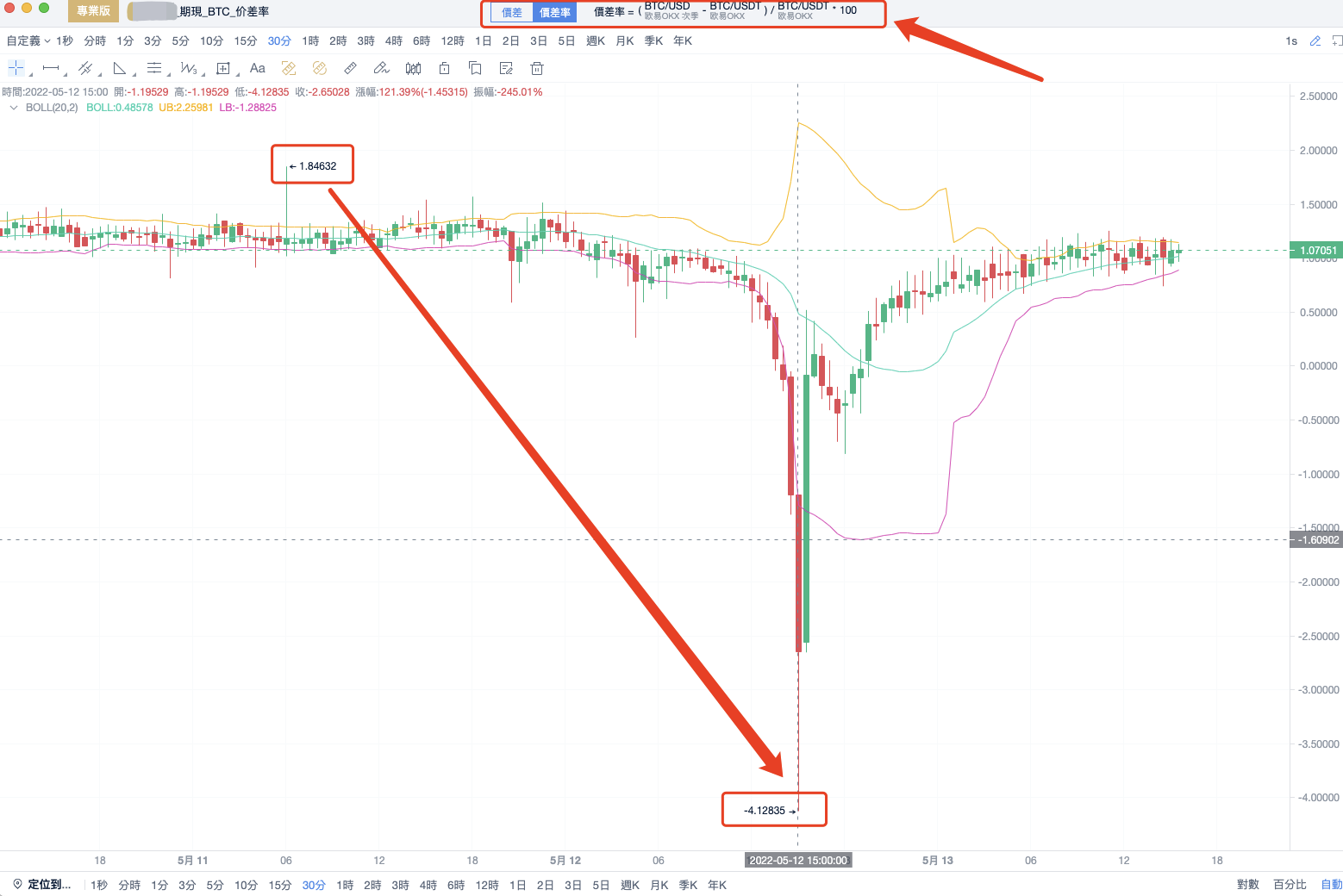

The following is a real-life example:

In this bearish market, the spread of BTC fell from a high of 1.84% on May 11 to a low of 4.12% on May 12. This means that a low-risk return of around 6% can be obtained if the bearish market is captured.

- Summary of knowledge In summary, the term forward rate can be summarized in the following sentences: First, buy at a low price and sell at a high price. Second, the price difference expands the opening position, the price difference shrinks the placement. Third, earnings are not dependent on price fluctuations, low risk, stable earnings.

This is about buying at a low price and selling at a high price, rather than buying and selling contracts. This is because the coin circle has long been a multi-head market, where contract prices are higher than spot prices, and we call contract opportunities higher than spot prices positive leverage opportunities. When the market is down, the contract price is lower than the spot price, we need to sell the high-priced spot and buy the low-priced contract. In short, remember to buy at low prices and sell at high prices. Of course, there are also disadvantages to the futures swap, the earnings are higher without a one-sided contract, and the down payment is more than one-sided trouble. Leverage opportunities need to be calculated by comparing futures and contracts, and it is difficult to seize opportunities with the naked eye alone. The market has just experienced a wave of decline, and the price differential is small towards the leverage.

- The grid strategy

- Return to the latest strategy of cash multi-currency hedging

- There is a bear market, there is no strategy to run

- Interest on capital charges

- Today's laughing incident (transliterated)

- The telegraph cluster suddenly stopped going in.

- Civilian gamers, is there a balancing strategy written by God?

- What interface can be used to get the market value of the currencies?

- Is there anyone who can help?

- Sharing a trend strategy

- I hope FMZ officially publishes the project.

- What is leverage?

- Bin An's campaign strategy application

- Precision issues

- Is there a way to remove a table line?

- I've been getting no signals on the retest. Can you fix it?

- Inventors quantified the PINE language introductory tutorial

- Please ask how to draw the earnings chart for the multi-currency.

- Digital currency

- Currency value

Little white cabbageRecently, there have been few opportunities for interest rate swaps, and there are more opportunities for reverse interest rate swaps.

Inventors quantifiedThank you for sharing, many people around us have been persisting in doing it, and they are doing very well on average.