Which of the following is the most recent year-over-year increase in the overhead and reverse overhead rates?

Author: Little white cabbage, Created: 2022-06-28 10:18:18, Updated:(i) The interest rate on the capital chargeI've done a little bit of a positive capital charge spread before.

At that time, the market was relatively good, with a one-time annual fee of up to 50% and a minimum of 20%; that is, a stable income of 35 to 90 U every 8 hours.

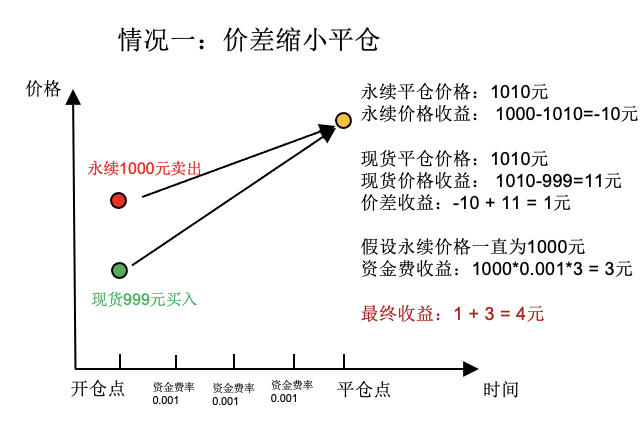

Let me give you a simple theoretical example.

The spot price is 999 yuan, the permanent price is 1000 yuan, the price difference is 1 yuan, and the capital fee is 0.001.

In this case, buy one item and sell one item permanently.

At some point in the future, the price of both the spot and the perpetual changes to 1010 yuan, and the price difference is reduced by 1 yuan, at which point the price difference is 0 yuan.

So, if you're going to make a permanent loss of 10 yuan, you're going to make a profit of 11 yuan.

The total of the three principal fees charged before the settlement, each of which is 0.001 for convenience, is assumed to be 1000 for the three principal fees.

So the capital gain is 1000.0.0013 is 3.

The final payoff: 1 + 3 = 4 The earnings of a fixed-rate fee package consist of two parts: the earnings of a fixed-rate fee and the earnings of a fixed-rate fee. The earnings of a fixed-rate fee are the long-term stable earnings and the earnings of a fixed-rate fee are the instantaneous earnings that are affected by market fluctuations.

We can even out and eat that part of the difference when the difference can cover the handling fees.

After the settlement, continue trading and continue to get stable capital fee returns

The earnings of a fixed-rate fee package consist of two parts: the earnings of a fixed-rate fee and the earnings of a fixed-rate fee. The earnings of a fixed-rate fee are the long-term stable earnings and the earnings of a fixed-rate fee are the instantaneous earnings that are affected by market fluctuations.

We can even out and eat that part of the difference when the difference can cover the handling fees.

After the settlement, continue trading and continue to get stable capital fee returns

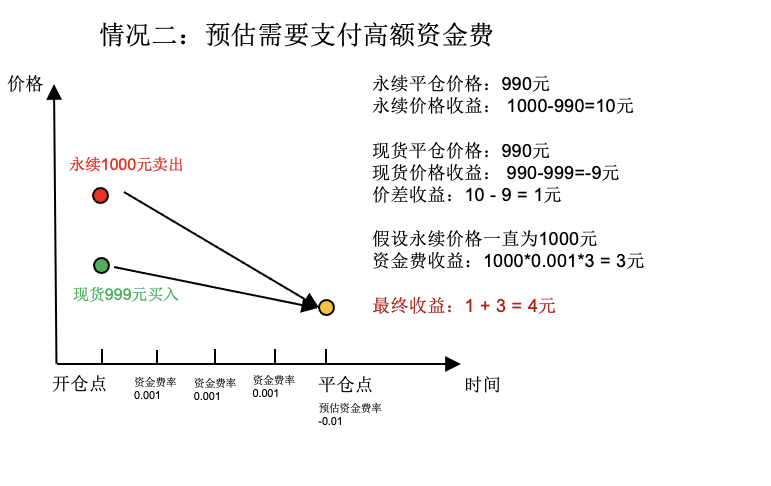

There is also a situation of equity where the down payment rate is expected to be negative and the absolute value is relatively high, i.e. when a high capital fee is required.

The spot price is 999 yuan, the permanent price is 1000 yuan, the price difference is 1 yuan, and the capital fee is 0.001.

In this case, buy one item and sell one item permanently.

At some point in the future, the forecasted down payment rate will be -0.01, and you will need to pay a 10 yuan high fee, which should be flat.

So, if you have a permanent loss of 10 yuan and a profit of 9 yuan, then the difference in price is 10-9 = 1 yuan.

The total of three principal fees charged before the strike, each at a rate of 0.001, is calculated for convenience by assuming that the three principal fees are calculated at a perpetual price of 1000

So the capital gain is 1000.0.0013 is 3.

The final payoff: 1 + 3 = 4

Details determine success. Above I am talking about the interest rate of the capital is right, and the value is relatively large, i.e. the need to pay a high capital fee when the equity.

Note that the word "high" is used here.

If the expected down payment rate is -0.000001, the amount of down payment required is less and it is estimated that the down payment can be continued in the next period.

If we are going to break even then we will lose the operating fee, and we can choose to hold on to the capital fee that needs to be paid for this period, not break even.(ii) Reverse charge preferences**

This time period has more reverse leverage opportunities, most recently mainly in this area of study, there have been 100%+ current annualised leverage opportunities every day for the past two weeks. There are many leverage portfolios that have been able to maintain a rate annualisation of more than 20%.

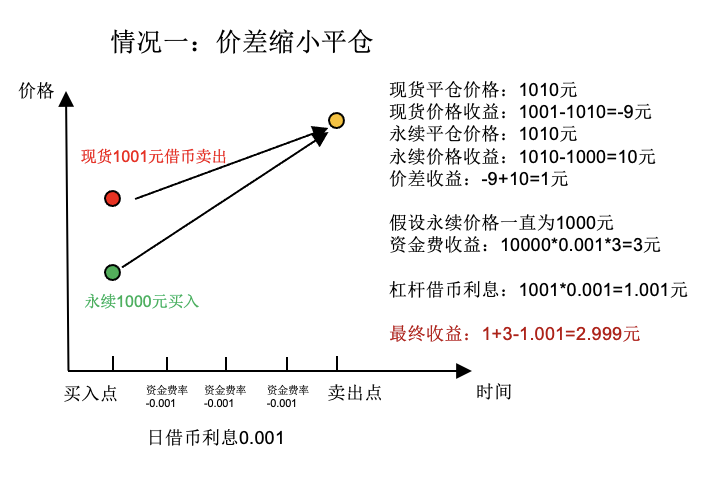

The reverse charge rate is the sale of a commodity and the purchase of a commodity permanently. When we don't have cash on hand, we need to borrow coins and then perform a sell-and-sell operation. We'll start with a simple example.

The spot price is 1001 yuan, the perpetual price is 1000 yuan, the price difference is 1 yuan, the capital rate is -0.001 ; the daily borrowing rate is 0.001

The first leveraged loan is a mortgage for U to borrow cash, and then sell one cash to buy one permanent.

At some point in the future, the price of both the spot and the perpetual changes to 1010 yuan, and the price difference is reduced by 1 yuan, at which point the price difference is 0 yuan.

So the current loss is 9 yuan, the permanent gain is 10 yuan.

The total of the three principal fees charged before the settlement, each of which is 0.001 for convenience, is assumed to be 1000 for the three principal fees.

So the capital gain is 1000.0.0013 is 3.

If the holding time is assumed to be one day, then the interest to be paid on the leveraged coin is 1001This is 0.001 = 1.001

The final profit: 1 + 3 - 1.001 = 2.999 In general, it is worthwhile to use a leverage when the capital charge can cover the interest. For example, in the example above, the interest rate is 0.001.3 is 0.003.

Daily capital rate - daily leveraged interest = 0.003-0.001 = 0.002

The situation of reverse equity and the need to pay high capital fees, rising interest rates on loans, etc. are no longer listed.

In general, it is worthwhile to use a leverage when the capital charge can cover the interest. For example, in the example above, the interest rate is 0.001.3 is 0.003.

Daily capital rate - daily leveraged interest = 0.003-0.001 = 0.002

The situation of reverse equity and the need to pay high capital fees, rising interest rates on loans, etc. are no longer listed.

(iii) Summary of the interest rate

- The capital fee for a permanent contract is settled every 8 hours. The capital fee > 0 is paid by multiple heads and the capital fee is received by multiple heads. The capital fee < 0 is paid by multiple heads and the capital fee is received by multiple heads.

- If the interest rate is greater than zero, buy the spot, sell the permanent. If the interest rate is less than zero, buy the permanent.

- The interest rate is stable and can be used to cover the transaction fees and interest on the loan.

- Ask for help with procedural framework and multi-strategy combination

- Is pine script able to directly switch market data?

- The web page is full of questions.

- Do you think that the retracement graph can only show a few thousand data points?

- MACD, the king of the indicators, is the one who has the biggest household denomination indicator.

- How to order through FMZ

- The new version of the TV reset icon is not convenient.

- MyLanguage Doc

- The most advanced way to trade: master the order wall!

- What is the unit of volume?

- Problems with tradingview: Always delay 1 to 2 seconds between signal to FMZ

- How to operate multiple accounts on one disk

- WeChat can't receive a policy alert?

- Quantity price distribution chart: Watch the distribution of the chips to get an insight into average costs

- Problems with disk error reporting

- Why can't small currencies be recalculated?

- The grid strategy

- Return to the latest strategy of cash multi-currency hedging

- There is a bear market, there is no strategy to run

- Interest on capital charges

Ding is singing.Is there a corresponding strategy?

dairuoqiCan you share your WeChat with me, please?

dairuoqiThank you for sharing.

Little white cabbageCan you send a telegram to @shayideng?

Little white cabbageIf you have a private message or a telegram, @shayideng, can you share it?