Overview

The First Candle Breakout with Stop Loss or End-of-Day Closing Strategy is an intraday trading approach that identifies potential entry signals based on the high and low points of the first candle of the trading day. This strategy captures momentum when price breaks out of the first candle’s range and closes positions either at the end of the day or when stop-loss levels are triggered, allowing for short-term volatility profits. The strategy design is straightforward, focusing on directional breakouts during the initial phase of the trading day, with clear stop-loss and exit rules for effective risk management.

Strategy Principles

The core principle of this strategy is to leverage price momentum and breakout signals from the initial phase of the trading day to predict subsequent movements. The specific process follows:

- First, the strategy defines the trading day start time (default 9:15) and records the high and low of the first candle.

- When price breaks above the first candle’s high, a long signal is triggered; when price breaks below the first candle’s low, a short signal is triggered.

- The strategy employs a strict single-trade mechanism, ensuring only one trade (either long or short) is executed per trading day.

- For long trades, the stop-loss is set at the first candle’s low; for short trades, the stop-loss is set at the first candle’s high.

- Regardless of whether the stop-loss is hit, all open positions are automatically closed at the end of the trading day (default 15:30).

The strategy uses the variable tradeTaken to ensure only one trade per day and tradeDirection to record the current trade direction (1 for long, -1 for short), effectively managing trade status and stop-loss application.

Strategy Advantages

- Simplicity and Efficiency: The strategy logic is straightforward, easy to understand and implement, requiring no complex technical indicators or parameter optimization.

- Clear Entry Signals: Provides distinct trading signals based on price breakouts, reducing subjective judgment factors.

- Strict Risk Control: Limits maximum loss per trade by setting stop-loss at the opposite extreme of the first candle.

- Timed Exit Mechanism: Ensures all trades are completed within the day, avoiding overnight risk.

- High Adaptability: The strategy can be applied to various trading instruments and timeframes by adjusting the start and end time parameters.

- Emotional Neutrality: Automated trading signals reduce the impact of trader emotions on decision-making.

- Intraday Momentum Capture: Effectively utilizes initial momentum and directional breakouts after market open.

Strategy Risks

- False Breakout Risk: Markets may quickly reverse after a breakout, triggering stop-losses. To mitigate this risk, consider adding confirmation indicators such as volume confirmation or multi-timeframe analysis.

- Slippage and Execution Delays: In volatile markets, order execution may face slippage or delays, affecting actual entry prices and stop-loss execution. Consider using limit orders rather than market orders and setting wider stops.

- Single Reference Point Risk: Relying solely on the first candle as a judgment criterion ignores broader market environment and trends. Consider combining market trend and support/resistance analysis to filter trading signals.

- Fixed Timeframe Limitation: The strategy is based on fixed start and end times, potentially missing good opportunities in other time periods. Consider backtesting different time windows to find optimal trading timeframes.

- Lack of Profit Targets: The strategy doesn’t set clear take-profit objectives, potentially failing to maximize gains in favorable market conditions. Consider setting dynamic profit targets based on historical volatility.

- Intraday Volatility Constraints: Low volatility markets may result in a small first candle range with close stop-loss levels that are easily triggered.

Strategy Optimization Directions

- Add Filtering Conditions: Incorporate trend indicators (such as moving averages) to screen trade direction, entering only when aligned with the trend to improve success rates.

- Dynamic Stop-Loss Settings: Consider setting dynamic stops based on ATR (Average True Range) rather than simply using the first candle’s high/low points to adapt to different volatility environments.

- Introduce Take-Profit Mechanism: Design profit-taking rules based on risk-reward ratios, such as closing partial positions when profit reaches 1.5 or 2 times the stop-loss distance.

- Optimize Trading Times: Analyze optimal trading windows for different markets and instruments, adjusting start and end times for best results.

- Phased Position Building and Closing: Consider executing a single trade in multiple batches, building and closing positions at different price levels to reduce timing risk.

- Add Volume Confirmation: Require volume confirmation when breakout signals trigger to filter out low-volume false breakouts.

- Adaptive Parameter Adjustment: Dynamically adjust strategy parameters based on market conditions (volatility, trading volume) to improve strategy adaptability.

- Market Environment Filtering: Pause strategy execution during extreme market conditions (abnormal high volatility or major news release days) to avoid unnecessary risks.

Conclusion

The First Candle Breakout with Stop Loss or End-of-Day Closing Strategy is a concise and efficient intraday trading method that profits by capturing directional breakouts after market open. The main advantages of this strategy lie in its simplicity, controllable risk, and suitability for intraday traders. However, the strategy also faces false breakout risks and limitations from relying on a single reference point. By adding filtering conditions, optimizing stop-loss and take-profit mechanisms, and incorporating market environment analysis, the stability and profitability of the strategy can be significantly enhanced. For beginners entering the quantitative trading field, this serves as an excellent starting strategy and can also function as a foundational component for more complex trading systems. Most importantly, traders should adjust and optimize strategy parameters according to their risk tolerance and trading objectives to achieve optimal trading results.

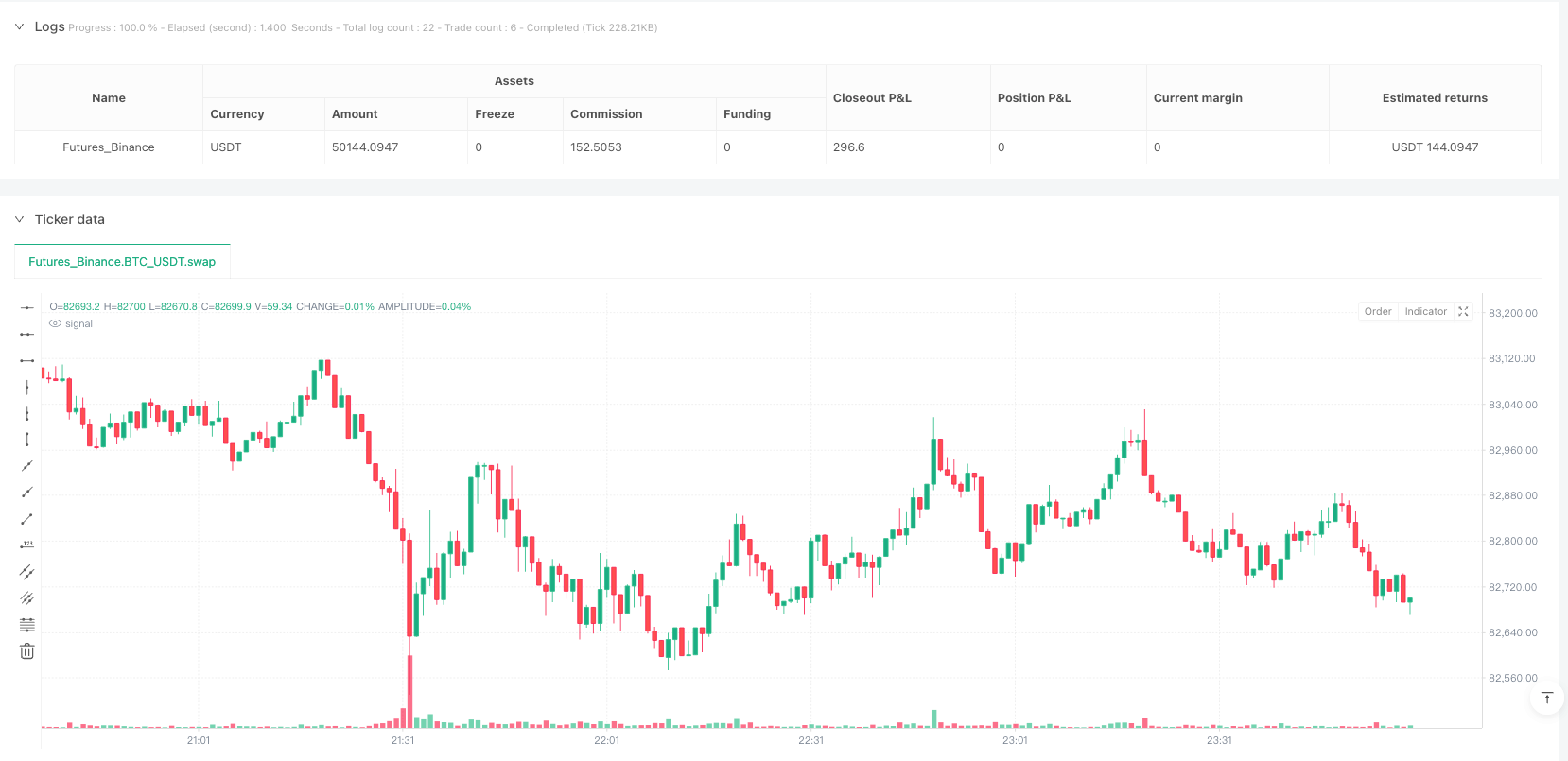

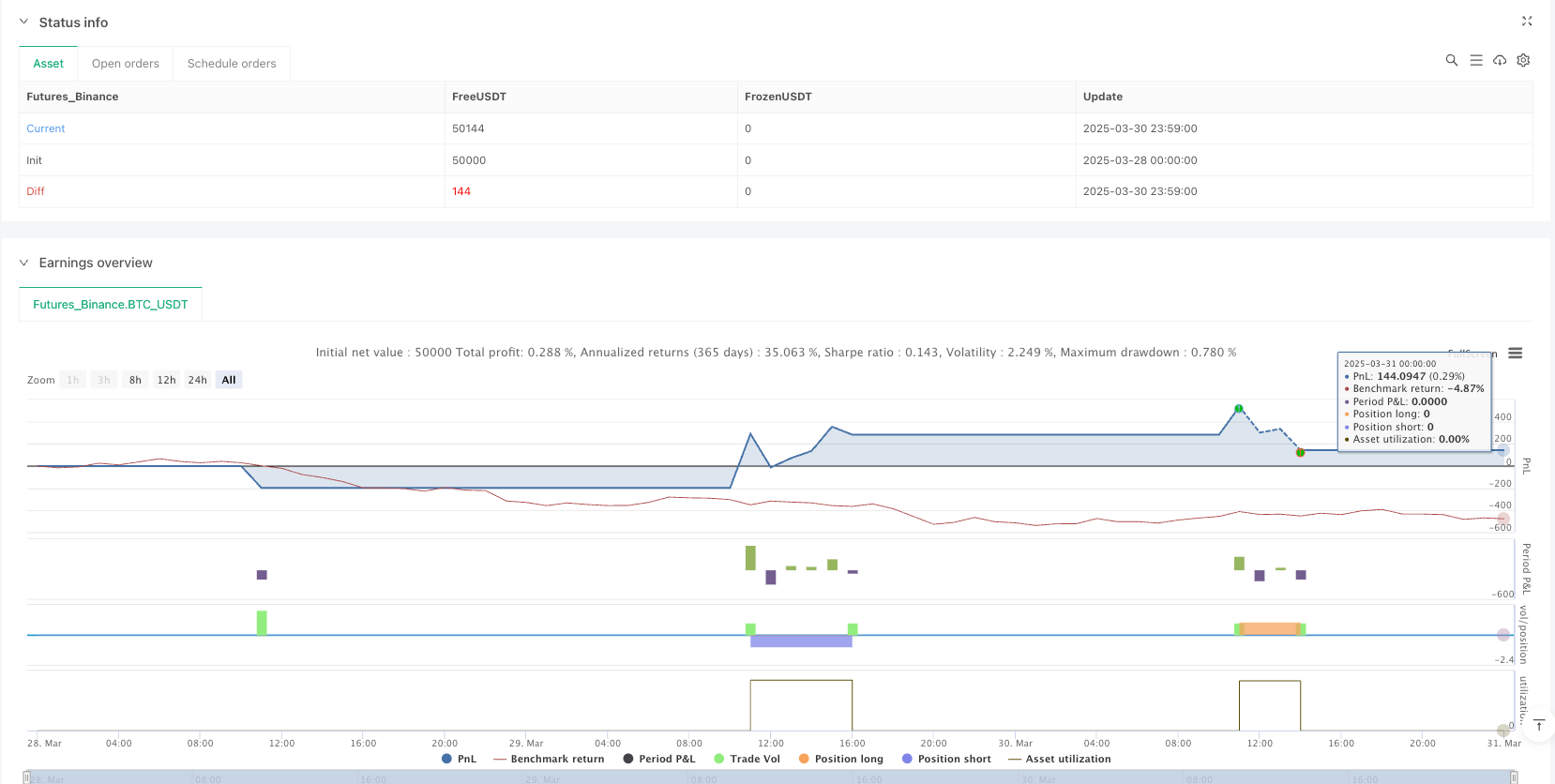

/*backtest

start: 2025-03-28 00:00:00

end: 2025-03-31 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("First Candle Breakout - Close on SL or EOD", overlay=true)

// User Inputs

startHour = input(9, "Start Hour (Exchange Time)")

startMinute = input(15, "Start Minute (Exchange Time)")

endHour = input(15, "End Hour (Exchange Time)") // Market closing hour

endMinute = input(30, "End Minute (Exchange Time)")

// Variables to store the first candle's high & low

var float firstCandleHigh = na

var float firstCandleLow = na

var bool tradeTaken = false // Ensures only one trade per day

var int tradeDirection = 0 // 1 for long, -1 for short

// Identify first candle's high & low

if (hour == startHour and minute == startMinute and bar_index > 1)

firstCandleHigh := high

firstCandleLow := low

tradeTaken := false // Reset trade flag at start of day

tradeDirection := 0 // Reset trade direction

// Buy condition: Close above first candle high AFTER the first candle closes

longCondition = not na(firstCandleHigh) and close > firstCandleHigh and not tradeTaken and hour > startHour

if (longCondition)

strategy.entry("Buy", strategy.long, comment="Buy")

tradeTaken := true // Mark trade as taken

tradeDirection := 1 // Mark trade as long

// Sell condition: Close below first candle low AFTER the first candle closes

shortCondition = not na(firstCandleLow) and close < firstCandleLow and not tradeTaken and hour > startHour

if (shortCondition)

strategy.entry("Sell", strategy.short, comment="Sell")

tradeTaken := true // Mark trade as taken

tradeDirection := -1 // Mark trade as short

// Stop loss for long trades (first candle low)

if (tradeDirection == 1 and close <= firstCandleLow)

strategy.close("Buy", comment="SL Hit")

// Stop loss for short trades (first candle high)

if (tradeDirection == -1 and close >= firstCandleHigh)

strategy.close("Sell", comment="SL Hit")

// Close trade at end of day if still open

if (tradeTaken and hour == endHour and minute == endMinute)

strategy.close_all(comment="EOD Close")