Evaluasi kurva modal backtest menggunakan alat "pyfolio"

Penulis:Kebaikan, Dibuat: 2020-06-23 09:55:35, Diperbarui: 2023-10-31 21:02:34

Pengantar

Beberapa hari yang lalu ditemukan bahwa output kurva laba rugi dari hasil backtest strategi FMZ relatif sederhana, jadi saya berpikir tentang apakah untuk mendapatkan data hasil pendapatan dan kemudian memprosesnya sendiri untuk mendapatkan laporan evaluasi kurva modal yang lebih rinci dan menampilkannya secara grafis. ketika saya mulai menulis ide-ide, saya menemukan bahwa itu tidak begitu mudah, jadi saya bertanya-tanya apakah ada yang memiliki ide yang sama dan sudah membuat alat yang sesuai? jadi saya mencari di internet dan menemukan bahwa memang ada alat seperti itu. saya melihat beberapa proyek di GitHub dan akhirnya memilihpyfolio.

Apa itu pyfolio?

pyfolioadalah perpustakaan Python untuk kinerja portofolio keuangan dan analisis risiko yang dikembangkan oleh Zipline, Alphalens, Pyfolio, FactSetdata, dll.

Inti daripyfolioadalah apa yang disebut

GitHub address: https://github.com/quantopian/pyfolio

Belajar menggunakan pyfolio

Karena fakta bahwa ada sedikit materi pembelajaran online untuk alat ini, dibutuhkan waktu yang lama bagi saya untuk menggunakannya dengan mudah.

PyFolioReferensi API:

https://www.quantopian.com/docs/api-reference/pyfolio-api-reference#pyfolio-api-reference

Berikut adalah pengantar yang lebih rinci untukpyfolioplatform dapat digunakan untuk backtesting saham AS. hasil backtesting dapat ditampilkan langsung melaluipyfolioAku hanya belajar secara kasar. sepertinya fungsi lain cukup kuat.

Menginstal pyfolio

Pemasanganpyfoliorelatif sederhana, ikuti saja instruksi di GitHub.

Hasil backtest FMZ ditampilkan oleh pyfolio

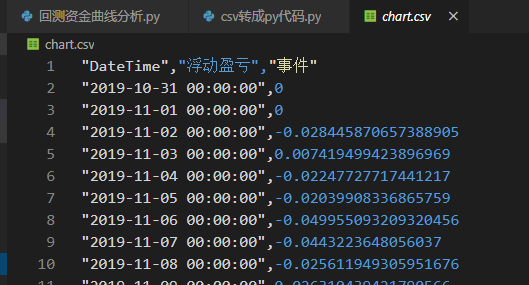

Pertama, dapatkan data kurva modal backtest di platform FMZ.

Klik tombol di sebelah layar penuh pada gambar di atas dalam grafik laba rugi yang mengambang dari hasil backtest, dan kemudian pilih

Jika Anda ingin memiliki benchmark komparatif untuk hasil analisis, Anda juga perlu menyiapkan data harian K-line dari target perdagangan. jika tidak ada data K-line, hanya data pendapatan yang juga dapat dianalisis, tetapi akan ada beberapa indikator lagi untuk hasil analisis data benchmark, seperti: Alpha, Beta, dll.

Kita bisa mendapatkan data K-line langsung dari platform melalui lingkungan penelitian FMZ:

# Use the API provided by the FMZ research environment to obtain K-line data which equal to the revenue data

dfh = get_bars('bitfinex.btc_usd', '1d', start=str(startd), end=str(endd))

Setelah data disiapkan, kita dapat memulai pengkodean. kita perlu memproses data yang diperoleh untuk membuatnya sesuai dengan struktur data yang dibutuhkan olehpyfolio, dan kemudian hubungicreate_returns_tear_sheetantarmukapyfoliountuk menghitung dan menghasilkan hasilnya.returns, benchmark_rets=Nonedanlive_start_date=Nonetiga parameter.

Peraturanreturnparameter adalah data pendapatan yang diperlukan;benchmark_retsadalah data benchmark, tidak diperlukan;live_start_datelive_start_datetidak perlu.

Arti dari parameter ini adalah: kapanreturnsmulai dari pasar yang sebenarnya?returnsdi atas, dengan asumsi bahwa kita memulai pasar nyata setelah 2019-12-01, dan yang sebelumnya adalah pasar simulasi atau hasil backtest, maka kita bisa mengaturnya seperti ini:live_start_date = '2019-12-01'.

Dengan menetapkan parameter, kita secara teoritis dapat menganalisis apakah strategi kita telah overfit. Jika perbedaan antara dalam dan luar sampel besar, maka ada kemungkinan besar bahwa ini adalah overfit.

Kita dapat menerapkan fungsi analisis ini di lingkungan penelitian FMZ, atau kita dapat menerapkannya secara lokal. berikut mengambil implementasi di lingkungan penelitian FMZ sebagai contoh:

https://www.fmz.com/upload/asset/1379deaa35b22ee37de23.ipynb?name=%E5%88%A9%E7%94%A8pyfolio%E5%B7%A5%E5%85%B7%E8%AF%84%E4%BB%B7%E5%9B%9E%E6%B5%8B%E8%B5%84%E9%87%91%E6%9B%B2%E7%BA%BF(%E5%8E%9F%E5%88%9B).ipynb

# First, create a new "csv to py code.py" python file locally and copy the following code to generate the py code containing the CSV file of the fund curve downloaded from FMZ. Running the newly created py file locally will generate "chart_hex.py" file.

#!/usr/bin/python

# -*- coding: UTF-8 -*-

import binascii

# The file name can be customized as needed, this example uses the default file name

filename = 'chart.csv'

with open(filename, 'rb') as f:

content = f.read()

# csv to py

wFile = open(filename.split('.')[0] + '_hex.py', "w")

wFile.write("hexstr = bytearray.fromhex('" +

bytes.decode(binascii.hexlify(content))

+ "').decode()\nwFile = open('" + filename + "', 'w')\nwFile.write(hexstr)\nwFile.close()")

wFile.close()

# Open the "chart_hex.py" file generated above, copy all the contents and replace the following code blocks, and then run the following code blocks one by one to get the chart.csv file

hexstr = bytearray.fromhex('efbbbf224461746554696d65222c22e6b5aee58aa8e79b88e4ba8f222c22e4ba8be4bbb6220a22323031392d31302d33312030303a30303a3030222c300a22323031392d31312d30312030303a30303a3030222c300a22323031392d31312d30322030303a30303a3030222c2d302e3032383434353837303635373338383930350a22323031392d31312d30332030303a30303a3030222c302e3030373431393439393432333839363936390a22323031392d31312d30342030303a30303a3030222c2d302e30323234373732373731373434313231370a22323031392d31312d30352030303a30303a3030222c2d302e30323033393930383333363836353735390a22323031392d31312d30362030303a30303a3030222c2d302e3034393935353039333230393332303435360a22323031392d31312d30372030303a30303a3030222c2d302e303434333232333634383035363033370a22323031392d31312d30382030303a30303a3030222c2d302e3032353631313934393330353935313637360a22323031392d31312d30392030303a30303a3030222c302e3032363331303433393432313739303536360a22323031392d31312d31302030303a30303a3030222c302e3033303232303332383333303436333137350a22323031392d31312d31312030303a30303a3030222c302e3033313230373133363936363633313133330a22323031392d31312d31322030303a30303a3030222c2d302e3031383533323831363136363038333135350a22323031392d31312d31332030303a30303a3030222c2d302e30313736393032353136363738333732320a22323031392d31312d31342030303a30303a3030222c2d302e3032323339313034373338373637393338360a22323031392d31312d31352030303a30303a3030222c2d302e3030383433363137313736363631333438370a22323031392d31312d31362030303a30303a3030222c302e3031373430363536343033313836383133330a22323031392d31312d31372030303a30303a3030222c302e303232393131353234343739303732330a22323031392d31312d31382030303a30303a3030222c302e3033323032363631303538383035373131340a22323031392d31312d31392030303a30303a3030222c302e303138393230323836383338373438380a22323031392d31312d32302030303a30303a3030222c302e30363632363938393337393232363738390a22323031392d31312d32312030303a30303a3030222c302e3036303835343430303337353130313033370a22323031392d31312d32322030303a30303a3030222c302e31343432363035363831333031303231330a22323031392d31312d32332030303a30303a3030222c302e32343239343037303935353332323336370a22323031392d31312d32342030303a30303a3030222c302e32313133303432303033353237373934310a22323031392d31312d32352030303a30303a3030222c302e323735363433303736313138343937380a22323031392d31312d32362030303a30303a3030222c302e323532343832323739343237363235360a22323031392d31312d32372030303a30303a3030222c302e32343931313136313839303039383437370a22323031392d31312d32382030303a30303a3030222c302e31313038373135373939323036393134310a22323031392d31312d32392030303a30303a3030222c302e313633343530313533373233393139390a22323031392d31312d33302030303a30303a3030222c302e31393838303132323332343735393737350a22323031392d31322d30312030303a30303a3030222c302e31363633373536393939313635393038350a22323031392d31322d30322030303a30303a3030222c302e32303638323732383333323337393630370a22323031392d31322d30332030303a30303a3030222c302e32303434323831303032303830393033320a22323031392d31322d30342030303a30303a3030222c302e323030353636323836353230383830360a22323031392d31322d30352030303a30303a3030222c302e31323434363439343330303739303635360a22323031392d31322d30362030303a30303a3030222c302e31303032343339383239393236303637332c302e31303032343339383239393236303637330a22323031392d31322d30372030303a30303a3030222c302e31303637313232383937343130373831360a22323031392d31322d30382030303a30303a3030222c302e31323839363336313133333032313036310a22323031392d31322d30392030303a30303a3030222c302e313337393030323234303239323136320a22323031392d31322d31302030303a30303a3030222c302e31313432333735383637323436303130350a22323031392d31322d31312030303a30303a3030222c302e31323638353037323134353130343038320a22323031392d31322d31322030303a30303a3030222c302e31343139333631313738343432333234330a22323031392d31322d31332030303a30303a3030222c302e31333838333632383537383138383536370a22323031392d31322d31342030303a30303a3030222c302e313136323031343031393435393734350a22323031392d31322d31352030303a30303a3030222c302e31363135333931303631363930313932330a22323031392d31322d31362030303a30303a3030222c302e31343937383138343836363238323231380a22323031392d31322d31372030303a30303a3030222c302e31353734393833333435363438393438320a22323031392d31322d31382030303a30303a3030222c302e32343234393031303233333139323635380a22323031392d31322d31392030303a30303a3030222c302e32313830363838353631363039303035350a22323031392d31322d32302030303a30303a3030222c302e323938383636303034333936303139340a22323031392d31322d32312030303a30303a3030222c302e33303135333036303934383834370a22323031392d31322d32322030303a30303a3030222c302e323938363835393334383634363038370a22323031392d31322d32332030303a30303a3030222c302e333039333035323733383735393130310a22323031392d31322d32342030303a30303a3030222c302e333834363231343935353136383931320a22323031392d31322d32352030303a30303a3030222c302e33343532373534363233383138313130360a22323031392d31322d32362030303a30303a3030222c302e33363235323332383833363737313035330a22323031392d31322d32372030303a30303a3030222c302e33343937363331393933333834333133360a22323031392d31322d32382030303a30303a3030222c302e33303732393733373234353434373938360a22323031392d31322d32392030303a30303a3030222c302e33323238383132323432363135363530370a22323031392d31322d33302030303a30303a3030222c302e33343134363537343239333438363535330a22323031392d31322d33312030303a30303a3030222c302e333435323733393139363237303738320a22323032302d30312d30312030303a30303a3030222c302e33353730313633323035353433343337340a22323032302d30312d30322030303a30303a3030222c302e33343937353937393034363236373934370a22323032302d30312d30332030303a30303a3030222c302e33373032333633333138303534353335370a22323032302d30312d30342030303a30303a3030222c302e33383636373137373837343037313635370a22323032302d30312d30352030303a30303a3030222c302e33383834373536373836393031343634330a22323032302d30312d30362030303a30303a3030222c302e34313331323236353139383433373731340a22323032302d30312d30372030303a30303a3030222c302e34323335323332383237303436333733350a22323032302d30312d30382030303a30303a3030222c302e34363837333531323838353035333330330a22323032302d30312d30392030303a30303a3030222c302e353436373135313832363033383332380a22323032302d30312d31302030303a30303a3030222c302e353530373037323136333937383830310a22323032302d30312d31312030303a30303a3030222c302e35353531373436393236393938310a22323032302d30312d31322030303a30303a3030222c302e353632323130363337343737323731330a22323032302d30312d31332030303a30303a3030222c302e353734373831373030393536383631370a22323032302d30312d31342030303a30303a3030222c302e353632383330303731353536353831350a22323032302d30312d31352030303a30303a3030222c302e363538323839383038313031393136380a22323032302d30312d31362030303a30303a3030222c302e363732323034393830303331333936370a22323032302d30312d31372030303a30303a3030222c302e363537313832383237323238323335380a22323032302d30312d31382030303a30303a3030222c302e363734393831383838383639373536330a22323032302d30312d31392030303a30303a3030222c302e363739373632303637393239383131330a22323032302d30312d32302030303a30303a3030222c302e363334313332373332393636313231370a22323032302d30312d32312030303a30303a3030222c302e363237353837313436323430323734370a22323032302d30312d32322030303a30303a3030222c302e363331313336373230353334393834370a22323032302d30312d32332030303a30303a3030222c302e3630313936323331393931343334360a22323032302d30312d32342030303a30303a3030222c302e363036343239313935383633313431360a22323032302d30312d32352030303a30303a3030222c302e35383130363933393531373337390a22323032302d30312d32362030303a30303a3030222c302e363133313034353130383436353937380a22323032302d30312d32372030303a30303a3030222c302e3632393938323638373737383035350a22323032302d30312d32382030303a30303a3030222c302e363831333134363734333130313533350a22323032302d30312d32392030303a30303a3030222c302e373134303533393533383834313233350a22323032302d30312d33302030303a30303a3030222c302e373433383032353331363031313135360a22323032302d30312d33312030303a30303a3030222c302e373535393639303935383539313330370a22323032302d30322d30312030303a30303a3030222c302e373533383030313630323737353438310a22323032302d30322d30322030303a30303a3030222c302e373534343434333437323732343132350a22323032302d30322d30332030303a30303a3030222c302e373435373138393532343434373738330a22323032302d30322d30342030303a30303a3030222c302e3738373636303035313130343530340a22323032302d30322d30352030303a30303a3030222c302e373935393939343930353732393834360a22323032302d30322d30362030303a30303a3030222c302e373935323037323039363636373034390a22323032302d30322d30372030303a30303a3030222c302e3832393234363232343838363336350a22323032302d30322d30382030303a30303a3030222c302e383239393034373635353939363035350a22323032302d30322d30392030303a30303a3030222c302e383338363639323137313033313436350a22323032302d30322d31302030303a30303a3030222c302e38353830313634373631380a22323032302d30322d31312030303a30303a3030222c302e383130323530393437393936313938330a22323032302d30322d31322030303a30303a3030222c302e383433323631313436333636313030320a22323032302d30322d31332030303a30303a3030222c302e383535383536353834363731333632320a22323032302d30322d31342030303a30303a3030222c302e383337323730363631383738303935360a22323032302d30322d31352030303a30303a3030222c302e383333353332343038383538303234330a22323032302d30322d31362030303a30303a3030222c302e383636383832343034353334343633320a22323032302d30322d31372030303a30303a3030222c302e383836363634323232323038333831310a22323032302d30322d31382030303a30303a3030222c302e393032363430303937303731373033390a22323032302d30322d31392030303a30303a3030222c302e383832373838333631373939333438380a22323032302d30322d32302030303a30303a3030222c302e383530303035363732363738333734320a22323032302d30322d32312030303a30303a3030222c302e3737383436363530373530313739360a22323032302d30322d32322030303a30303a3030222c302e373737383734393835393335313437350a22323032302d30322d32332030303a30303a3030222c302e373731333834393530303532383132330a22323032302d30322d32342030303a30303a3030222c302e373937383030363936353434323134340a22323032302d30322d32352030303a30303a3030222c302e373736383231373934313333363939370a22323032302d30322d32362030303a30303a3030222c302e373938353333313136353336313831310a22323032302d30322d32372030303a30303a3030222c302e383530343335363139343238353239390a22323032302d30322d32382030303a30303a3030222c302e383734333333393138383334393638310a22323032302d30322d32392030303a30303a3030222c302e3838383336363333393338343837380a22323032302d30332d30312030303a30303a3030222c302e383933393737393637343631333438380a22323032302d30332d30322030303a30303a3030222c302e3931323431323035313530303336362c302e3931323431323035313530303336360a22323032302d30332d30332030303a30303a3030222c302e383733353632323939353238363532330a22323032302d30332d30342030303a30303a3030222c302e383532353336353235333030343039310a22323032302d30332d30352030303a30303a3030222c302e383633323633313830363733313335350a22323032302d30332d30362030303a30303a3030222c302e383734303237343632353730373730350a22323032302d30332d30372030303a30303a3030222c302e383634323439323631363431353135360a22323032302d30332d30382030303a30303a3030222c302e38373630353132313331363135333031').decode()

wFile = open('chart.csv', 'w')

wFile.write(hexstr)

wFile.close()

!ls -la

cat chart.csv

# Install pyfolio library in research environment

!pip3 install --user pyfolio

import pandas as pd

import sys

sys.path.append('/home/quant/.local/lib/python3.6/site-packages')

import pyfolio as pf

import matplotlib.pyplot as plt

%matplotlib inline

import warnings

warnings.filterwarnings('ignore')

from fmz import * # import all FMZ functions

# Read fund curve data, FMZ platform download, cumulative income data

df=pd.read_csv(filepath_or_buffer='chart.csv')

# Convert to date format

df['Date'] = pd.to_datetime(df['DateTime'],format='%Y-%m-%d %H:%M:%S')

# Get start and end time

startd = df.at[0,'Date']

endd = df.at[df.shape[0]-1,'Date']

# Read the target asset daily K-line data, and use it as the benchmark income data

# Use the API provided by the FMZ research environment to obtain K-line data equal to the revenue data

dfh = get_bars('bitfinex.btc_usd', '1d', start=str(startd), end=str(endd))

dfh=dfh[['close']]

# Calculate the daily rise and fall based on the closing price of k-line data

dfh['close_shift'] = dfh['close'].shift(1)

dfh = dfh.fillna(method='bfill') # Look down for the nearest non-null value, fill the exact position with this value, full name "backward fill"

dfh['changeval']=dfh['close']-dfh['close_shift']

dfh['change']=dfh['changeval']/dfh['close_shift']

# Frequency changes keep 6 decimal places

dfh = dfh.round({'change': 6})

# Revenue data processing, the FMZ platform obtains the cumulative revenue, and converts it to the daily revenue change rate

df['return_shift'] = df['Floating Profit and Loss'].shift(1)

df['dayly']=df['Floating P&L']-df['return_shift']

chushizichan = 3 # Initial asset value in FMZ backtest

df['returns'] = df['dayly']/(df['return_shift']+chushizichan)

df=df[['Date','Floating Profit and Loss','return_shift','dayly','returns']]

df = df.fillna(value=0.0)

df = df.round({'dayly': 3}) # retain three decimal places

df = df.round({'returns': 6})

# Convert pd.DataFrame to pd.Series required for pyfolio earnings

df['Date'] = pd.to_datetime(df['Date'])

df=df[['Date','returns']]

df.set_index('Date', inplace=True)

# Processed revenue data

returns = df['returns'].tz_localize('UTC')

# Convert pd.DataFrame to pd.Series required for pyfolio benchmark returns

dfh=dfh[['change']]

dfh = pd.Series(dfh['change'].values, index=dfh.index)

# Processed benchmark data

benchmark_rets = dfh

# The point in time when real-time trading begins after the strategy's backtest period.

live_start_date = '2020-02-01'

# Call pyfolio's API to calculate and output the fund curve analysis result graph

# "returns" Parameters are required, the remaining parameters can not be entered

pf.create_returns_tear_sheet(returns,benchmark_rets=benchmark_rets,live_start_date=live_start_date)

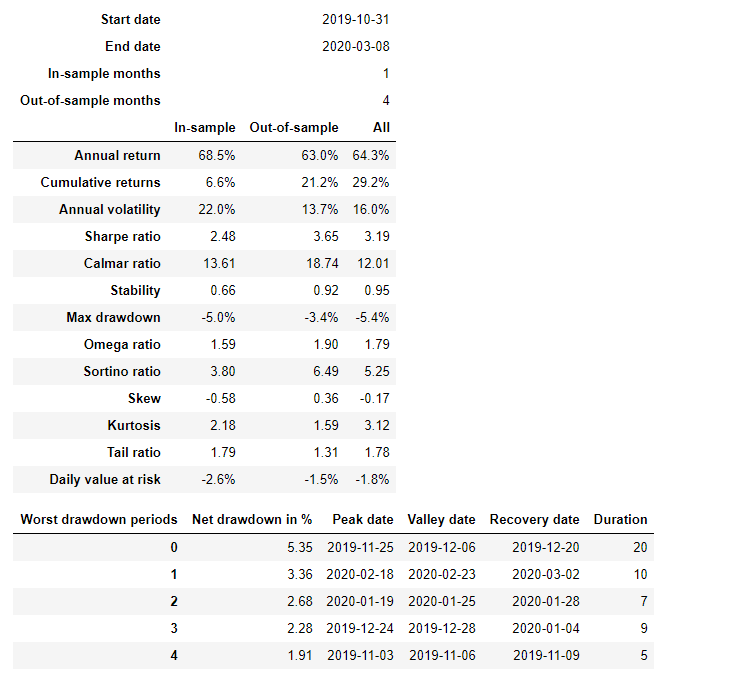

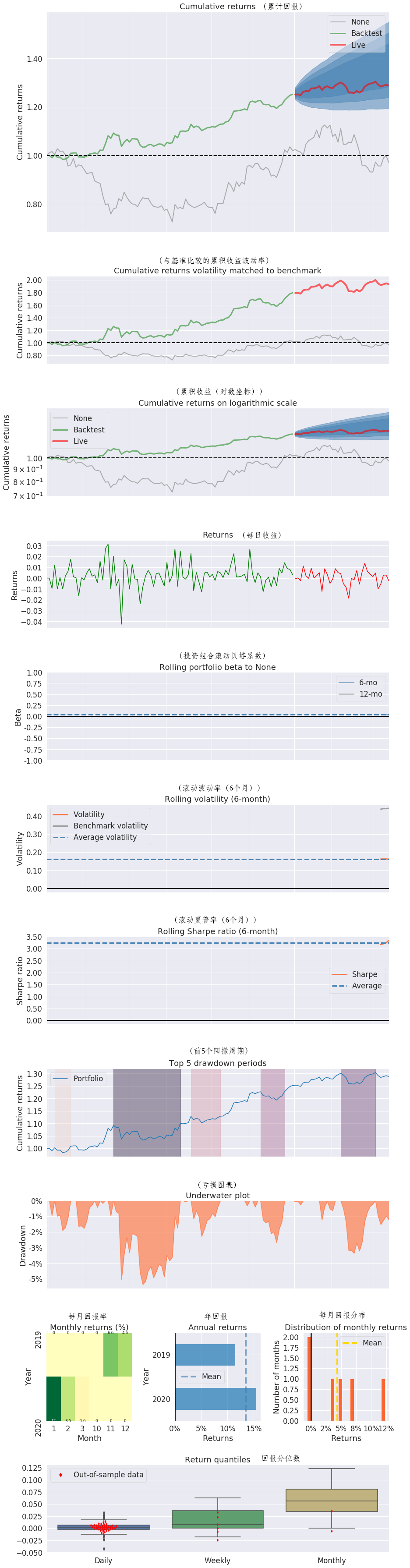

Hasil analisis output:

Interpretasi hasil

Ada banyak data output, kita perlu untuk tenang dan belajar apa yang indikator ini berarti. biarkan saya memperkenalkan beberapa dari mereka. setelah kita menemukan pengantar untuk indikator yang relevan dan memahami arti dari indikator, kita dapat menafsirkan status strategi perdagangan kita.

- Pengembalian tahunan

Tingkat pengembalian tahunan dihitung dengan mengubah tingkat pengembalian saat ini (tingkat pengembalian harian, tingkat pengembalian mingguan, tingkat pengembalian bulanan, dll.) menjadi tingkat pengembalian tahunan. Ini adalah tingkat pengembalian teoritis, bukan tingkat pengembalian yang telah benar-benar dicapai. Tingkat pengembalian tahunan perlu dibedakan dari tingkat pengembalian tahunan. Tingkat pengembalian tahunan mengacu pada tingkat pengembalian untuk satu tahun pelaksanaan strategi dan merupakan tingkat pengembalian aktual.

- Hasil kumulatif

Konsep yang paling mudah dipahami adalah laba atas strategi, yang merupakan tingkat perubahan total aset dari awal hingga akhir strategi. Volatilitas Tahunan Tingkat volatilitas tahunan digunakan untuk mengukur risiko volatilitas dari target investasi.

- Rasio Sharpe

Menggambarkan keuntungan yang berlebihan yang dapat diperoleh oleh strategi dengan total risiko satuan.

- Pengurangan Maksimal

Menjelaskan kerugian terbesar dari strategi. penarikan maksimum biasanya lebih kecil, lebih baik.

- Rasio Omega

Indikator kinerja risiko-balasan lainnya. Keuntungannya terbesar dibandingkan rasio Sharpe adalah-dengan konstruksi-itu mempertimbangkan semua momen statistik, sedangkan rasio Sharpe hanya mempertimbangkan dua momen pertama.

- Rasio Sortino

Menjelaskan kelebihan laba yang dapat diperoleh oleh strategi di bawah risiko penurunan unit.

- Nilai-Risiko Harian

Nilai harian pada risiko-Indikator risiko lain yang sangat populer. Dalam hal ini, ini berarti bahwa dalam 95% kasus, posisi (portfolio) disimpan untuk hari lain, dan kerugian tidak akan melebihi 1,8%.

- Rasio ekor

Pilih kuantil ke-95 dan ke-5 untuk distribusi laba harian, dan kemudian bagi untuk mendapatkan nilai absolut.

- Stabilitas

Ini disebut stabilitas. sebenarnya, ini sangat sederhana, yaitu berapa banyak peningkatan waktu menjelaskan nilai bersih kumulatif, yaitu r-kuadrat regresi. ini agak abstrak, mari kita jelaskan secara singkat.

Referensi:https://blog.csdn.net/qtlyx/article/details/88724236

Saran kecil

Diharapkan bahwa FMZ dapat meningkatkan fungsi evaluasi kurva modal kaya, dan meningkatkan fungsi penyimpanan hasil backtest historis, sehingga dapat menampilkan hasil backtest lebih nyaman dan profesional, dan membantu Anda membuat strategi yang lebih baik.