Futures Manual Cryptocurrency & Strategi Hedge Spot

Penulis:Ninabadass, Dicipta: 2022-04-12 15:12:36, Dikemas kini: 2022-04-12 15:44:18Futures Manual Cryptocurrency & Strategi Hedge Spot

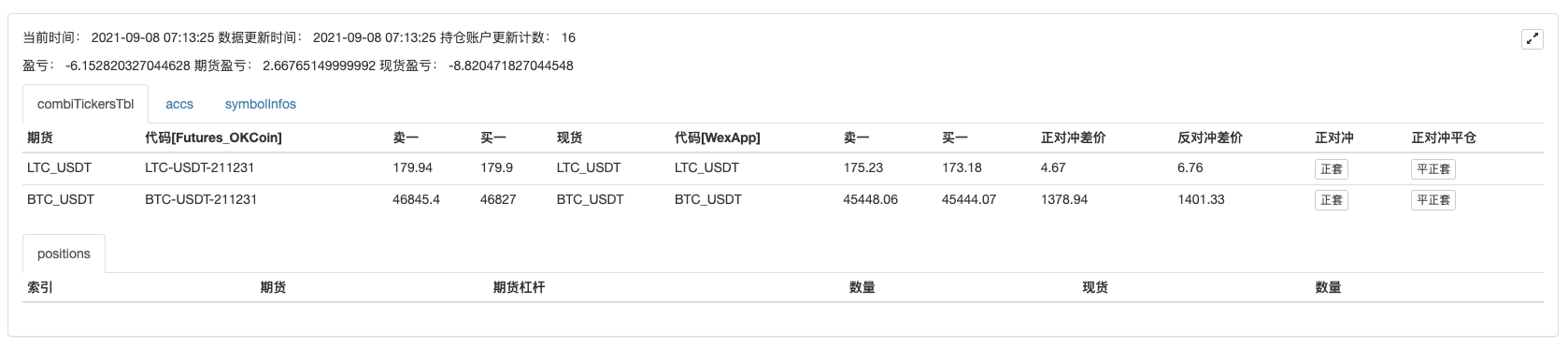

Oleh kerana frekuensi lindung nilai strategi lindung nilai semasa tidak terlalu tinggi, ia sebenarnya boleh dikendalikan secara manual. Walau bagaimanapun, jika anda melakukannya secara manual, beralih halaman pelbagai platform, memerhatikan harga, dan mengira spread harga, yang sangat tidak selesa. Kadang-kadang, anda mungkin ingin melihat lebih banyak simbol, dan tidak perlu menyediakan beberapa paparan untuk menunjukkan sebut harga pasaran. Adakah mungkin untuk mencapai keperluan operasi manual ini dengan strategi separa automatik? Dan lebih baik mempunyai lebih banyak simbol? oh! ya. Adalah lebih baik untuk membuka dan menutup kedudukan dengan satu klik. oh, betul.

Jika ada keperluan, lakukan sekarang!

Merancang Manual Cryptocurrency Futures & Spot Hedge Strategy

Kod yang ditulis di sini agak membosankan, tidak mencapai 600 baris.

function createManager(fuEx, spEx, symbolPairs, cmdHedgeAmount, fuMarginLevel, fuMarginReservedRatio) {

var self = {}

self.fuEx = fuEx

self.spEx = spEx

self.symbolPairs = symbolPairs

self.pairs = []

self.fuExTickers = null

self.spExTickers = null

self.tickerUpdateTS = 0

self.fuMarginLevel = fuMarginLevel

self.fuMarginReservedRatio = fuMarginReservedRatio

self.cmdHedgeAmount = cmdHedgeAmount

self.preUpdateAccTS = 0

self.accAndPosUpdateCount = 0

self.profit = []

self.allPairs = []

self.PLUS = 0

self.MINUS = 1

self.COVER_PLUS = 2

self.COVER_MINUS = 3

self.arrTradeTypeDesc = ["positive arbitrage", "reverse arbitrage", "close positive arbitrage", "close reverse arbitrage"]

self.updateTickers = function() {

self.fuEx.goGetTickers()

self.spEx.goGetTickers()

var fuExTickers = self.fuEx.getTickers()

var spExTickers = self.spEx.getTickers()

if (!fuExTickers || !spExTickers) {

return null

}

self.fuExTickers = fuExTickers

self.spExTickers = spExTickers

self.tickerUpdateTS = new Date().getTime()

return true

}

self.hedge = function(index, fuSymbol, spSymbol, tradeType, amount) {

var fe = self.fuEx

var se = self.spEx

var pair = self.pairs[index]

var timeStamp = new Date().getTime()

var fuDirection = null

var spDirection = null

var fuPrice = null

var spPrice = null

if (tradeType == self.PLUS) {

fuDirection = fe.OPEN_SHORT

spDirection = se.OPEN_LONG

fuPrice = pair.fuTicker.bid1

spPrice = pair.spTicker.ask1

} else if (tradeType == self.MINUS) {

fuDirection = fe.OPEN_LONG

spDirection = se.OPEN_SHORT

fuPrice = pair.fuTicker.ask1

spPrice = pair.spTicker.bid1

} else if (tradeType == self.COVER_PLUS) {

fuDirection = fe.COVER_SHORT

spDirection = se.COVER_LONG

fuPrice = pair.fuTicker.ask1

spPrice = pair.spTicker.bid1

} else if (tradeType == self.COVER_MINUS) {

fuDirection = fe.COVER_LONG

spDirection = se.COVER_SHORT

fuPrice = pair.fuTicker.bid1

spPrice = pair.spTicker.ask1

} else {

throw "unknow tradeType!"

}

fe.goGetAcc(fuSymbol, timeStamp)

se.goGetAcc(spSymbol, timeStamp)

var nowFuAcc = fe.getAcc(fuSymbol, timeStamp)

var nowSpAcc = se.getAcc(spSymbol, timeStamp)

if (!nowFuAcc || !nowSpAcc) {

Log(fuSymbol, spSymbol, ", fail to obtain the account data")

return

}

pair.nowFuAcc = nowFuAcc

pair.nowSpAcc = nowSpAcc

var nowFuPos = fe.getFuPos(fuSymbol, timeStamp)

var nowSpPos = se.getSpPos(spSymbol, spPrice, pair.initSpAcc, pair.nowSpAcc)

if (!nowFuPos || !nowSpPos) {

Log(fuSymbol, spSymbol, ",fail to obtain the position data")

return

}

pair.nowFuPos = nowFuPos

pair.nowSpPos = nowSpPos

var fuAmount = amount

var spAmount = amount

if (tradeType == self.PLUS || tradeType == self.MINUS) {

if (nowFuAcc.Balance < (pair.initFuAcc.Balance + pair.initFuAcc.FrozenBalance) * self.fuMarginReservedRatio + (fuAmount * fuPrice / self.fuMarginLevel)) {

Log(pair.fuSymbol, "Inadequate margin!", "This time, plan to use", (fuAmount * fuPrice / self.fuMarginLevel), "Currently available:", nowFuAcc.Balance,

"Plan to reserve:", (pair.initFuAcc.Balance + pair.initFuAcc.FrozenBalance) * self.fuMarginReservedRatio)

return

}

if ((tradeType == self.PLUS && nowSpAcc.Balance < spAmount * spPrice)) {

Log(pair.spSymbol, "Inadequate assets!", "This time, buy and plan to use", spAmount * spPrice, "Currently available:", nowSpAcc.Balance)

return

} else if (tradeType == self.MINUS && nowSpAcc.Stocks < spAmount) {

Log(pair.spSymbol, "Inadequate assets!", "This time, sell and plan to use", spAmount, "Currently available:", nowSpAcc.Stocks)

return

}

} else {

var fuLongPos = self.getLongPos(nowFuPos)

var fuShortPos = self.getShortPos(nowFuPos)

var spLongPos = self.getLongPos(nowSpPos)

var spShortPos = self.getShortPos(nowSpPos)

if ((tradeType == self.COVER_PLUS && !fuShortPos) || (tradeType == self.COVER_MINUS && !fuLongPos)) {

Log(fuSymbol, spSymbol, ", no corresponding position of futures!")

return

} else if (tradeType == self.COVER_PLUS && Math.abs(fuShortPos.amount) < fuAmount) {

fuAmount = Math.abs(fuShortPos.amount)

} else if (tradeType == self.COVER_MINUS && Math.abs(fuLongPos.amount) < fuAmount) {

fuAmount = Math.abs(fuLongPos.amount)

}

if ((tradeType == self.COVER_PLUS && !spLongPos) || (tradeType == self.COVER_MINUS && !spShortPos)) {

Log(fuSymbol, spSymbol, ", no corresponding position of spot!")

return

} else if (tradeType == self.COVER_PLUS && Math.min(Math.abs(spLongPos.amount), nowSpAcc.Stocks) < spAmount) {

spAmount = Math.min(Math.abs(spLongPos.amount), nowSpAcc.Stocks)

} else if (tradeType == self.COVER_MINUS && Math.min(Math.abs(spShortPos.amount), nowSpAcc.Balance / spPrice) < spAmount) {

spAmount = Math.min(Math.abs(spShortPos.amount), nowSpAcc.Balance / spPrice)

}

}

fuAmount = fe.calcAmount(fuSymbol, fuDirection, fuPrice, fuAmount)

spAmount = se.calcAmount(spSymbol, spDirection, spPrice, spAmount)

if (!fuAmount || !spAmount) {

Log(fuSymbol, spSymbol, "Order amount calculation error:", fuAmount, spAmount)

return

} else {

fuAmount = fe.calcAmount(fuSymbol, fuDirection, fuPrice, fuAmount[1])

spAmount = se.calcAmount(spSymbol, spDirection, spPrice, Math.min(fuAmount[1], spAmount[1]))

if (!fuAmount || !spAmount) {

Log(fuSymbol, spSymbol, "Order amount calculation error:", fuAmount, spAmount)

return

}

}

Log("Contract code:", fuSymbol + "/" + spSymbol, "Direction:", self.arrTradeTypeDesc[tradeType], "Spread:", fuPrice - spPrice, "Futures amount:", fuAmount, "Spot amount:", spAmount, "@")

fe.goGetTrade(fuSymbol, fuDirection, fuPrice, fuAmount[0])

se.goGetTrade(spSymbol, spDirection, spPrice, spAmount[0])

var feIdMsg = fe.getTrade()

var seIdMsg = se.getTrade()

return [feIdMsg, seIdMsg]

}

self.process = function() {

var nowTS = new Date().getTime()

if(!self.updateTickers()) {

return

}

_.each(self.pairs, function(pair, index) {

var fuTicker = null

var spTicker = null

_.each(self.fuExTickers, function(ticker) {

if (ticker.originalSymbol == pair.fuSymbol) {

fuTicker = ticker

}

})

_.each(self.spExTickers, function(ticker) {

if (ticker.originalSymbol == pair.spSymbol) {

spTicker = ticker

}

})

if (fuTicker && spTicker) {

pair.canTrade = true

} else {

pair.canTrade = false

}

fuTicker = fuTicker ? fuTicker : {}

spTicker = spTicker ? spTicker : {}

pair.fuTicker = fuTicker

pair.spTicker = spTicker

pair.plusDiff = fuTicker.bid1 - spTicker.ask1

pair.minusDiff = fuTicker.ask1 - spTicker.bid1

if (pair.plusDiff && pair.minusDiff) {

pair.plusDiff = _N(pair.plusDiff, Math.max(self.fuEx.judgePrecision(fuTicker.bid1), self.spEx.judgePrecision(spTicker.ask1)))

pair.minusDiff = _N(pair.minusDiff, Math.max(self.fuEx.judgePrecision(fuTicker.ask1), self.spEx.judgePrecision(spTicker.bid1)))

}

if (nowTS - self.preUpdateAccTS > 1000 * 60 * 5) {

self.fuEx.goGetAcc(pair.fuSymbol, nowTS)

self.spEx.goGetAcc(pair.spSymbol, nowTS)

var fuAcc = self.fuEx.getAcc(pair.fuSymbol, nowTS)

var spAcc = self.spEx.getAcc(pair.spSymbol, nowTS)

if (fuAcc) {

pair.nowFuAcc = fuAcc

}

if (spAcc) {

pair.nowSpAcc = spAcc

}

var nowFuPos = self.fuEx.getFuPos(pair.fuSymbol, nowTS)

var nowSpPos = self.spEx.getSpPos(pair.spSymbol, (pair.spTicker.ask1 + pair.spTicker.bid1) / 2, pair.initSpAcc, pair.nowSpAcc)

if (nowFuPos && nowSpPos) {

pair.nowFuPos = nowFuPos

pair.nowSpPos = nowSpPos

self.keepBalance(pair)

} else {

Log(pair.fuSymbol, pair.spSymbol, "Fail to update combined position, nowFuPos:", nowFuPos, " nowSpPos:", nowSpPos)

}

self.accAndPosUpdateCount++

}

})

if (nowTS - self.preUpdateAccTS > 1000 * 60 * 5) {

self.preUpdateAccTS = nowTS

self.profit = self.calcProfit()

LogProfit(self.profit[0], "Futures:", self.profit[1], "Spot:", self.profit[2], "&") // print the total equity curve, and use charater "&" to not print the equity log

}

var cmd = GetCommand()

if(cmd) {

Log("Interactive command:", cmd)

var arr = cmd.split(":")

if(arr[0] == "plus") {

var pair = self.pairs[parseFloat(arr[1])]

self.hedge(parseFloat(arr[1]), pair.fuSymbol, pair.spSymbol, self.PLUS, self.cmdHedgeAmount)

} else if (arr[0] == "cover_plus") {

var pair = self.pairs[parseFloat(arr[1])]

self.hedge(parseFloat(arr[1]), pair.fuSymbol, pair.spSymbol, self.COVER_PLUS, self.cmdHedgeAmount)

}

}

LogStatus("Current date:", _D(), " Data update date:", _D(self.tickerUpdateTS), "Update count of postion account:", self.accAndPosUpdateCount, "\n", "Profit and loss:", self.profit[0], " Futures profit and loss:", self.profit[1],

" Spot profit and loss:", self.profit[2], "\n`" + JSON.stringify(self.returnTbl()) + "`", "\n`" + JSON.stringify(self.returnPosTbl()) + "`")

}

self.keepBalance = function (pair) {

var nowFuPos = pair.nowFuPos

var nowSpPos = pair.nowSpPos

var fuLongPos = self.getLongPos(nowFuPos)

var fuShortPos = self.getShortPos(nowFuPos)

var spLongPos = self.getLongPos(nowSpPos)

var spShortPos = self.getShortPos(nowSpPos)

if (fuLongPos || spShortPos) {

Log("Do not support reverse arbitrage")

}

if (fuShortPos || spLongPos) {

var fuHoldAmount = fuShortPos ? fuShortPos.amount : 0

var spHoldAmount = spLongPos ? spLongPos.amount : 0

var sum = fuHoldAmount + spHoldAmount

if (sum > 0) {

var spAmount = self.spEx.calcAmount(pair.spSymbol, self.spEx.COVER_LONG, pair.spTicker.bid1, Math.abs(sum), true)

if (spAmount) {

Log(pair.fuSymbol, pair.spSymbol, "spot long position", Math.abs(sum), "fuShortPos:", fuShortPos, "spLongPos:", spLongPos)

self.spEx.goGetTrade(pair.spSymbol, self.spEx.COVER_LONG, pair.spTicker.bid1, spAmount[0])

var seIdMsg = self.spEx.getTrade()

}

} else if (sum < 0) {

var fuAmount = self.fuEx.calcAmount(pair.fuSymbol, self.fuEx.COVER_SHORT, pair.fuTicker.ask1, Math.abs(sum), true)

if (fuAmount) {

Log(pair.fuSymbol, pair.spSymbol, "futures long position", Math.abs(sum), "fuShortPos:", fuShortPos, "spLongPos:", spLongPos)

self.fuEx.goGetTrade(pair.fuSymbol, self.fuEx.COVER_SHORT, pair.fuTicker.ask1, fuAmount[0])

var feIdMsg = self.fuEx.getTrade()

}

}

}

}

self.getLongPos = function (positions) {

return self.getPosByDirection(positions, PD_LONG)

}

self.getShortPos = function (positions) {

return self.getPosByDirection(positions, PD_SHORT)

}

self.getPosByDirection = function (positions, direction) {

var ret = null

if (positions.length > 2) {

Log("Position error, and three positions are detected:", JSON.stringify(positions))

return ret

}

_.each(positions, function(pos) {

if ((direction == PD_LONG && pos.amount > 0) || (direction == PD_SHORT && pos.amount < 0)) {

ret = pos

}

})

return ret

}

self.calcProfit = function() {

var arrInitFuAcc = []

var arrNowFuAcc = []

_.each(self.pairs, function(pair) {

arrInitFuAcc.push(pair.initFuAcc)

arrNowFuAcc.push(pair.nowFuAcc)

})

var fuProfit = self.fuEx.calcProfit(arrInitFuAcc, arrNowFuAcc)

var spProfit = 0

var deltaBalance = 0

_.each(self.pairs, function(pair) {

var nowSpAcc = pair.nowSpAcc

var initSpAcc = pair.initSpAcc

var stocksDiff = nowSpAcc.Stocks + nowSpAcc.FrozenStocks - (initSpAcc.Stocks + initSpAcc.FrozenStocks)

var price = stocksDiff > 0 ? pair.spTicker.bid1 : pair.spTicker.ask1

spProfit += stocksDiff * price

deltaBalance = nowSpAcc.Balance + nowSpAcc.FrozenBalance - (initSpAcc.Balance + initSpAcc.FrozenBalance)

})

spProfit += deltaBalance

return [fuProfit + spProfit, fuProfit, spProfit]

}

self.returnPosTbl = function() {

var posTbl = {

type : "table",

title : "positions",

cols : ["Index", "Futures", "Futures Leverage", "Amount", "Spot", "Amount"],

rows : []

}

_.each(self.pairs, function(pair, index) {

var nowFuPos = pair.nowFuPos

var nowSpPos = pair.nowSpPos

for (var i = 0 ; i < nowFuPos.length ; i++) {

if (nowSpPos.length > 0) {

posTbl.rows.push([index, nowFuPos[i].symbol, nowFuPos[i].marginLevel, nowFuPos[i].amount, nowSpPos[0].symbol, nowSpPos[0].amount])

} else {

posTbl.rows.push([index, nowFuPos[i].symbol, nowFuPos[i].marginLevel, nowFuPos[i].amount, "--", "--"])

}

}

})

return posTbl

}

self.returnTbl = function() {

var fuExName = "[" + self.fuEx.getExName() + "]"

var spExName = "[" + self.spEx.getExName() + "]"

var combiTickersTbl = {

type : "table",

title : "combiTickersTbl",

cols : ["Futures", "Code" + fuExName, "Sell 1", "Buy 1", "Spot", "Code" + spExName, "Sell 1", "Buy 1", "Positive Hedge Spread", "Reverse Hedge Spread", "Positive Hedge", "Positive Hedge to close Positions"],

rows : []

}

_.each(self.pairs, function(pair, index) {

var spSymbolInfo = self.spEx.getSymbolInfo(pair.spTicker.originalSymbol)

combiTickersTbl.rows.push([

pair.fuTicker.symbol,

pair.fuTicker.originalSymbol,

pair.fuTicker.ask1,

pair.fuTicker.bid1,

pair.spTicker.symbol,

pair.spTicker.originalSymbol,

pair.spTicker.ask1,

pair.spTicker.bid1,

pair.plusDiff,

pair.minusDiff,

{'type':'button', 'cmd': 'plus:' + String(index), 'name': 'Positive Arbitrage'},

{'type':'button', 'cmd': 'cover_plus:' + String(index), 'name': 'Close POsitive Arbitrage'}

])

})

var accsTbl = {

type : "table",

title : "accs",

cols : ["Code" + fuExName, "Initial Symbol", "Initial Frozen Symbol", "Initial Assets", "Initial Frozen Assets", "Symbol", "Frozen Symbol", "Assets", "Frozen Assets",

"Code" + spExName, "Initial Symbol", "Initial Frozen Symbol", "Initial Assets", "Initial Frozen Assets", "Symbol", "Frozen Symbol", "Assets", "Forzen Assets"],

rows : []

}

_.each(self.pairs, function(pair) {

var arr = [pair.fuTicker.originalSymbol, pair.initFuAcc.Stocks, pair.initFuAcc.FrozenStocks, pair.initFuAcc.Balance, pair.initFuAcc.FrozenBalance, pair.nowFuAcc.Stocks, pair.nowFuAcc.FrozenStocks, pair.nowFuAcc.Balance, pair.nowFuAcc.FrozenBalance,

pair.spTicker.originalSymbol, pair.initSpAcc.Stocks, pair.initSpAcc.FrozenStocks, pair.initSpAcc.Balance, pair.initSpAcc.FrozenBalance, pair.nowSpAcc.Stocks, pair.nowSpAcc.FrozenStocks, pair.nowSpAcc.Balance, pair.nowSpAcc.FrozenBalance]

for (var i = 0 ; i < arr.length ; i++) {

if (typeof(arr[i]) == "number") {

arr[i] = _N(arr[i], 6)

}

}

accsTbl.rows.push(arr)

})

var symbolInfoTbl = {

type : "table",

title : "symbolInfos",

cols : ["Contract Code" + fuExName, "Amount Precision", "Price Precision", "Multiplier", "Minimum Order Amount", "Spot Code" + spExName, "Amount Precision", "Price Precision", "Multiplier", "Minimum Order Amount"],

rows : []

}

_.each(self.pairs, function(pair) {

var fuSymbolInfo = self.fuEx.getSymbolInfo(pair.fuTicker.originalSymbol)

var spSymbolInfo = self.spEx.getSymbolInfo(pair.spTicker.originalSymbol)

symbolInfoTbl.rows.push([fuSymbolInfo.symbol, fuSymbolInfo.amountPrecision, fuSymbolInfo.pricePrecision, fuSymbolInfo.multiplier, fuSymbolInfo.min,

spSymbolInfo.symbol, spSymbolInfo.amountPrecision, spSymbolInfo.pricePrecision, spSymbolInfo.multiplier, spSymbolInfo.min])

})

var allPairs = []

_.each(self.fuExTickers, function(fuTicker) {

_.each(self.spExTickers, function(spTicker) {

if (fuTicker.symbol == spTicker.symbol) {

allPairs.push({symbol: fuTicker.symbol, fuSymbol: fuTicker.originalSymbol, spSymbol: spTicker.originalSymbol, plus: fuTicker.bid1 - spTicker.ask1})

}

})

})

_.each(allPairs, function(pair) {

var findPair = null

_.each(self.allPairs, function(selfPair) {

if (pair.fuSymbol == selfPair.fuSymbol && pair.spSymbol == selfPair.spSymbol) {

findPair = selfPair

}

})

if (findPair) {

findPair.minPlus = pair.plus < findPair.minPlus ? pair.plus : findPair.minPlus

findPair.maxPlus = pair.plus > findPair.maxPlus ? pair.plus : findPair.maxPlus

pair.minPlus = findPair.minPlus

pair.maxPlus = findPair.maxPlus

} else {

self.allPairs.push({symbol: pair.symbol, fuSymbol: pair.fuSymbol, spSymbol: pair.spSymbol, plus: pair.plus, minPlus: pair.plus, maxPlus: pair.plus})

pair.minPlus = pair.plus

pair.maxPlus = pair.plus

}

})

return [combiTickersTbl, accsTbl, symbolInfoTbl]

}

self.onexit = function() {

_G("pairs", self.pairs)

_G("allPairs", self.allPairs)

Log("Execute clean-up processing, and save the data", "#FF0000")

}

self.init = function() {

var fuExName = self.fuEx.getExName()

var spExName = self.spEx.getExName()

var gFuExName = _G("fuExName")

var gSpExName = _G("spExName")

if ((gFuExName && gFuExName != fuExName) || (gSpExName && gSpExName != spExName)) {

throw "The exchenge object is changed, so reset the data"

}

if (!gFuExName) {

_G("fuExName", fuExName)

}

if (!gSpExName) {

_G("spExName", spExName)

}

self.allPairs = _G("allPairs")

if (!self.allPairs) {

self.allPairs = []

}

var arrPair = _G("pairs")

if (!arrPair) {

arrPair = []

}

var arrStrPair = self.symbolPairs.split(",")

var timeStamp = new Date().getTime()

_.each(arrStrPair, function(strPair) {

var arrSymbol = strPair.split("|")

var recoveryPair = null

_.each(arrPair, function(pair) {

if (pair.fuSymbol == arrSymbol[0] && pair.spSymbol == arrSymbol[1]) {

recoveryPair = pair

}

})

if (!recoveryPair) {

var pair = {

fuSymbol : arrSymbol[0],

spSymbol : arrSymbol[1],

fuTicker : {},

spTicker : {},

plusDiff : null,

minusDiff : null,

canTrade : false,

initFuAcc : null,

initSpAcc : null,

nowFuAcc : null,

nowSpAcc : null,

nowFuPos : null,

nowSpPos : null,

fuMarginLevel : null

}

self.pairs.push(pair)

Log("Initialize:", pair)

} else {

self.pairs.push(recoveryPair)

Log("Recover:", recoveryPair)

}

self.fuEx.pushSubscribeSymbol(arrSymbol[0])

self.spEx.pushSubscribeSymbol(arrSymbol[1])

if (!self.pairs[self.pairs.length - 1].initFuAcc) {

self.fuEx.goGetAcc(arrSymbol[0], timeStamp)

var nowFuAcc = self.fuEx.getAcc(arrSymbol[0], timeStamp)

self.pairs[self.pairs.length - 1].initFuAcc = nowFuAcc

self.pairs[self.pairs.length - 1].nowFuAcc = nowFuAcc

}

if (!self.pairs[self.pairs.length - 1].initSpAcc) {

self.spEx.goGetAcc(arrSymbol[1], timeStamp)

var nowSpAcc = self.spEx.getAcc(arrSymbol[1], timeStamp)

self.pairs[self.pairs.length - 1].initSpAcc = nowSpAcc

self.pairs[self.pairs.length - 1].nowSpAcc = nowSpAcc

}

Sleep(300)

})

Log("self.pairs:", self.pairs)

_.each(self.pairs, function(pair) {

var fuSymbolInfo = self.fuEx.getSymbolInfo(pair.fuSymbol)

if (!fuSymbolInfo) {

throw pair.fuSymbol + ", fail to obtain the symbol information!"

} else {

Log(pair.fuSymbol, fuSymbolInfo)

}

var spSymbolInfo = self.spEx.getSymbolInfo(pair.spSymbol)

if (!spSymbolInfo) {

throw pair.spSymbol + ", fail to obtain the symbol information!"

} else {

Log(pair.spSymbol, spSymbolInfo)

}

})

_.each(self.pairs, function(pair) {

pair.fuMarginLevel = self.fuMarginLevel

var ret = self.fuEx.setMarginLevel(pair.fuSymbol, self.fuMarginLevel)

Log(pair.fuSymbol, "Leverage Setting:", ret)

if (!ret) {

throw "Leverage initial setting failed!"

}

})

}

self.init()

return self

}

var manager = null

function main() {

if(isReset) {

_G(null)

LogReset(1)

LogProfitReset()

LogVacuum()

Log("Reset all data", "#FF0000")

}

if (isOKEX_V5_Simulate) {

for (var i = 0 ; i < exchanges.length ; i++) {

if (exchanges[i].GetName() == "Futures_OKCoin" || exchanges[i].GetName() == "OKEX") {

var ret = exchanges[i].IO("simulate", true)

Log(exchanges[i].GetName(), "Switch to simulated bot")

}

}

}

var fuConfigureFunc = null

var spConfigureFunc = null

if (exchanges.length != 2) {

throw "Two exchange objects need to be added!"

} else {

var fuName = exchanges[0].GetName()

if (fuName == "Futures_OKCoin" && isOkexV5) {

fuName += "_V5"

Log("Use OKEX V5 interface")

}

var spName = exchanges[1].GetName()

fuConfigureFunc = $.getConfigureFunc()[fuName]

spConfigureFunc = $.getConfigureFunc()[spName]

if (!fuConfigureFunc || !spConfigureFunc) {

throw (fuConfigureFunc ? "" : fuName) + " " + (spConfigureFunc ? "" : spName) + " not support!"

}

}

var fuEx = $.createBaseEx(exchanges[0], fuConfigureFunc)

var spEx = $.createBaseEx(exchanges[1], spConfigureFunc)

manager = createManager(fuEx, spEx, symbolPairs, cmdHedgeAmount, fuMarginLevel, fuMarginReservedRatio)

while(true) {

manager.process()

Sleep(interval)

}

}

function onerror() {

if (manager) {

manager.onexit()

}

}

function onexit() {

if (manager) {

manager.onexit()

}

}

Oleh kerana strategi pelbagai simbol lebih sesuai untuk reka bentuk IO, perpustakaan templat bernamaMultiSymbolCtrlLibOleh itu, strategi tidak boleh diuji kembali, tetapi ia boleh diuji dengan bot simulasi (walaupun ia telah dijalankan dalam bot sebenar selama 2 bulan, dalam peringkat ujian dan kefahaman, anda lebih baik menjalankannya dalam bot simulasi).

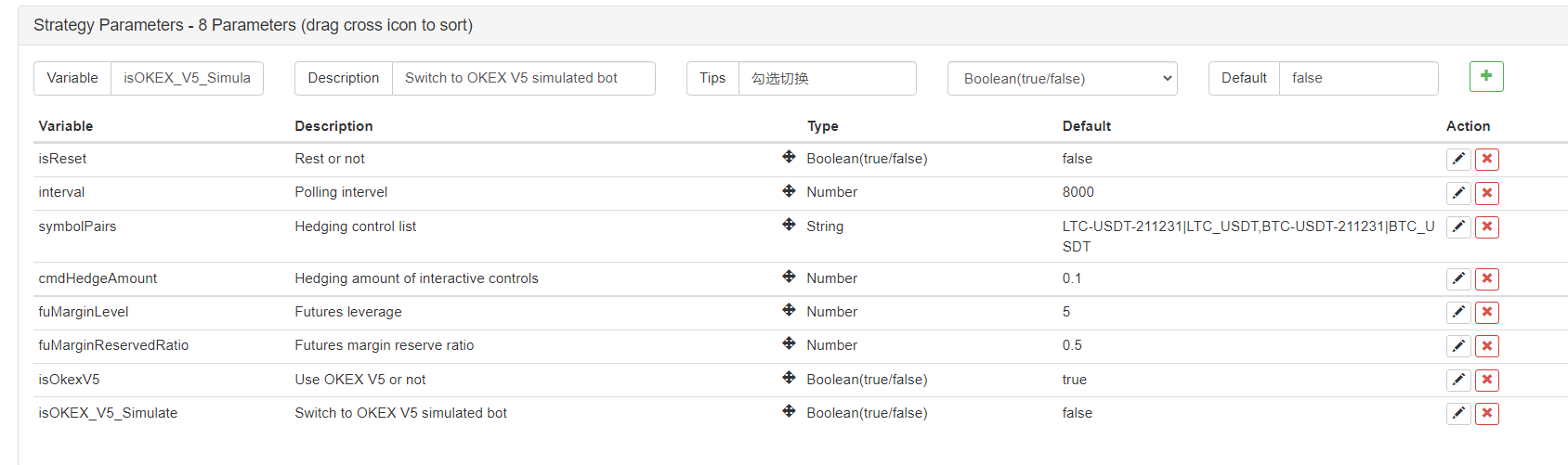

Parameter

Sebelum ujian, mari kita bercakap tentang reka bentuk parameter.

Parameter strategi tidak terlalu banyak, dan yang penting ialah:

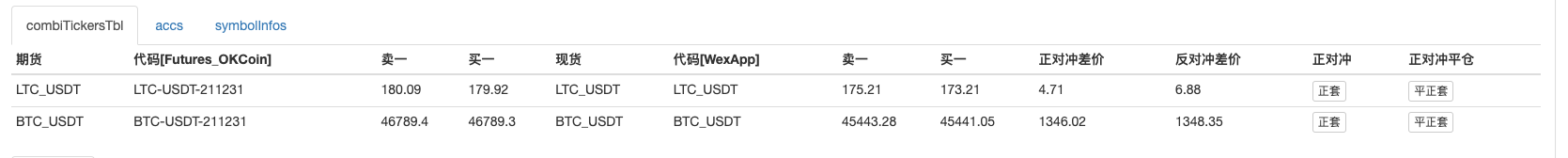

LTC-USDT-211231|LTC_USDT,BTC-USDT-211231|BTC_USDT

Di sini adalah untuk menetapkan strategi untuk memantau kombinasi tersebut. Sebagai contoh, tetapan di atas adalah untuk memantau kontrak Litecoin (LTC-USDT-211231) platform niaga hadapan dan Litecoin (LTC_USDT) platform spot.|simbol untuk membentuk kombinasi. kombinasi yang berbeza dibahagikan oleh,Perhatikan bahawa simbol di sini adalah semua dalam keadaan kaedah input bahasa Inggeris!

Kemudian anda boleh bertanya kepada saya bagaimana untuk mencari kod kontrak. kod kontrak ini dan pasangan dagangan spot semua ditakrifkan oleh platform, tidak ditakrifkan pada platform FMZ.

Sebagai contoh, kontrakLTC-USDT-211231adalah kontrak suku berikutnya, yang dipanggilnext_quarterpada FMZ, dan sistem antara muka OKEX dipanggilLTC-USDT-211231. UntukLTC/USDTpasangan perdagangan, bot simulasi WexApp ditulis sebagaiLTC_USDTJadi bagaimana untuk mengisi di sini bergantung kepada nama yang ditakrifkan dalam platform tertentu.

-

Jumlah lindung nilai kawalan interaktif Klik butang kawalan dalam bar status, iaitu jumlah lindung nilai. unit adalah jumlah mata wang, yang akan ditukar secara automatik ke dalam jumlah kontrak oleh strategi untuk meletakkan pesanan.

Fungsi lain adalah untuk menetapkan bot simulasi, menetapkan semula data, menggunakan antara muka OKEX V5 (kerana ia juga serasi dengan V3) dan fungsi lain, yang tidak begitu penting.

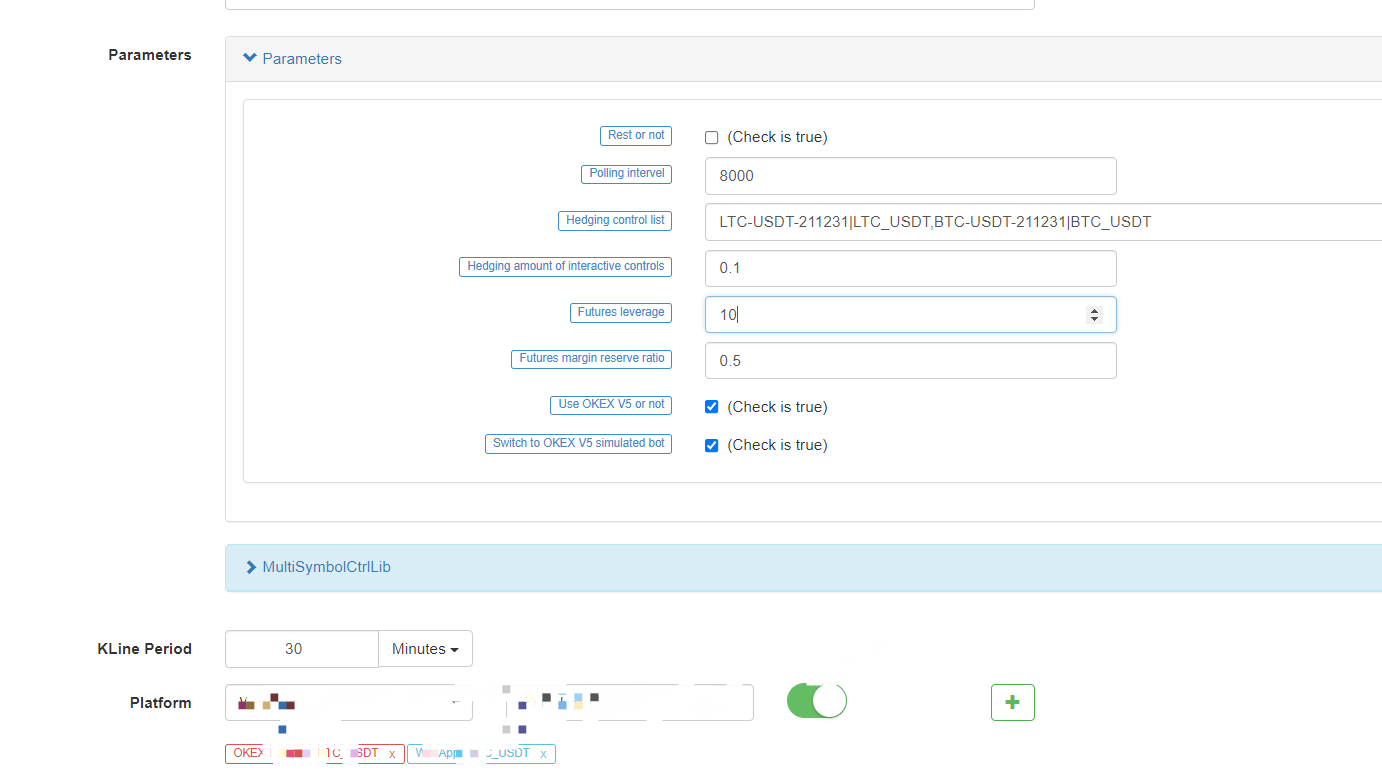

Ujian

Objek pertukaran pertama yang ditambahkan memilih platform yang menambah niaga hadapan, dan yang kedua memilih objek pertukaran spot.

Platform niaga hadapan menggunakan bot simulasi antara muka OKEX V5, dan platform spot menggunakan bot simulasi wexApp.

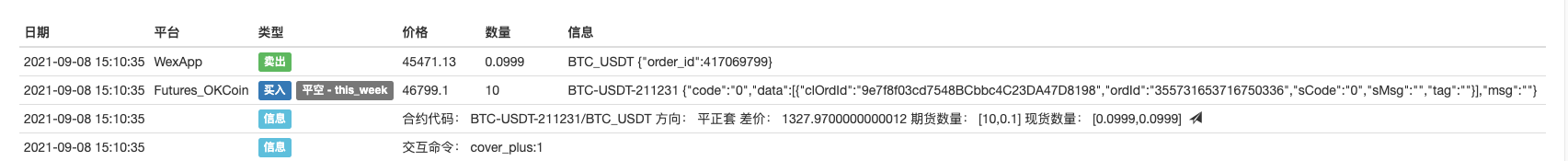

Saya mengklik butang arbitrage positif gabungan BTC dan membuka kedudukan.

Kemudian, klik arbitraj positif untuk menutup kedudukan.

Rupanya apabila profit spread kecil, penutupan kedudukan tidak dapat menampung bayaran. Ia adalah perlu untuk mengira bayaran dan titik jatuh kira-kira, dan kemudian merancang secara munasabah spread untuk menutup kedudukan, dan kemudian menutup kedudukan.

Kod Sumber Strategi:https://www.fmz.com/strategy/314352

Sesiapa yang berminat boleh menggunakannya dan mengubahnya.

- Strategi Hedge Spot Cryptocurrency (1)

- Dalam API Bitget, masalah berlaku apabila transaksi yang disertakan pada ADA, AVAX, AXS, BCH, DOT, EOS, ETC, FIL, LINK, LTC, LUNA, MATIC, SOL, XRP diletakkan.

- Berdoa

- Strategi Martins Net untuk membeli dan beli dengan bayaran segera

- Adakah ada contoh strategi pertukaran bitget? Adakah pentadbir membantu, terima kasih

- Dapatkan 80 Kali Dalam 5 Hari

Kuasa Strategi Frekuensi Tinggi - Penggunaan Metadata Kod Sewa Strategi

- Penyelidikan Platform Lanjutan

Analisis Data Python & Ujian Kembali Strategi - Reka bentuk strategi jenis Martingale untuk niaga hadapan mata wang kripto

- Strategi Mylanguage untuk mencapai Push Masa Nyata Perubahan Kedudukan ke Aplikasi mudah alih & WeChat

- Contoh Perjanjian Akses Protokol Umum FMZ

- Analisis Arbitraj Futures & Spot Spread Return dalam Kontrak Margin Crypto

- Menghapuskan pencetakan log

- Batalkan semua pesanan yang belum selesai dalam mata wang semasa

- Permulaan Cepat APP Platform Dagangan Kuantum FMZ

- Memahami Bot Pengawasan Perintah Sederhana Cryptocurrency Spot

- Platform pembayaran berdasarkan FMZ

- Kontrak Cryptocurrency Bot Pengawasan Perintah Sederhana

- Apabila menggunakan getdepth untuk mendapatkan timestamp yang sesuai

- Mengingkari, diselesaikan