Strategi EMA Double Multi-varieti Mata Wang Digital Spot (Tutorial)

Penulis:Lydia, Dicipta: 2022-11-08 12:50:56, Dikemas kini: 2023-09-15 20:57:25

Pada permintaan pengguna komuniti yang ingin mempunyai strategi double-EMA pelbagai untuk rujukan reka bentuk. Dalam artikel ini, kami akan melaksanakan strategi double-EMA pelbagai. Komen akan ditulis pada kod strategi untuk pemahaman dan pembelajaran yang mudah. Biarkan lebih banyak pendatang baru dalam pengaturcaraan dan perdagangan kuantitatif mendapat permulaan yang cepat.

Idea strategi

Logik strategi EMA berganda sangat mudah, iaitu dua EMA. EMA (garis pantas) dengan tempoh parameter yang kecil dan EMA (garis perlahan) dengan tempoh parameter yang besar. Jika kedua-dua garis mempunyai salib emas (garis pantas melalui garis perlahan dari bawah ke atas), maka kita membeli dan pergi panjang; dan jika kedua-dua garis mempunyai salib mati (garis pantas melalui garis perlahan dari atas ke bawah), maka kita menjual dan pergi pendek.

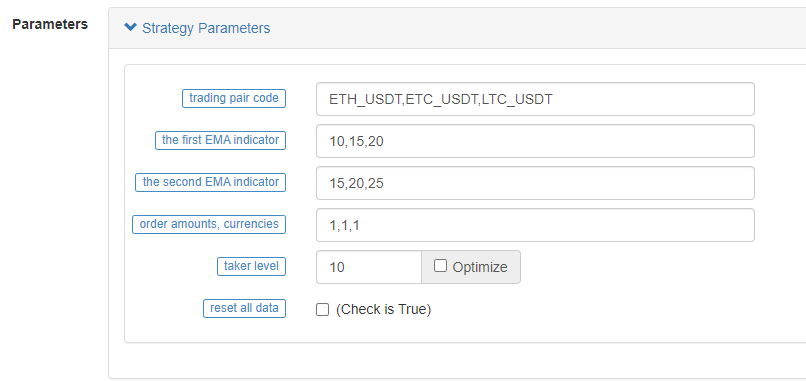

Walau bagaimanapun, strategi harus direka sebagai pelbagai jenis, jadi parameter setiap jenis mungkin berbeza (jenis yang berbeza menggunakan parameter EMA yang berbeza), jadi kaedah

Parameter yang direka dalam bentuk rentetan, dengan setiap parameter koma dipisahkan. Menganalisis rentetan ini apabila strategi mula berjalan. Logik pelaksanaan sepadan dengan setiap varieti (pasangan perdagangan). Strategi berputar mengesan pasaran setiap varieti, pencetakan syarat perdagangan, cetakan carta, dan lain-lain. Selepas semua varieti berputar sekali, ringkasan data dan memaparkan maklumat jadual pada bar status.

Strategi ini direka untuk menjadi sangat mudah dan sesuai untuk pelajar baru, dengan hanya 200+ baris kod secara keseluruhan.

Kod strategi

// Function: cancel all takers of the current trading pair

function cancelAll(e) {

while (true) {

var orders = _C(e.GetOrders)

if (orders.length == 0) {

break

} else {

for (var i = 0 ; i < orders.length ; i++) {

e.CancelOrder(orders[i].Id, orders[i])

Sleep(500)

}

}

Sleep(500)

}

}

// Functionn: calculate the profit/loss in real-time

function getProfit(account, initAccount, lastPrices) {

// account is the current account information, initAccount is the initial account information, lastPrices is the latest price of all varieties

var sum = 0

_.each(account, function(val, key) {

// Iterate through all current assets, calculate the currency difference of assets other than USDT, and the amount difference

if (key != "USDT" && typeof(initAccount[key]) == "number" && lastPrices[key + "_USDT"]) {

sum += (account[key] - initAccount[key]) * lastPrices[key + "_USDT"]

}

})

// Return to the profit and loss of the asset based on the current prices

return account["USDT"] - initAccount["USDT"] + sum

}

// Function: generate chart configuration

function createChartConfig(symbol, ema1Period, ema2Period) {

// symbol is the trading pair, ema1Period is the first EMA period, ema2Period is the second EMA period

var chart = {

__isStock: true,

extension: {

layout: 'single',

height: 600,

},

title : { text : symbol},

xAxis: { type: 'datetime'},

series : [

{

type: 'candlestick', // K-line data series

name: symbol,

id: symbol,

data: []

}, {

type: 'line', // EMA data series

name: symbol + ',EMA1:' + ema1Period,

data: [],

}, {

type: 'line', // EMA data series

name: symbol + ',EMA2:' + ema2Period,

data: []

}

]

}

return chart

}

function main() {

// Reset all data

if (isReset) {

_G(null) // Clear data of all persistent records

LogReset(1) // Clear all logs

LogProfitReset() // Clear all return logs

LogVacuum() //Release the resources occupied by the real bot database

Log("Reset all data", "#FF0000") // Print messages

}

// Parameter analysis

var arrSymbols = symbols.split(",") // Comma-separated string of trading varieties

var arrEma1Periods = ema1Periods.split(",") // Parameter string for splitting the first EMA

var arrEma2Periods = ema2Periods.split(",") // Parameter string for splitting the second EMA

var arrAmounts = orderAmounts.split(",") // Splitting the amount of orders placed for each variety

var account = {} // Variables used for recording current asset messages

var initAccount = {} // Variables used for recording initial asset messages

var currTradeMsg = {} // Variables used for recording whether current BAR trades

var lastPrices = {} // Variables used for recording the latest price of monitored varieties

var lastBarTime = {} // Variable used for recording the time of the last BAR, used to judge the update of BAR when drawing

var arrChartConfig = [] // Used for recording chart configuration message and draw

if (_G("currTradeMsg")) { // For example, restore currTradeMsg data when restarting

currTradeMsg = _G("currTradeMsg")

Log("Restore records", currTradeMsg)

}

// Initialize account

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol)

var arrCurrencyName = symbol.split("_")

var baseCurrency = arrCurrencyName[0]

var quoteCurrency = arrCurrencyName[1]

if (quoteCurrency != "USDT") {

throw "only support quoteCurrency: USDT"

}

if (!account[baseCurrency] || !account[quoteCurrency]) {

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

}

// Initialize chart-related data

lastBarTime[symbol] = 0

arrChartConfig.push(createChartConfig(symbol, arrEma1Periods[index], arrEma2Periods[index]))

})

if (_G("initAccount")) {

initAccount = _G("initAccount")

Log("Restore initial account records", initAccount)

} else {

// Initialize the initAccount variable with the current asset information

_.each(account, function(val, key) {

initAccount[key] = val

})

}

Log("account:", account, "initAccount:", initAccount) // Print asset information

// Initialize the chart object

var chart = Chart(arrChartConfig)

// Chart reset

chart.reset()

// Strategy main loop logic

while (true) {

// Iterate through all varieties and execute the double-EMA logic one by one

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol) // Switch the trading pair to the trading pair of symbol string record

var arrCurrencyName = symbol.split("_") // Split the trading pairs with the "_" symbol

var baseCurrency = arrCurrencyName[0] // String for trading currencies

var quoteCurrency = arrCurrencyName[1] // String for denominated currency

// Obtain the EMA parameters of the current trading pair according to the index

var ema1Period = parseFloat(arrEma1Periods[index])

var ema2Period = parseFloat(arrEma2Periods[index])

var amount = parseFloat(arrAmounts[index])

// Obtain the K-line data of the current trading pair

var r = exchange.GetRecords()

if (!r || r.length < Math.max(ema1Period, ema2Period)) { // Return directly if K-line length is insufficient

Sleep(1000)

return

}

var currBarTime = r[r.length - 1].Time // Record the current BAR timestamp

lastPrices[symbol] = r[r.length - 1].Close // Record the latest current price

var ema1 = TA.EMA(r, ema1Period) // Calculate EMA indicators

var ema2 = TA.EMA(r, ema2Period) // Calculate EMA indicators

if (ema1.length < 3 || ema2.length < 3) { // The length of EMA indicator array is too short, return directly

Sleep(1000)

return

}

var ema1Last2 = ema1[ema1.length - 2] // EMA on the penultimate BAR

var ema1Last3 = ema1[ema1.length - 3] // EMA on the third from the last BAR

var ema2Last2 = ema2[ema2.length - 2]

var ema2Last3 = ema2[ema2.length - 3]

// Write data to the chart

var klineIndex = index + 2 * index

// Iterate through the K-line data

for (var i = 0 ; i < r.length ; i++) {

if (r[i].Time == lastBarTime[symbol]) { // Draw the chart, update the current BAR and indicators

// update

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close], -1)

chart.add(klineIndex + 1, [r[i].Time, ema1[i]], -1)

chart.add(klineIndex + 2, [r[i].Time, ema2[i]], -1)

} else if (r[i].Time > lastBarTime[symbol]) { // Draw the charts, add BARs and indicators

// add

lastBarTime[symbol] = r[i].Time // Update timestamp

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close])

chart.add(klineIndex + 1, [r[i].Time, ema1[i]])

chart.add(klineIndex + 2, [r[i].Time, ema2[i]])

}

}

if (ema1Last3 < ema2Last3 && ema1Last2 > ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// Golden cross

var depth = exchange.GetDepth() // Obtain the depth data of current order book

var price = depth.Asks[Math.min(takeLevel, depth.Asks.length)].Price // Take the 10th grade price, taker

if (depth && price * amount <= account[quoteCurrency]) { // Obtain deep data normally with enough assets to place an order

exchange.Buy(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2) // Place a buy order

cancelAll(exchange) // Cancel all makers

var acc = _C(exchange.GetAccount) // Obtain account asset information

if (acc.Stocks != account[baseCurrency]) { // Detect changes in account assets

account[baseCurrency] = acc.Stocks // Update assets

account[quoteCurrency] = acc.Balance // Update assets

currTradeMsg[symbol] = currBarTime // Record that the current BAR has been traded

_G("currTradeMsg", currTradeMsg) // Persistent records

var profit = getProfit(account, initAccount, lastPrices) // Calculate profits

if (profit) {

LogProfit(profit, account, initAccount) // Print profits

}

}

}

} else if (ema1Last3 > ema2Last3 && ema1Last2 < ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// dead cross

var depth = exchange.GetDepth()

var price = depth.Bids[Math.min(takeLevel, depth.Bids.length)].Price

if (depth && amount <= account[baseCurrency]) {

exchange.Sell(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2)

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

if (acc.Stocks != account[baseCurrency]) {

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

currTradeMsg[symbol] = currBarTime

_G("currTradeMsg", currTradeMsg)

var profit = getProfit(account, initAccount, lastPrices)

if (profit) {

LogProfit(profit, account, initAccount)

}

}

}

}

Sleep(1000)

})

// Table variables in the status bar

var tbl = {

type : "table",

title : "Account Information",

cols : [],

rows : []

}

// Write data into the status bar table structure

tbl.cols.push("--")

tbl.rows.push(["initial"])

tbl.rows.push(["current"])

_.each(account, function(val, key) {

if (typeof(initAccount[key]) == "number") {

tbl.cols.push(key)

tbl.rows[0].push(initAccount[key]) // initial

tbl.rows[1].push(val) // current

}

})

// Show status bar table

LogStatus(_D(), "\n", "profit:", getProfit(account, initAccount, lastPrices), "\n", "`" + JSON.stringify(tbl) + "`")

}

}

Ujian belakang strategi

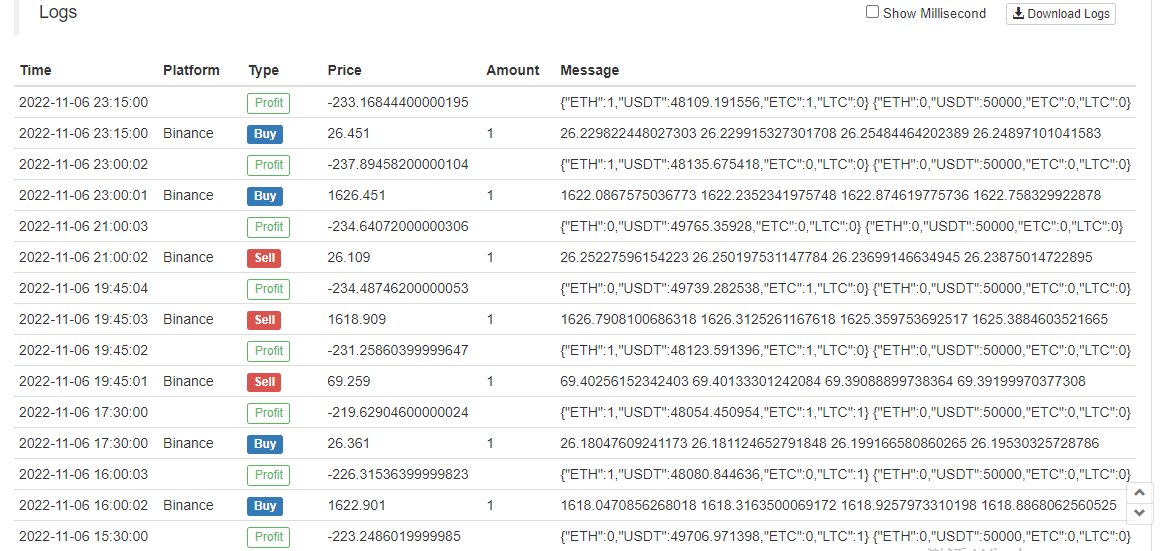

Ia dapat dilihat bahawa ETH, LTC dan ETC dipicu mengikut Golden Cross dan Dead Cross EMA, dan perdagangan telah berlaku.

Kita juga boleh mengambil bot simulasi untuk ujian.

Kod sumber strategi:https://www.fmz.com/strategy/333783

Strategi ini digunakan untuk backtesting, pembelajaran reka bentuk strategi sahaja, dan ia harus digunakan dengan berhati-hati dalam bot sebenar.