概述

该策略基于布林带和ATR指标,通过布林带捕捉价格的波动范围,利用价格突破布林带上下轨作为建仓信号,同时使用ATR作为移动止损,最后以价格突破简单移动平均线作为平仓信号。该策略试图捕捉趋势行情,跟随趋势方向建仓,并在趋势反转时及时平仓。

策略原理

- 计算布林带:使用收盘价计算简单移动平均线(SMA)作为布林带中轨,并根据波动率(标准差)计算上下轨。

- 计算ATR:使用真实波幅(TR)的移动平均值计算ATR,作为移动止损的依据。

- 产生交易信号:当价格向下突破布林带下轨时产生做多信号,向上突破布林带上轨时产生做空信号;当价格向上突破ATR移动止损时产生做多信号,向下突破ATR移动止损时产生做空信号。

- 平仓:当做多仓位时,如果价格向上突破简单移动平均线,则平多;当做空仓位时,如果价格向下突破简单移动平均线,则平空。

策略优势

- 趋势跟踪:通过布林带和ATR移动止损捕捉趋势行情,适应不同市场环境。

- 及时止损:使用ATR作为移动止损,可以根据市场波动情况动态调整止损位置,控制风险。

- 简单易用:策略逻辑清晰,参数较少,易于理解和应用。

策略风险

- 参数敏感:布林带和ATR的参数选择会影响策略表现,需要根据不同市场和品种进行优化。

- 震荡市:在震荡市场环境下,频繁的交易信号可能导致过多的交易次数和成本。

- 趋势反转:当趋势反转时,策略可能会产生较大回撤。

策略优化方向

- 参数优化:对布林带和ATR的参数进行优化,找到适合不同市场和品种的最佳参数组合。

- 过滤器:添加其他技术指标或价格行为模式作为过滤器,减少误判和提高信号质量。

- 仓位管理:根据市场波动率或账户风险进行仓位动态调整,提高资金利用效率和收益风险比。

总结

布林带ATR趋势跟踪策略通过布林带和ATR指标捕捉趋势行情,具有趋势跟踪、及时止损和简单易用的优势。但同时也存在参数敏感、震荡市和趋势反转等风险。可以通过参数优化、添加过滤器和仓位管理等方式进一步优化策略表现。

策略源码

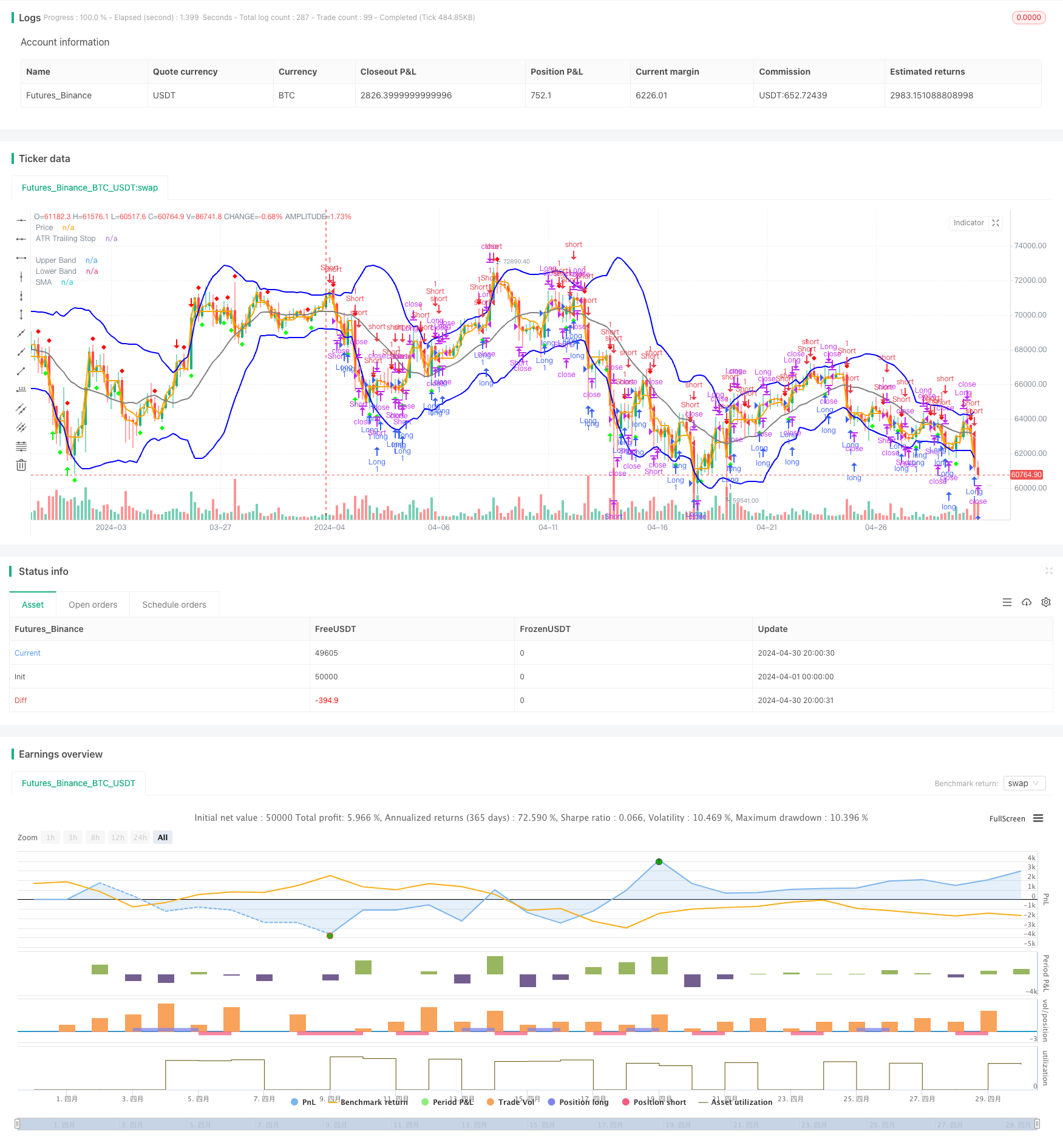

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands and ATR Strategy", overlay=true)

// Veri Çekme

symbol = "AAPL"

timeframe = "D"

src = close

// Bollinger Bantları Hesaplama

len = 20

mult = 2

sum1 = 0.0, sum2 = 0.0

for i = 0 to len - 1

sum1 += src[i]

basis = sum1 / len

for i = 0 to len - 1

diff = src[i] - basis

sum2 += diff * diff

dev = math.sqrt(sum2 / len)

upper_band = basis + dev * mult

lower_band = basis - dev * mult

// ATR Hesaplama

atr_period = input(10, title="ATR Period")

atr_value = 0.0

for i = 0 to atr_period - 1

atr_value += math.abs(src[i] - src[i + 1])

atr_value /= atr_period

loss = input(1, title="Key Value (Sensitivity)")

atr_trailing_stop = src[1]

if src > atr_trailing_stop[1]

atr_trailing_stop := math.max(atr_trailing_stop[1], src - loss * atr_value)

else if src < atr_trailing_stop[1]

atr_trailing_stop := math.min(atr_trailing_stop[1], src + loss * atr_value)

else

atr_trailing_stop := src - loss * atr_value

// Sinyal Üretme

long_condition = src < lower_band and src[1] >= lower_band[1]

short_condition = src > upper_band and src[1] <= upper_band[1]

close_long = src > basis

close_short = src < basis

buy_signal = src > atr_trailing_stop[1] and src[1] <= atr_trailing_stop[1]

sell_signal = src < atr_trailing_stop[1] and src[1] >= atr_trailing_stop[1]

if (long_condition)

strategy.entry("Long", strategy.long, comment="Long Signal")

if (short_condition)

strategy.entry("Short", strategy.short, comment="Short Signal")

if (close_long)

strategy.close("Long", comment="Close Long")

if (close_short)

strategy.close("Short", comment="Close Short")

if (buy_signal)

strategy.entry("Long", strategy.long, comment="Buy Signal")

if (sell_signal)

strategy.entry("Short", strategy.short, comment="Sell Signal")

// Çizim

plot(upper_band, color=#0000FF, linewidth=2, title="Upper Band")

plot(lower_band, color=#0000FF, linewidth=2, title="Lower Band")

plot(basis, color=#808080, linewidth=2, title="SMA")

plot(atr_trailing_stop, color=#FFA500, linewidth=2, title="ATR Trailing Stop")

plot(src, color=#FFA500, linewidth=2, title="Price")

// Sinyal İşaretleri

plotshape(long_condition, style=shape.arrowup, color=#00FF00, location=location.belowbar, size=size.small, title="Long Signal")

plotshape(short_condition, style=shape.arrowdown, color=#FF0000, location=location.abovebar, size=size.small, title="Short Signal")

plotshape(buy_signal, style=shape.diamond, color=#00FF00, location=location.belowbar, size=size.small, title="Buy Signal")

plotshape(sell_signal, style=shape.diamond, color=#FF0000, location=location.abovebar, size=size.small, title="Sell Signal")

相关推荐